Answered step by step

Verified Expert Solution

Question

1 Approved Answer

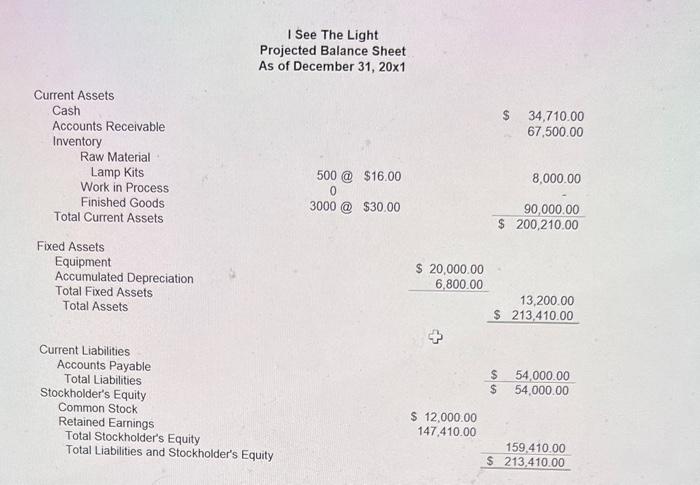

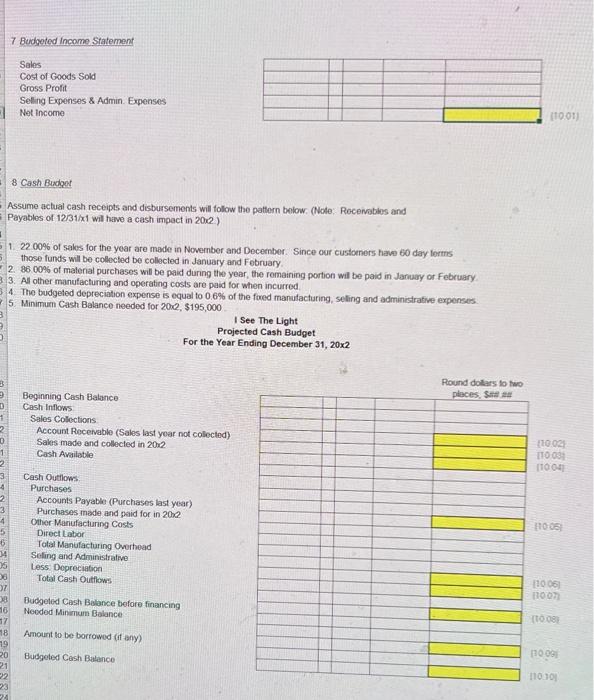

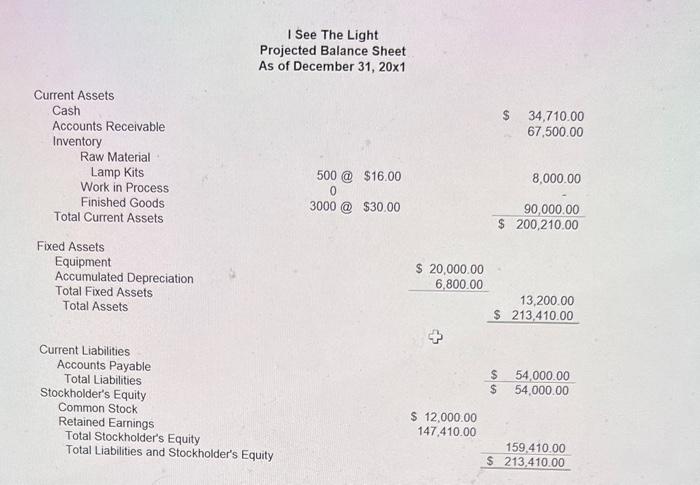

please only andwer the yellow box for the missing ones, please make answerr clear I See The Light Projected Balance Sheet As of December 31,201

please only andwer the yellow box for the missing ones, please make answerr clear

