Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please please please I know the policy but I need it all answered, I was given 3 attempts to complete the assignment, and the first

Please please please I know the policy but I need it all answered, I was given 3 attempts to complete the assignment, and the first time I got a 67, the second time I scored a 69, and I really need to pass this assignment. please help me. please

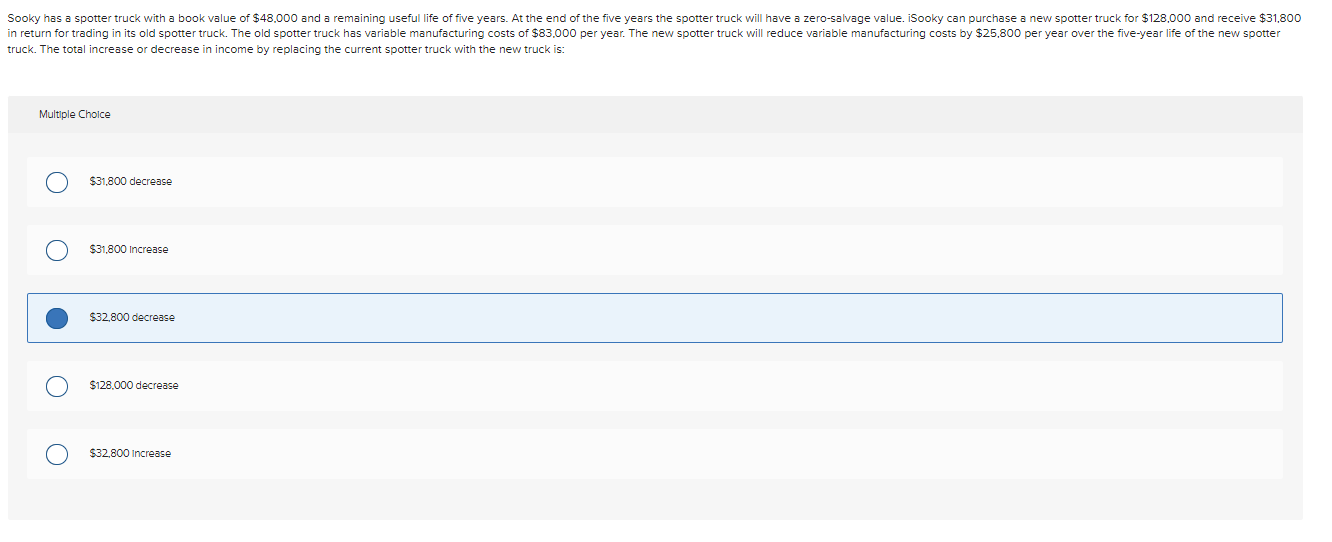

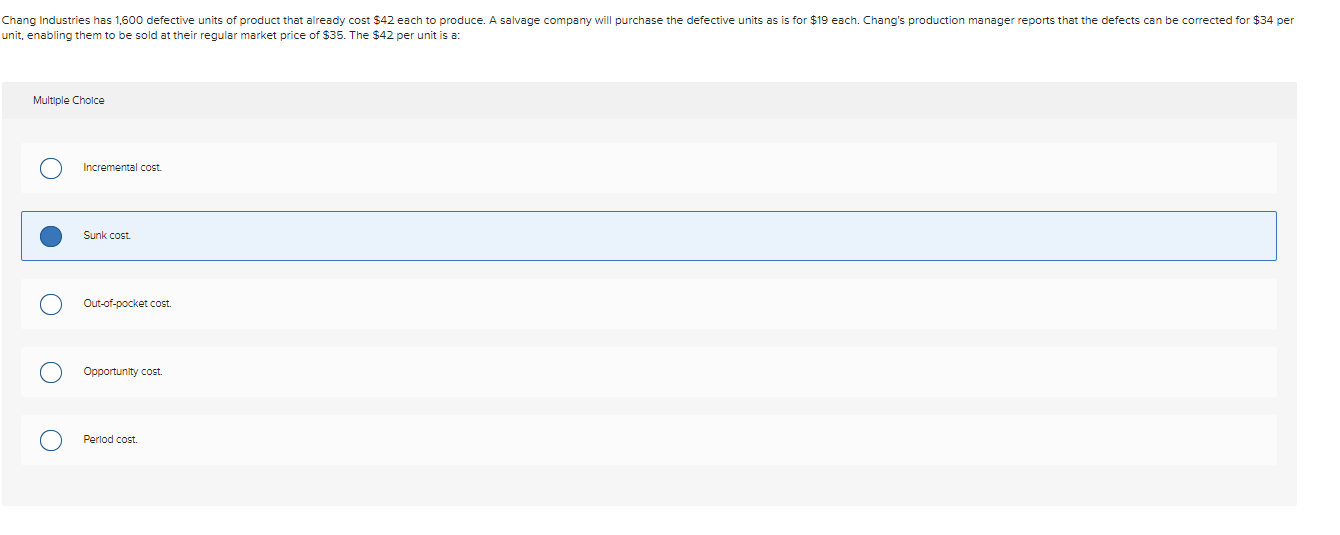

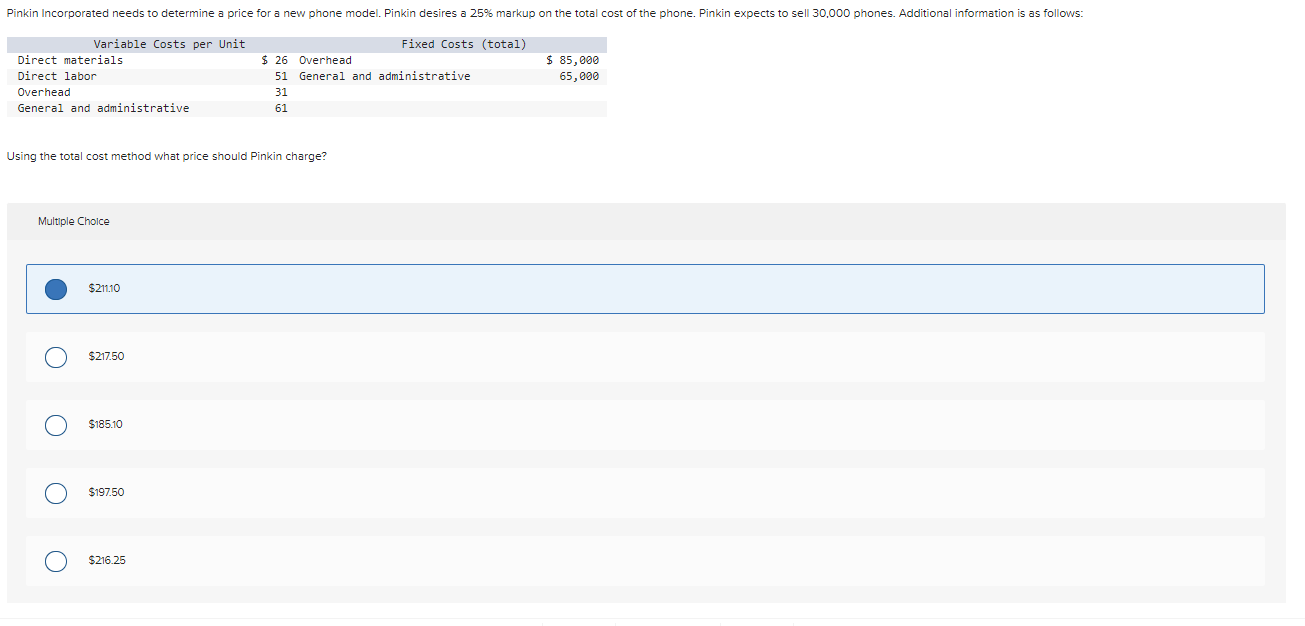

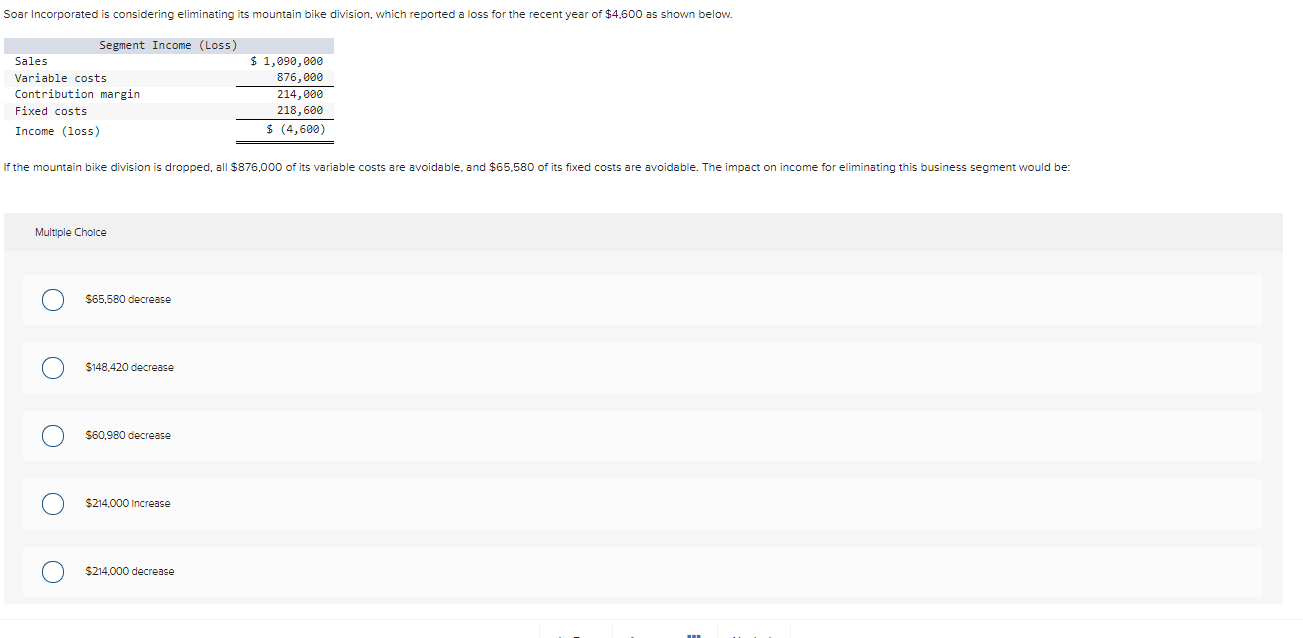

