Answered step by step

Verified Expert Solution

Question

1 Approved Answer

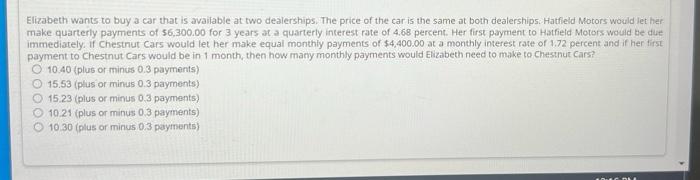

PLEASE PLEASE PLEASE ANSWER BOTH ITS MY LAST QUESTION!!! WILL GOVE A GOOD RATING (THUMBSUP) Elizabeth wants to buy a car that is avaifable at

PLEASE PLEASE PLEASE ANSWER BOTH ITS MY LAST QUESTION!!!

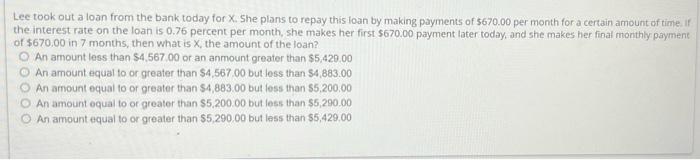

Elizabeth wants to buy a car that is avaifable at two dealerships. The price of the car is the same at both dealerships. Hatfieid Motors would let hermake quarterly payments of 56,300.00 for 3 years at a quarterly interest rate of 4.68 percent. Her first payment to Hatfield Motors Wouid be dut immediately. If chestnut Cars would let her make equal monthly payments of $4,400.00 at a monthly interest rate of 1.72 percent and if her tirst payment to Chestnut Cars would be in 1 month, then how many monthly payments would Elizabeth need to make to Chesthut Cars? 10.40 (plus or minus 0.3 payments) 15.53 (plus or minus 0.3 payments) 15.23 (plus or minus 0.3 payments) 10.21 (plus or minus 0.3 payments) 10.30 (plus of minus 0.3 payments) Lee took out a loan from the bank today for X. She plans to repay this loan by making payments of $670.00 per month for a certain amount of time if the interest rate on the loan is 0.76 percent per month, she makes her first $670.00 payment later today, and she makes her final monthly payment of $670.00 in 7 months, then what is X, the amount of the loan? An amount less than $4,567,00 or an anmount greater than $5,420.00 An amount equal to or greater than $4,567,00 but less than $4,883.00 An amount equal to of greater than $4,883.00 but fess than 55,200.00 An amount equal to or greater than $5,200.00 but less than $5,290.00 An amount equal to or greater than $5,290.00 but less than 55,429.00 WILL GOVE A GOOD RATING (THUMBSUP)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started