Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Only attempt if you are confident to provide correct answer!! Provide me clean and correct Answer. Q 3) Pass journal entries for the following

Please Only attempt if you are confident to provide correct answer!!

Provide me clean and correct Answer.

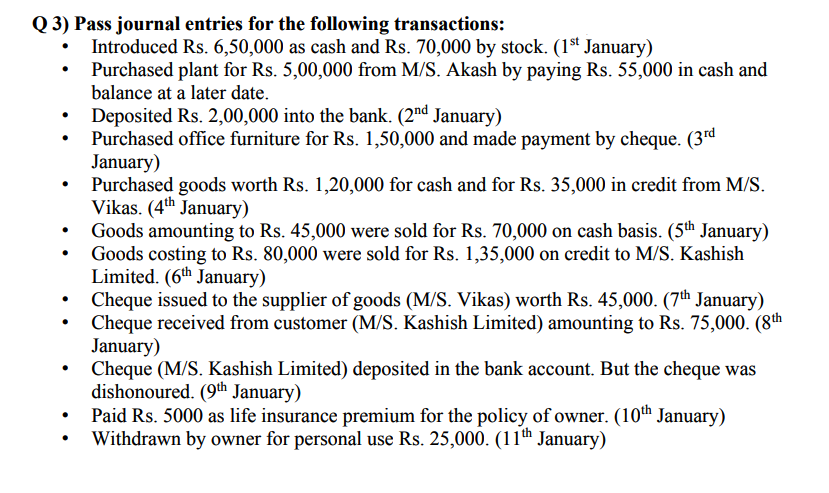

Q 3) Pass journal entries for the following transactions: Introduced Rs. 6,50,000 as cash and Rs. 70,000 by stock. (1st January) Purchased plant for Rs. 5,00,000 from M/S. Akash by paying Rs. 55,000 in cash and balance at a later date. Deposited Rs. 2,00,000 into the bank. (2nd January) Purchased office furniture for Rs. 1,50,000 and made payment by cheque. (3rd January) Purchased goods worth Rs. 1,20,000 for cash and for Rs. 35,000 in credit from M/S. Vikas. (4th January) Goods amounting to Rs. 45,000 were sold for Rs. 70,000 on cash basis. (5th January) Goods costing to Rs. 80,000 were sold for Rs. 1,35,000 on credit to M/S. Kashish Limited. (6th January) Cheque issued to the supplier of goods (M/S. Vikas) worth Rs. 45,000. (7th January) Cheque received from customer (M/S. Kashish Limited) amounting to Rs. 75,000. (8th January) Cheque (M/S. Kashish Limited) deposited in the bank account. But the cheque was dishonoured. (9th January) Paid Rs. 5000 as life insurance premium for the policy of owner. (10th January) Withdrawn by owner for personal use Rs. 25,000. (11th January)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started