Question

PLEASE ONLY ANSWER P3. A and B. P3. Use all the projection and data of NSM from the problem P2 except the following assumption: HES

PLEASE ONLY ANSWER P3. A and B.

P3. Use all the projection and data of NSM from the problem P2 except the following assumption: HES Inc. expects to withdraw only 30% of the income of NSM as dividends.

Questions:

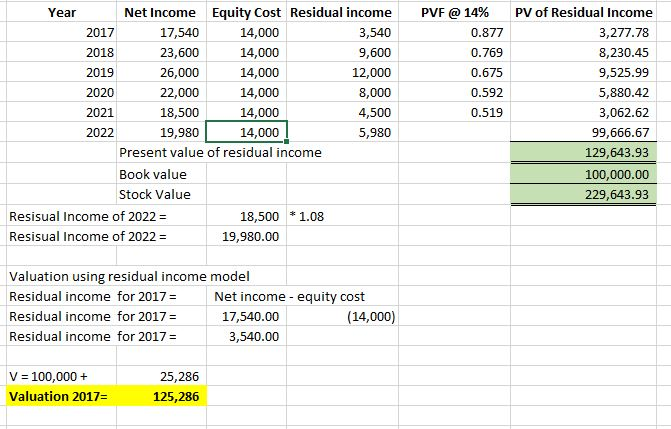

a. Using the residual income valuation model, compute the value of NSM as of January 1, 2017.

b. What advice would you provide to HES regarding the ownership of NSM?

Below is the P2 question and answer that you wll need to calculate P3.

P2. NSM, Inc. is a distributor of electrical supplies. Management for the company has developed the following forecasts of net income:

Forecasted

Year Net Income

2017 $17,540

2018 $23,600

2019 $26,000

2020 $22,000

2021 $18,500

HES Inc. wholly owns the firm NSM. Jane King, CFO of HES, made the projections for NSM.

Jane King expects net income to grow at a rate of 8 percent per year after 2021 and the company's cost of equity capital is 14%. NSM common shareholders' equity at January 1, 2017 is $100,000. Assume that HES Inc. expects to withdraw all the income of NSM as dividends.

Questions:

a. Using the residual income valuation model, compute the value of NSM as of January 1, 2017.

b. What advice would you provide to HES regarding the ownership of NSM?

The company's stock value has increased, the net income has growth and the value of company using residual income is high, I would recommend to HES to hold ownership of MSN purchase stock.

Equity Cost 14,000 14,000 14,000 14,000 14,000 14,000 Residual income 3,540 9,600 12,000 8,000 4,500 Year PVF @ 14% PV of Residual income Net Income 17,540 23,600 26,000 22,000 18,500 19,980 0.877 0.769 0.675 0.592 0.519 3,277.78 8,230.45 9,525.99 5,880.42 3,062.62 99,666.67 129,643.93 100,000.00 229,643.93 2017 2018 2019 2020 2021 Present value of residual income Book value Stock Value Resisual Income of 2022 18,500 1.08 19,980.00 Resisual Income of 2022- Valuation using residual income model Residual income for 2017- Residual income for 2017- Residual income for 2017- Net income equity cost (14,000) 17,540.00 3,540.00 V 100,000+ Valuation 2017- 25,286 125,286

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started