Answered step by step

Verified Expert Solution

Question

1 Approved Answer

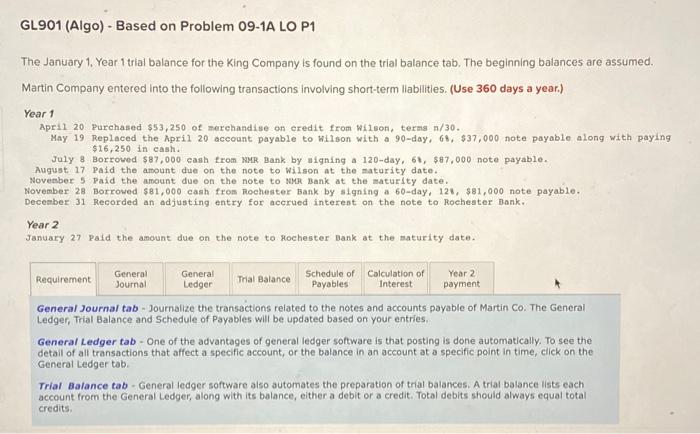

please please please help! i always rate! GL901 (Algo) - Based on Problem 09-1A LO P1 The January 1. Year 1 trial balance for the

please please please help! i always rate!

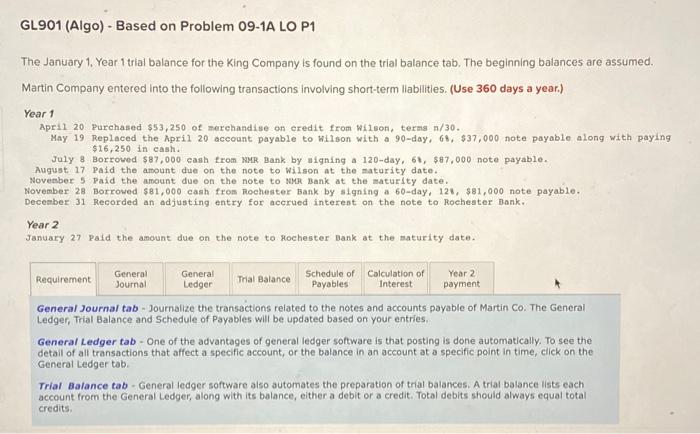

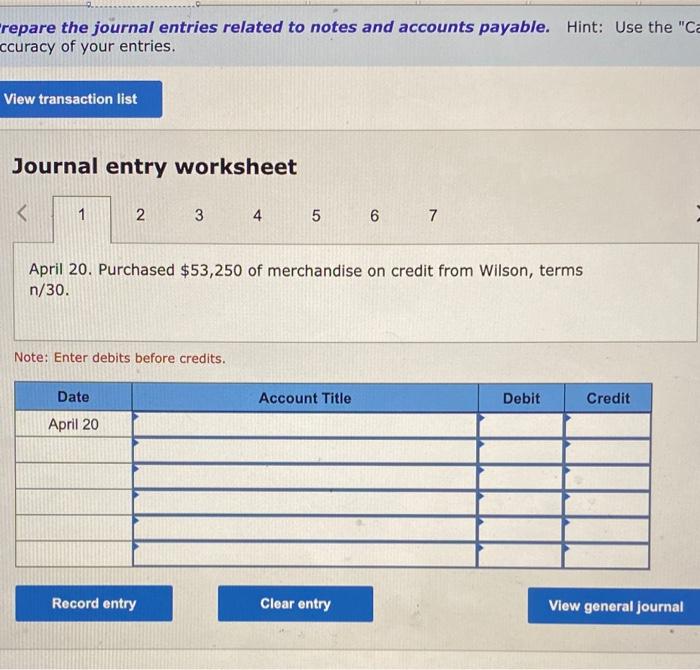

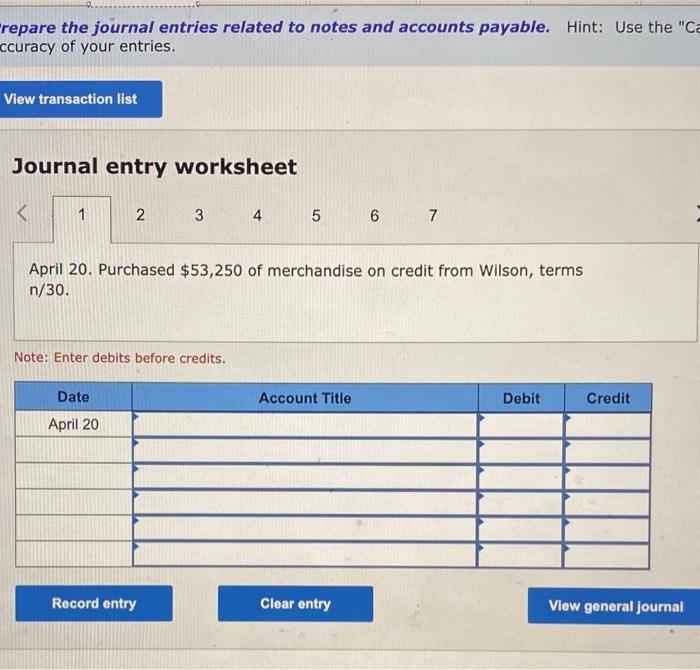

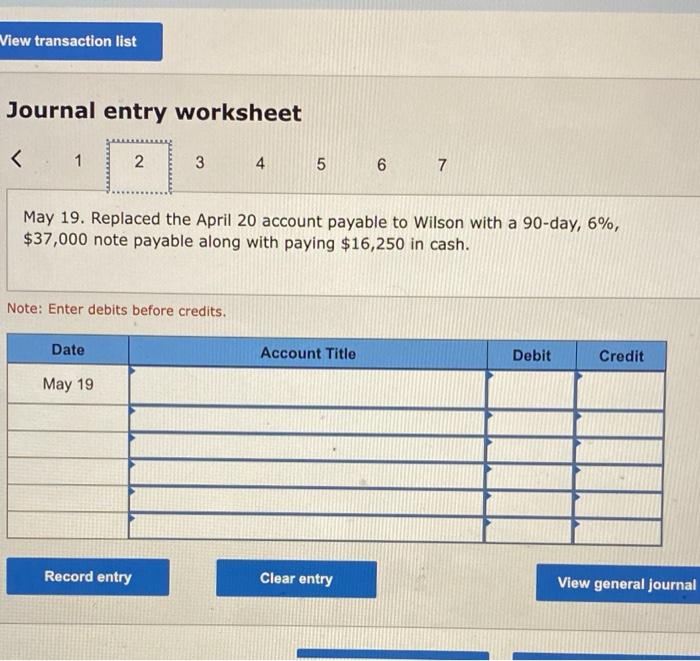

