Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please please help!! will like if its correct! On January 1,2024 . The Donut Stop purchased a patent for $73.000. At that time, the remaining

please please help!! will like if its correct!

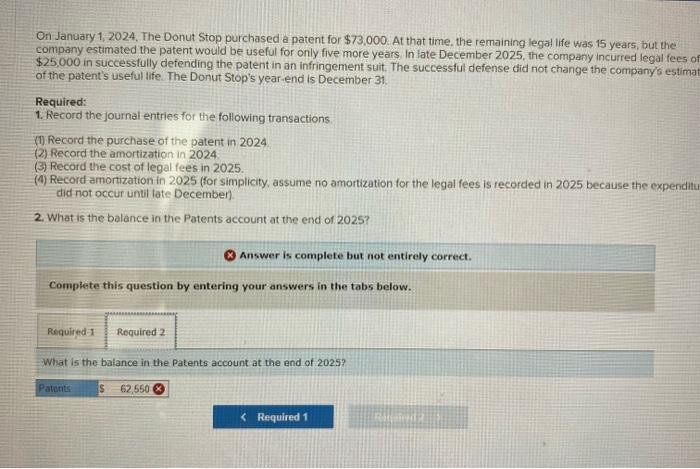

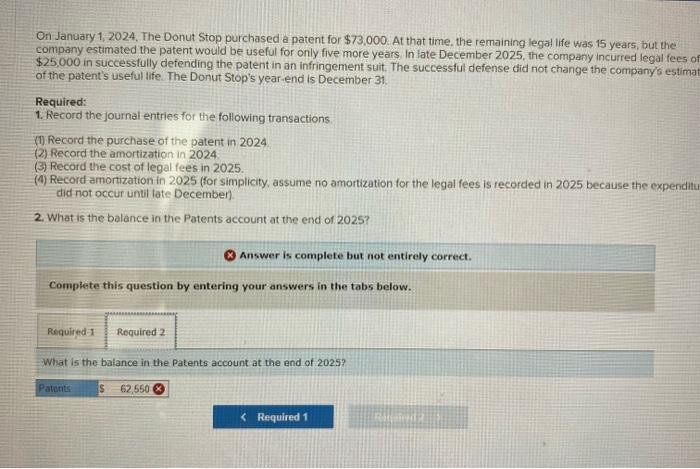

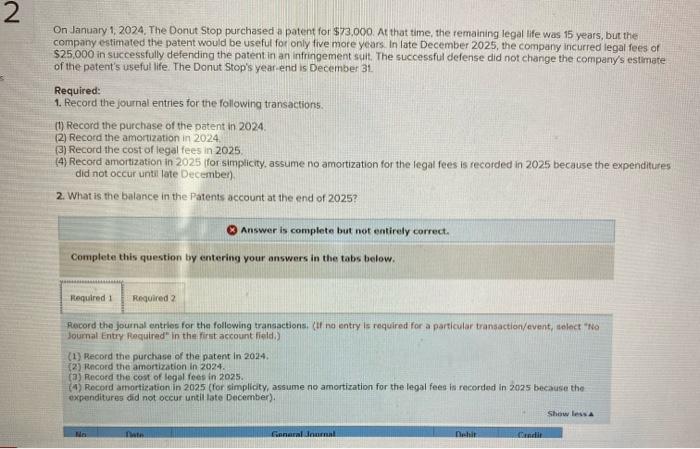

On January 1,2024 . The Donut Stop purchased a patent for \$73.000. At that time, the remaining legal life was 15 years, but the company estimated the patent would be useful for only five more years. In late December 2025 , the company incurred legal fees of $25.000 in successfully defending the patent in an infringement suit. The successful defense did not change the company's estimate of the patent's useful life. The Donut Stop's year-end is December 31 . Required: 1. Record the journal entries for the following transactions. (1) Record the purchase of the patent in 2024 . (2) Record the amortization in 2024. (3) Record the cost of legal fees in 2025 (4) Record amortization in 2025 ffor simplicity, assume no amortization for the legal fees is recorded in 2025 because the expenditures did not occur until late December). 2. What is the balance in the Patents account at the end of 2025 ? (a) Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Record the journal entries for the following transactions. (tt no entry is required for a particular transaction/event, select "No -latirnal Fntry Required in the first account field.) (1) Record the purchase of the patent in 2024. (2) Record the amortization in 2024. (3) Record the cost of legal fees in 2025 . (4) Record amortization in 2025 (for simplicity, assume no amortization for the logal foes is recorded in 2025 becausen the expenditures did not occur until late December). On January 1,2024 . The Donut Stop purchased a patent for $73.000. At that time, the remaining legal life was 15 years, but the company estimated the patent would be useful for only five more years. In late December 2025 , the company incurred legal fees o $25,000 in successfully defending the patent in an infringement suit. The successfut defense did not change the company's estima of the patent's useful life. The Donut Stop's year-end is December 31 . Required: 1. Record the journal entries for the following transactions. (1) Record the purchase of the patent in 2024 . (2) Record the amortization in 2024 (3) Record the cost of legal fees in 2025. (4) Record amortization in 2025 (for simplicity, assume no amortization for the legal fees is recorded in 2025 because the expenditi did not occur until tate December). 2. What is the balance in the Patents account at the end of 2025 ? (3) Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. What is the balance in the Patents account at the end of 2025 ? On January 1, 2024. The Donut Stop purchased a patent for $73.000. At that time, the remaining legal life was 15 years, but the company estimated the patent would be useful fot only five more years. In late December 2025 , the company incurred legal fees of $25,000 in successfully defending the patent in an infringement suit. The successful defense did not change the company's estmate of the patent's useful life. The Donut Stop's year-end is December 31 . Required: 1. Record the journal entries for the following transactions. (1) Record the purchase of the patent in 2024. (2) Record the amortization in 2024 (3) Record the cost of legal fees in 2025 . (4) Record amortization in 2025 (for simplicity. assume no amortization for the legal fees is recorded in 2025 because the expenditures did not occur until late December). 2. What is the balance in the Patents account at the end of 2025? Q Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Record the journal entries for the following transactions. it no entry is required for a particular transaction/event, select "No Journal Entry Recuired in in the first account field,) (1) Record the purchase of the patent in 2024. (2) Rncord the amortization in 2024. (3) Record the cost of legal fees in 2025 . (4) Recond amortization in 2025 (for simplicty, assume no amortization for the legal fees is recorded in 2025 because the expenditures did not occur until late December)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started