Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ONLY ANSWER THE INCORRECT ITEMS IN C AND BELOW Suppose that you sell short 400 shares of Xtel, currently selling for $55 per share,

PLEASE ONLY ANSWER THE INCORRECT ITEMS IN C AND BELOW

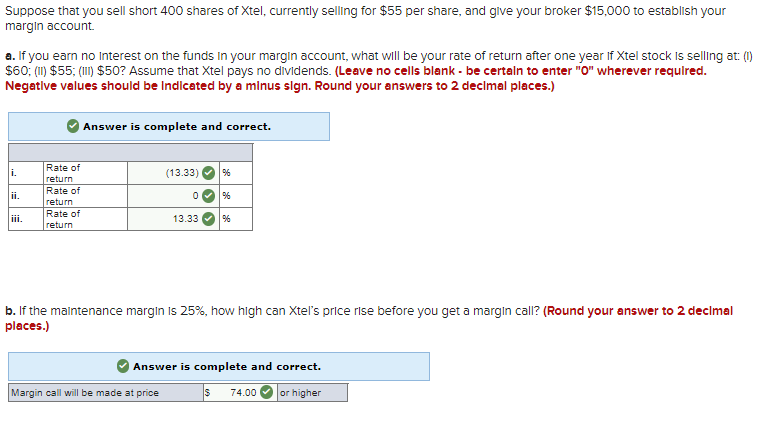

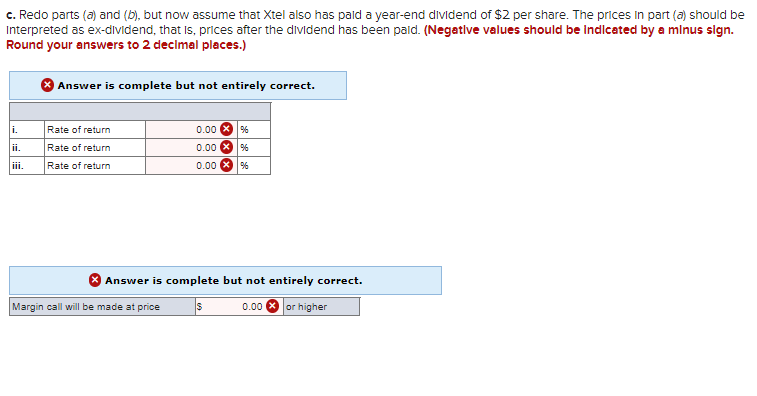

Suppose that you sell short 400 shares of Xtel, currently selling for $55 per share, and give your broker $15,000 to establish your margin account. a. If you earn no Interest on the funds in your margin account, what will be your rate of return after one year if Xtel stock is selling at: (0) $60; (11) $55; (II) $50? Assume that Xtel pays no dividends. (Leave no cells blank - be certain to enter "o" wherever required. Negative values should be Indicated by a minus sign. Round your answers to 2 decimal places.) Answer is complete and correct. i. (13.33) % Rate of return Rate of return Rate of return 0 9% 13.33 996 b. If the maintenance margin is 25%, how high can Xtel's price rise before you get a margin call? (Round your answer to 2 decimal places.) Answer is complete and correct. Margin call will be made at price S 74.00 or higher c. Redo parts (a) and (b), but now assume that Xtel also has paid a year-end dividend of $2 per share. The prices in part (a) should be Interpreted as ex-dividend, that is, prices after the dividend has been paid. (Negative values should be indicated by a minus sign. Round your answers to 2 decimal places.) Answer is complete but not entirely correct. i. 0.00 X % Rate of return Rate of return 0.00 X % 0.00 96 Rate of return Answer is complete but not entirely correct. Margin call will be made at price s 0.00 or higherStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started