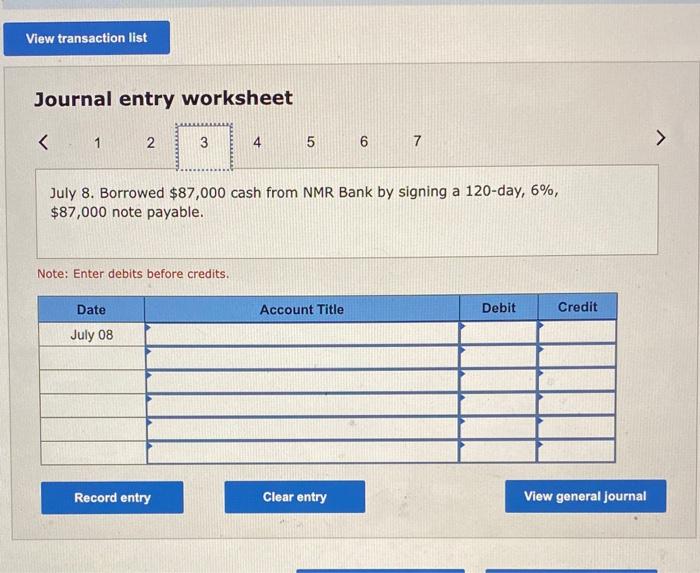

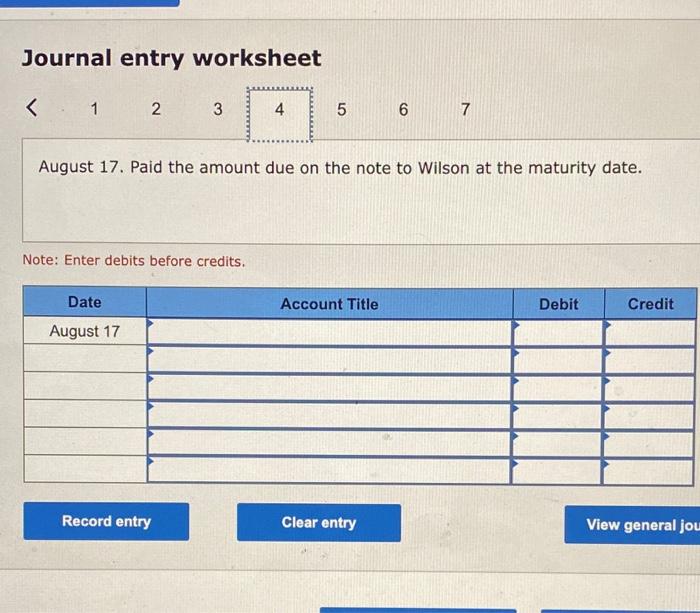

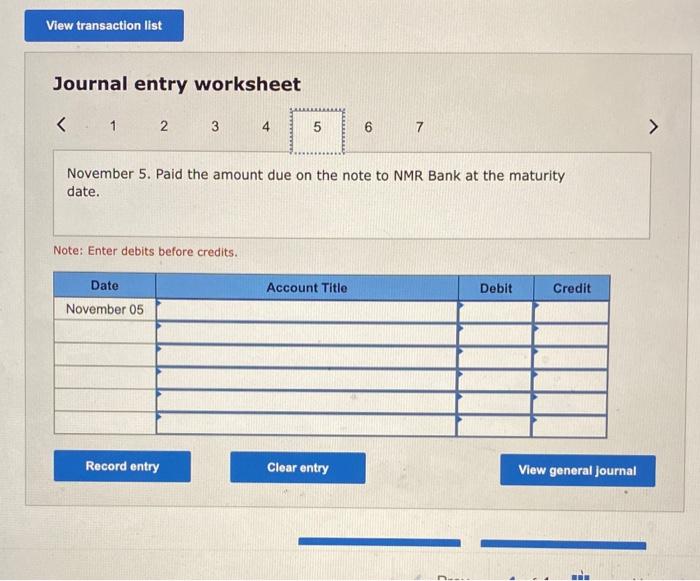

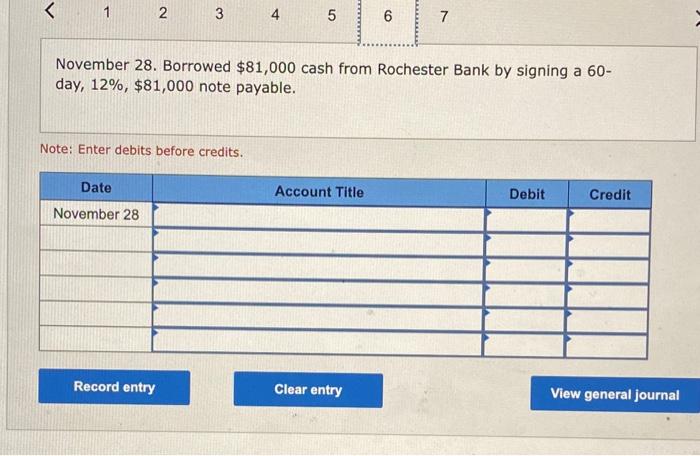

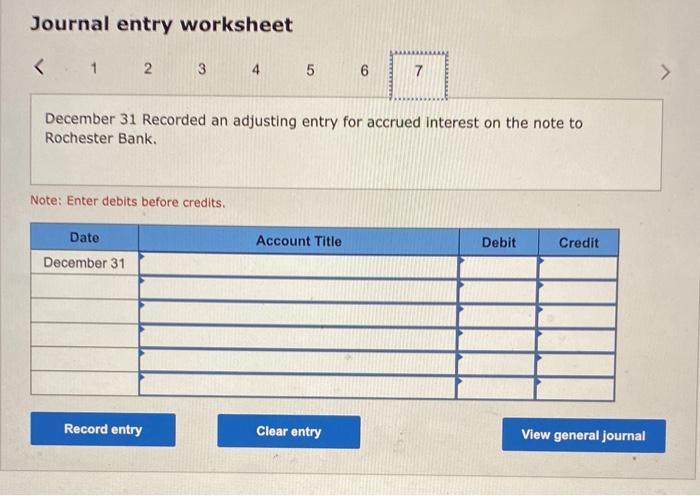

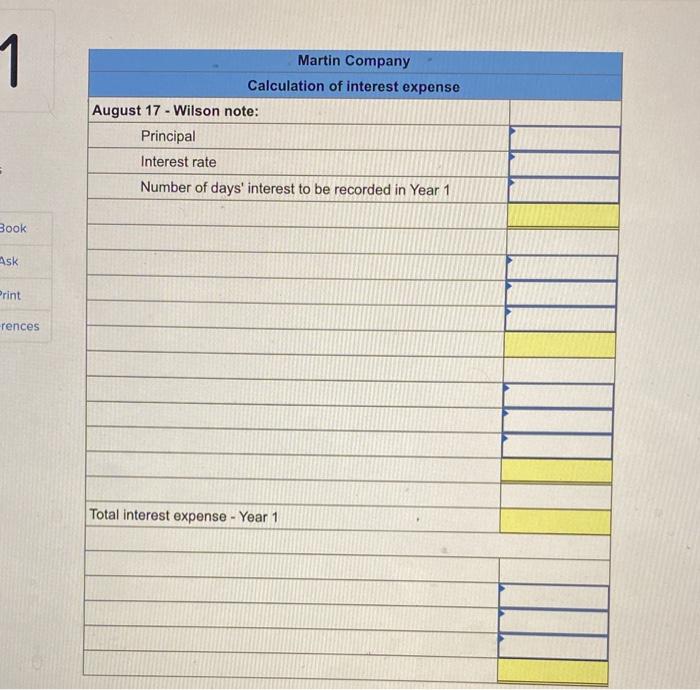

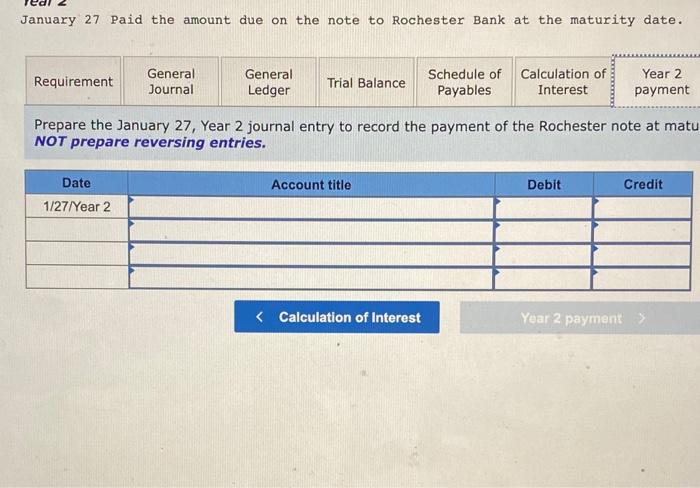

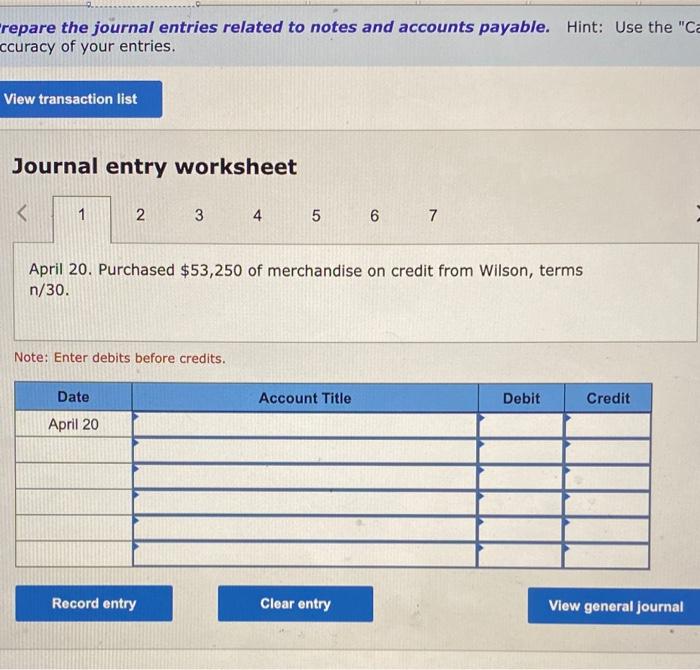

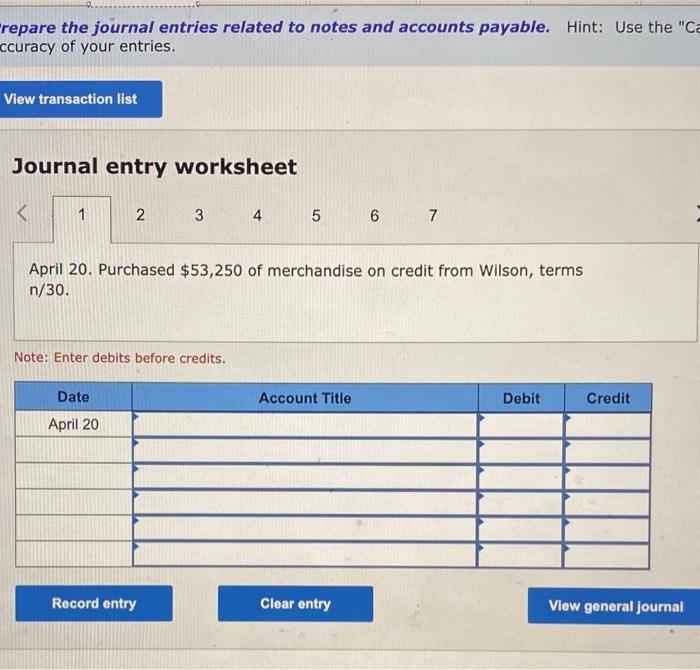

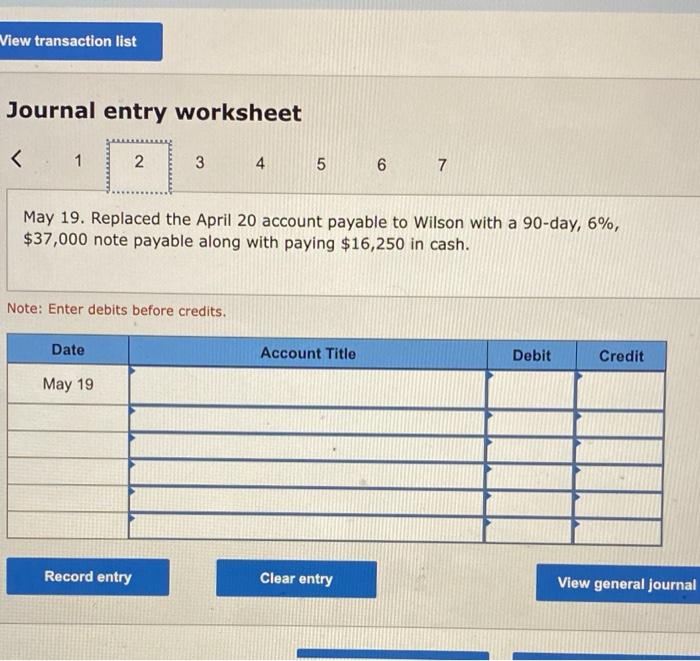

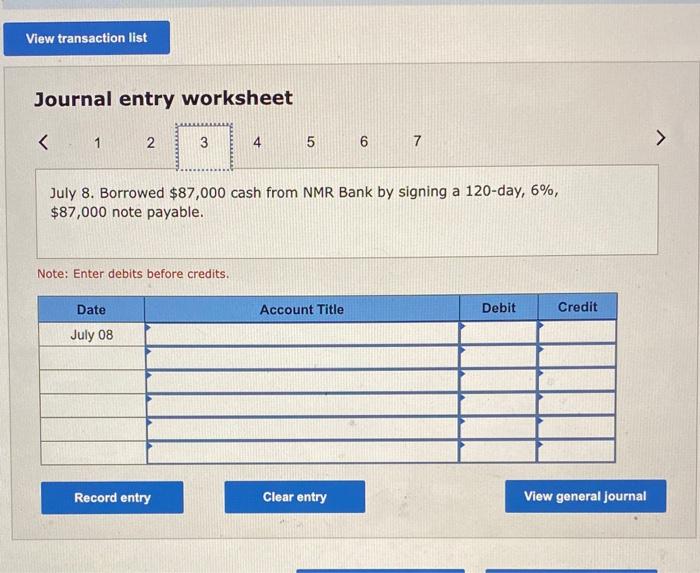

