Answered step by step

Verified Expert Solution

Question

1 Approved Answer

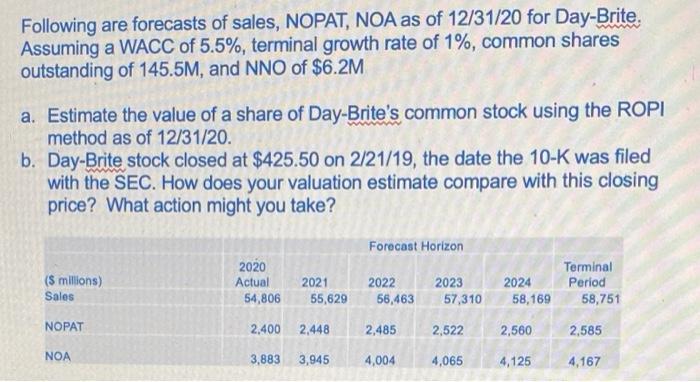

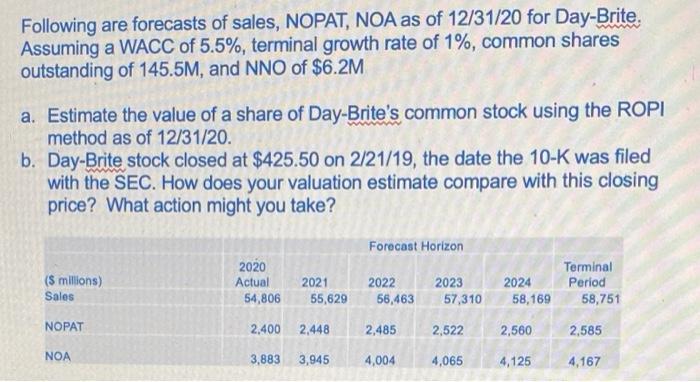

please post answer in excel with explanation! Following are forecasts of sales, NOPAT, NOA as of 12/31/20 for Day-Brite. Assuming a WACC of 5.5%, terminal

please post answer in excel with explanation!

Following are forecasts of sales, NOPAT, NOA as of 12/31/20 for Day-Brite. Assuming a WACC of 5.5%, terminal growth rate of 1%, common shares outstanding of 145.5M, and NNO of $6.2M a. Estimate the value of a share of Day-Brite's common stock using the ROPI method as of 12/31/20. b. Day-Brite stock closed at $425.50 on 2/21/19, the date the 10K was filed with the SEC. How does your valuation estimate compare with this closing price? What action might you take? Following are forecasts of sales, NOPAT, NOA as of 12/31/20 for Day-Brite. Assuming a WACC of 5.5%, terminal growth rate of 1%, common shares outstanding of 145.5M, and NNO of $6.2M a. Estimate the value of a share of Day-Brite's common stock using the ROPI method as of 12/31/20. b. Day-Brite stock closed at $425.50 on 2/21/19, the date the 10K was filed with the SEC. How does your valuation estimate compare with this closing price? What action might you take

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started