Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please please solve all parts of this question perfectly and urgently. Give correct answer for all parts. and mention each part answer as you give

please please solve all parts of this question perfectly and urgently. Give correct answer for all parts. and mention each part answer as you give

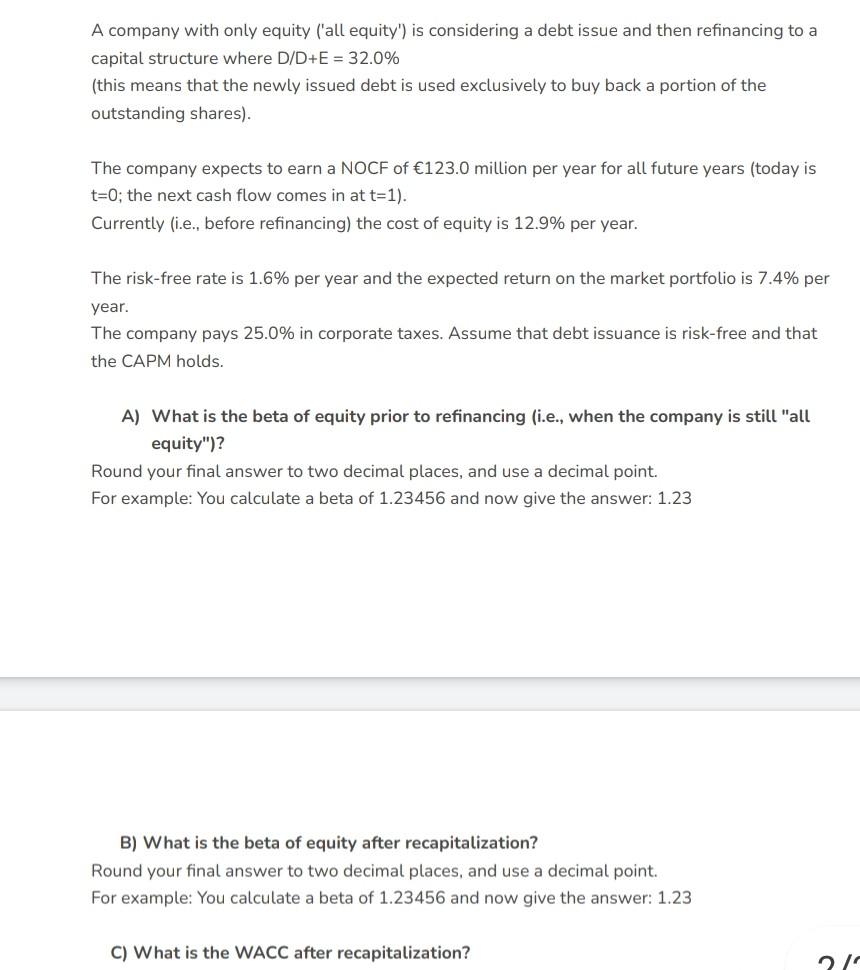

A company with only equity ('all equity') is considering a debt issue and then refinancing to a capital structure where D/D+E = 32.0% (this means that the newly issued debt is used exclusively to buy back a portion of the outstanding shares). The company expects to earn a NOCF of 123.0 million per year for all future years (today is t=0; the next cash flow comes in at t=1). Currently (i.e., before refinancing) the cost of equity is 12.9% per year. The risk-free rate is 1.6% per year and the expected return on the market portfolio is 7.4% per year. The company pays 25.0% in corporate taxes. Assume that debt issuance is risk-free and that the CAPM holds. A) What is the beta of equity prior to refinancing (i.e., when the company is still "all equity")? Round your final answer to two decimal places, and use a decimal point. For example: You calculate a beta of 1.23456 and now give the answer: 1.23 B) What is the beta of equity after recapitalization? Round your final answer to two decimal places, and use a decimal point. For example: You calculate a beta of 1.23456 and now give the answer: 1.23 C) What is the WACC after recapitalization? A company with only equity ('all equity') is considering a debt issue and then refinancing to a capital structure where D/D+E = 32.0% (this means that the newly issued debt is used exclusively to buy back a portion of the outstanding shares). The company expects to earn a NOCF of 123.0 million per year for all future years (today is t=0; the next cash flow comes in at t=1). Currently (i.e., before refinancing) the cost of equity is 12.9% per year. The risk-free rate is 1.6% per year and the expected return on the market portfolio is 7.4% per year. The company pays 25.0% in corporate taxes. Assume that debt issuance is risk-free and that the CAPM holds. A) What is the beta of equity prior to refinancing (i.e., when the company is still "all equity")? Round your final answer to two decimal places, and use a decimal point. For example: You calculate a beta of 1.23456 and now give the answer: 1.23 B) What is the beta of equity after recapitalization? Round your final answer to two decimal places, and use a decimal point. For example: You calculate a beta of 1.23456 and now give the answer: 1.23 C) What is the WACC after recapitalizationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started