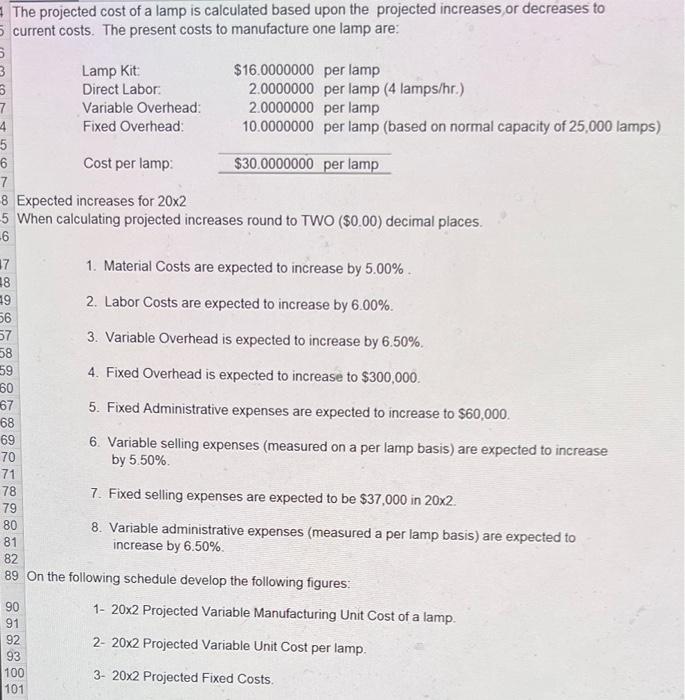

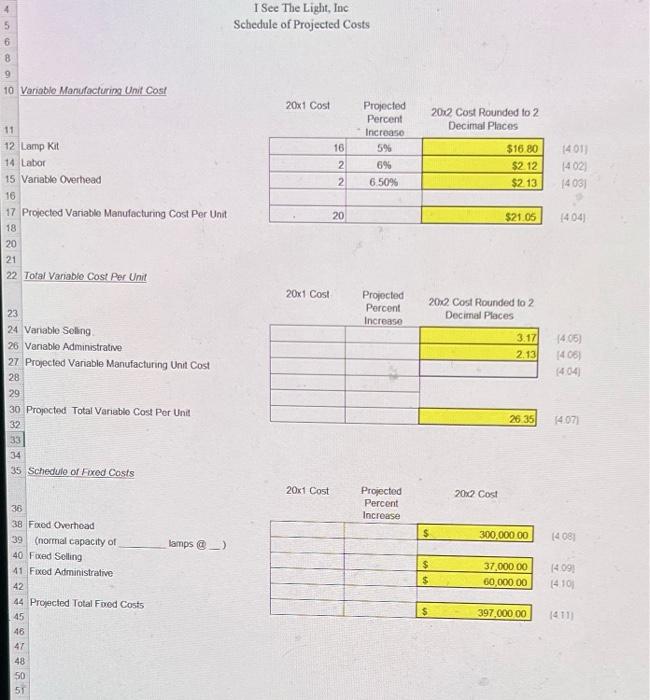

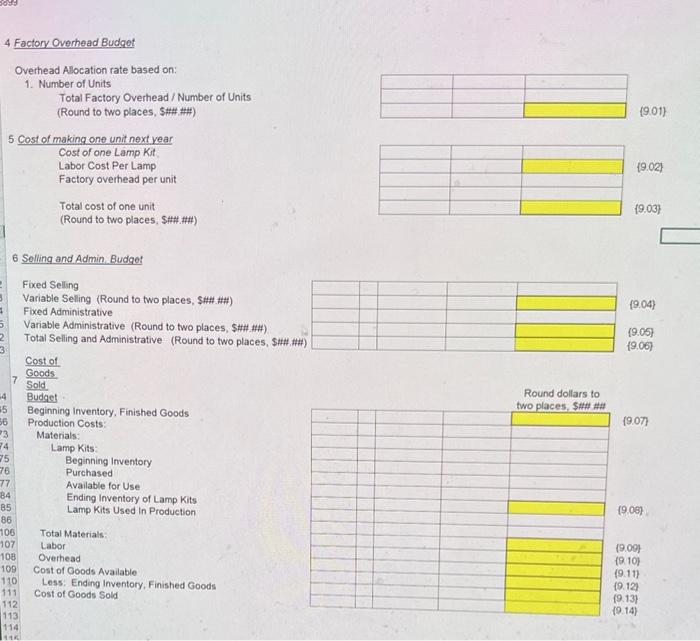

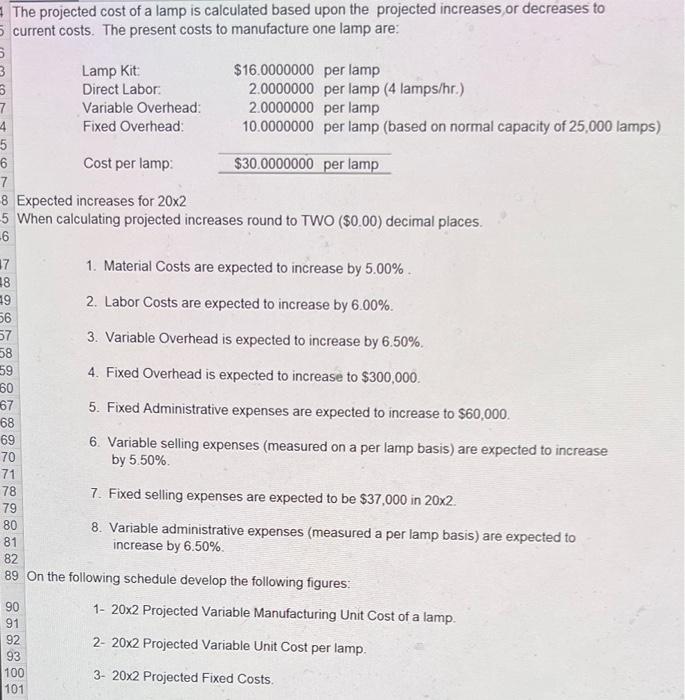

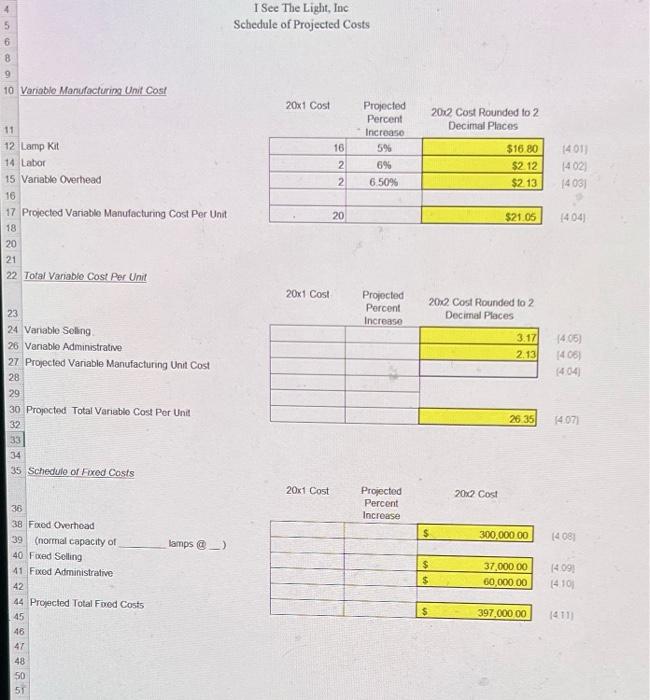

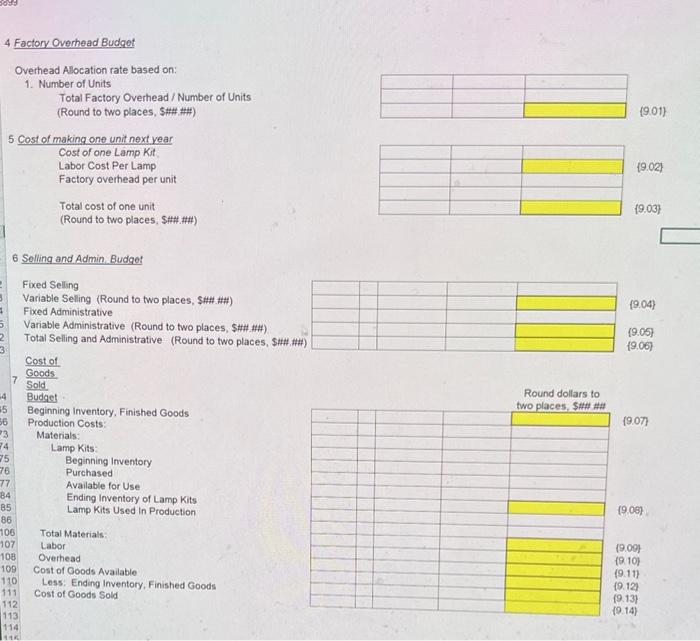

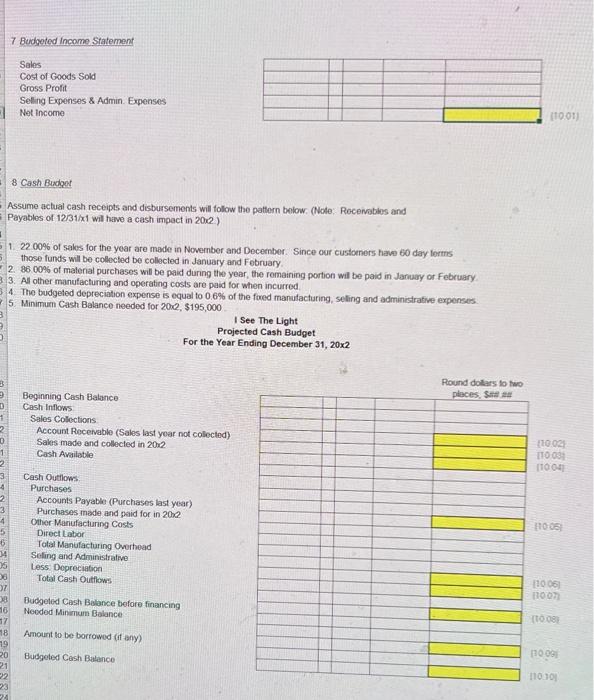

I See The Light Projected Balance Sheet As of December 31,201 Current Assets Cash Accounts Receivable $34,710.00 67,500.00 Inventory Raw Material Fixed Assets Current Liabilities Accounts Payable Stockholder's Equity \begin{tabular}{cr} $54,000.00 \\ \hline$54,000.00 \end{tabular} Common Stock Retained Earnings \$ 12,000.00 147,410.00 Total Stockholder's Equity \begin{tabular}{rr} 147,410.00 & 159,410.00 \\ $213.410.00 \\ \hline \end{tabular} Total Liabilities and Stockholder's Equity The projected cost of a lamp is calculated based upon the projected increases, or decreases to surrent costs. The present costs to manufacture one lamp are: Expected increases for 202 When calculating projected increases round to TWO ($0.00) decimal places. 