Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ONLY ANSWER part bi and bii a) Companies A and B have been offered the following rates per annum on a $10 million four-year

PLEASE ONLY ANSWER part bi and bii

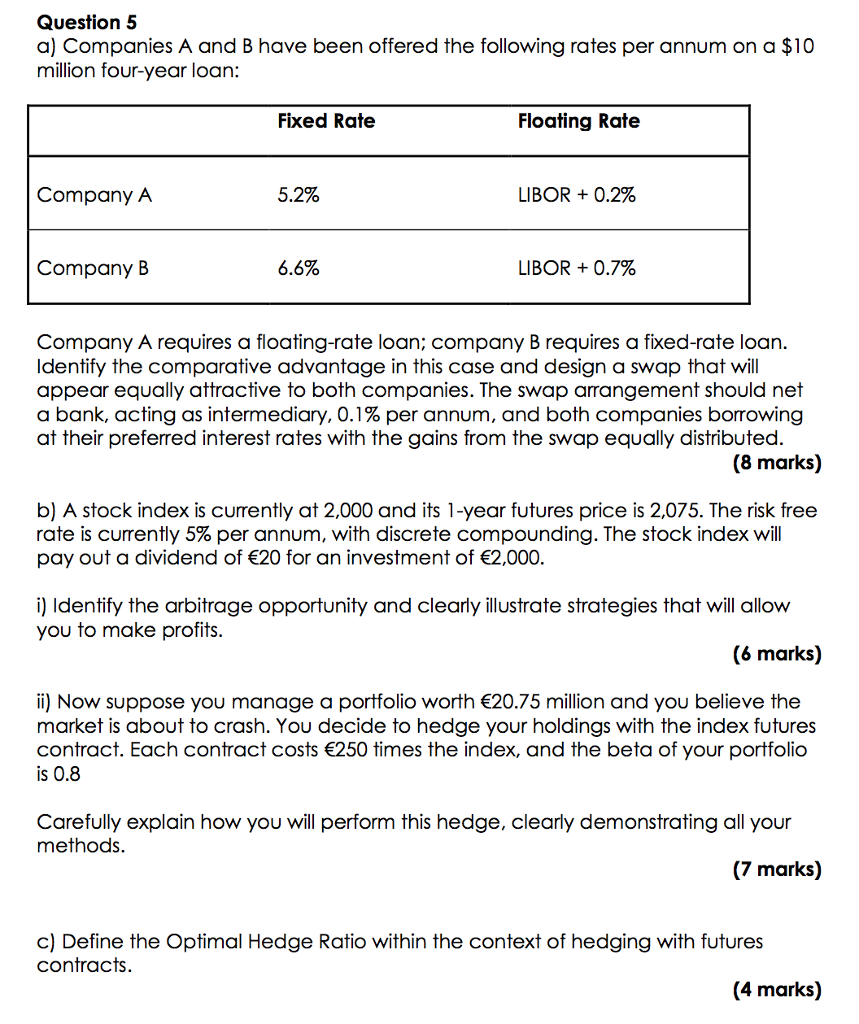

a) Companies A and B have been offered the following rates per annum on a $10 million four-year loan: Company A requires a floating-rate loan; company B requires a fixed-rate loan. Identify the comparative advantage in this case and design a swap that will appear equally attractive to both companies. The swap arrangement should net a bank, acting as intermediary, 0.1% per annum, and both companies borrowing at their preferred interest rates with the gains from the swap equally distributed. b) A stock index is currently at 2,000 and its 1 -year futures price is 2, 075. The risk free rate is currently 5% per annum, with discrete compounding. The stock index will pay out a dividend of euro 20 for an investment of euro 2,000. i) Identify the arbitrage opportunity and clearly illustrate strategies that will allow you to make profits. ii) Now suppose you manage a portfolio worth euro 20.75 million and you believe the market is about to crash. You decide to hedge your holdings with the index futures contract. Each contract costs euro 250 times the index, and the beta of your portfolio is 0.8 Carefully explain how you will perform this hedge, clearly demonstrating all your methods. c) Define the Optimal Hedge Ratio within the context of hedging with futures contracts. a) Companies A and B have been offered the following rates per annum on a $10 million four-year loan: Company A requires a floating-rate loan; company B requires a fixed-rate loan. Identify the comparative advantage in this case and design a swap that will appear equally attractive to both companies. The swap arrangement should net a bank, acting as intermediary, 0.1% per annum, and both companies borrowing at their preferred interest rates with the gains from the swap equally distributed. b) A stock index is currently at 2,000 and its 1 -year futures price is 2, 075. The risk free rate is currently 5% per annum, with discrete compounding. The stock index will pay out a dividend of euro 20 for an investment of euro 2,000. i) Identify the arbitrage opportunity and clearly illustrate strategies that will allow you to make profits. ii) Now suppose you manage a portfolio worth euro 20.75 million and you believe the market is about to crash. You decide to hedge your holdings with the index futures contract. Each contract costs euro 250 times the index, and the beta of your portfolio is 0.8 Carefully explain how you will perform this hedge, clearly demonstrating all your methods. c) Define the Optimal Hedge Ratio within the context of hedging with futures contractsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started