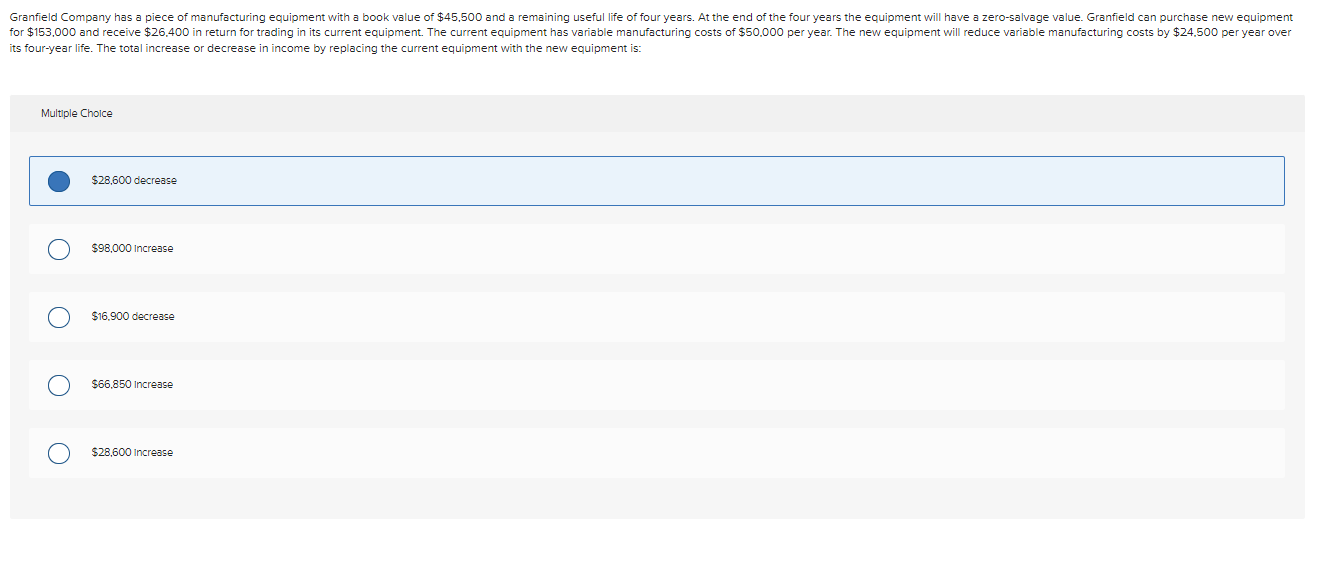

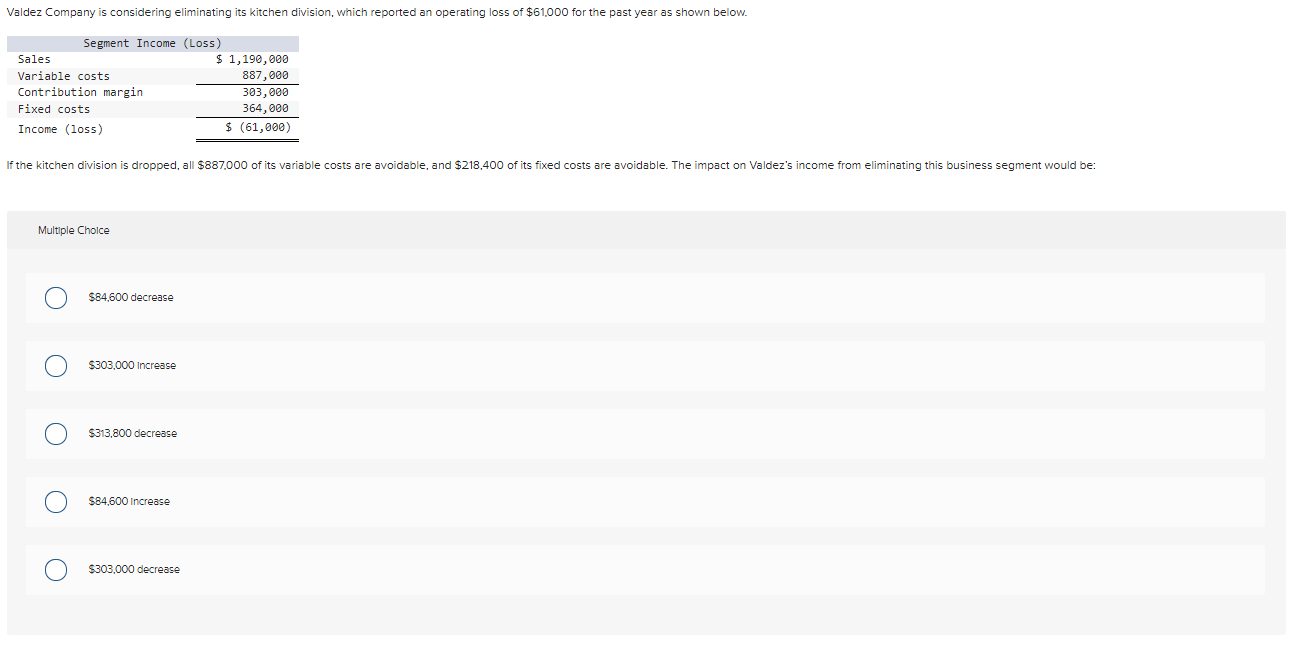

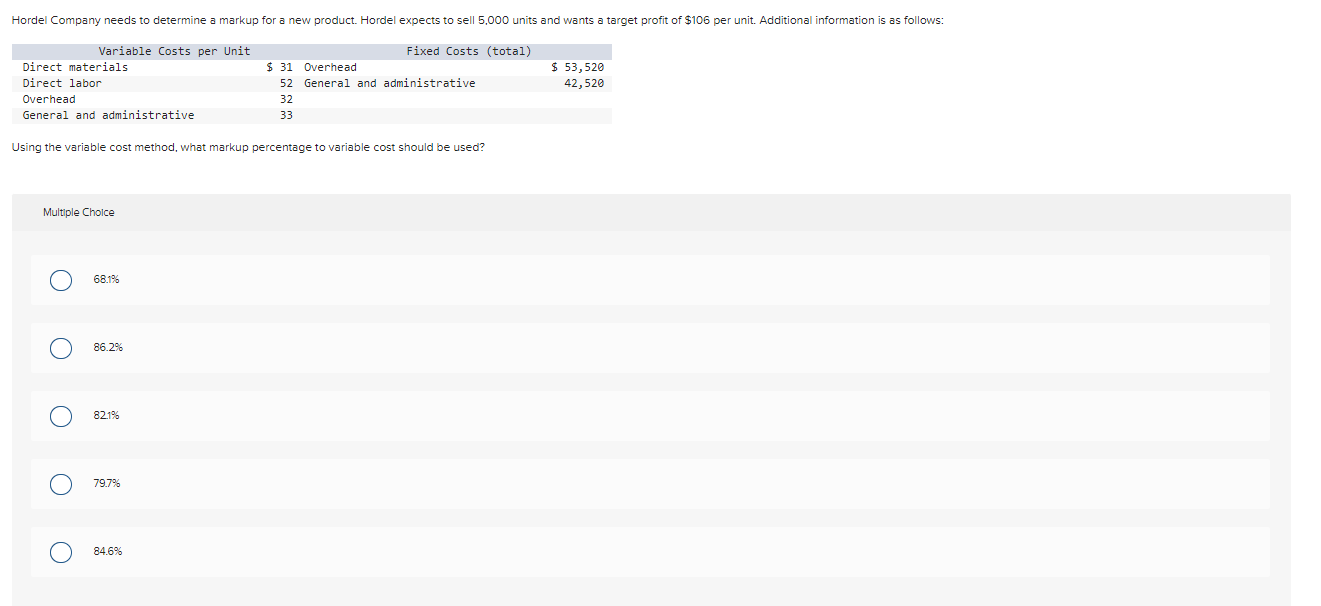

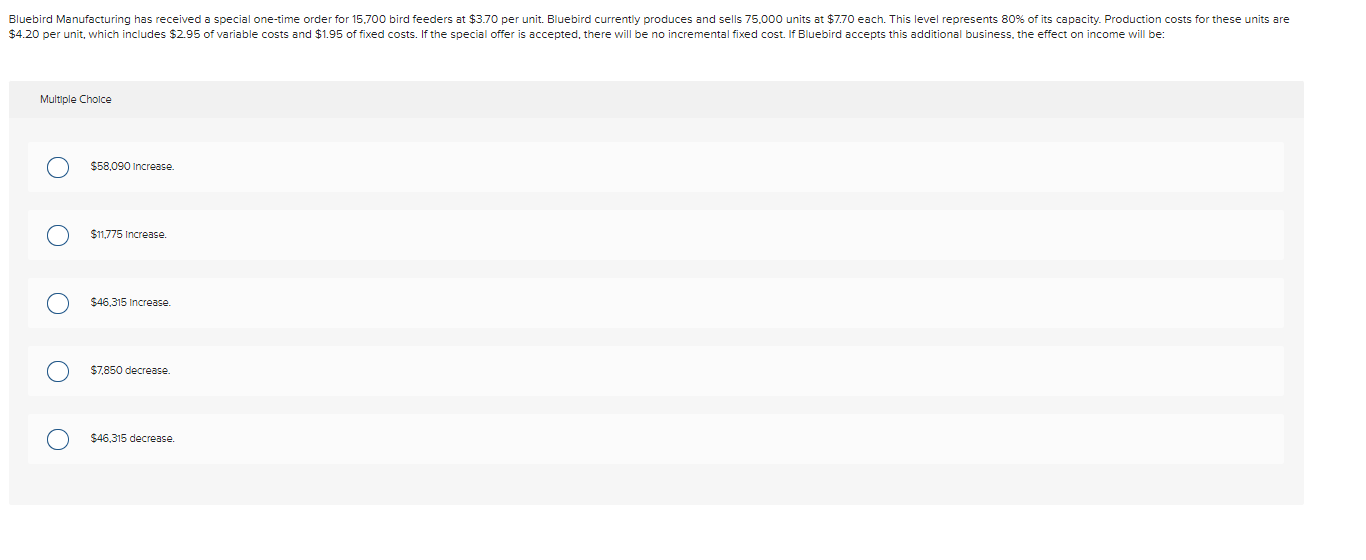

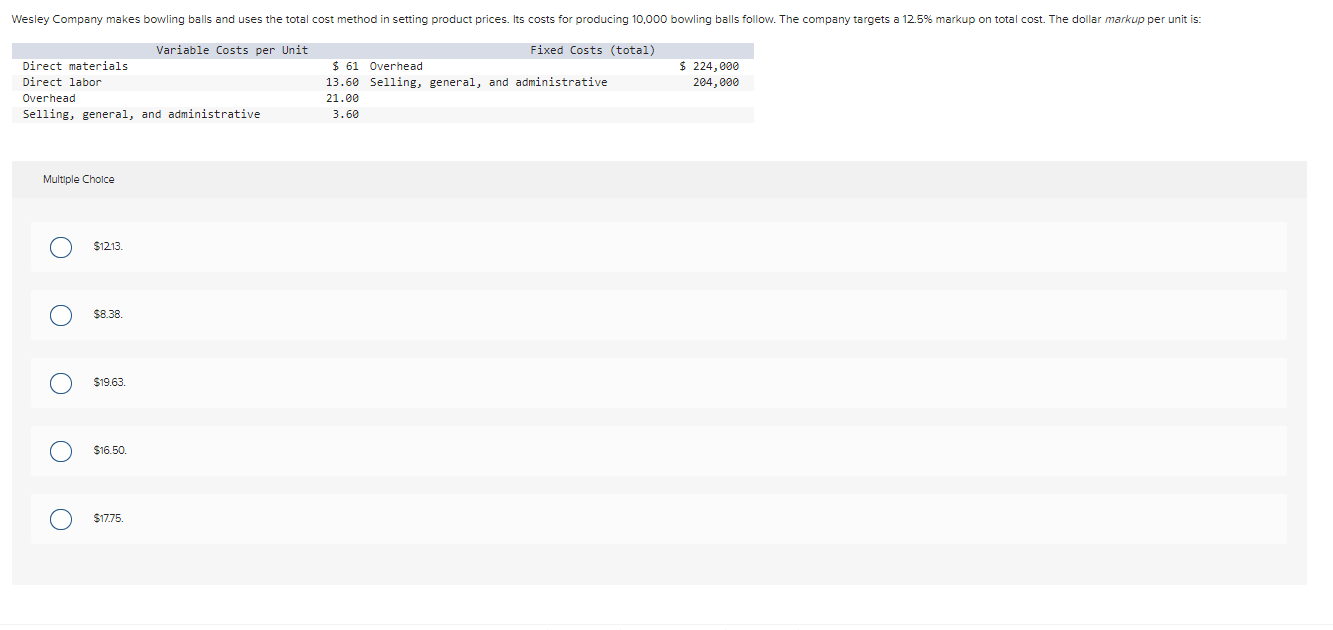

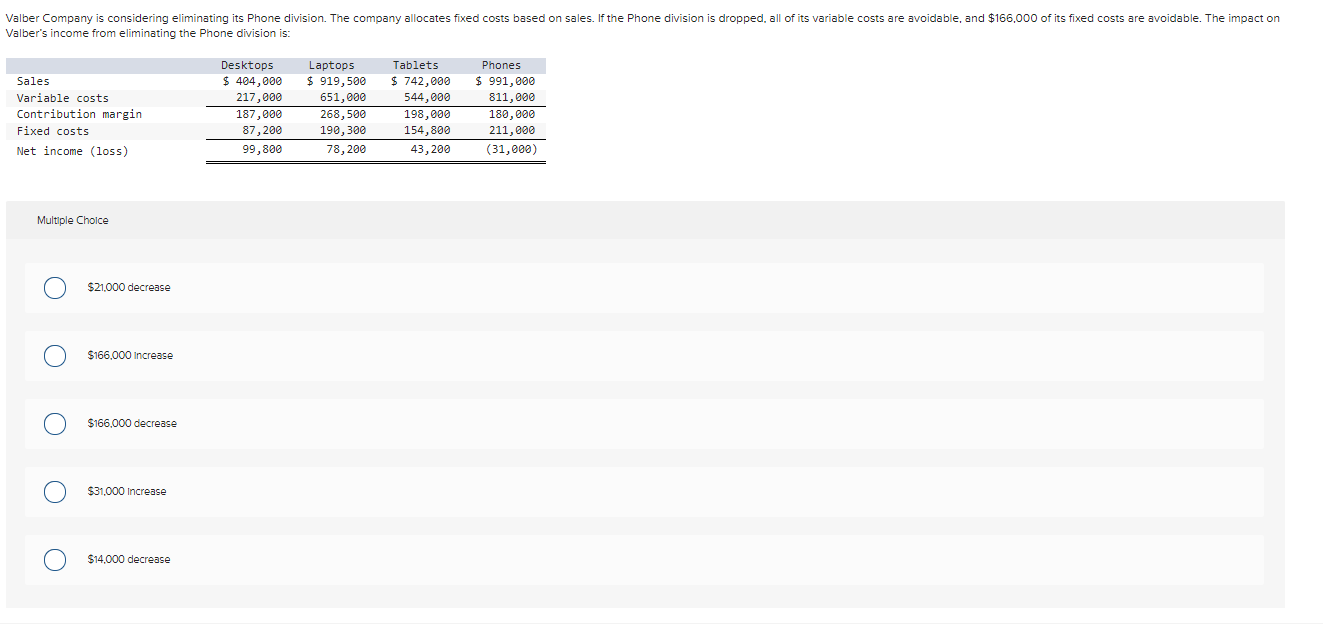

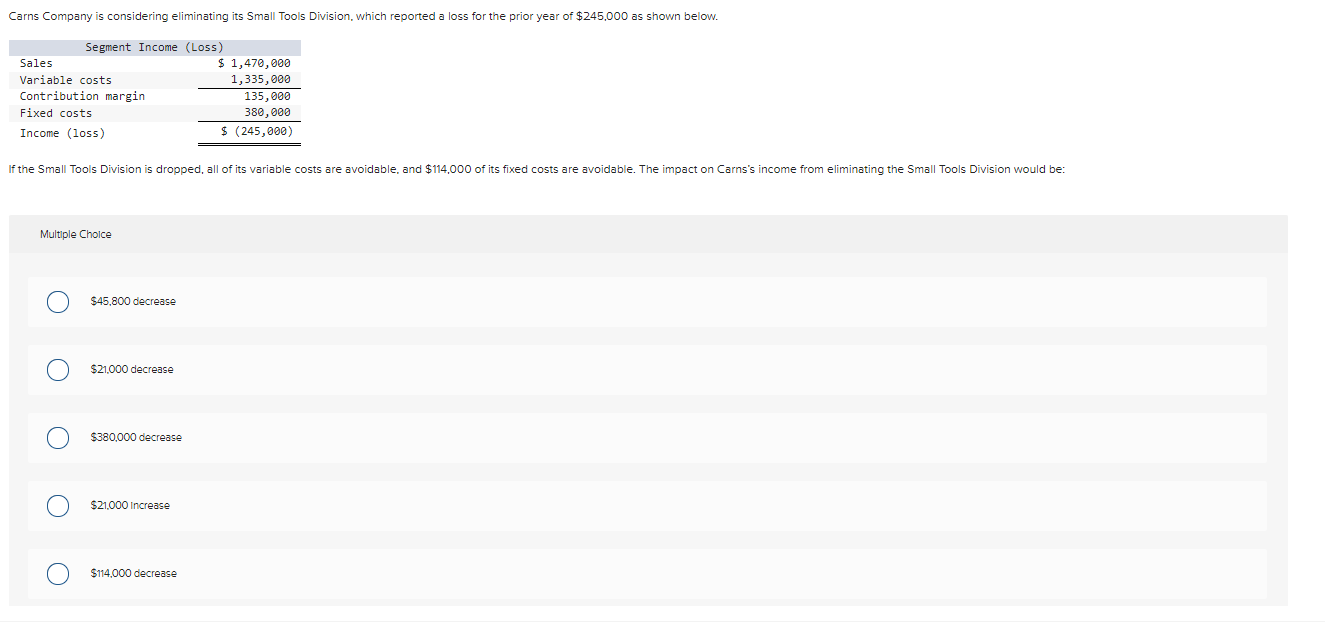

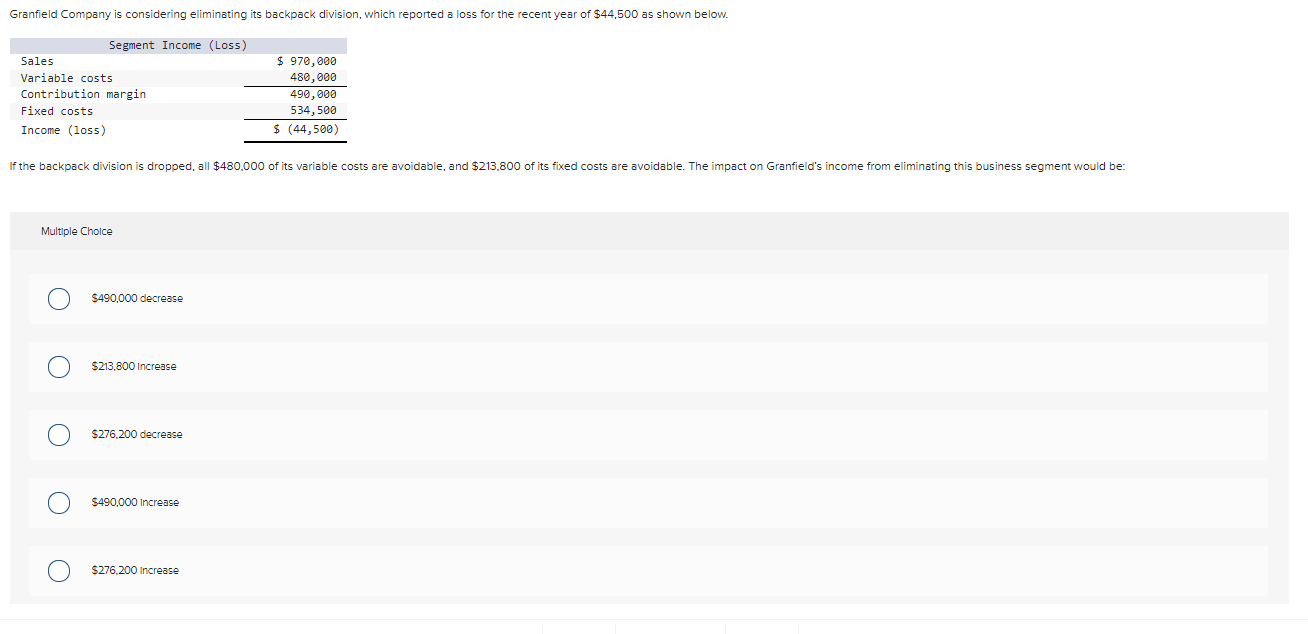

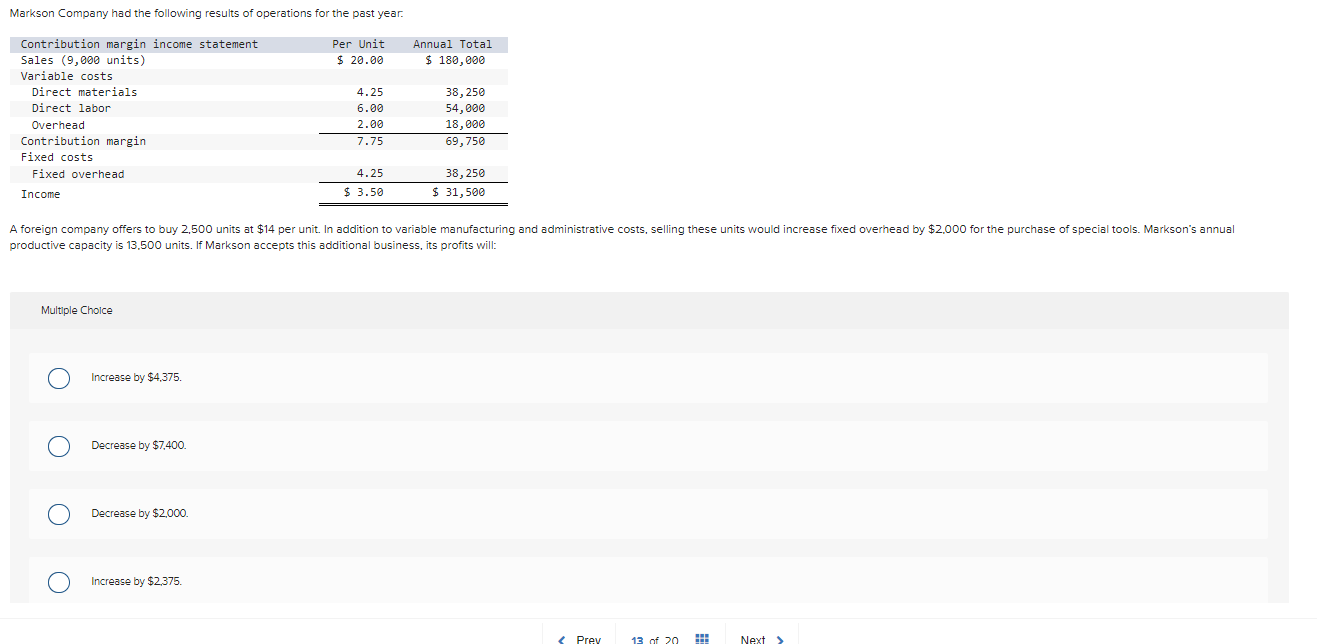

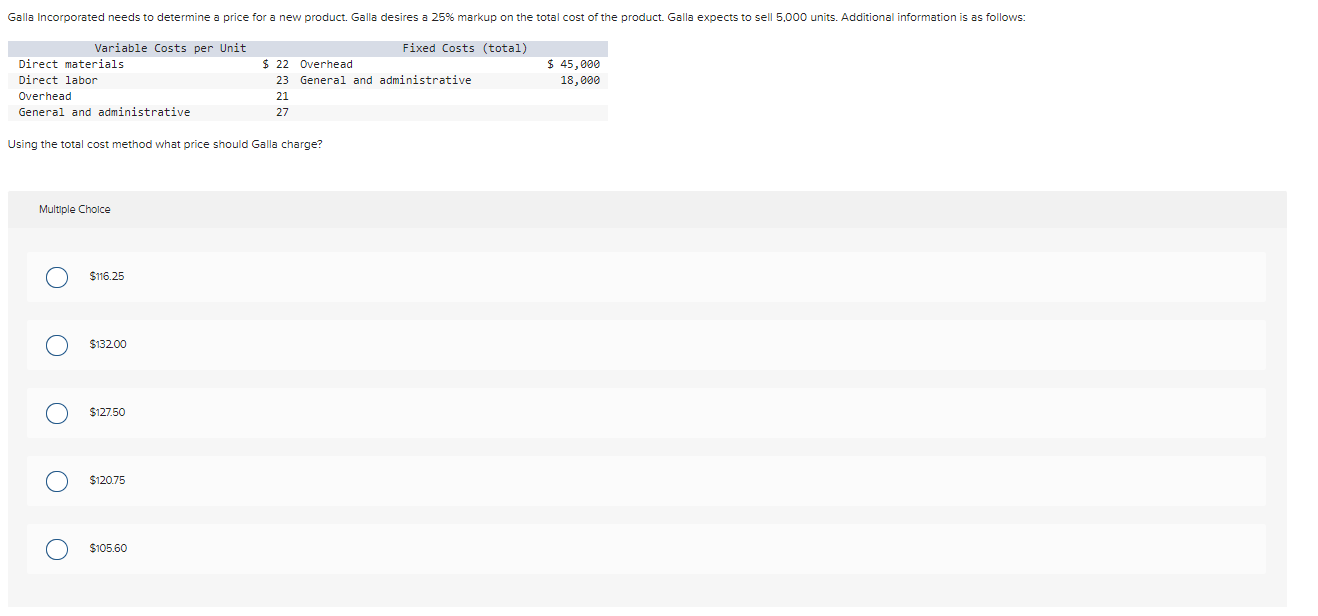

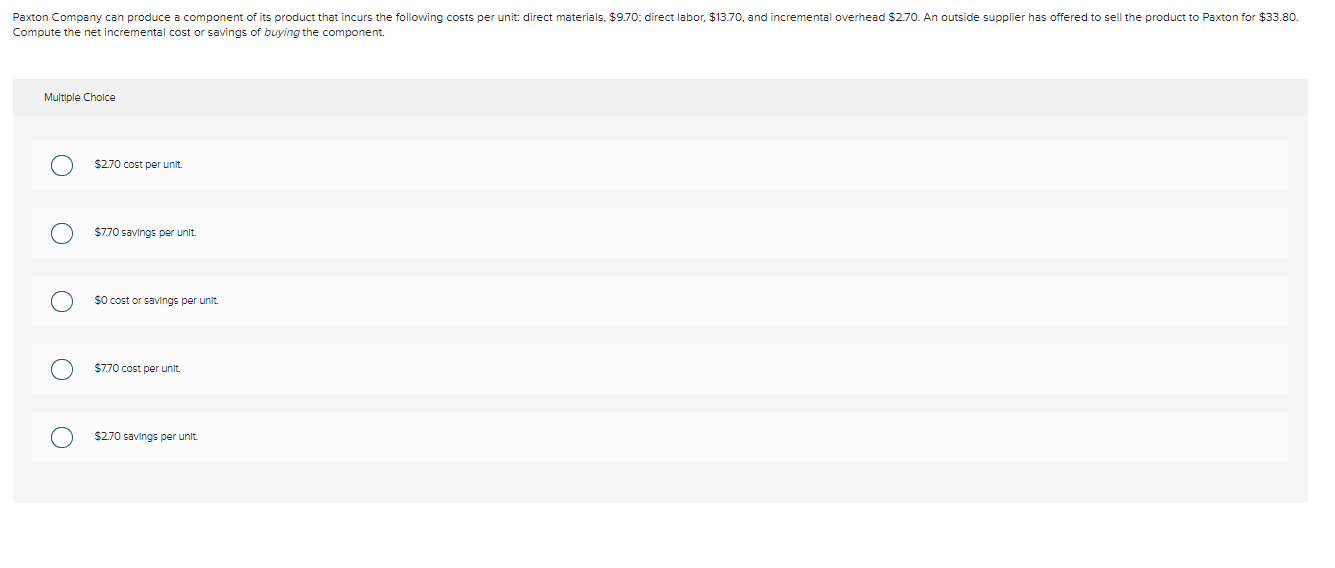

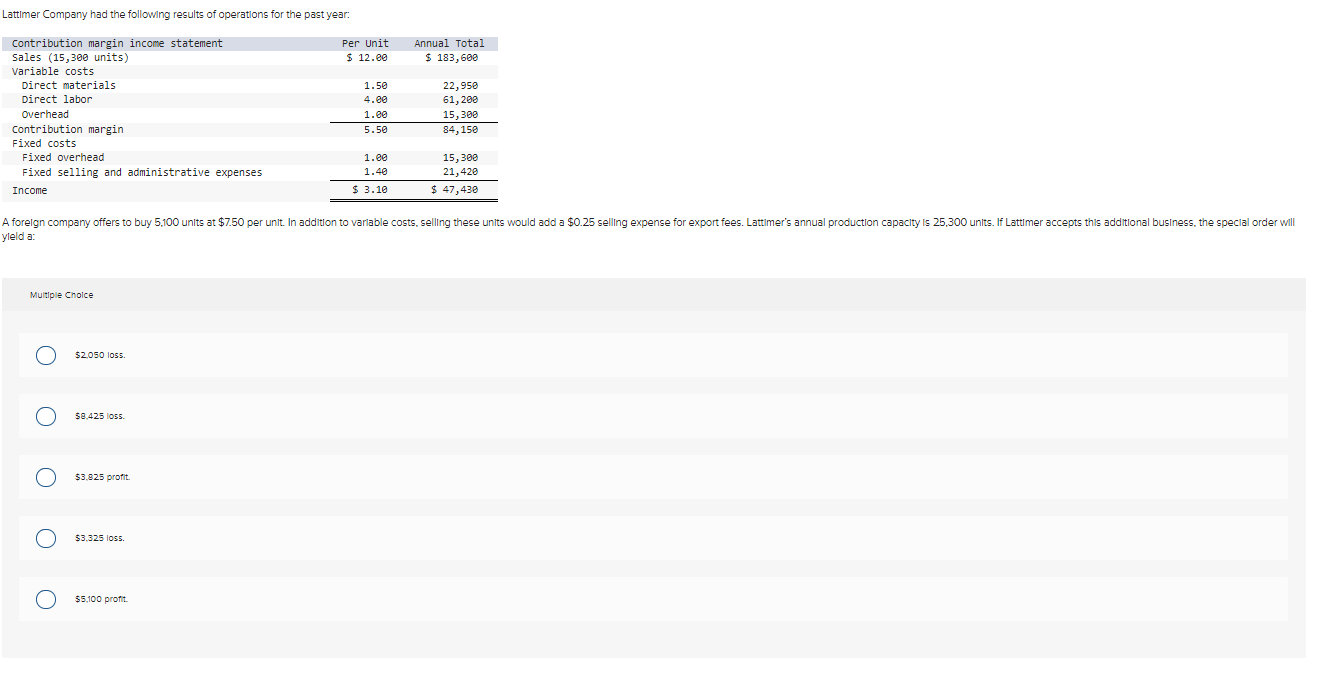

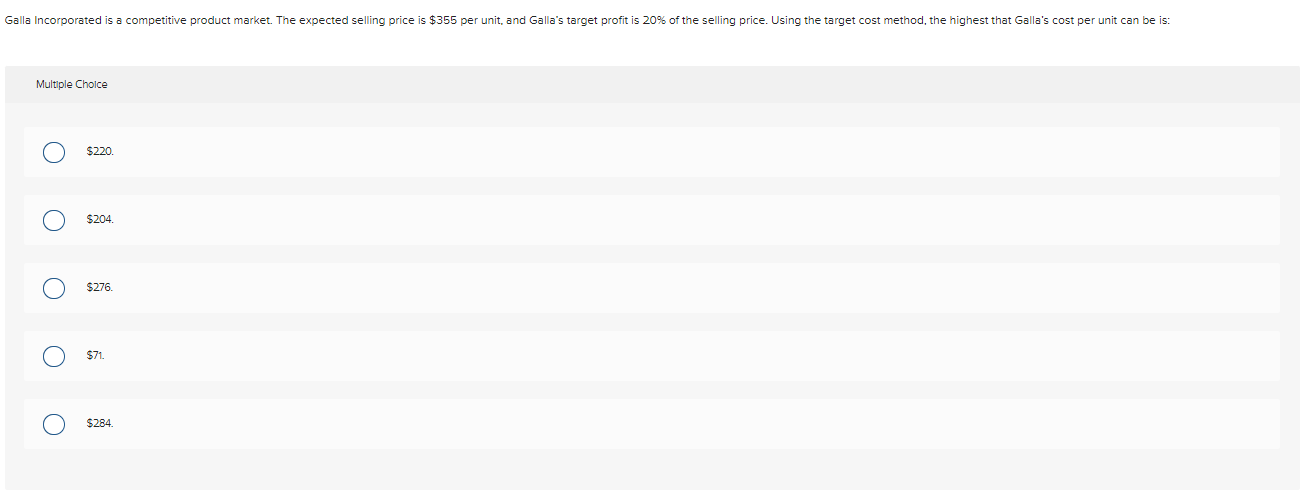

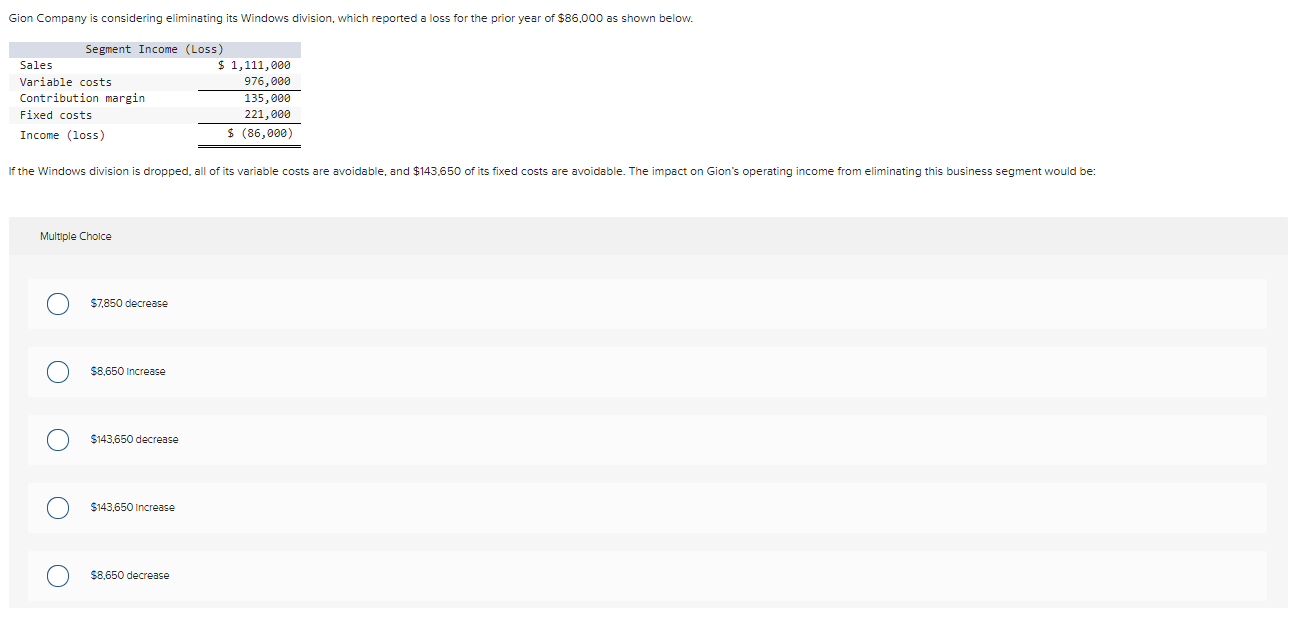