1. Material Costs are expected to increase by 5.00%. 2. Labor Costs are expected to increase by 6.00%. 3. Variable Overhead is expected to increase by 6.50%. 4. Fixed Overhead is expected to increase to $300,000. 5. Fixed Administrative expenses are expected to increase to $60,000. 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 5.50%. 7. Fixed selling expenses are expected to be $37,000 in 202. 8. Variable administrative expenses (measured a per lamp basis) are expected to increase by 6.50%. On the following schedule develop the following figures: 3. 202 Projected Fixed Costs. ISee The Light, Inc Schedule of Projected Costs 10 Variable Manufacturing Unit Casf (4) 101) Total Variabie Cost Per Unit 35 Schedule of Fixed Costs \{404\} 3332 4 Factory Overhead Budget Overhead Alocation rate based on: 1. Number of Units Total Factory Overhead / Number of Units (Round to two places, Stat an) {901} 5 Cost of making one unit next year Lost of one Lamp Kit Labor Cost Per Lamp Factory overhead per unit \begin{tabular}{|l|l|l|} \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} {9.02} Total cost of one unit (Round to two places, \$4# #\#) {9.03} 6 Selling and Admin. Budgot 7SooldCostof (9.05) {9.09} {910} (9.11) 19.124 (9.13] {9.13} {9.14} 8 Cash Prodont Assume actual cash receipts and disbursements will follow the pattern beiow. (Nole Recenobles and Payables of 1231/1 will have a cash impact in 20r2) 1. 2200% of sales for the yoar are made in November and December. Since our cusioners have 60 day lorms those funds will be collected be collected in January and February. 2. 8600% of materal purchases will be paid during the year, the romaining portion will be paid in Jaruacy or February. 3. Al other manufacturing and operating costs are paid for when incurrod 4. The budgeted depreciation expense is equal to 0.6% of the fored manutacturing, seling and administrative expenses 5. Minimuan Cash Balance needed for 20r2, $195,000 I See The Light Projected Cash Budget For the Year Ending December 31, 20x2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started