Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please open the attachments Harrison current ratio is --------------------------- Option are Deteriorated, improved or steady . Income statement Harrison's, a home-improvement store chain, reported these

Please open the attachments

Harrison current ratio is ---------------------------

Option are Deteriorated, improved or steady

.

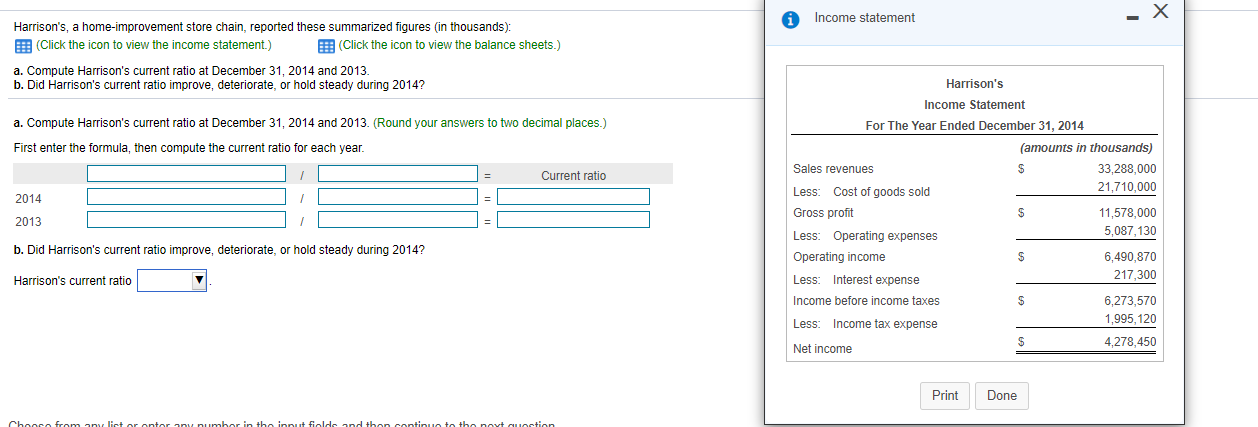

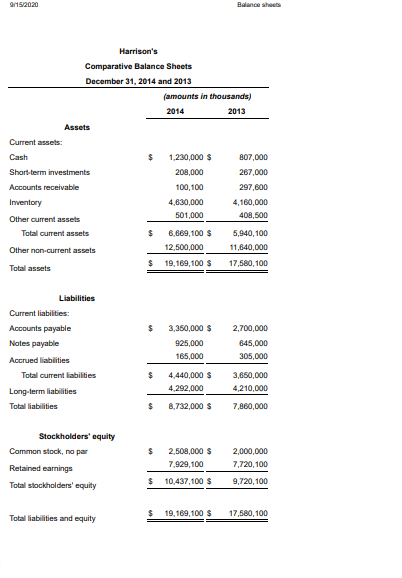

Income statement Harrison's, a home-improvement store chain, reported these summarized figures in thousands): (Click the icon to view the income statement.) (Click the icon to view the balance sheets.) a. Compute Harrison's current ratio at December 31, 2014 and 2013 b. Did Harrison's current ratio improve, deteriorate, or hold steady during 2014? a. Compute Harrison's current ratio at December 31, 2014 and 2013. (Round your answers to two decimal places.) First enter the formula, then compute the current ratio for each year. = Current ratio 2014 2013 Harrison's Income Statement For The Year Ended December 31, 2014 (amounts in thousands) Sales revenues $ 33,288,000 Less: Cost of goods sold 21,710,000 Gross profit $ 11,578,000 5,087,130 Less: Operating expenses Operating income $ 6,490,870 217,300 Less: Interest expense Income before income taxes $ 6,273,570 1,995, 120 Less: Income tax expense $ 4,278,450 Net income 1 b. Did Harrison's current ratio improve, deteriorate, or hold steady during 2014? Harrison's current ratio Print Done Choon from a litet ar antara umbor in the input field and then continue to the not action 9/15/2020 Balance Harrison's Comparative Balance Sheets December 31, 2014 and 2013 famounts in thousands) 2014 2013 Assets Current assets: Cash $ 1,230,000 $ 807,000 Short-term investments 208,000 267,000 Accounts receivable 100,100 297,600 Inventory 4,830,000 4,160,000 Other current assets 501,000 408,500 Total current assets $ 6,669,100 $ 5,940,100 Other non-current assets 12,500,000 11,640,000 $ 19,169,100 $ 17,580,100 Total assets Liabilities Current liabilities: Accounts payable Notes payable Accrued liabilities Total current liabilities Long-term liabilities Total liabilities 3,350,000 $ 925,000 165,000 2,700,000 845,000 305,000 $ 4.440,000 $ 4.292,000 3,650,000 4,210,000 7,860,000 $ 8,732,000 $ Stockholders' equity Common stock, na par Retained earnings $ 2,508,000 $ 7,929,100 2,000,000 7,720,100 Total stockholders' equity $ 10,437,100 $ 9,720,100 $ Total liabilities and equity 19,169,100 $ 17,580,100Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started