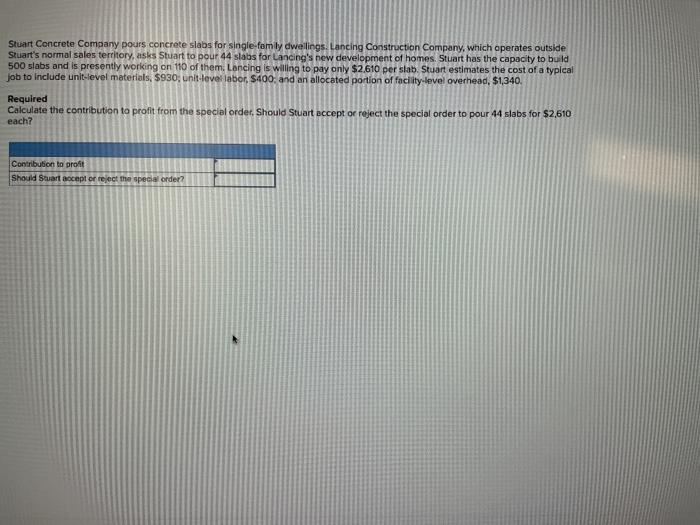

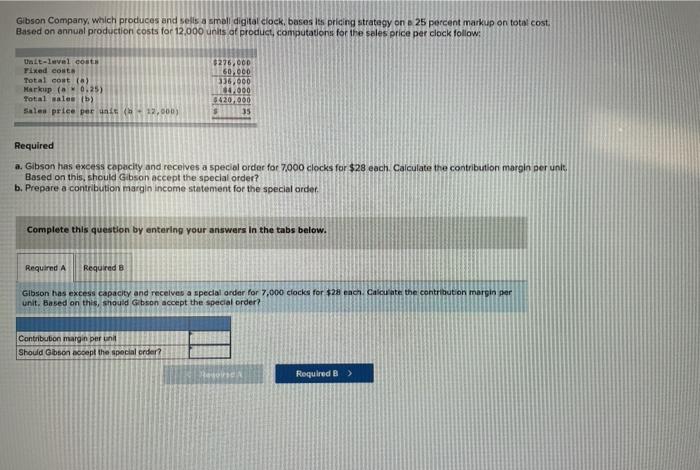

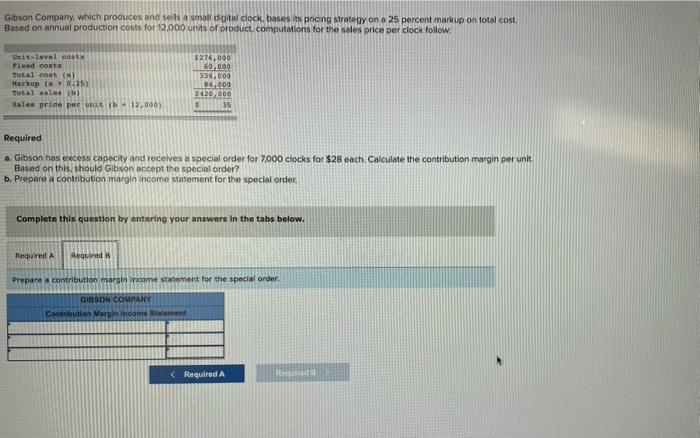

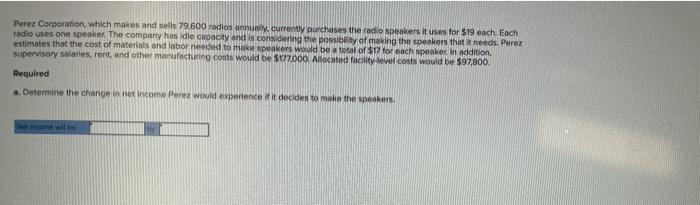

Stuart Concrete Company pours concrete slabs for single-famly dwellings. Lancing Construction Company, which operates outside Stuart's normal sales territory, asks Stuart to pour 44 slabs for Lancing's new development of homes. Stuart has the capacity to build 500 slabs and is presently working on 110 of them. Lancing is willing to pay only $2,610 per slab. Stuart estimates the cost of a typical job to include unit-level materials, $930, unit-ever labor, $400, and an allocated portion of facility-level overhead, $1,340, Required Calculate the contribution to profit from the special order, Should Stuart accept or reject the special order to pour 44 slabs for $2.610 each? Contribution to profit Should Stuart scept or reject the special order? Gibson Company, which produces and sells a small digital clock, buses its pricing strategy on 25 percent markup on total cost. Based on annual production costs for 12.000 units of product, computations for the sales price per clock follow: Unit-level costs Fixed costa Total cost ) Markup ( 0.25) Total sales (b) sales price per un 12.000) $275,000 60.000 336,000 80.000 8420000 5 35 Required a. Gibson has excess capacity and receives a special order for 7,000 clocks for $28 each. Calculate the contribution margin per unit. Based on this should Gibson accept the special order? b. Prepare a contribution margin income statement for the special order Complete this question by entering your answers in the tabs below. Required A Required B Gibson has excess capacity and receives a special order for 7.000 clocks for $28 enen. Calculate the contribution margin per unit. Based on this should Gibson accept the special order? Contribubon margin per un Should Gibson accept the special order? More Required B > Gibson Company, which produces and sells molt dital clock bases its pricing strategy on 25 percent markup on total cost Based on annual production costs for 12.000 units of product computations for the sales price per clock follow Unit-level coat Fixed cost Total cost ) Markup ( 0.25 Total sales (3 sales price per unit 12,000) $276,000 60,000 336.000 84.000 3420 000 35 Required a Gibson has excess capacity and receives a special order for 7000 clocks for $28 each Calculate the contribution margin per unit. Based on this should Gibson accept the special order? b. Prepare a contribution margin income statement for the special order, Complete this question by entering your answers in the tabs below. Required A Required Prepare a contribution margin income statement for the special order GIBSON COMPANY Contribution Margin income statement Gibson Company, which produces and sells molt dital clock bases its pricing strategy on 25 percent markup on total cost Based on annual production costs for 12.000 units of product computations for the sales price per clock follow Unit-level coat Fixed cost Total cost ) Markup ( 0.25 Total sales (3 sales price per unit 12,000) $276,000 60,000 336.000 84.000 3420 000 35 Required a Gibson has excess capacity and receives a special order for 7000 clocks for $28 each Calculate the contribution margin per unit. Based on this should Gibson accept the special order? b. Prepare a contribution margin income statement for the special order, Complete this question by entering your answers in the tabs below. Required A Required Prepare a contribution margin income statement for the special order GIBSON COMPANY Contribution Margin income statement