Answered step by step

Verified Expert Solution

Question

1 Approved Answer

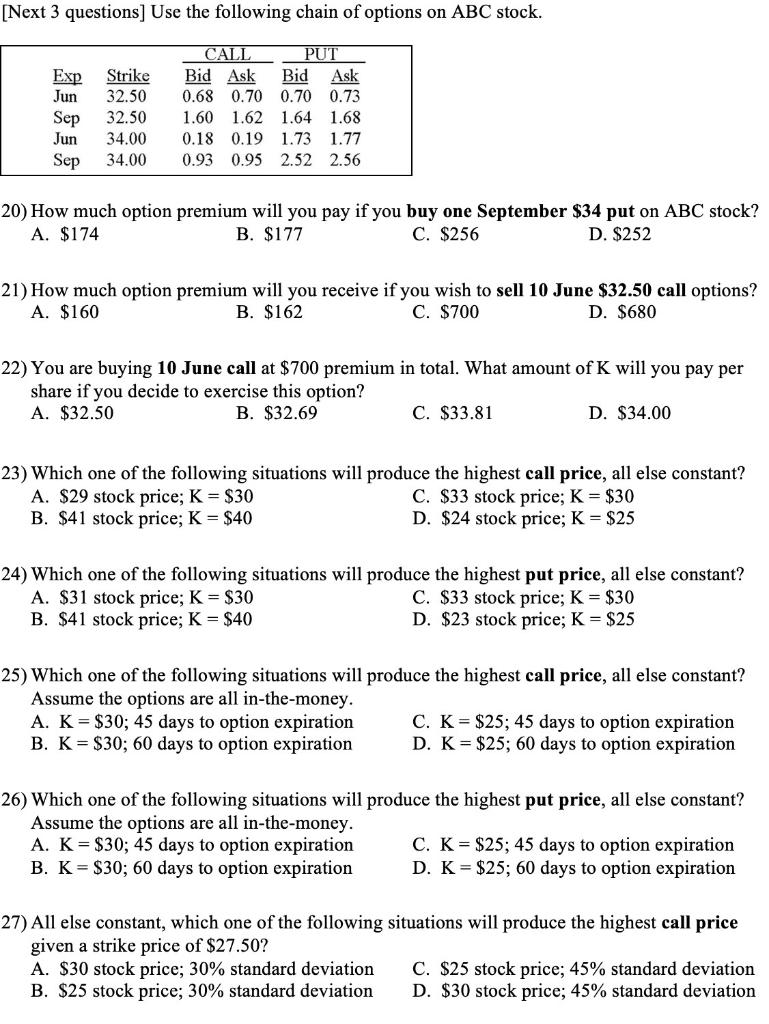

Please only do 24-27. Thank you. [Next 3 questions] Use the following chain of options on ABC stock. Exp Jun Sep Jun Sep Strike 32.50

Please only do 24-27. Thank you.

[Next 3 questions] Use the following chain of options on ABC stock. Exp Jun Sep Jun Sep Strike 32.50 32.50 34.00 34.00 CALL PUT Bid Ask Bid Ask 0.68 0.70 0.70 0.73 1.60 1.62 1.64 1.68 0.18 0.19 1.73 1.77 0.93 0.95 2.52 2.56 20) How much option premium will you pay if you buy one September $34 put on ABC stock? A. $174 B. $177 C. $256 D. $252 21) How much option premium will you receive if you wish to sell 10 June $32.50 call options? A. $160 B. $162 C. $700 D. $680 22) You are buying 10 June call at $700 premium in total. What amount of K will you pay per share if you decide to exercise this option? A. $32.50 B. $32.69 C. $33.81 D. $34.00 23) Which one of the following situations will produce the highest call price, all else constant? A. $29 stock price; K = $30 C. $33 stock price; K= $30 B. $41 stock price; K = $40 D. $24 stock price; K = $25 24) Which one of the following situations will produce the highest put price, all else constant? A. $31 stock price; K = $30 C. $33 stock price; K = $30 B. $41 stock price; K = $40 D. $23 stock price; K = $25 25) Which one of the following situations will produce the highest call price, all else constant? Assume the options are all in-the-money. A. K = $30; 45 days to option expiration C. K = $25; 45 days to option expiration B. K = $30; 60 days to option expiration D. K = $25; 60 days to option expiration 26) Which one of the following situations will produce the highest put price, all else constant? Assume the options are all in-the-money. A. K = $30; 45 days to option expiration C. K = $25; 45 days to option expiration B. K = $30; 60 days to option expiration D. K = $25; 60 days to option expiration 27) All else constant, which one of the following situations will produce the highest call price given a strike price of $27.50? A. $30 stock price; 30% standard deviation C. $25 stock price; 45% standard deviation B. $25 stock price; 30% standard deviation D. $30 stock price; 45% standard deviationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started