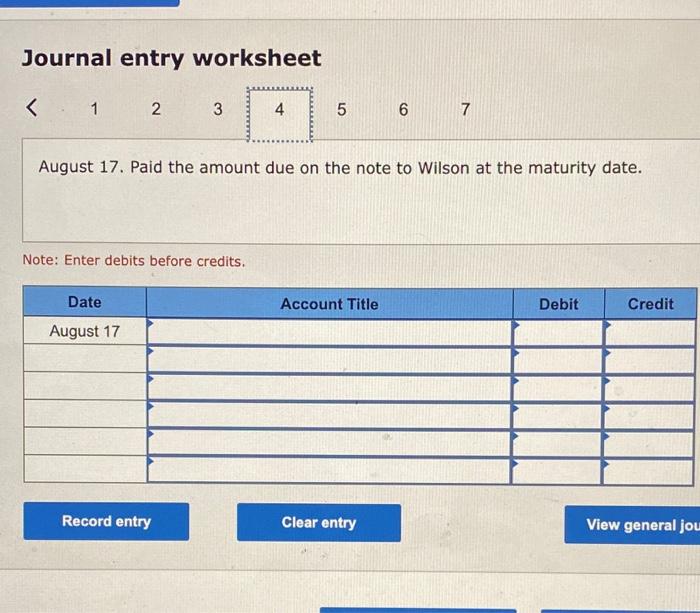

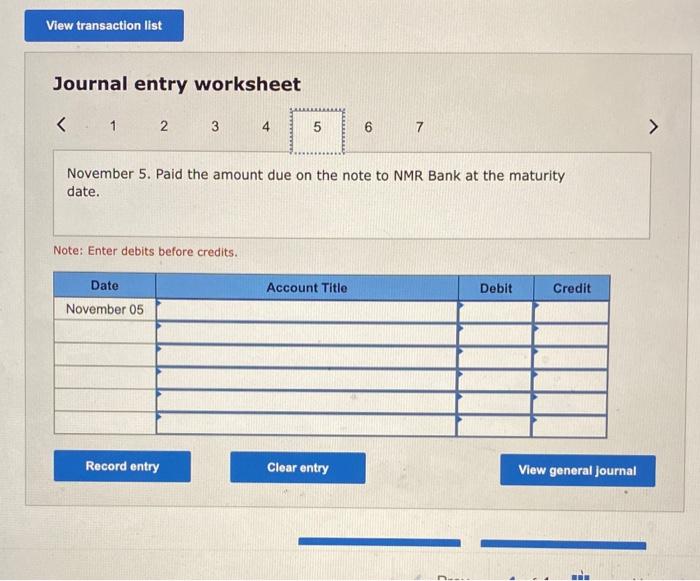

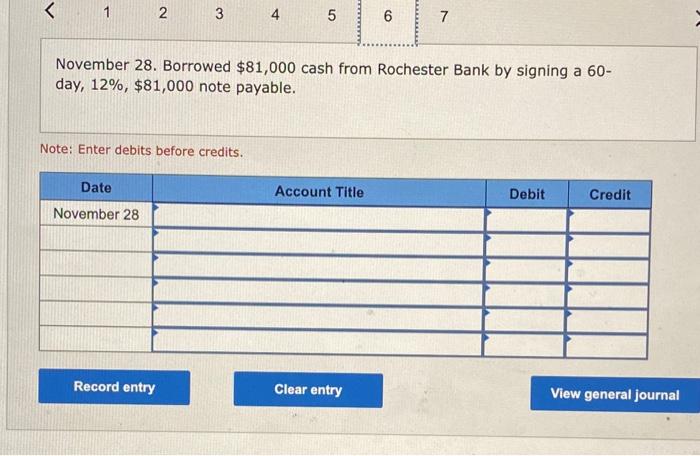

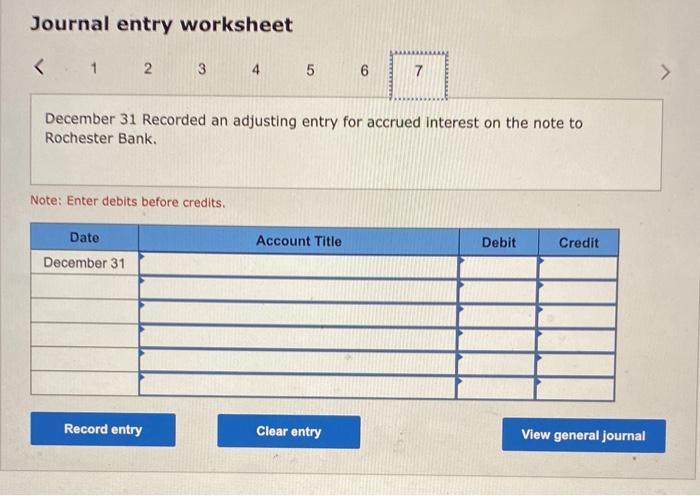

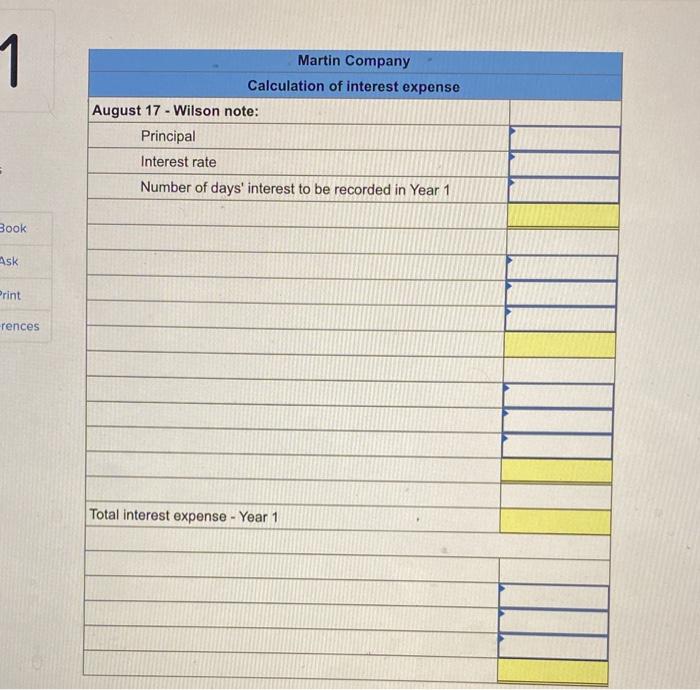

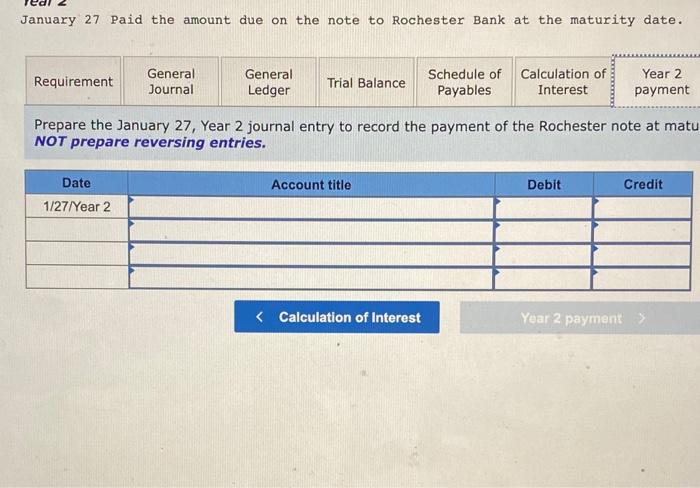

GL901 (Algo) - Based on Problem 09-1A LO P1 The January 1. Year 1 trial balance for the King Company is found on the trial balance tab. The beginning balances are assumed. Martin Company entered into the following