Answered step by step

Verified Expert Solution

Question

1 Approved Answer

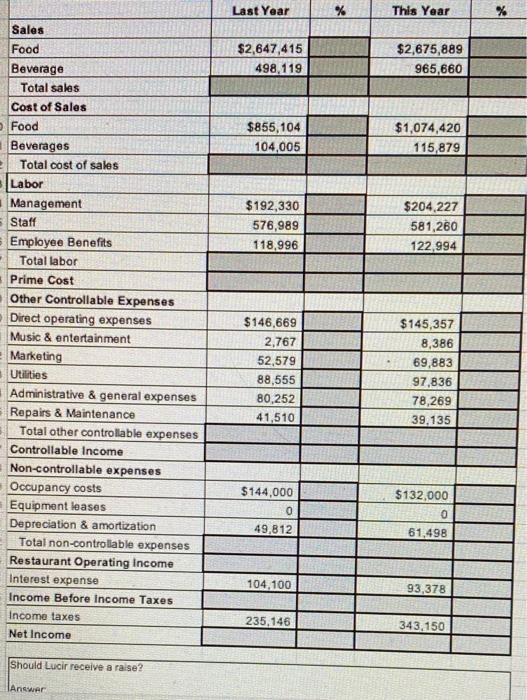

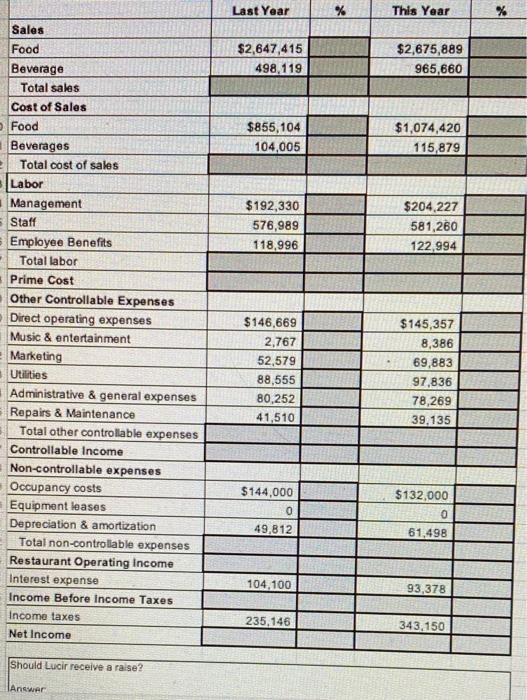

please post FORMULAS! so i can learn Last Year This Year % $2,647,415 498,119 $2,675,889 965,660 $855,104 104,005 $1,074,420 115,879 $192,330 576,989 118,996 $204,227 581,260

please post FORMULAS! so i can learn

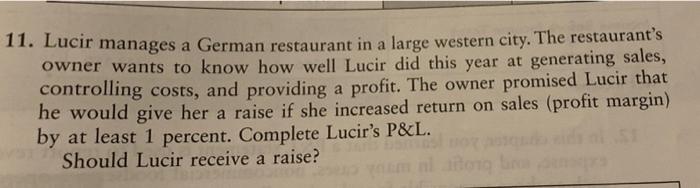

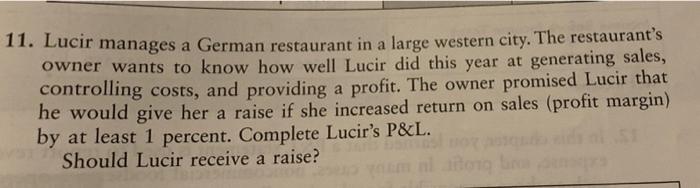

Last Year This Year % $2,647,415 498,119 $2,675,889 965,660 $855,104 104,005 $1,074,420 115,879 $192,330 576,989 118,996 $204,227 581,260 122.994 Sales Food Beverage Total sales Cost of Sales Food Beverages Total cost of sales Labor Management Staff Employee Benefits Total labor Prime Cost Other Controllable Expenses Direct operating expenses Music & entertainment Marketing Utilities Administrative & general expenses Repairs & Maintenance Total other controllable expenses Controllable Income Non-controllable expenses Occupancy costs Equipment leases Depreciation & amortization Total non-controllable expenses Restaurant Operating income Interest expense Income Before Income Taxes Income taxes Net Income $146,669 2,767 52,579 88,555 80,252 41,510 $145,357 8,386 69,883 97,836 78,269 39,135 $144,000 0 49,812 $132.000 0 61,498 104,100 93,378 235,146 343.150 Should Lucir receive a raise? Answer 11. Lucir manages a German restaurant in a large western city. The restaurant's owner wants to know how well Lucir did this year at generating sales, controlling costs, and providing a profit . The owner promised Lucir that he would give her a raise if she increased return on sales (profit margin) by at least 1 percent. Complete Lucir's P&L. Should Lucir receive a raise? tor

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started