please only give answers no explanation needed

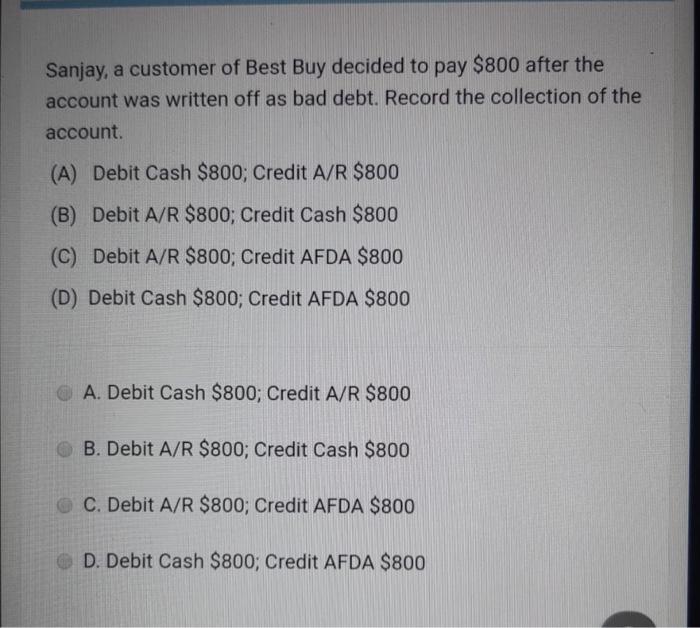

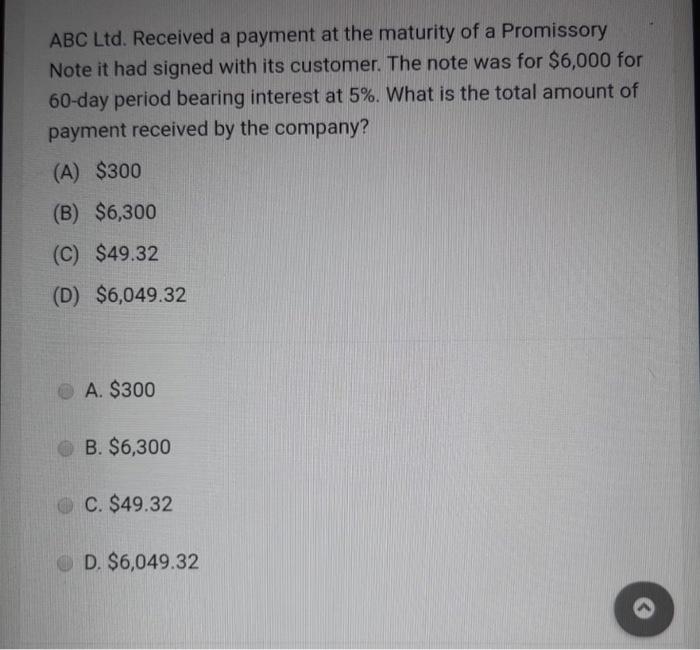

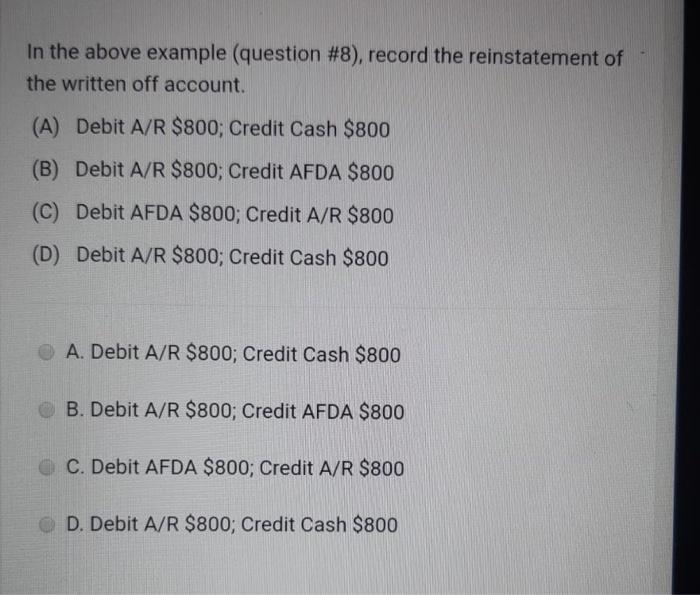

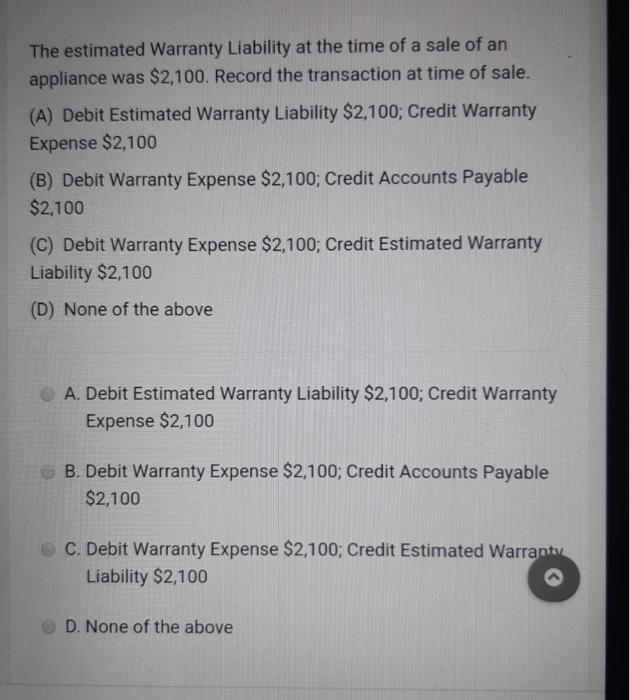

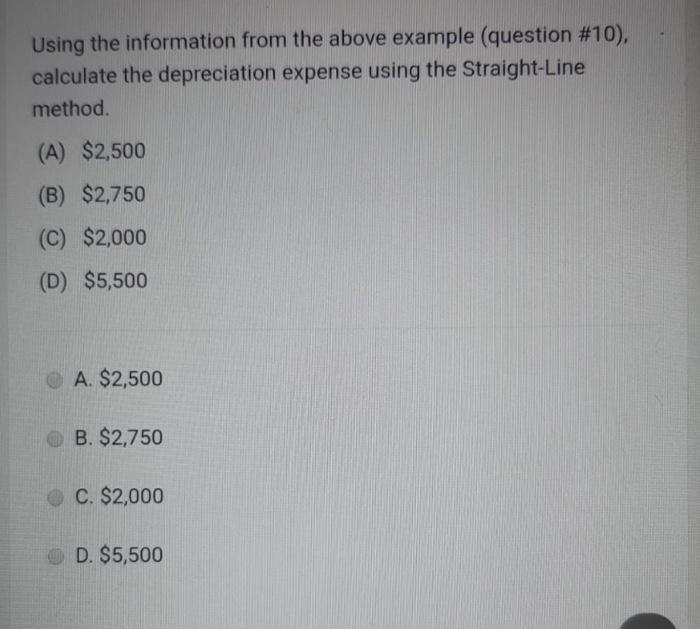

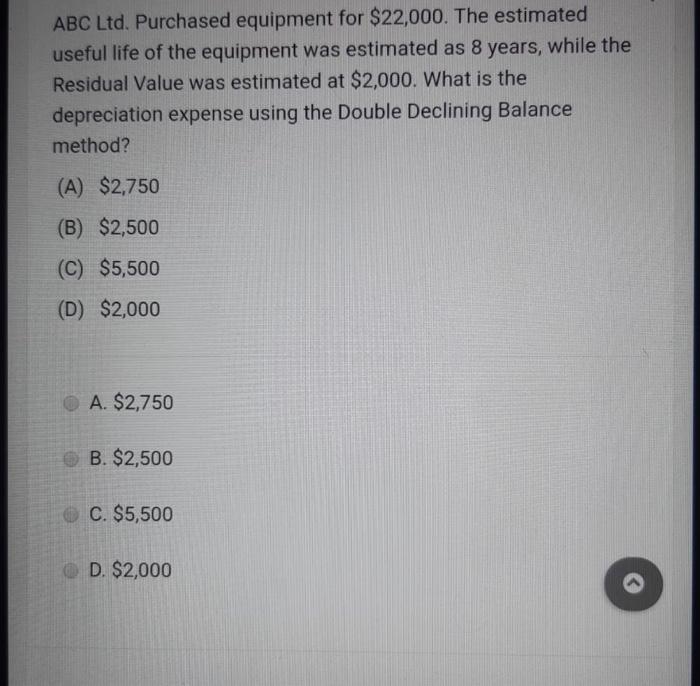

The journal entry for initially creating a Petty Cash Fund is: (A) Debit Cash and Credit Expenses (B) Debit Petty Cash and Credit Expenses (C) Debit Petty Cash fund and Credit Cash (D) Debit Expenses and Credit Cash A. Debit Cash and Credit Expenses B. Debit Petty Cash and Credit Expenses C. Debit Petty Cash fund and Credit Cash D. Debit Expenses and Credit Cash In the above example (question #5), record the transaction when the initial transaction was made, i.e., when ABC Ltd. Advanced the monies to the customer. (A) Debit Cash $6,000; Credit Notes Receivable $6,000 (B) Debit Cash $6,049.32; Credit Notes Receivable $6,049.32 (C) Debit Notes Receivable $6,000; Credit Cash $6,000 (D) Debit Notes Receivable $6,049.32; Credit Cash $6,049.32 A. Debit Cash $6,000; Credit Notes Receivable $6,000 B. Debit Cash $6,049.32; Credit Notes Receivable $6,049.32 C. Debit Notes Receivable $6,000; Credit Cash $6,000 D. Debit Notes Receivable $6,049.32; Credit Cash $6,049.32 In the above example (question #5), how would you record the transaction at maturity? (A) Debit Cash $6,000; Credit Notes Receivable $6,000 (B) Debit Cash $49.32; Credit Interest Revenue $49.32 (C) Debit Notes Receivable $6,049.32; Credit Cash $6,049.32 (D) Debit