Answered step by step

Verified Expert Solution

Question

1 Approved Answer

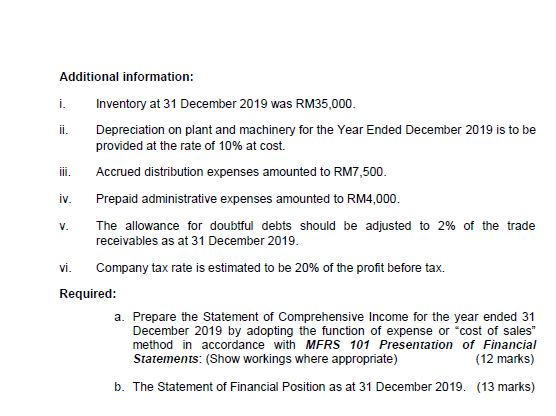

Please note that Question a is '' by adopting the function of expense or cost of sales method in accordance with MFRS 101 Presentation of

Please note that Question a is ''by adopting the function of expense or cost of sales method in accordance with MFRS 101 Presentation of Financial Statements'' :

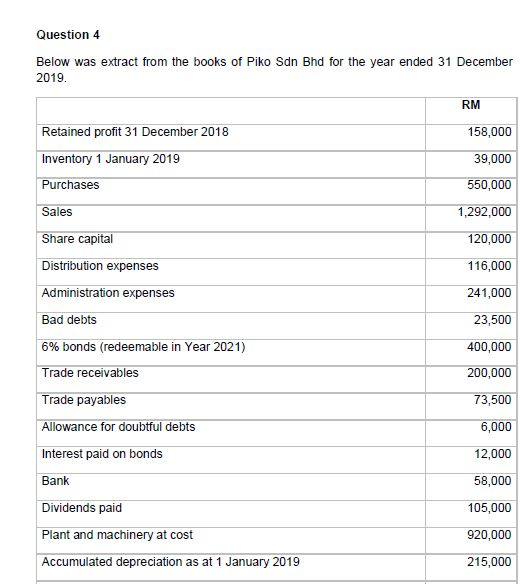

Question 4 Below was extract from the books of Piko Sdn Bhd for the year ended 31 December 2019. RM 158,000 Retained profit 31 December 2018 Inventory 1 January 2019 Purchases 39,000 550,000 1,292,000 Sales Share capital 120,000 116,000 241,000 23,500 400,000 Distribution expenses Administration expenses Bad debts 6% bonds (redeemable in Year 2021) Trade receivables Trade payables Allowance for doubtful debts Interest paid on bonds Bank 200,000 73,500 6,000 12,000 58,000 105,000 Dividends paid Plant and machinery at cost 920,000 Accumulated depreciation as at 1 January 2019 215,000 V. Additional information: i. Inventory at 31 December 2019 was RM35,000. ii. Depreciation on plant and machinery for the Year Ended December 2019 is to be provided at the rate of 10% at cost. Accrued distribution expenses amounted to RM7,500. iv. Prepaid administrative expenses amounted to RM4,000. The allowance for doubtful debts should be adjusted to 2% of the trade receivables as at 31 December 2019. vi. Company tax rate is estimated to be 20% of the profit before tax. Required: a. Prepare the Statement of Comprehensive Income for the year ended 31 December 2019 by adopting the function of expense or cost of sales" method in accordance with MERS 101 Presentation of Financial Statements: (Show workings where appropriate) (12 marks) b. The Statement of Financial Position as at 31 December 2019. (13 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started