Answered step by step

Verified Expert Solution

Question

1 Approved Answer

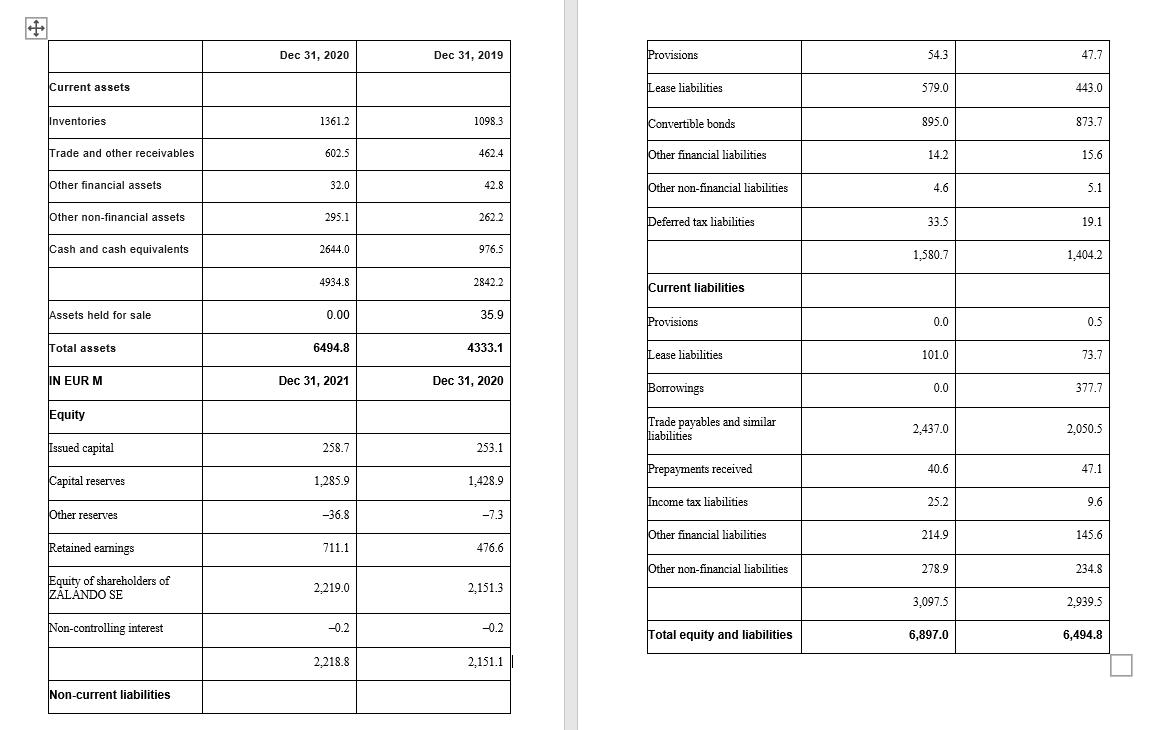

Please perform 3-years analysis on those ratios and provide your professional interpretation (comments) on the ratios calculated. Please use year 2019, 2020, 2021 Calculate Current

Please perform 3-years analysis on those ratios and provide your professional interpretation (comments) on the ratios calculated. Please use year 2019, 2020, 2021

Calculate

Current Ratio, Quick Ratio, Inventory Turnover , Debt Ratio, Net Profit Margin, Return on Equity (ROE), Non-Current Asset Turnover with formula

+++ Current assets Inventories Trade and other receivables Other financial assets Other non-financial assets Cash and cash equivalents Assets held for sale Total assets IN EUR M Equity Issued capital Capital reserves Other reserves Retained earnings Equity of shareholders of ZALANDO SE Non-controlling interest Non-current liabilities Dec 31, 2020 1361.2 602.5 32.0 295.1 2644.0 4934.8 0.00 6494.8 Dec 31, 2021 258.7 1,285.9 -36.8 711.1 2.219.0 -0.2 2,218.8 Dec 31, 2019 1098.3 462.4 42.8 262.2 976.5 2842.2 35.9 4333.1 Dec 31, 2020 253.1 1,428.9 -7.3 476.6 2,151.3 -0.2 2,151.1 Provisions Lease liabilities Convertible bonds Other financial liabilities. Other non-financial liabilities Deferred tax liabilities Current liabilities Provisions Lease liabilities Borrowings Trade payables and similar liabilities Prepayments received Income tax liabilities Other financial liabilities Other non-financial liabilities. Total equity and liabilities 54.3 579.0 895.0 14.2 4.6 33.5 1.580.7 0.0 101.0 0.0 2,437.0 40.6 25.2 214.9 278.9 3,097.5 6,897.0 47.7 443.0 873.7 15.6 5.1 19.1 1,404.2 0.5 73.7 377.7 2,050.5 47.1 9.6 145.6 234.8 2.939.5 6,494.8

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started