Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please please do all parts for thumbs up. Is shall be very thankful to you 1. Tool Time Inc. uses job-order costing for its brand

please please do all parts for thumbs up. Is shall be very thankful to you

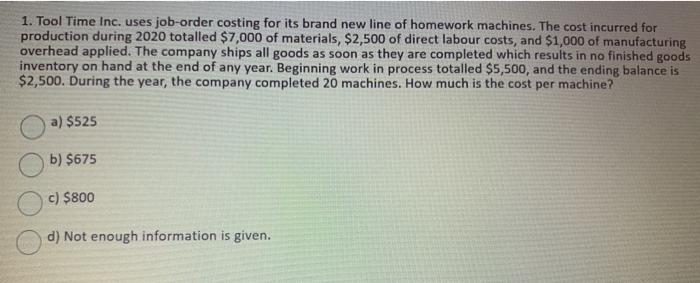

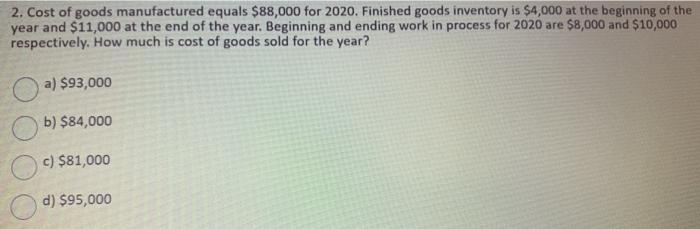

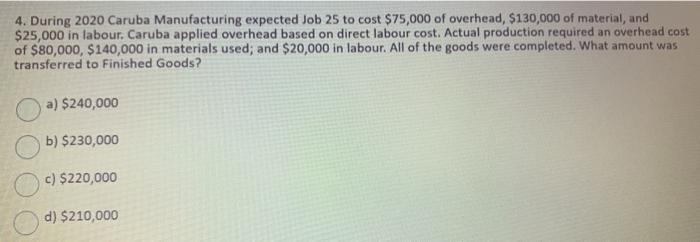

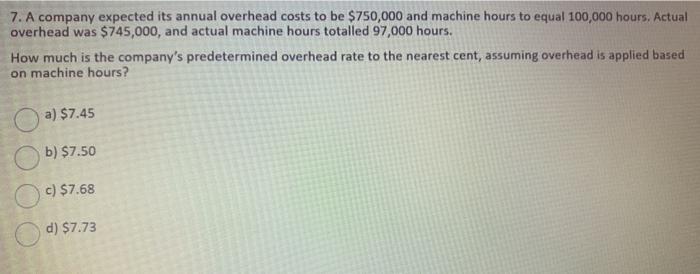

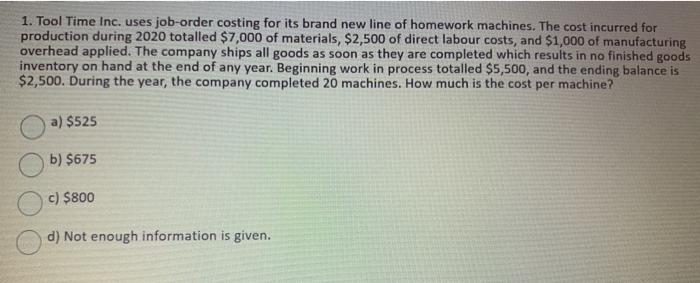

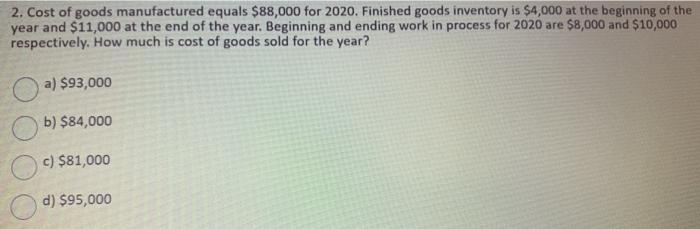

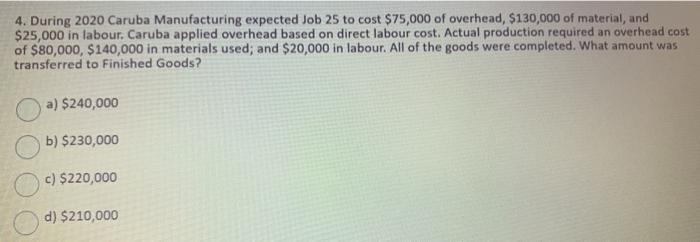

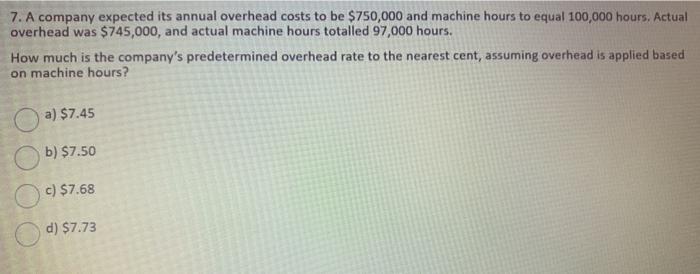

1. Tool Time Inc. uses job-order costing for its brand new line of homework machines. The cost incurred for production during 2020 totalled $7,000 of materials, $2,500 of direct labour costs, and $1,000 of manufacturing overhead applied. The company ships all goods as soon as they are completed which results in no finished goods inventory on hand at the end of any year. Beginning work in process totalled $5,500, and the ending balance is $2,500. During the year, the company completed 20 machines. How much is the cost per machine? a) $525 b) $675 c) $800 d) Not enough information is given. 2. Cost of goods manufactured equals $88,000 for 2020. Finished goods inventory is $4,000 at the beginning of the year and $11,000 at the end of the year. Beginning and ending work in process for 2020 are $8,000 and $10,000 respectively. How much is cost of goods sold for the year? a) $93,000 b) $84,000 c) $81,000 d) $95,000 4. During 2020 Caruba Manufacturing expected Job 25 to cost $75,000 of overhead, $130,000 of material, and $25,000 in labour. Caruba applied overhead based on direct labour cost. Actual production required an overhead cost of $80,000, $140,000 in materials used; and $20,000 in labour. All of the goods were completed. What amount was transferred to Finished Goods? a) $240,000 b) $230,000 c) $220,000 d) $210,000 7. A company expected its annual overhead costs to be $750,000 and machine hours to equal 100,000 hours. Actual overhead was $745,000, and actual machine hours totalled 97,000 hours. How much is the company's predetermined overhead rate to the nearest cent, assuming overhead is applied based on machine hours? a) $7.45 b) $7.50 c) $7.68 d) $7.73

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started