Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE PLEASE PLEASE I NEED ANSWER NOW Al Qasim Traders began their operation on 1st January 2019. Following details related to their operations for the

PLEASE PLEASE PLEASE I NEED ANSWER NOW

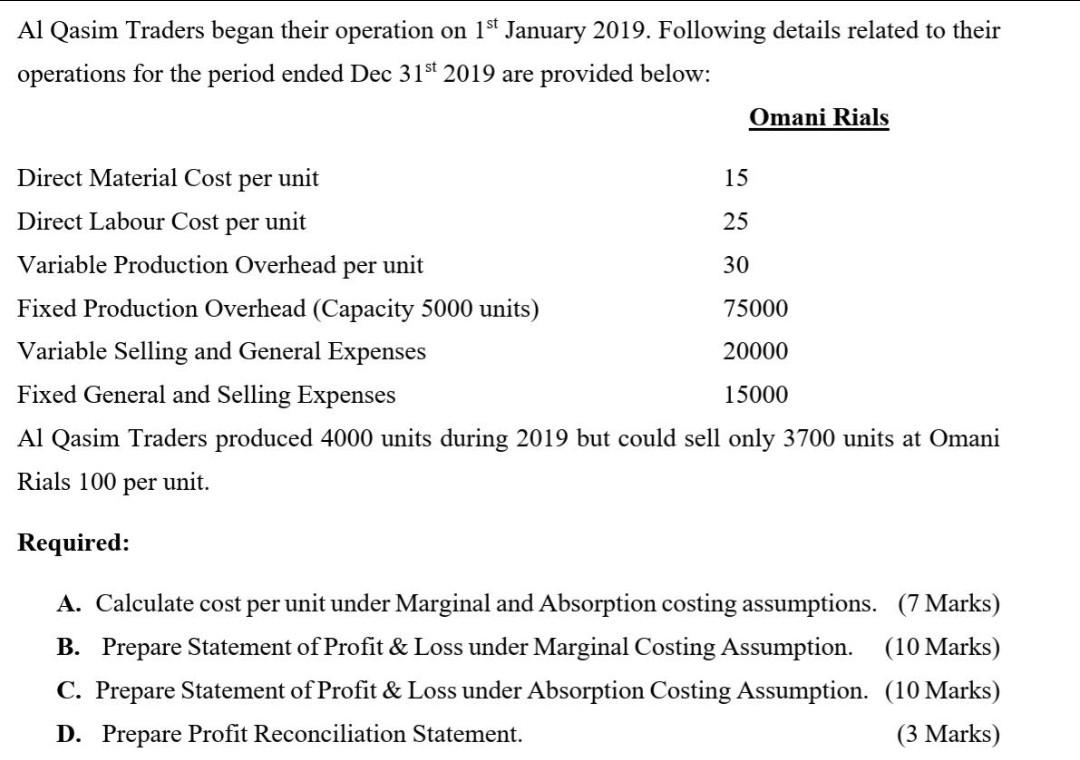

Al Qasim Traders began their operation on 1st January 2019. Following details related to their operations for the period ended Dec 31st 2019 are provided below: Omani Rials Direct Material Cost per unit 15 Direct Labour Cost per unit 25 Variable Production Overhead per unit 30 Fixed Production Overhead (Capacity 5000 units) 75000 Variable Selling and General Expenses 20000 Fixed General and Selling Expenses 15000 Al Qasim Traders produced 4000 units during 2019 but could sell only 3700 units at Omani Rials 100 per unit. Required: A. Calculate cost per unit under Marginal and Absorption costing assumptions. (7 Marks) B. Prepare Statement of Profit & Loss under Marginal Costing Assumption. (10 Marks) C. Prepare Statement of Profit & Loss under Absorption Costing Assumption. (10 Marks) D. Prepare Profit Reconciliation StatementStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started