Answered step by step

Verified Expert Solution

Question

1 Approved Answer

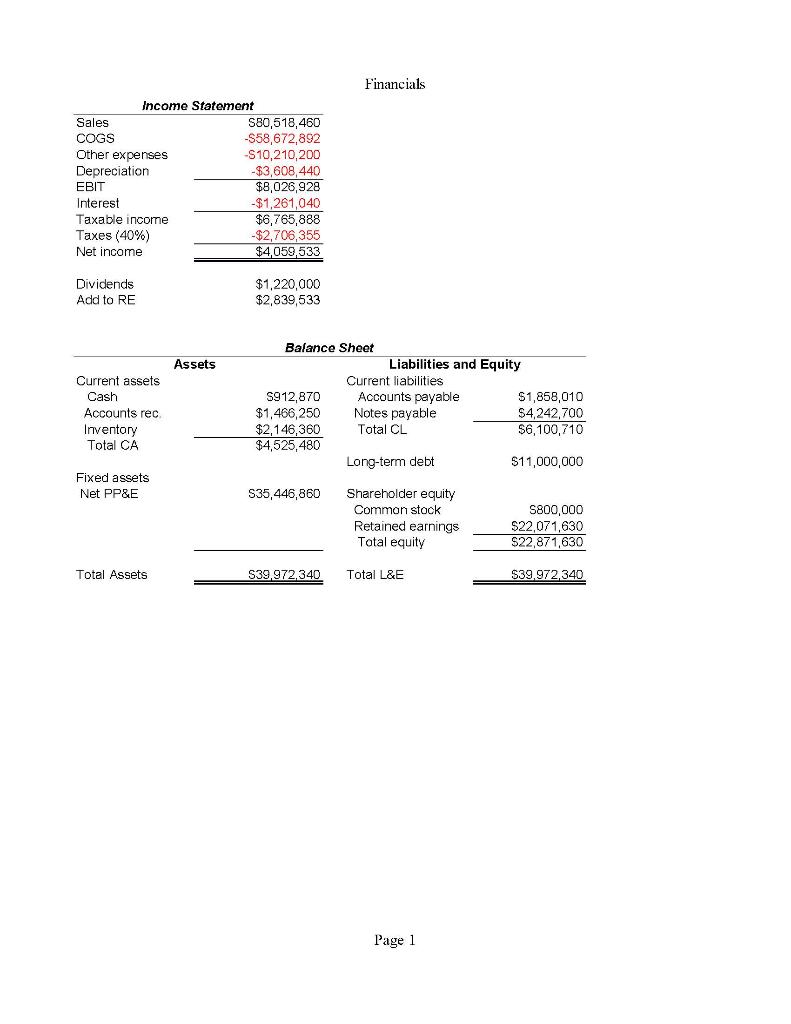

Please only typewritten answers- no handwritten answers please. The product and marketing departments at ABC Corp are estimating a growth rate of 15 percent for

Please only typewritten answers- no handwritten answers please.

The product and marketing departments at ABC Corp are estimating a growth rate of 15 percent for next year. Consider the two distinct scenarios below:

- Assume fixed assets increase proportionally to sales and will be depreciated at a similar rate to existing fixed assets.

- Assume that, to increase production, ABC Corp must set up an entirely new location at a cost of $10,000,000. The new fixed assets will be depreciated at 10% a year.

- For each of the scenarios above, calculate the EFN for the company assuming the company is operating at full capacity. Can the company's sales increase at this growth rate? What will be the capacity utilization for the company next year? Please only typewritten answers- no handwritten answers please

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started