Cash $6,049.32; Credit Notes Receivable $6,000; Credit Interest Revenue $49.32 A. Debit Cash $6,000; Credit Notes Receivable $6,000 B. Debit Cash $49.32; Credit Interest Revenue $49.32 C. Debit Notes Receivable $6,049.32; Credit Cash $6,049.32 D. Debit Cash $6,049.32; Credit Notes Receivable $6,000; Credit Interest Revenue $49.32 A company's bank statement at Dec.31,2020 showed balance of $16,500 while the Company's book had a balance of $8,800 on same date. It was subsequently discovered that the total outstanding cheques were $8,000 and $1,050 respectively while the total deposits in transit totaled $1,500. Total debit memos amounted to $50. Interest earned was $200 What is the Bank Reconciled balance? (A) $ 9,050 (B) $ 7,700 (C) $ 8,950 (D) $ 9,000 A. $ 9,050 B.$ 7,700 C. $ 8,950 D. $ 9,000 Sanjay, a customer of Best Buy decided to pay $800 after the account was written off as bad debt. Record the collection of the account. (A) Debit Cash $800; Credit A/R $800 (B) Debit A/R $800; Credit Cash $800 (C) Debit A/R $800; Credit AFDA $800 (D) Debit Cash $800; Credit AFDA $800 A. Debit Cash $800; Credit A/R $800 B. Debit A/R $800; Credit Cash $800 C. Debit A/R $800, Credit AFDA $800 D. Debit Cash $800; Credit AFDA $800 ABC Ltd. Received a payment at the maturity of a Promissory Note it had signed with its customer. The note was for $6,000 for 60-day period bearing interest at 5%. What is the total amount of payment received by the company? (A) $300 (B) $6,300 (C) $49.32 (D) $6,049.32 A. $300 B. $6,300 C. $49.32 