Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please Notice please give Answer in step by step I need urgently please in 3 hours You are a portfolio manager, responsible for a portfolio

please Notice

please give Answer in step by step

I need urgently please in 3 hours

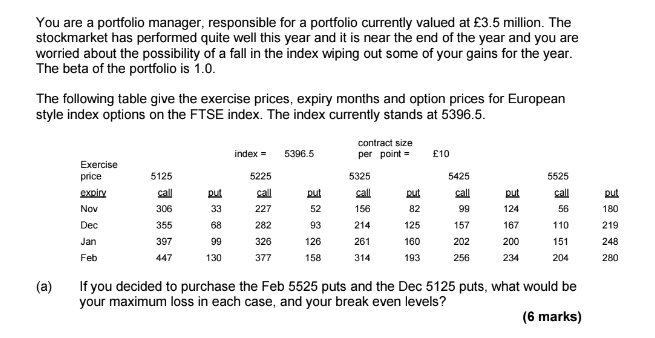

You are a portfolio manager, responsible for a portfolio currently valued at 3.5 million. The stockmarket has performed quite well this year and it is near the end of the year and you are worried about the possibility of a fall in the index wiping out some of your gains for the year. The beta of the portfolio is 1.0. The following table give the exercise prices, expiry months and option prices for European style index options on the FTSE index. The index currently stands at 5396.5. contract size per point index = 5396.5 10 Exercise price 5125 5225 5325 5425 5525 expiry call DU call put put put call bul Nov 306 33 227 52 156 82 99 124 56 180 Dec 355 68 282 93 214 125 157 167 110 219 Jan 397 99 326 126 261 160 202 200 151 248 Feb 447 130 377 158 314 193 256 234 204 280 (a) a If you decided to purchase the Feb 5525 puts and the Dec 5125 puts, what would be your maximum loss in each case, and your break even levels? (6 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started