Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ONLY ANSWER PROBLEM 2.2. Problem 2.1 is included to reference the same facts as in Problem 2.1. Thank you! 2.1 Basic capital budgeting problem

PLEASE ONLY ANSWER PROBLEM 2.2. Problem 2.1 is included to reference the "same facts as in Problem 2.1". Thank you!

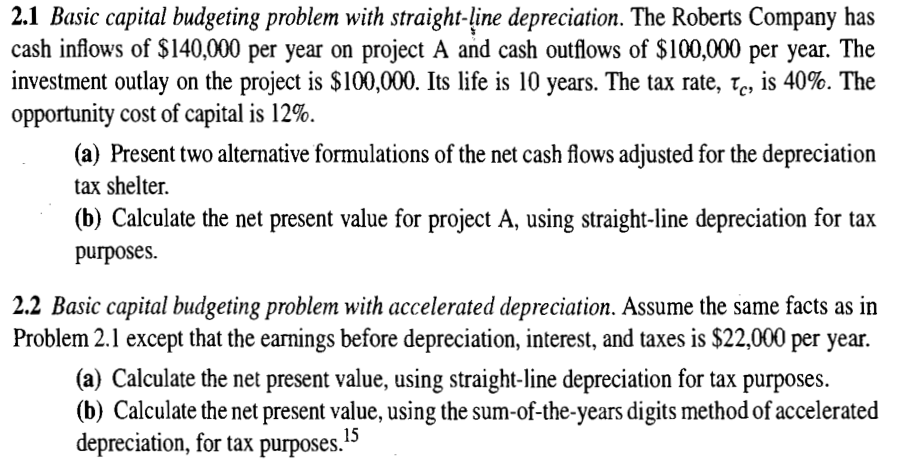

2.1 Basic capital budgeting problem with straight-line depreciation. The Roberts Company has cash inflows of $140,000 per year on project A and cash outflows of $100,000 per year. The investment outlay on the project is $100,000. Its life is 10 years. The tax rate, c, is 40%. The opportunity cost of capital is 12%. (a) Present two alternative formulations of the net cash flows adjusted for the depreciation tax shelter. (b) Calculate the net present value for project A, using straight-line depreciation for tax purposes. 2.2 Basic capital budgeting problem with accelerated depreciation. Assume the same facts as in Problem 2.1 except that the earnings before depreciation, interest, and taxes is $22,000 per year. (a) Calculate the net present value, using straight-line depreciation for tax purposes. (b) Calculate the net present value, using the sum-of-the-years digits method of accelerated depreciation, for tax purposes. 15Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started