D. $6,049.32 In the above example (question #8), record the reinstatement of the written off account. (A) Debit A/R $800; Credit Cash $800 (B) Debit A/R $800; Credit AFDA $800 (C) Debit AFDA $800; Credit A/R $800 (D) Debit A/R $800; Credit Cash $800 A. Debit A/R $800; Credit Cash $800 B. Debit A/R $800; Credit AFDA $800 C. Debit AFDA $800; Credit A/R $800 D. Debit A/R $800; Credit Cash $800 The estimated Warranty Liability at the time of a sale of an appliance was $2,100. Record the transaction at time of sale. (A) Debit Estimated Warranty Liability $2,100; Credit Warranty Expense $2,100 (B) Debit Warranty Expense $2,100; Credit Accounts Payable $2,100 (C) Debit Warranty Expense $2,100; Credit Estimated Warranty Liability $2,100 (D) None of the above A. Debit Estimated Warranty Liability $2,100; Credit Warranty Expense $2,100 B. Debit Warranty Expense $2,100; Credit Accounts Payable $2,100 C. Debit Warranty Expense $2,100; Credit Estimated Warranty Liability $2,100 D. None of the above Using the information from the above example (question #10), calculate the depreciation expense using the Straight-Line method. (A) $2,500 (B) $2,750 (C) $2,000 (D) $5,500 A. $2,500 B. $2,750 C. $2,000 D. $5,500 ABC Ltd. Purchased equipment for $22,000. The estimated useful life of the equipment was estimated as 8 years, while the Residual Value was estimated at $2,000. What is the depreciation expense using the Double Declining Balance method? (A) $2,750 (B) $2,500 (C) $5,500 (D) $2,000 O A. $2,750 B. $2,500 OC. $5,500 D. $2,000