Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please please helpppp!! i need help asap ! Translate D Question 3 8 pts Using the below 2018 tax schedule, calculate the federal income tax

please please helpppp!! i need help asap !

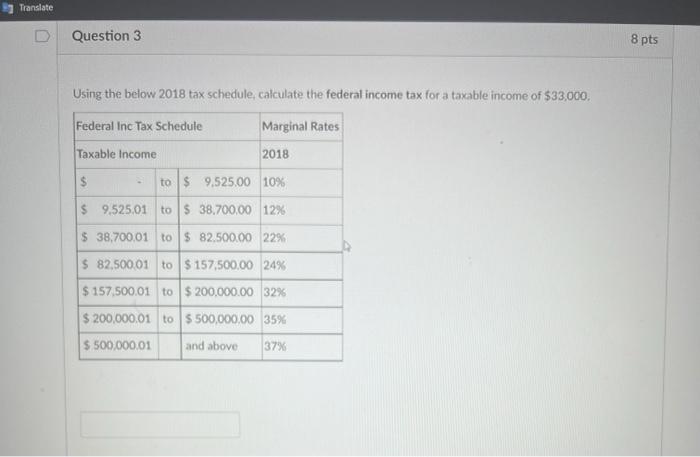

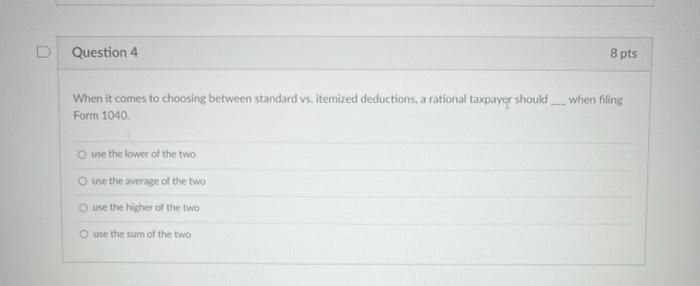

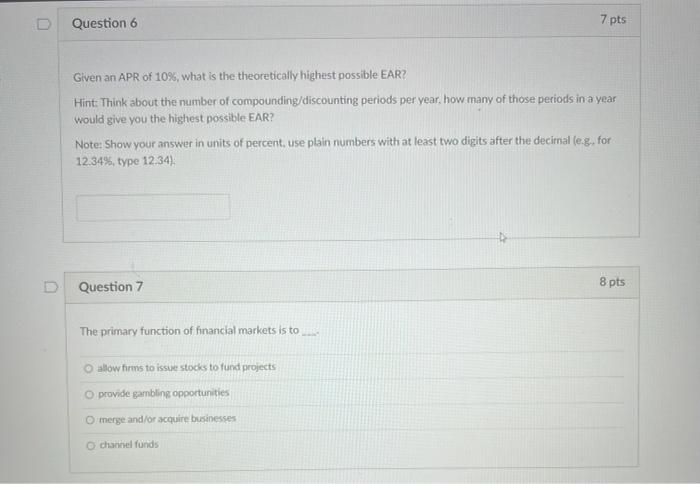

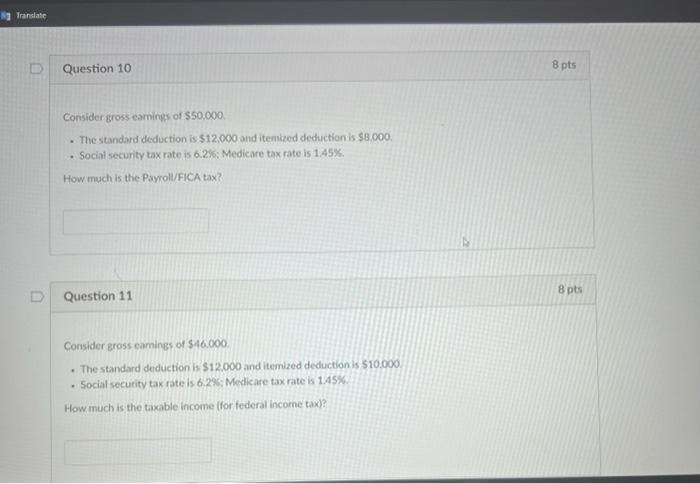

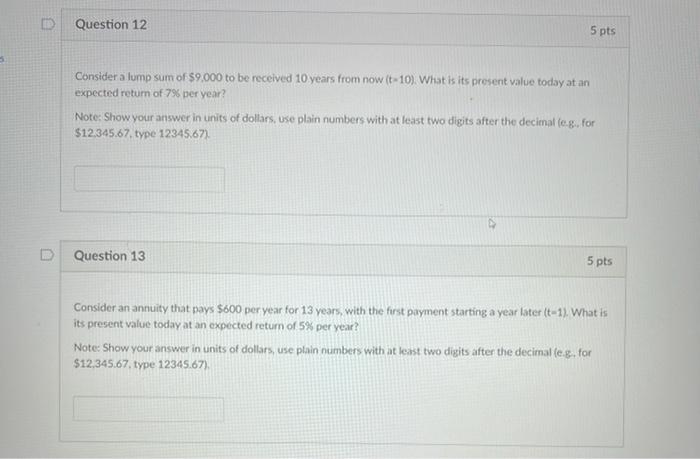

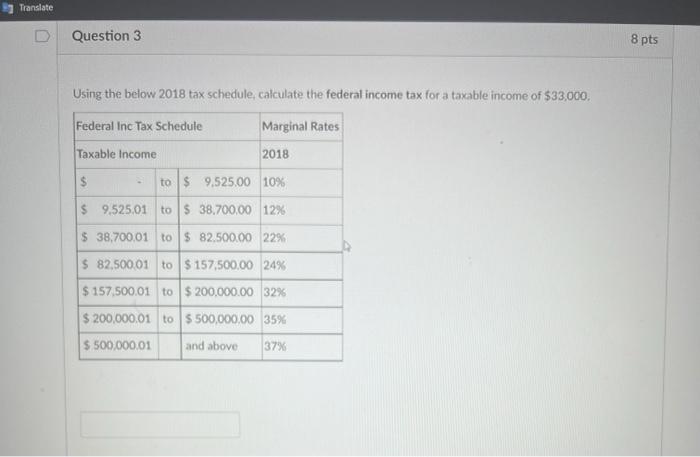

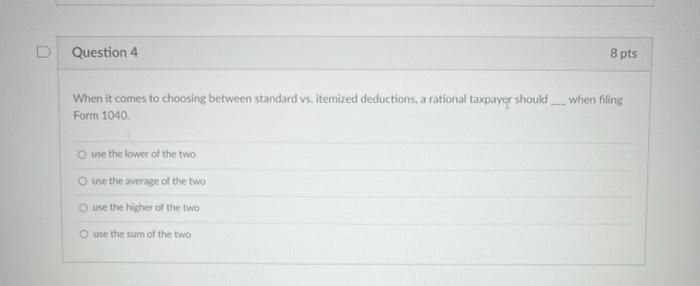

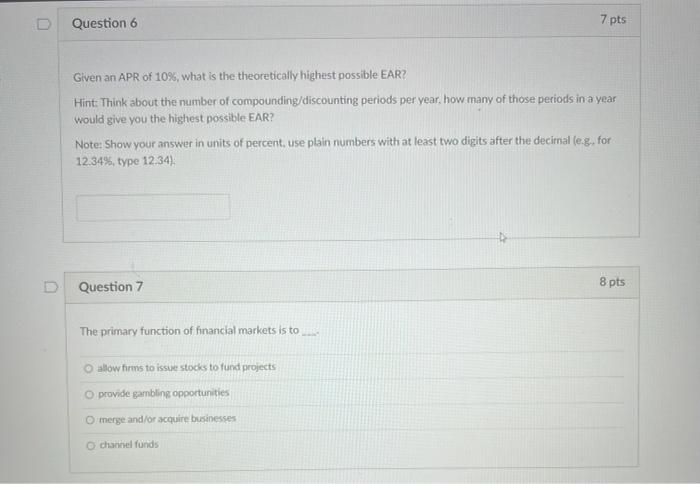

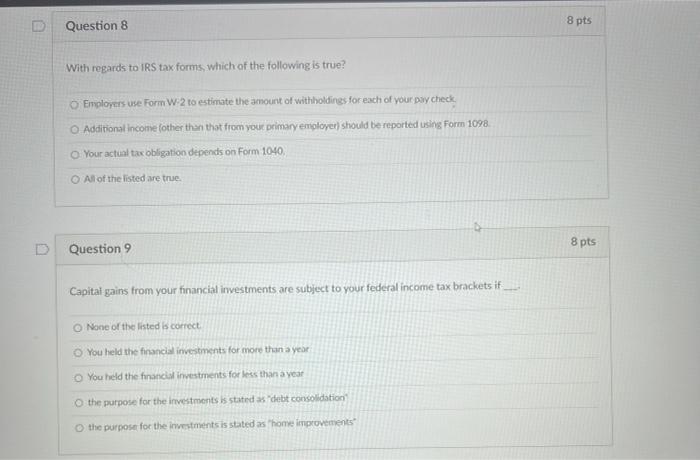

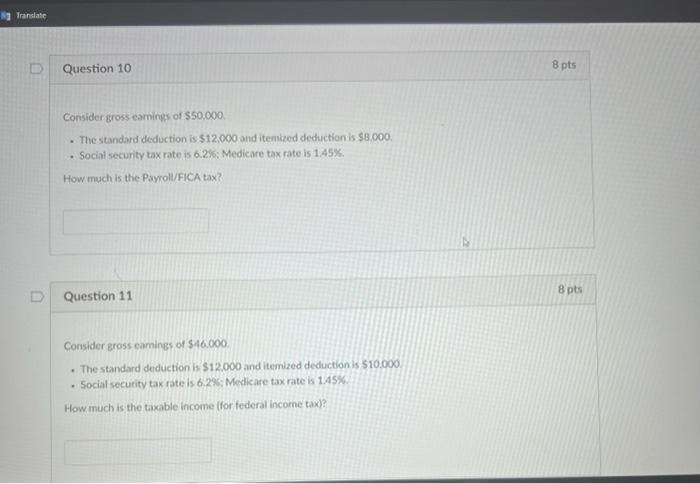

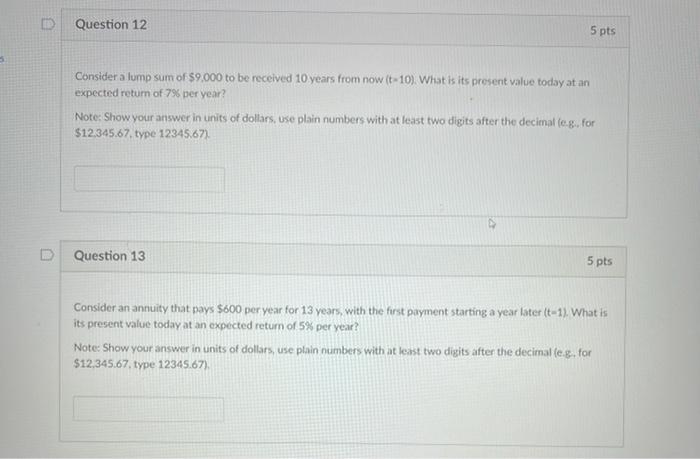

Translate D Question 3 8 pts Using the below 2018 tax schedule, calculate the federal income tax for a taxable income of $33,000 Federal Inc Tax Schedule Marginal Rates Taxable income 2018 $ to $ 9.525.00 10% $ 9,525.01 to $ 38.700,00 12% $ 38,700.01 to $ 82.500.00 22% $ 82,500,01 to $ 157,500.00 24% $ 157,500.01 to $ 200,000.00 32% $ 200,000,01 to $ 500,000,00 35% $ 500.000.01 and above 37% D Question 4 8 pts When it comes to choosing between standard vs. itemized deductions, a rational taxpayer should ___ when filing Form 1040 use the lower of the two o use