Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please only answer if you know it for certain!! 1. Two portfolios on the same indifference curve will have the same a. Expected return b.

please only answer if you know it for certain!!

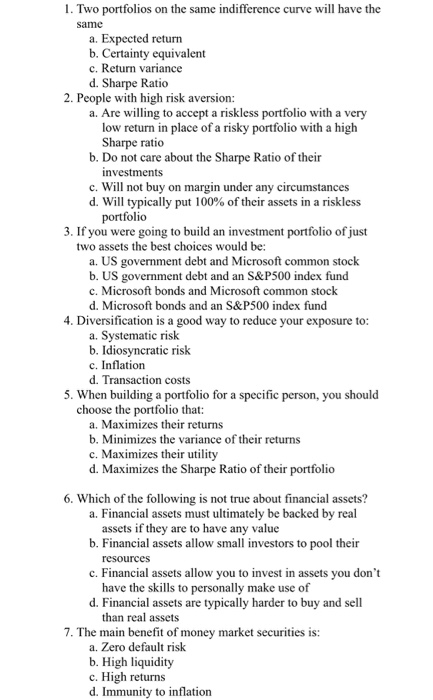

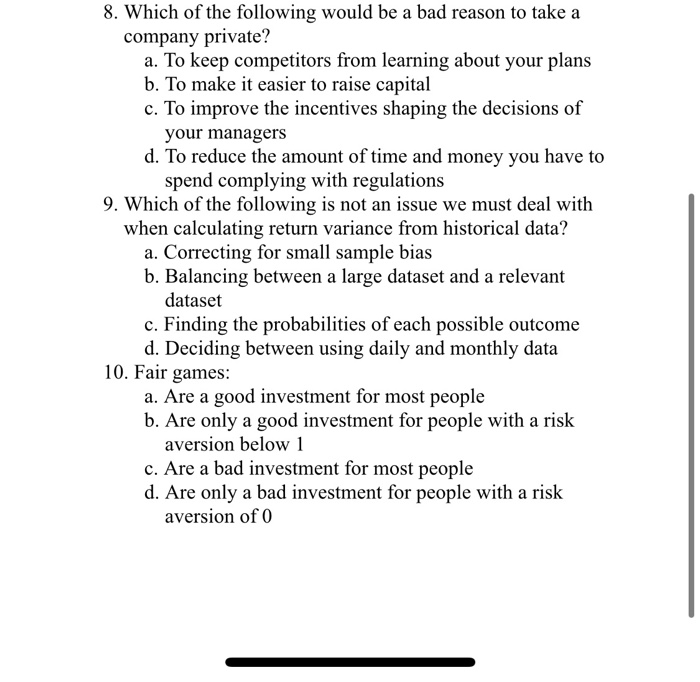

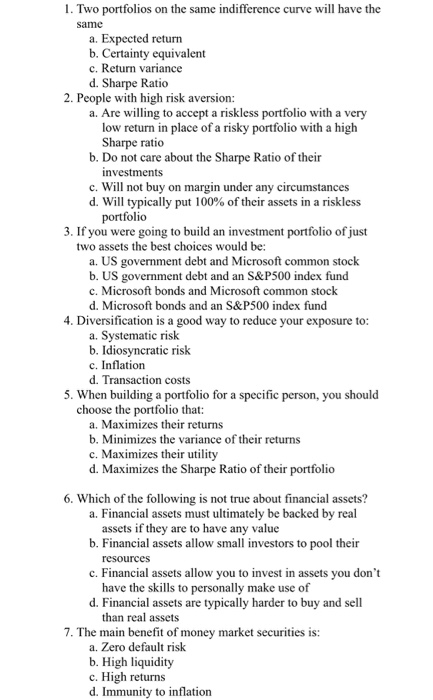

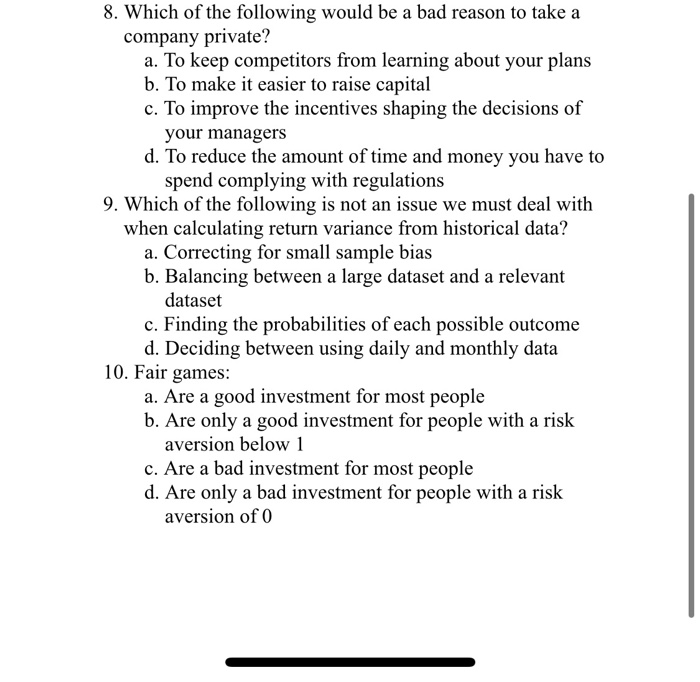

1. Two portfolios on the same indifference curve will have the same a. Expected return b. Certainty equivalent c. Return variance d. Sharpe Ratio 2. People with high risk aversion: a. Are willing to accept a riskless portfolio with a very low return in place of a risky portfolio with a high Sharpe ratio b. Do not care about the Sharpe Ratio of their investments c. Will not buy on margin under any circumstances d. Will typically put 100% of their assets in a riskless portfolio 3. If you were going to build an investment portfolio of just two assets the best choices would be: a. US government debt and Microsoft common stock b. US government debt and an S&P500 index fund c. Microsoft bonds and Microsoft common stock d. Microsoft bonds and an S&P500 index fund 4. Diversification is a good way to reduce your exposure to: a. Systematic risk b. Idiosyncratic risk c. Inflation d. Transaction costs 5. When building a portfolio for a specific person, you should choose the portfolio that: a. Maximizes their returns b. Minimizes the variance of their returns c. Maximizes their utility d. Maximizes the Sharpe Ratio of their portfolio 6. Which of the following is not true about financial assets? a. Financial assets must ultimately be backed by real assets if they are to have any value b. Financial assets allow small investors to pool their resources c. Financial assets allow you to invest in assets you don't have the skills to personally make use of d. Financial assets are typically harder to buy and sell than real assets 7. The main benefit of money market securities is: a. Zero default risk b. High liquidity c. High returns d. Immunity to inflation 8. Which of the following would be a bad reason to take a company private? a. To keep competitors from learning about your plans b. To make it easier to raise capital c. To improve the incentives shaping the decisions of your managers d. To reduce the amount of time and money you have to spend complying with regulations 9. Which of the following is not an issue we must deal with when calculating return variance from historical data? a. Correcting for small sample bias b. Balancing between a large dataset and a relevant dataset c. Finding the probabilities of each possible outcome d. Deciding between using daily and monthly data 10. Fair games: a. Are a good investment for most people b. Are only a good investment for people with a risk aversion below 1 c. Are a bad investment for most people d. Are only a bad investment for people with a risk aversion of o

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started