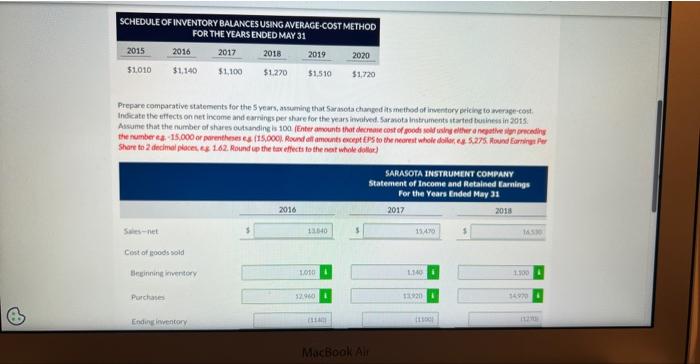

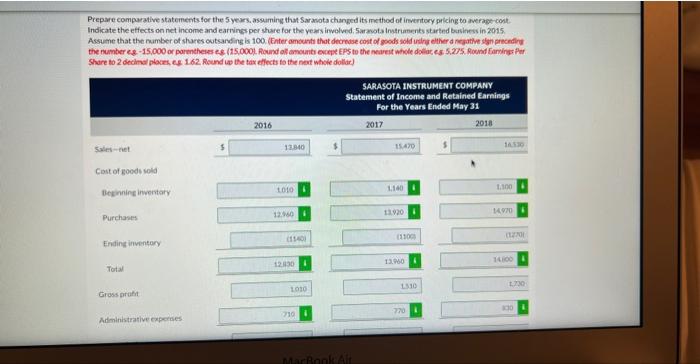

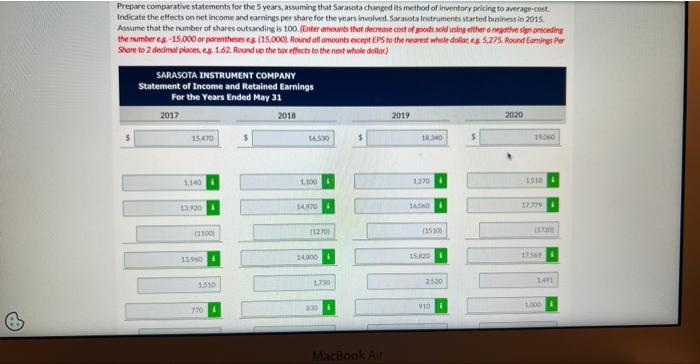

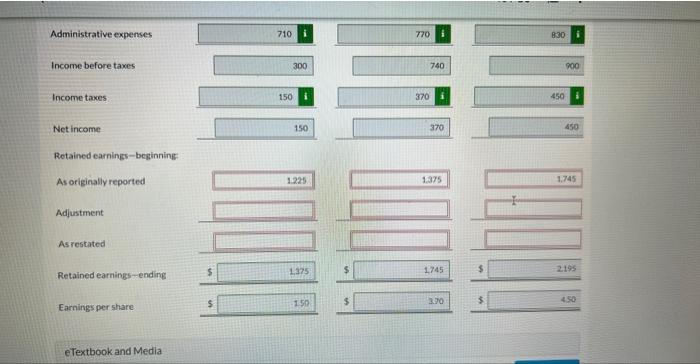

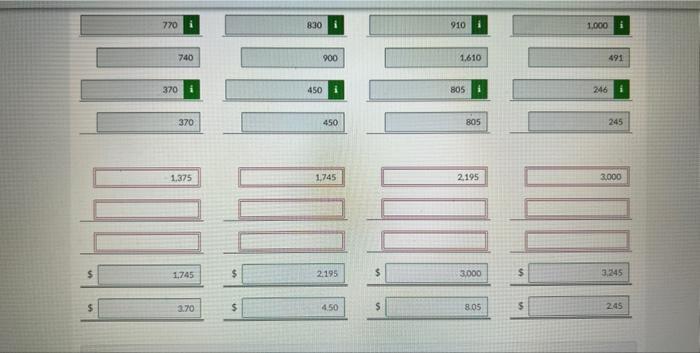

please only solve whats in red. all other data is correct. missing:

