Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE PLEASE PLEASE GIVE ME THE VERY CLEAVER EXPERT!!!!! I REALLY NEED THIS ANSWER CORRECTLY!!!!!!!!!!! THIS IS VERY IMPORTANT!!!! QUESTION 2 a) A financial analyst

PLEASE PLEASE PLEASE GIVE ME THE VERY CLEAVER EXPERT!!!!!

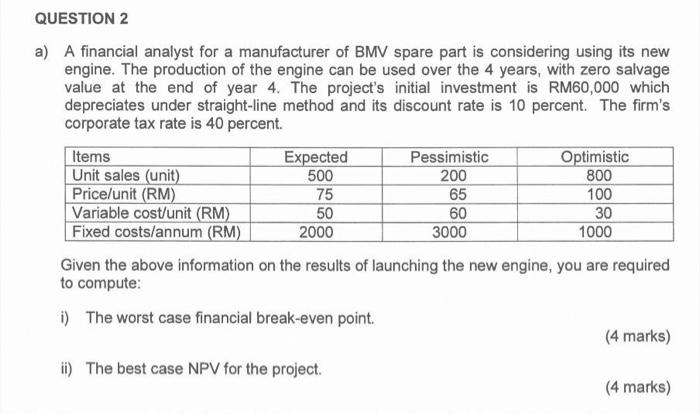

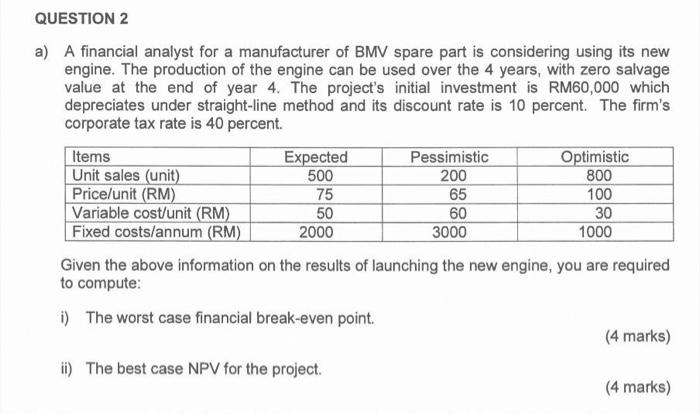

QUESTION 2 a) A financial analyst for a manufacturer of BMV spare part is considering using its new engine. The production of the engine can be used over the 4 years, with zero salvage value at the end of year 4. The project's initial investment is RM60,000 which depreciates under straight-line method and its discount rate is 10 percent. The firm's corporate tax rate is 40 percent. Items Expected Pessimistic Optimistic Unit sales (unit) 500 200 800 Price/unit (RM) 75 65 100 Variable cost/unit (RM) 50 60 30 Fixed costs/annum (RM) 2000 3000 1000 Given the above information on the results of launching the new engine, you are required to compute: i) The worst case financial break-even point. (4 marks) ii) The best case NPV for the project. (4 marks) I REALLY NEED THIS ANSWER CORRECTLY!!!!!!!!!!!

THIS IS VERY IMPORTANT!!!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started