Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please please answer using keyboard so I can understand the solution. On January 1, 2019 Stuff Inc. acquired land with a very old building on

please please answer using keyboard so I can understand the solution.

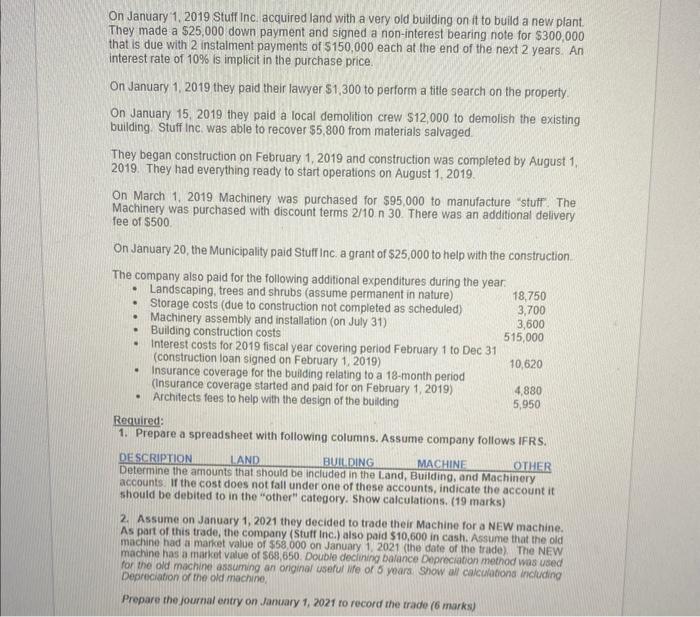

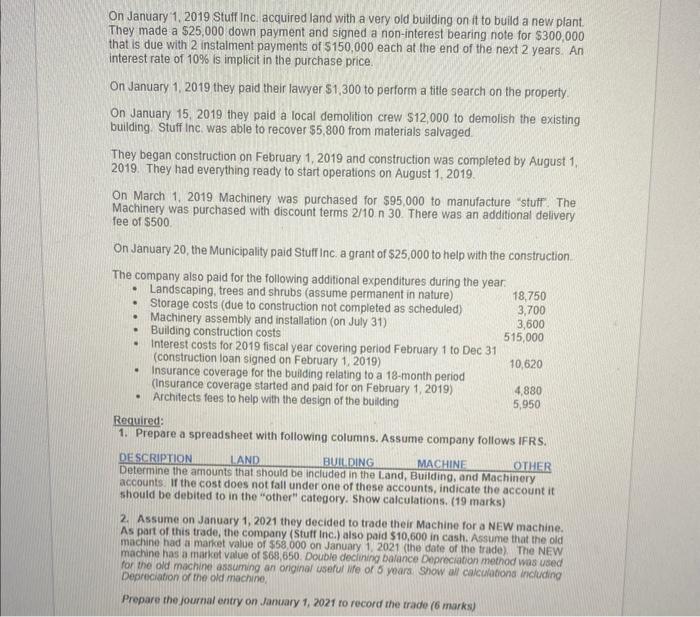

On January 1, 2019 Stuff Inc. acquired land with a very old building on it to build a new plant. They made a $25,000 down payment and signed a non-interest bearing note for $300,000 that is due with 2 instaiment payments of $150,000 each at the end of the next 2 years. An interest rate of 10% is implicit in the purchase price. On January 1, 2019 they paid their lawyer $1,300 to perform a title search on the property. On January 15, 2019 they paid a local demolition crew $12,000 to demolish the existing building. Stuff inc. Was able to recover $5,800 from materials salvaged. They began construction on February 1, 2019 and construction was completed by August 1, 2019. They had everything ready to start operations on August 1, 2019. On March 1, 2019 Machinery was purchased for $95,000 to manufacture "stuff: The Machinery was purchased with discount terms 2/10,30. There was an additional delivery fee of $500. On January 20 , the Municipality paid Stuff Inc. a grant of $25,000 to help with the construction. Required: 1. Prepare a spreadsheet with following columns. Assume company follows IFRS. 2. Assume on January 1, 2021 they decided to trade their Machine for a NEW machine. As part of this trade, the company (Stuff inc.) also paid $10,600 in cash. Assume that the old machine had a market value of $58.000 on January 1,2021 (the date of the trade) The NEW machine has a markot value of 568,650 . Dowble decining balance Depreciation method was used for the oid machine assuming an onginal useful ife of 5 years show al calculations indiding Desreciation of the old machine, Prepare the joumal entry on January 1,2021 to record the trade ( 6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started