Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please please please help Ratios for last year and Industry Average 2018 Quick Ratio Days Sales Outstanding Inventory turnover Debt Ratio Return on equity 0.90

please please please help

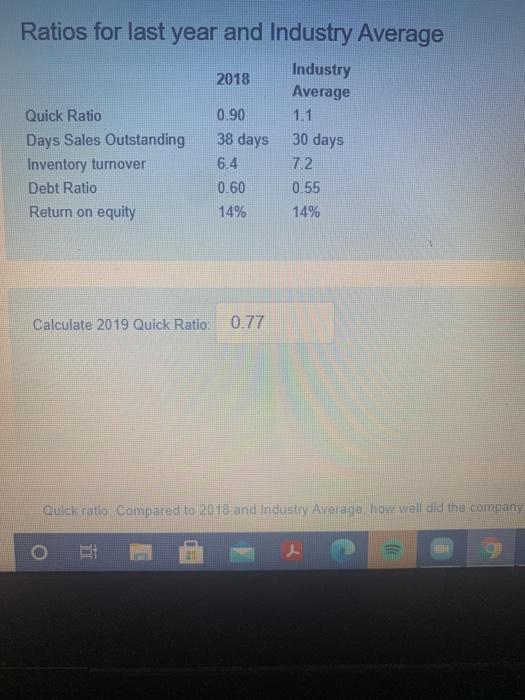

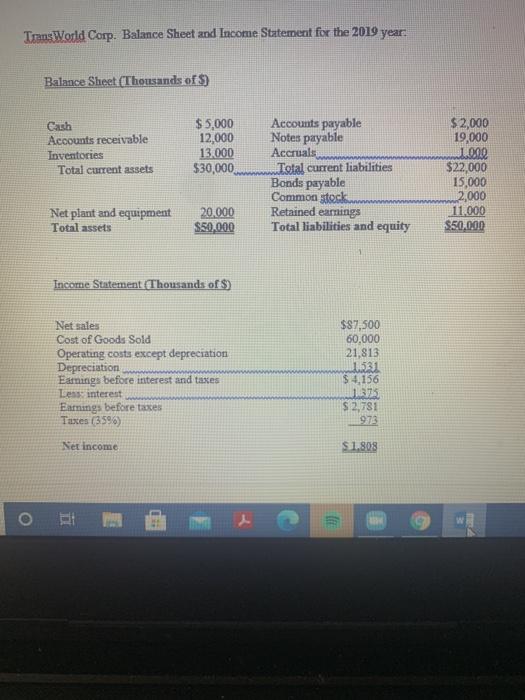

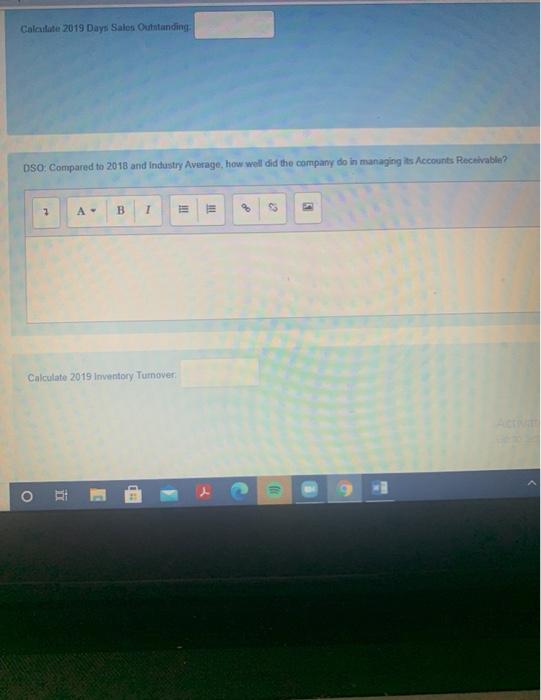

Ratios for last year and Industry Average 2018 Quick Ratio Days Sales Outstanding Inventory turnover Debt Ratio Return on equity 0.90 38 days 6.4 0.60 14% Industry Average 1.1 30 days 7.2 0.55 14% Calculate 2019 Quick Ratio 0.77 Quick ratio compared to 2018 and Industry Average, how well did the company TransWorld Corp. Balance Sheet and Income Statement for the 2019 year. Balance Sheet (Thousands of $) Cash Accounts receivable Inventories Total current assets $5,000 12,000 13.000 $30,000 Accounts payable Notes payable Accruals Total current liabilities Bonds payable Common stock Retained earnings Total liabilities and equity $2,000 19,000 1.00 $22,000 15,000 2,000 11.000 $50,000 Net plant and equipment Total assets 20.000 $50,000 Income Statement (Thousands of $) Net sales Cost of Goods Sold Operating costs except depreciation Depreciation Earnings before interest and taxes Les interest Earnings before taxes Taxes (359) $87,500 60,000 21,813 1531 $ 4,156 16375 $ 2,781 Net income $ 1.808 Calculate 2019 Days Sales Outstanding DSO: Compared to 2018 and Industry Average, how well did the company do in managing its Accounts Receivable? 2 A- B 1 & Calculate 2019 Inventory Turnover O Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started