Question

Please please please and thank you! III. The Highest Potential, Inc., will pay a quarterly dividend per share of $1 ineach of the next 12

Please please please and thank you!

III. The Highest Potential, Inc., will pay a quarterly dividend per share of $1 ineach of the next 12 quarters. Subsequently, the dividend will grow at a quarterlyrate of 0.5 percent indenitely. The appropriate rate of return on the stock is 10 percent. What is the current stock price? Assume capital markets are perfect.

VI. Write down the put-call parity relations with and without dividends. For either one, provide a brief (concise) argument for why the relation holds. Assumecapital markets are perfect.

VI. Write down the put-call parity relations with and without dividends. For either one, provide a brief (concise) argument for why the relation holds. Assumecapital markets are perfect.

VII. Investinus, Inc. issues a convertible bond with a face value of $120, withthe option to convert the bond into 3 shares of stock in the company. Drawthe payoff diagram of the convertible bond. Can you replicate the payoff dia-gram for the convertible bond with a portfolio consisting of a regular (i.e. non-convertible) bond and one or more call options on Investinus stock? (Assumecalls are written on single shares of stock). If so, describe the portfolio of callsand (non-convertible) bonds which replicates the convertible bond.

VIII.State the Modigliani-Millertheorem 2 (MM2).Make sureto clearly describethe assumption(s)). Now use this result to show that (under the assumptions ofMM2) a rms (weighted average) cost of capital is independent of its capital structure.

IX. SmartOptions, Inc. has no debt. Its assets will be worth $450 million in oneyear if the economy is strong, but only $200 million in one year if the economy is weak. Both events are equally likely. The market value today of its assets is $250million. 1. Suppose the risk-free interest rate is 5%. If SO borrows $100 million todayatthis rateandusesthe proceedsto payanimmediatecash dividend,whatwill be the market value of its equity just after the dividend is paid?

2. What is the (expected) return rate on SO stock after the dividend is paid inpart (1)

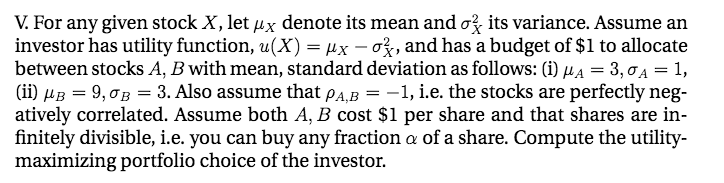

V For any given stock X, let Aux denote its mean and o its variance. Assume an investor has utility function u(X) Aux -ok, and has a budget of $1 to allocate between stocks A, Bwith mean, standard deviation as follows: (i) AuA 3, o A 1, (ii) AuB 9, o B 3. Also assume that pA.B 1, i.e. the stocks are perfectly ne atively correlated. Assume both A, B cost $1 per share and that shares are in finitely divisible, i.e. you can buy any fraction a of a share. Compute the utility- maximizing portfolio choice of the investor

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started