Answered step by step

Verified Expert Solution

Question

1 Approved Answer

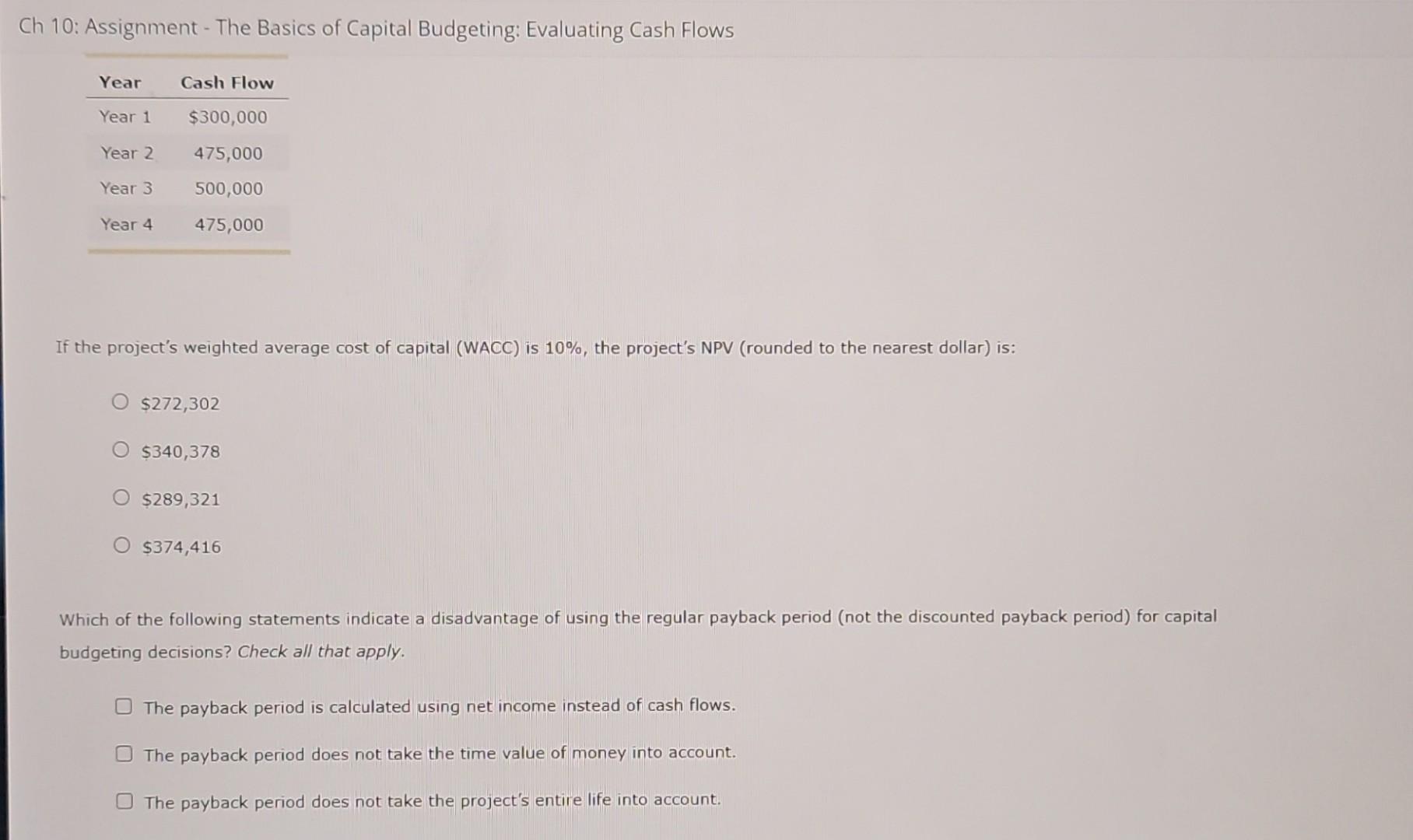

Please, please help 10: Assignment - The Basics of Capital Budgeting: Evaluating Cash Flows A project's payback period (PB) indicates the number of years required

Please, please help

10: Assignment - The Basics of Capital Budgeting: Evaluating Cash Flows A project's payback period (PB) indicates the number of years required for a project to recover its initial investment using its operating cash flows. As the theoretical soundness of the conventional (undiscounted) PB technique was criticized, the model was modified to incorporate the time value of money-adjusted operating cash flows to create the discounted payback method. While both payback models continue to reflect faulty ranking criteria, they do provide important (useful) information regarding a project's liquidity and riskiness. In general, cash flows expected in the distant future are risky than cash flows received in the near-term-which suggests that the payback period can also serve as an indicator of project risk. Suppose you are evaluating a project with the expected future cash inflows shown in the following table. Your boss has asked you to calculate the project's net present value (NPV). You don't know the project's initial cost, but you do know the project's regular, or conventional, payback period is 2.50 years. If the project's weighted average cost of capital (WACC) is 10%, the project's NPV (rounded to the nearest dollar) is: $272,302 $340,378 Ch 10: Assignment - The Basics of Capital Budgeting: Evaluating Cash Flows If the project's weighted average cost of capital (WACC) is 10%, the project's NPV (rounded to the nearest dollar) is: $272,302 $340,378 $289,321 $374,416 Which of the following statements indicate a disadvantage of using the regular payback period (not the discounted payback period) for capital budgeting decisions? Check all that apply. The payback period is calculated using net income instead of cash flows. The payback period does not take the time value of money into account. The payback period does not take the project's entire life into accountStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started