Answered step by step

Verified Expert Solution

Question

1 Approved Answer

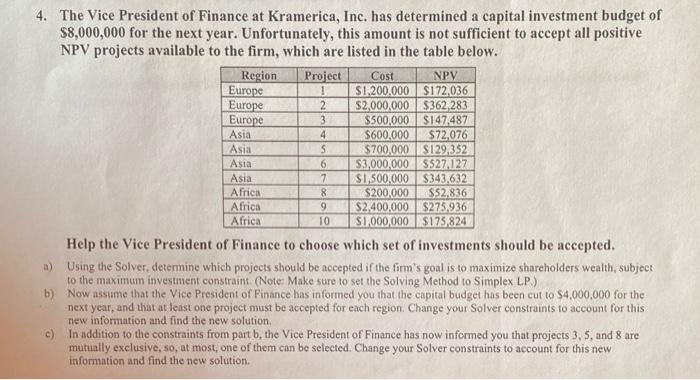

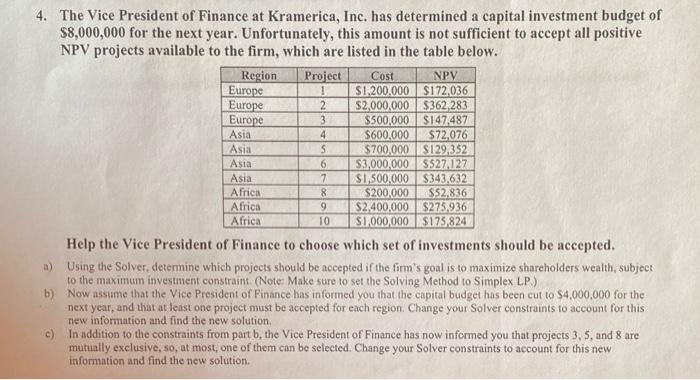

PLEASE POST FORMULAS AND SOLVE IN EXCEL!!!!!!!!!!! S 4. The Vice President of Finance at Kramerica, Inc. has determined a capital investment budget of $8,000,000

PLEASE POST FORMULAS AND SOLVE IN EXCEL!!!!!!!!!!!

S 4. The Vice President of Finance at Kramerica, Inc. has determined a capital investment budget of $8,000,000 for the next year. Unfortunately, this amount is not sufficient to accept all positive NPV projects available to the firm, which are listed in the table below. Region Project Cost NPV Europe 1 $1.200,000 $172,036 Europe 2 $2,000,000 $362,283 Europe 3 $500,000 $147.487 Asia 4 $600,000 $72,076 Asia $700,000 $129,352 Asia 6 $3,000,000 $27,127 Asia 7 $1,500,000 $343.632 Africa 8 $200,000 S$2,836 Africa $2,400,000 $275.936 Africa $1,000,000 $175.824 Help the Vice President of Finance to choose which set of investments should be accepted. a) Using the Solver, determine which projects should be accepted if the firm's goal is to maximize shareholders wealth, subject to the maximum investment constraint. (Note: Make sure to set the Solving Method to Simplex LP.) b) Now assume that the Vice President of Finance has informed you that the capital budget has been cut to $4,000,000 for the next year, and that at least one project must be accepted for each region. Change your Solver constraints to account for this new information and find the new solution. c) In addition to the constraints from part b, the Vice President of Finance has now informed you that projects 3, 5, and 8 are mutually exclusive, so, at most one of them can be selected. Change your Solver constraints to account for this new information and find the new solution. 9 10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started