the average of the two use the higher of the two use the sum of the two Question 6 7 pts Given an APR of 10%, what is the theoretically highest possible EAR? Hint: Think about the number of compounding/discounting periods per year, how many of those periods in a year would give you the highest possible EAR? Note: Show your answer in units of percent, use plain numbers with at least two digits after the decimal leg, for 12.34%, type 12.34) Question 7 8 pts The primary function of financial markets is to o allow firms to issue stocks to fund projects o provide gambling opportunities O merge and/or acquire businesses channel funds Question 8 8 pts With regards to IRS tax forms, which of the following is true? Employers use FormW 2 to estimate the amount of withholdings for each of your pay check Additional income other than that from your primary employer) should be reported using Form 1098 Your actual tax obligation depends on Form 1040, All of the listed are true. Question 9 8 pts Capital gains from your financial investments are subject to your federal income tax brackets it O None of the listed is correct You held the financial investments for more than a year You held the financial investments for less than a year o the purpose for the investments is stated as "debt consolidation the purpose for the investments is stated as home improvements Translate Question 10 8 pts Consider gross camings of $50,000 The standard deduction is $12.000 and itemized deduction is $8.000 Social security tax rate is 6.2%; Medicare tax rate is 145% How much is the Payroll/FICA tax? . 8 pts Question 11 Consider gross earnings of $46.000, . The standard deduction is $12.000 and itemized deduction is $10.000 Social security tax rate is 6.2% Medicare tax rate is 145% How much is the taxable income (for federal income tax)? Question 12 5 pts Consider a lump sum of $9.000 to be received 10 years from now (t-10). What is its present value today at an expected return of 7% per year? Note: Show your answer in units of dollars, use plain numbers with at least two digits after the decimal (eg, for $12,345.67 type 12345,67). Question 13 5 pts Consider an annuity that pays $600 per year for 13 years, with the first payment starting a year later (t-1). What is its present value today at an expected return of 5% per year? Note: Show your answer in units of dollars, use plain numbers with at least two digits after the decimal leg.for $12.345.67 type 12345.67)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started