Please please complete all

Please please complete all

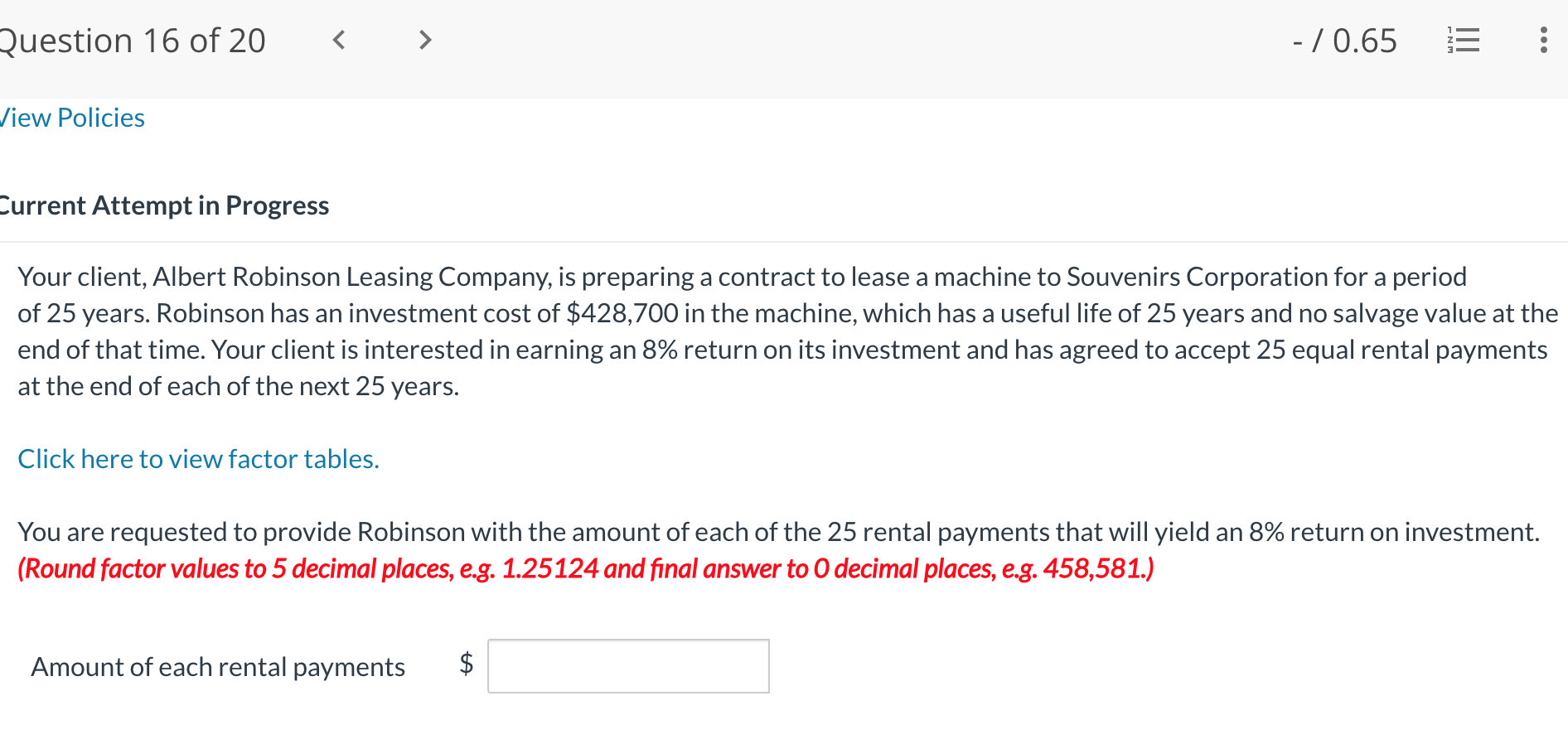

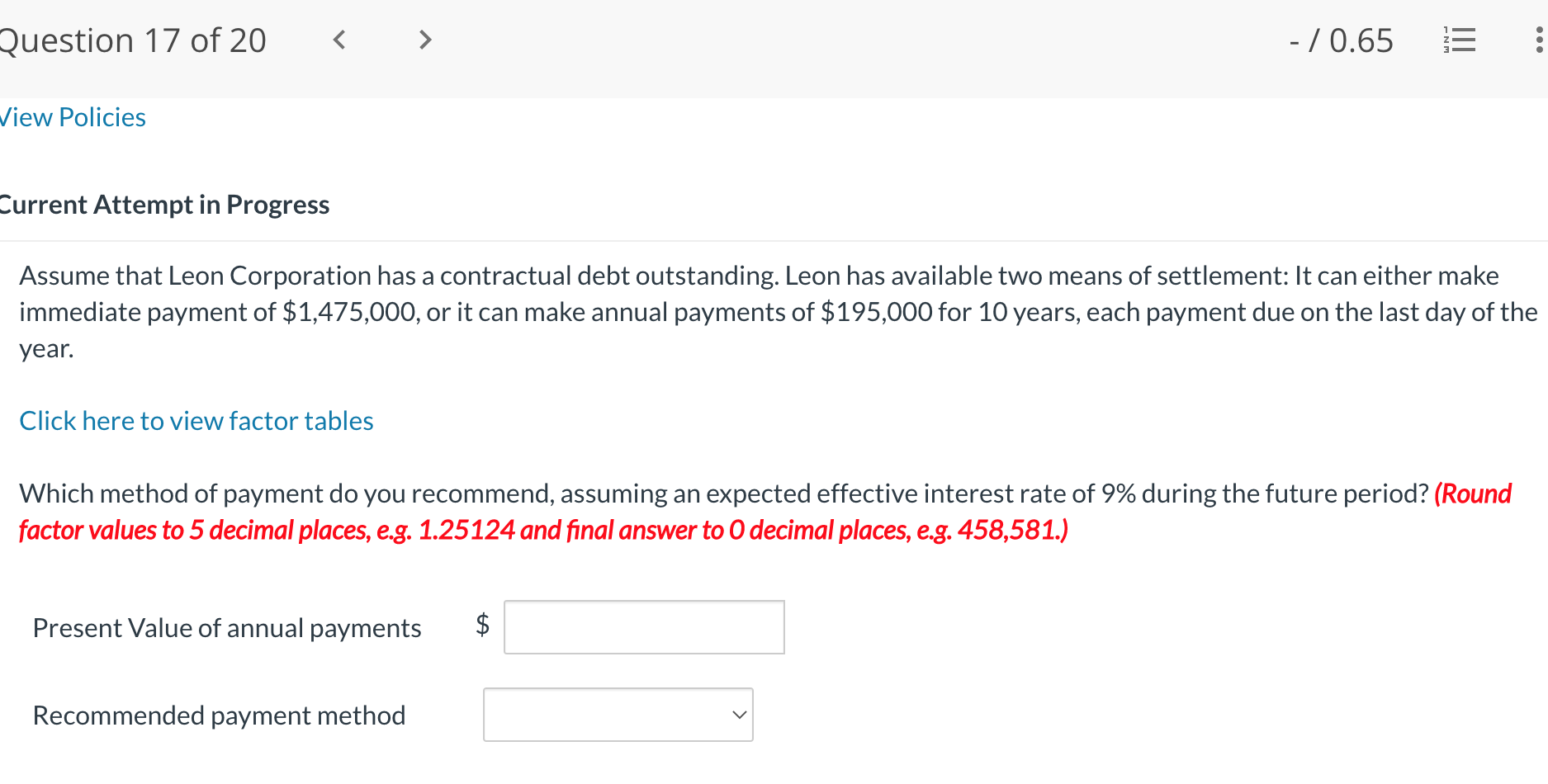

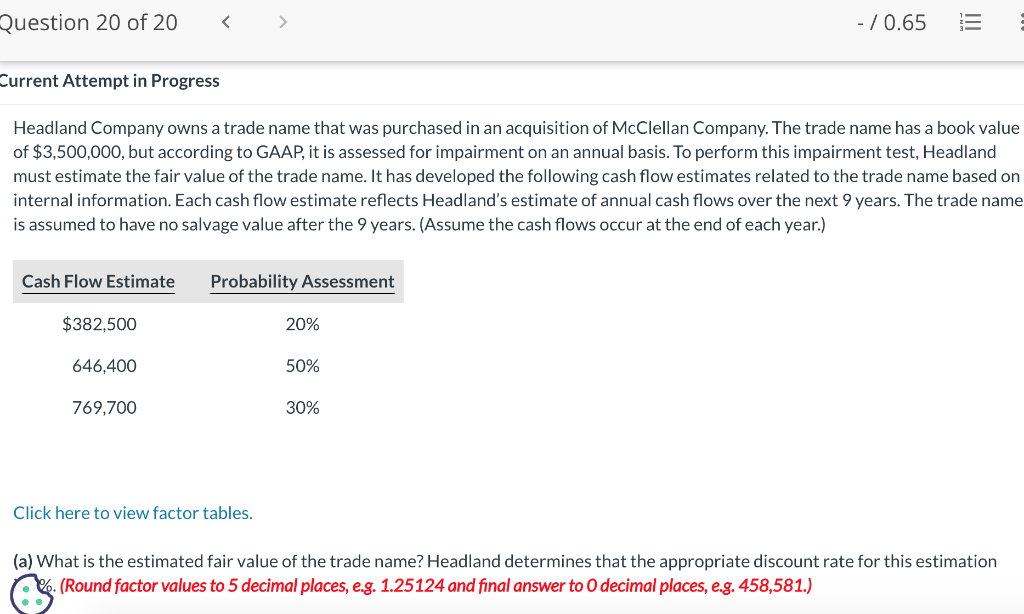

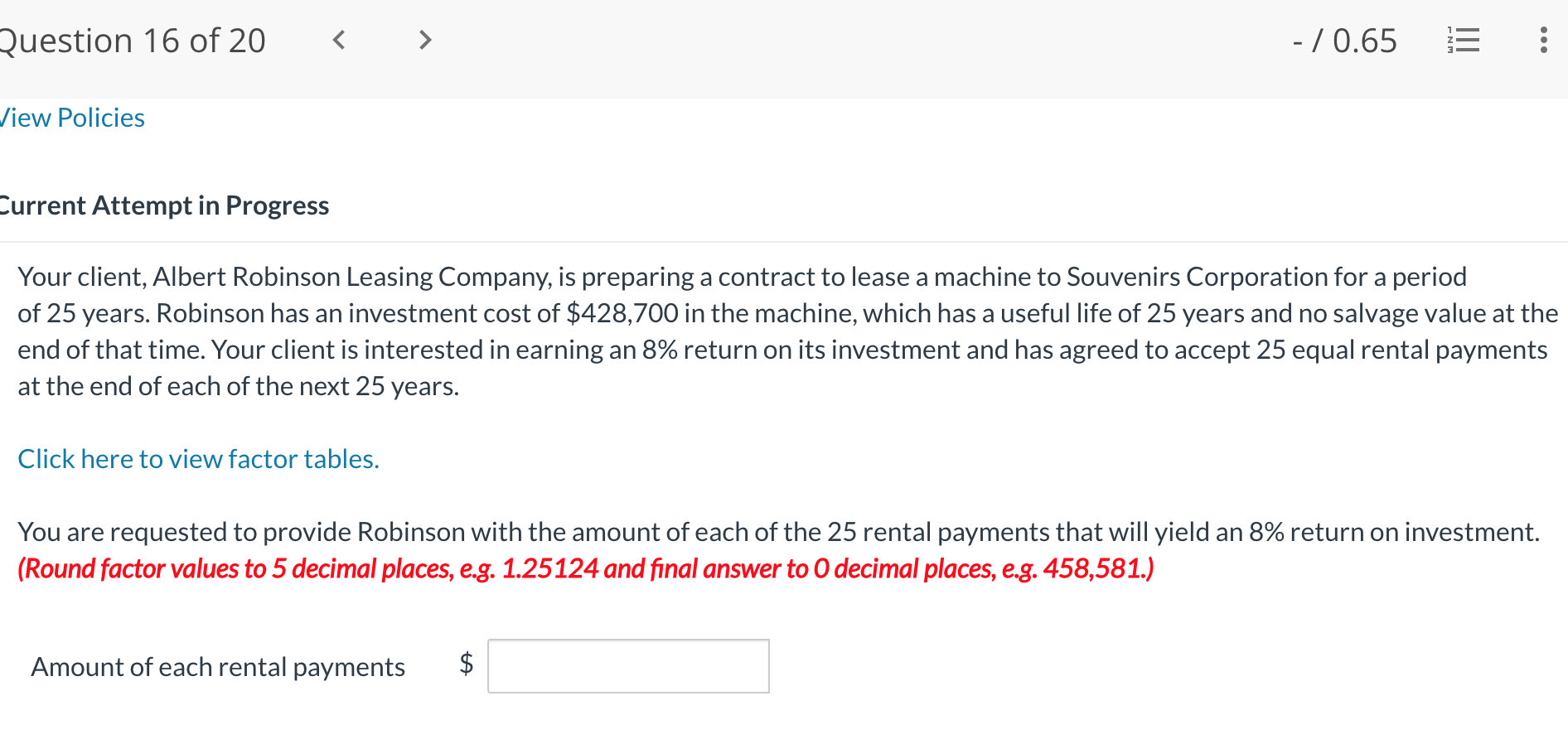

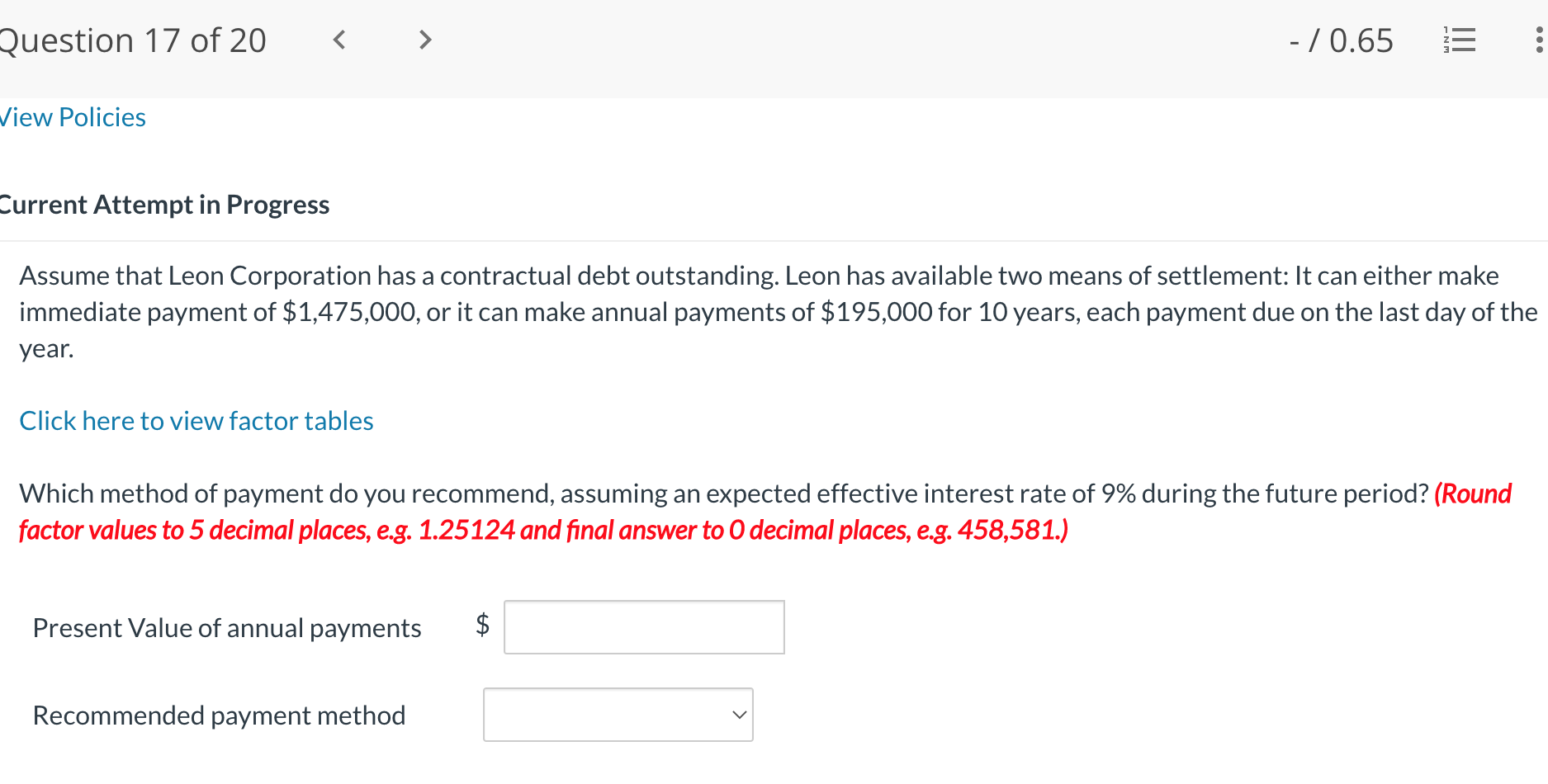

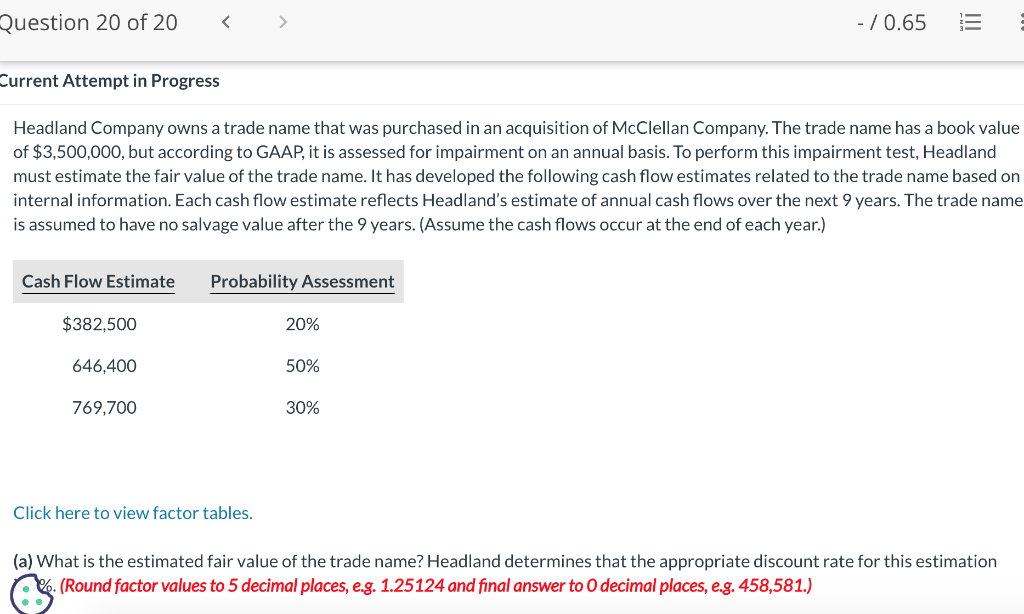

Your client, Albert Robinson Leasing Company, is preparing a contract to lease a machine to Souvenirs Corporation for a period of 25 years. Robinson has an investment cost of $428,700 in the