Answered step by step

Verified Expert Solution

Question

1 Approved Answer

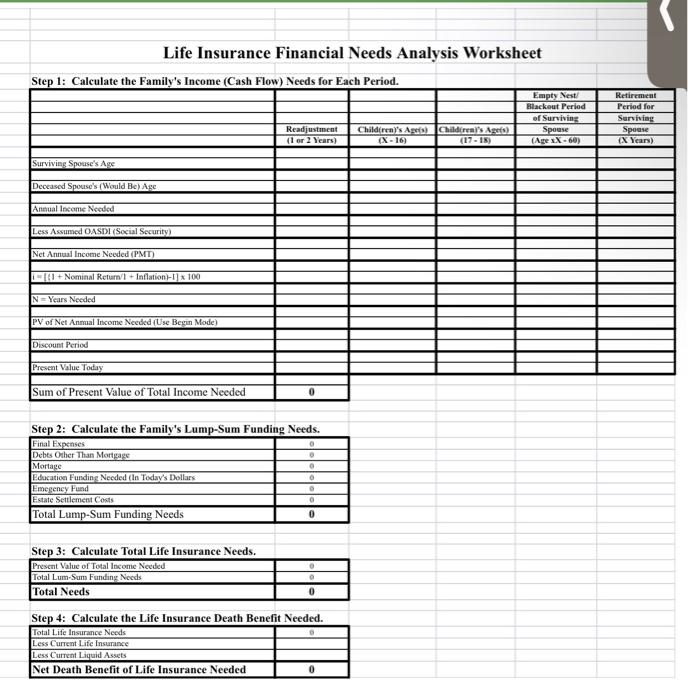

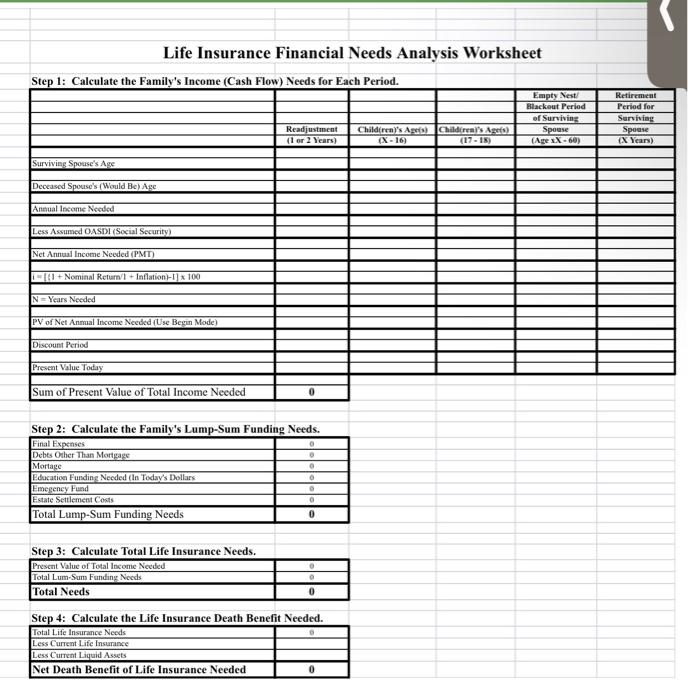

Please please help me fill this out! A single 23 year old nurse!! Life Insurance Financial Needs Analysis Worksheet Step 1: Calculate the Family's Income

Please please help me fill this out! A single 23 year old nurse!!

Life Insurance Financial Needs Analysis Worksheet Step 1: Calculate the Family's Income (Cash Flow) Needs for Each Period. Empty Nest Blackout Period of Surviving Spouse (Age X-60) Retirement Period for Surviving Spouse (X Years) Readjustment (1 or 2 Years) Children's Ages) Children's Age(s) (X-16) (17-18) Surviving Spouse's Are Deceased Spouse's (Would Bc) Age Annual Income Needed Less Assumed 0 (Social Security) Net Annual Income Needed (PMT) 161+ Nominal Return + Inflation-1} x 100 N = Years Needed PV of Net Annual Income Needed (Use Besin Mode) Discount Period Present Value Today Sum of Present Value of Total Income Needed 0 0 Step 2: Calculate the Family's Lump-Sum Funding Needs. Final Expenses Debts Other Than Mortgage Mortage Education Funding Needed (In Today's Dollars Emogency Fund Estate Settlement Costs Total Lump-Sum Funding Needs 0 o O Step 3: Calculate Total Life Insurance Needs. Present Value of Total Income Needed Total Lum-Sum Funding Needs Total Needs 0 Step 4: Calculate the Life Insurance Death Benefit Needed. Total Life Insurance Needs Less Current Life Insurance Less Current Liquid Assets Net Death Benefit of Life Insurance Needed 0 Life Insurance Financial Needs Analysis Worksheet Step 1: Calculate the Family's Income (Cash Flow) Needs for Each Period. Empty Nest Blackout Period of Surviving Spouse (Age X-60) Retirement Period for Surviving Spouse (X Years) Readjustment (1 or 2 Years) Children's Ages) Children's Age(s) (X-16) (17-18) Surviving Spouse's Are Deceased Spouse's (Would Bc) Age Annual Income Needed Less Assumed 0 (Social Security) Net Annual Income Needed (PMT) 161+ Nominal Return + Inflation-1} x 100 N = Years Needed PV of Net Annual Income Needed (Use Besin Mode) Discount Period Present Value Today Sum of Present Value of Total Income Needed 0 0 Step 2: Calculate the Family's Lump-Sum Funding Needs. Final Expenses Debts Other Than Mortgage Mortage Education Funding Needed (In Today's Dollars Emogency Fund Estate Settlement Costs Total Lump-Sum Funding Needs 0 o O Step 3: Calculate Total Life Insurance Needs. Present Value of Total Income Needed Total Lum-Sum Funding Needs Total Needs 0 Step 4: Calculate the Life Insurance Death Benefit Needed. Total Life Insurance Needs Less Current Life Insurance Less Current Liquid Assets Net Death Benefit of Life Insurance Needed 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started