Answered step by step

Verified Expert Solution

Question

1 Approved Answer

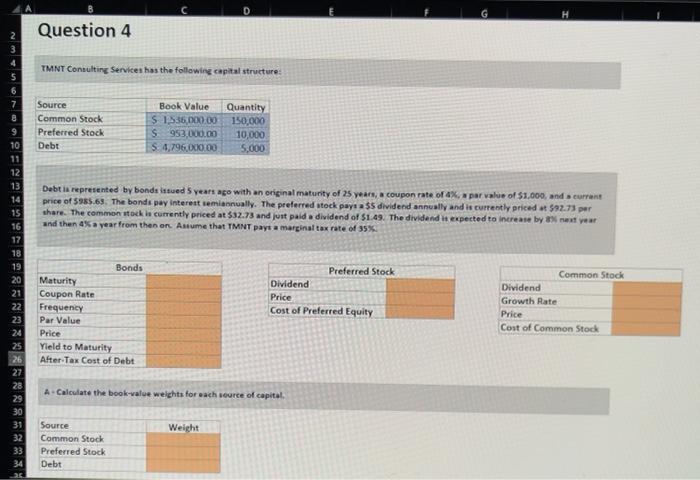

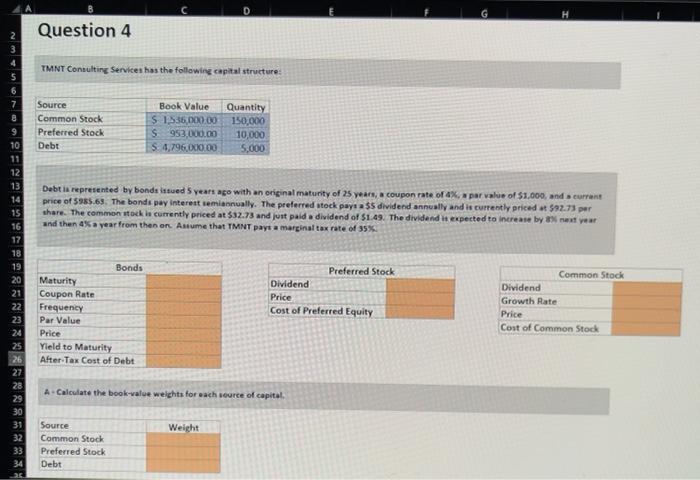

PLEASE POST EXCEL FORMULAS G H Question 4 TMNT Consulting Services has the following capital structure: Source Common Stock Preferred Stock Debt Book Value S

PLEASE POST EXCEL FORMULAS

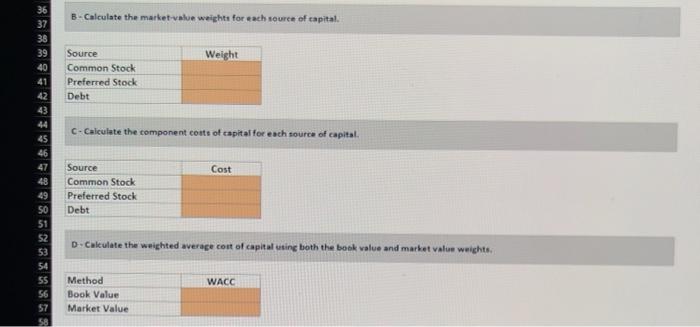

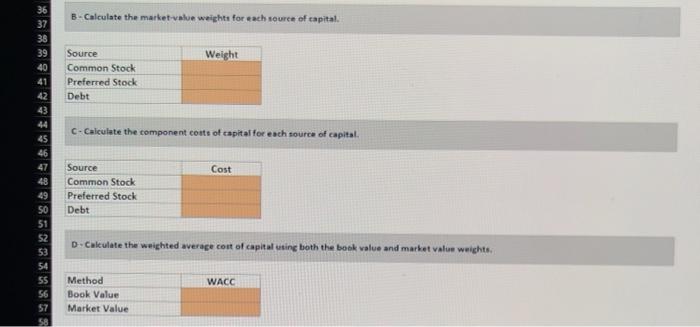

G H Question 4 TMNT Consulting Services has the following capital structure: Source Common Stock Preferred Stock Debt Book Value S 1.536,000.00 S953,000.00 $4,796,000.00 Quantity 150,000 10,000 5,000 Debt la represented by bonde irsued 5 years ago with an original matunity of 25 years, a coupon rate of par value of $3,000, and current price of $985.63. The bonda pay interest semiannually. The preferred stock payta $ dividend annually and is currently priced $93.73 per share. The common tok is currently priced at $12.73 and just palda dividend of $1.49. The dividend is expected to increase by year and then 4% a year from then on. Asume that TMNT pays a marginal tax rate of 35% 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 Bonds Maturity Coupon Rate Frequency Par Value Price Yield to Maturity After Tax Cost of Debt Preferred Stock Dividend Price Cost of Preferred Equity Common Stock Dividend Growth Rate Price Cost of Common Stock A Calculate the book-value weights for each source of capital 29 30 31 32 33 34 Weight Source Common Stock Preferred Stock Debt B-Calculate the market value weights for each source of capital Weight 36 37 38 39 40 41 42 43 44 45 46 Source Common Stock Preferred Stock Debt C- Calculate the component costs of capital for each source of capital Cost Source Common Stock Preferred Stock Debt 48 49 SO 51 52 53 54 55 56 57 58 D-Calculate the weighted average cost of capitaluring both the book value and market value weights WACC Method Book Value Market Value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started