"As originally reported" from 2016-2020

"Adjustment" from 2016-2020

"As restated" from 2016-2020

thanks

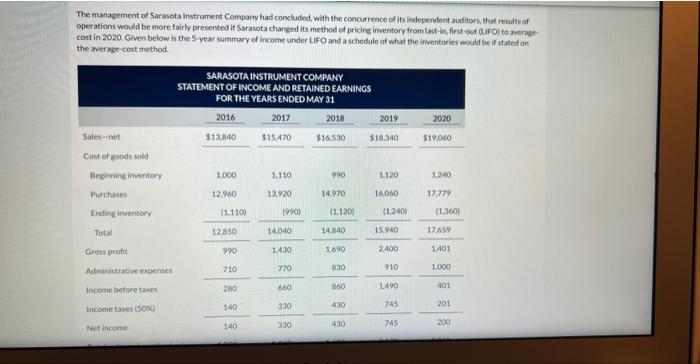

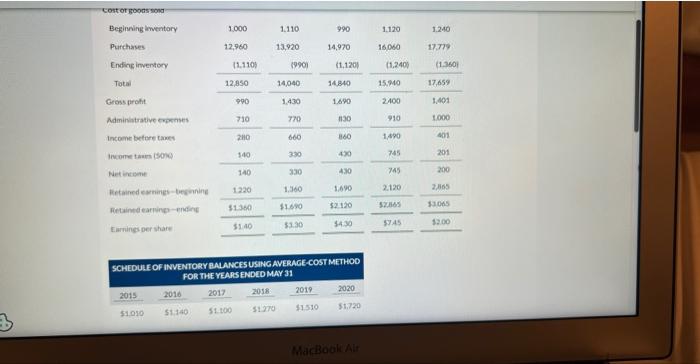

The management of Saraseta instrument Compary had concluded, with the concurrence of its independent auditors, that results of operations would be more fairfy presented it Sara wota changed its method of pricine invertary froen Isst-in, first out (tuFO) to weragecost in 2020 . Given below is the 5-year summary of income under Lifo and a schedule of what the inventories would be if stated on the average-cost method. Cost of goons sona Beginning imventory Purchaves Ending inventory Total Gross proft Adminitrative eqpens- income betore taxes SCHEDUEE OF INVENTOEY RALANCES USING AVERACE-COST METHOD FOR THE YEARS ENDED MAY 31 Prepare comparative statements for the 5 years, atuming that 5 aravota changed its method of inventery peicing to werage-cost. Insicate the effects on net income and camings pet share for the years awpilved. Saraiota instruments ut arted toutiocis in 2015 . Share to 2 decimal piocect es 1.62. Pound is the tax effects fo the net whole dollar) Prepare comparative statements for the 5 years, assuming that Sarawots changcd its me thod of inveritery pricing to average cost. Indicate the effects on net income and earrines per share for the years involved. 5 ar mot.a Instrianents started business in 2015 Assume that the number of shares outsanding is 100 . (Enter amounti that decrodse cost of goods sold inslas elther d negative shan precritiry Share to 2 decinal plaxes es 1.62. Round us the tax effects to the nert whole dollar) Prepare comparative statements for the 5 years, assuming that 5 arasota changed its method af inventory pricing to werage-cost. Indicate the effects on net income and earnings per share for the years involved, Sarasot a instruments started business in 2015 . Assume that the namber of shares outsanding is 100 . Enter omounts that decrecie coit of goods sold usinu elther ontgot he sian precedirt the number es. - 15,000 or parentheses es (15,000). Round all amounts except EPS to the nearef whole dollar e. 5,275 . Round Eamings Per Share to 2 decimal places eg. 1.62. Round up the tar effects to the nert whole dollac) Administrative expenses Income before taxes Income taxes: Netincome Retained earnings-beginning: As originally reported \begin{tabular}{rr|} \hline 1.225 \\ \hline \end{tabular} [1.375 \begin{tabular}{|l|l|} \hline 1.745 \\ \hline \end{tabular} Adjustment As restated Earnings per share eTextbook and Media