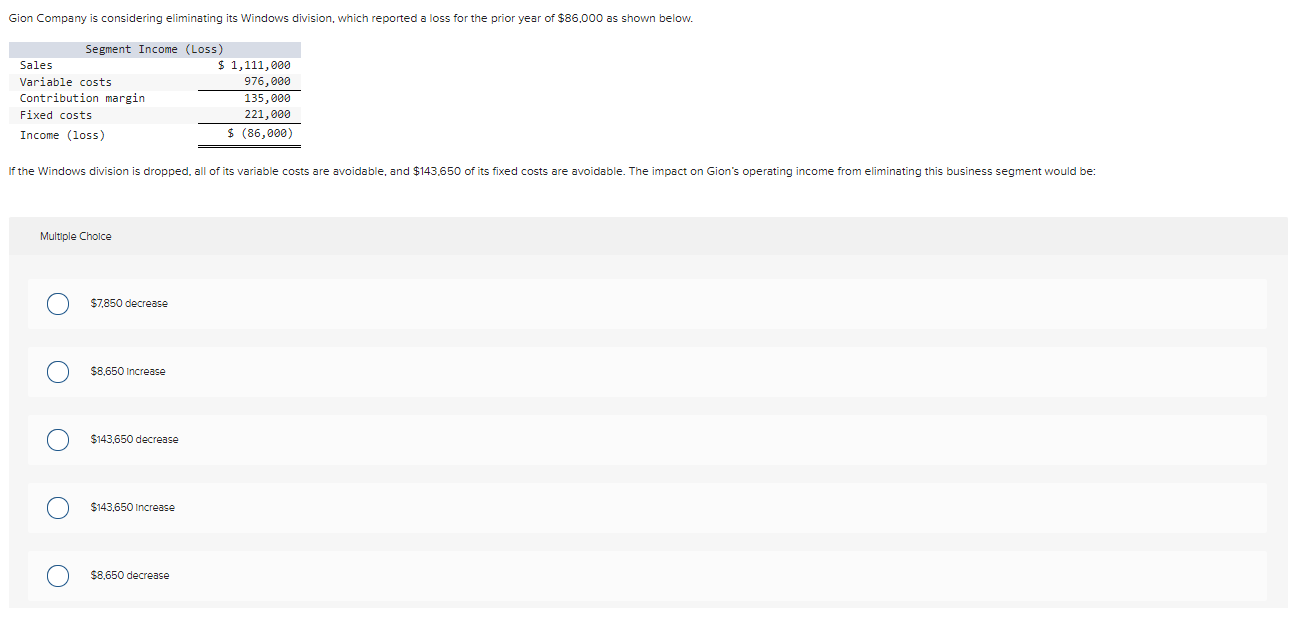

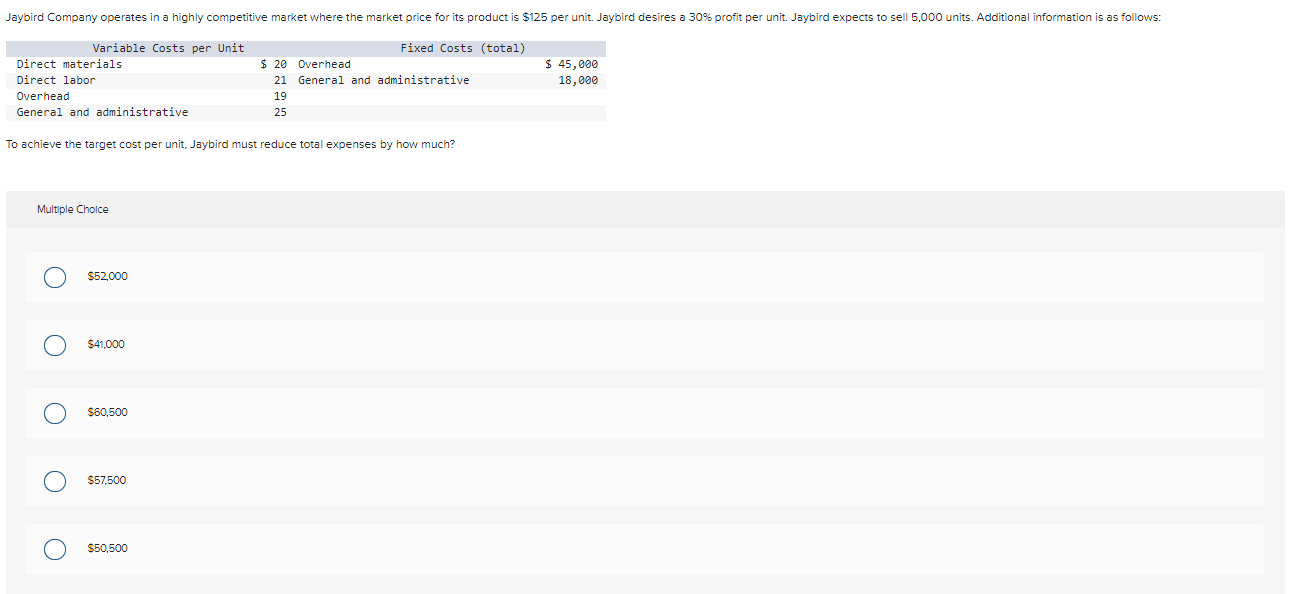

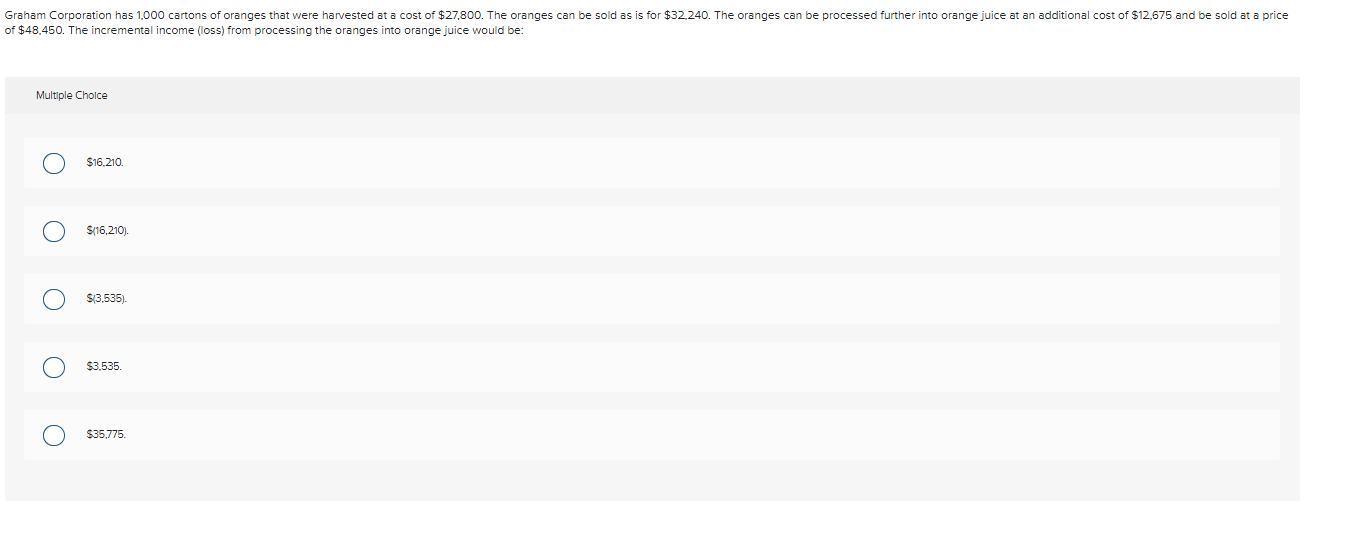

Gion Company is considering eliminating its Windows division, which reported a loss for the prior year of $86,000 as shown below. Multiple Cholce $7,850 decrease $8,650 Increase $143,650 decrease $143,650 Increase $8,650 decrease Multiple Choice $1213. $8.38. $19.63. $16.50. $17.75. Multiple Cholce $220. $204. $276. $71. $284. Multiple Choice $490,000 decrease $213,800 increase $276,200 decrease $490,000 increase $276.200 increase Compute the net