transactions involving short-term liabilities. (Use 360 days a year.) Year 1 April 20 Purchased $53,250 of merchandise on credit from Wilson terms m/30. May 19 Replaced the April 20 account payable to wilson with a 90-day, 68, $37,000 note payable along with paying $16,250 in cash. July 8 Borrowed $87,000 cash trom NMR Bank by signing 120-day, 68, $87,000 note payable. August 17 Paid the amount due on the note to Wilson at the maturity date. November 5 Paid the amount due on the note to NMR Bank at the maturity date. November 28 Borrowed $81,000 cash from Rochester Bank by signing a 60-day, 129, $81,000 note payable. December 31 Recorded an adjusting entry for accrued interest on the note to Rochester Bank Year 2 January 27 Paid the amount due on the note to Rochester Bank at the maturity date. Requirement General Journal General Ledger Trial Balance Schedule of Calculation of Payables Interest Year 2 payment General Journal tab - Journalize the transactions related to the notes and accounts payable of Martin Co. The General Ledger, Trial Balance and Schedule of Payables will be updated based on your entries General Ledger tab - One of the advantages of general ledger software is that posting is done automatically. To see the detail of all transactions that affect a specific account, or the balance in an account at a specific point in time, click on the General Ledger tab. Trial Balance tab - General ledger software also automates the preparation of trial balances. A trial balance lists each account from the General Ledger, along with its balance, either a debit or a credit. Total debits should always equal total credits repare the journal entries related to notes and accounts payable. Hint: Use the "Ca ccuracy of your entries. View transaction list Journal entry worksheet July 8. Borrowed $87,000 cash from NMR Bank by signing a 120-day, 6%, $87,000 note payable. Note: Enter debits before credits. Date Account Title Debit Credit July 08 Record entry Clear entry View general journal Journal entry worksheet November 5. Paid the amount due on the note to NMR Bank at the maturity date. Note: Enter debits before credits. Account Title Debit Credit Date November 05 Record entry Clear entry View general Journal N.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started