Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please post answers clearly. Which of the following is a theory of exchange rates whereby a unit of any given currency should be able to

Please post answers clearly.

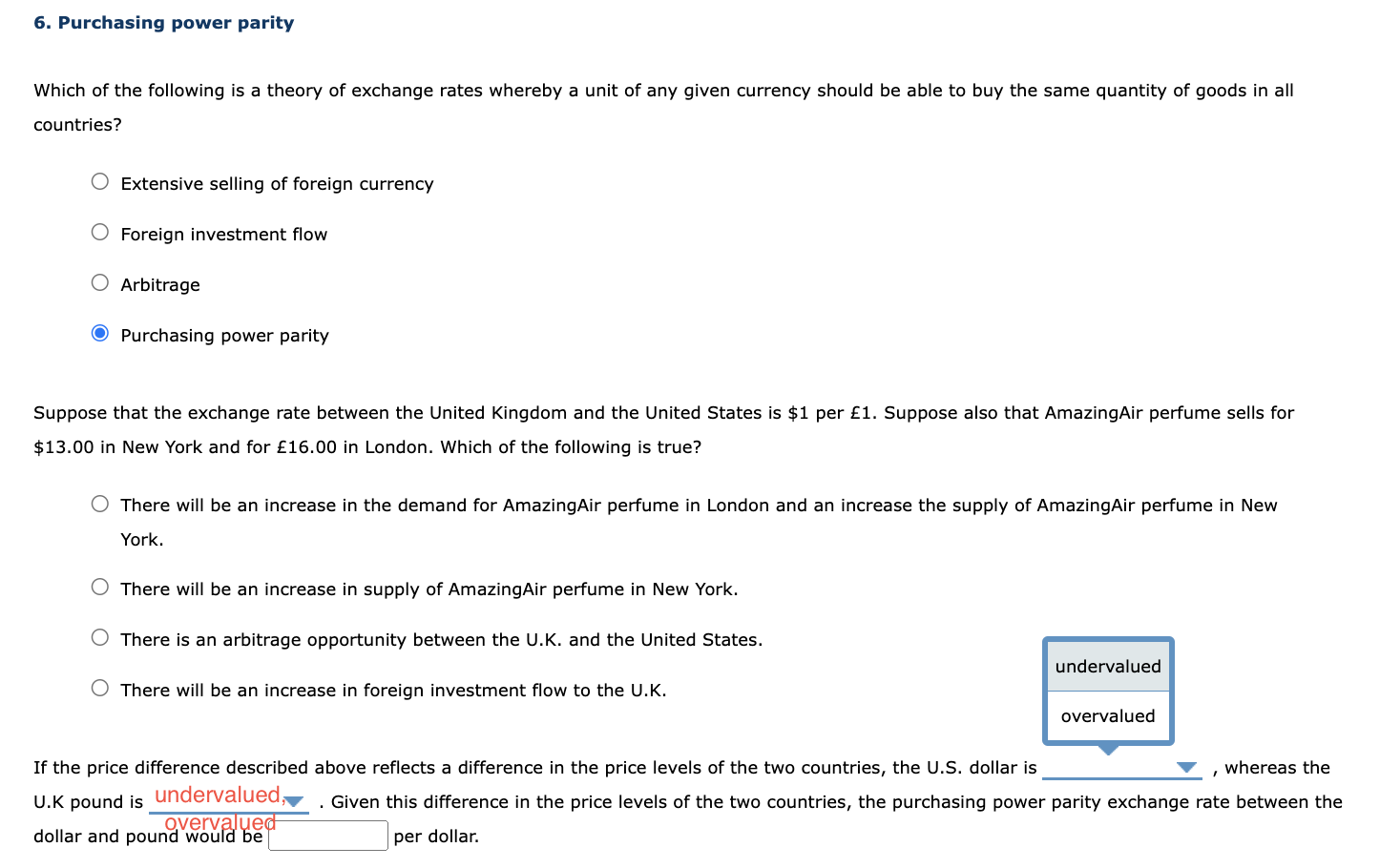

Which of the following is a theory of exchange rates whereby a unit of any given currency should be able to buy the same quantity of goods in all countries? Extensive selling of foreign currency Foreign investment flow Arbitrage Purchasing power parity Suppose that the exchange rate between the United Kingdom and the United States is $1 per 1. Suppose also that AmazingAir perfume sells for $13.00 in New York and for 16.00 in London. Which of the following is true? There will be an increase in the demand for AmazingAir perfume in London and an increase the supply of AmazingAir perfume in New York. There will be an increase in supply of AmazingAir perfume in New York. There is an arbitrage opportunity between the U.K. and the United States. There will be an increase in foreign investment flow to the U.K. If the price difference described above reflects a difference in the price levels of the two countries, the U.S. dollar is , whereas the U.K pound is dollar and pound would be . Given this difference in the price levels of the two countries, the purchasing power parity exchange rate between the per dollarStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started