incremental cost or savings of buying the component. Multiple Choice $2.70 cost per unit. \$7.70 savings per unlt. SO cost or savings per unit. $7.70 cost per unit. $2.70 savings per unlt. To achieve the target cost per unit. Jaybird must reduce total expenses by how much? Multiple Choice $52,000 $41,000 $60,500 $57,500 $50,500 Valdez Company is considering eliminating its kitchen division, which reported an operating loss of $61,000 for the past year as shown below. Multiple Choice $84,600 decrease $303,000 increase $313,800 decrease $84,600 Increase $303,000 decrease truck. The total increase or decrease in income by replacing the current spotter truck with the new truck is: Multiple Choice $31,800 decrease $31,800 increase $32,800 decrease $128,000 decrease $32,800 increase Using the total cost method what price should Galla charge? Multiple Choice $116.25 $13200 $127.50 $120.75 $105.60 Gion Company is considering eliminating its Windows division, which reported a loss for the prior year of $86,000 as shown below. Multiple Cholce $7,850 decrease $8,650 Increase $143,650 decrease $143,650 Increase $8,650 decrease nit, enabling them to be sold at their regular market price of $35. The $42 per unit is a: Multiple Choice Incremental cost. Sunk cost. Out-of-pocket cost. Opportunity cost. Perlod cost. Lattimer Company had the following results of operations for the past year: A forelgn company offers to buy 5,100 units at $7.50 per unlt. In addition to yleld a : Multiple Choice $2,0501055. $8,425 loss. $3,925 profl. $3.3251055. $5,100 profit. of $48,450. The incremental income (loss) from processing the oranges into orange juice would be: Multiple Choice $16,210 $(16,210). $(3,535) $3,535. $35,775. Multiple Cholce $65,580 decrease $148,420 decrease $60,960 decrease $214,000 increase $214,000 decrease Using the variable cost method, what markup percentage to variable cost should be used? Multiple Cholce 68.1% 86.2% 82.1% 79.7% 84.6% Markson Company had the following results of operations for the past year. A foreign company offers to buy 2,500 units at $14 per unit. In addition to vari productive capacity is 13,500 units. If Markson accepts this additional busines Multiple Choice Increase by $4,375. Decrease by $7,400. Decrease by $2,000. Increase by $2,375. /alber's income from eliminating the Phone division is: Multiple Cholce $21,000 decrease $166,000 increase $166,000 decrease $31,000 increase $14,000 decrease Multiple Choice $45,800 decrease $21,000 decrease $380,000 decrease $21,000 increase $114,000 decrease Using the total cost method what price should Pinkin charge? Multiple Choice $21110 $217.50 $185.10 $197.50 $216.25 its four-year life. The total increase or decrease in income by replacing the current equipment with the new equipment is: Multiple Choice $28,600 decrease $98,000 increase $16,900 decrease $66,850 increase $28,600 increaseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started