machine, which has a useful life of 25 years and no salvage value at the end of that time. Your client is interested in earning an 8% return on its investment and has agreed to accept 25 equal rental payments at the end of each of the next 25 years. Click here to view factor tables. You are requested to provide Robinson with the amount of each of the 25 rental payments that will yield an 8% return on investment. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 458,581.) Amount of each rental payments $ Current Attempt in Progress Assume that Leon Corporation has a contractual debt outstanding. Leon has available two means of settlement: It can either make immediate payment of $1,475,000, or it can make annual payments of $195,000 for 10 years, each payment due on the last day of the year. Click here to view factor tables Which method of payment do you recommend, assuming an expected effective interest rate of 9% during the future period? (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 458,581.) Present Value of annual payments \$ Recommended payment method Headland Company owns a trade name that was purchased in an acquisition of McClellan Company. The trade name has a book value of $3,500,000, but according to GAAP, it is assessed for impairment on an annual basis. To perform this impairment test, Headland must estimate the fair value of the trade name. It has developed the following cash flow estimates related to the trade name based on internal information. Each cash flow estimate reflects Headland's estimate of annual cash flows over the next 9 years. The trade name is assumed to have no salvage value after the 9 years. (Assume the cash flows occur at the end of each year.) Click here to view factor tables. (a) What is the estimated fair value of the trade name? Headland determines that the appropriate discount rate for this estimation (\%. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 458,581.)

Please please complete all

Please please complete all