Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please post full answer 12.4 pter 12 & App A-Homework Question 4 of 9 1.33/4 E Show Attempt History Current Attempt in Progress Ivanhoe Clinic

please post full answer 12.4

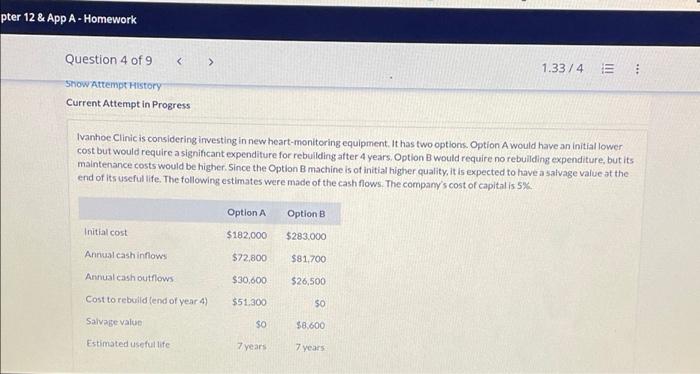

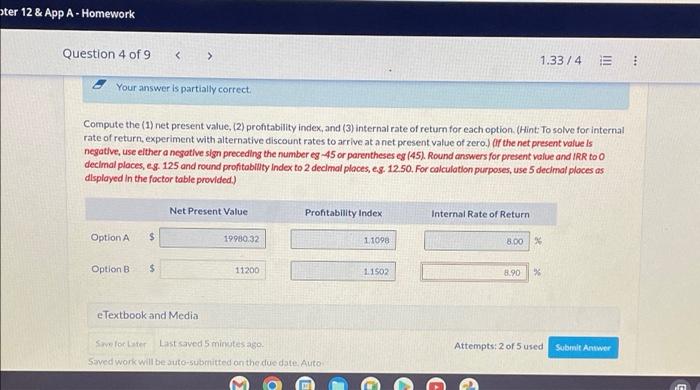

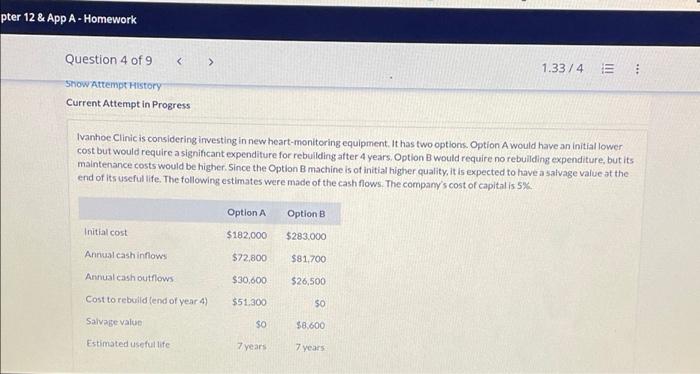

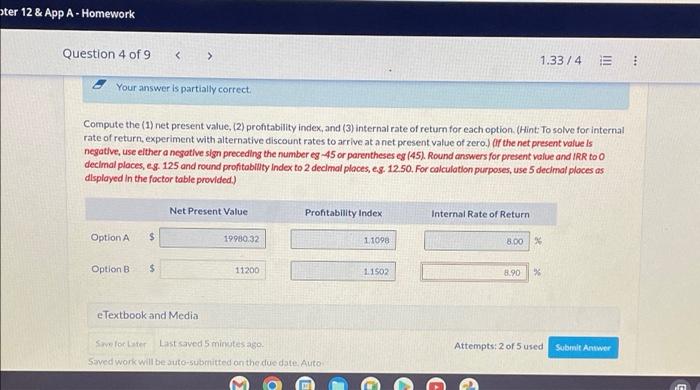

pter 12 & App A-Homework Question 4 of 9 1.33/4 E Show Attempt History Current Attempt in Progress Ivanhoe Clinic is considering investing in new heart-monitoring equipment. It has two options. Option A would have an initial lower cost but would require a significant expenditure for rebuilding after 4 years. Option B would require no rebuilding expenditure, but its maintenance costs would be higher. Since the Option B machine is of initial higher quality, it is expected to have a salvage value at the end of its useful life. The following estimates were made of the cash flows. The company's cost of capital is 5% Option A Option B Initial cost $182,000 $283,000 Annual cash inflows $72,800 $81,700 Annual cash outflows $30,600 $26,500 Cost to rebuild (end of year 4) $51.300 50 Salvage value $0 $8,600 Estimated useful life 7 years 7 years ter 12 & App A - Homework Question 4 of 9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started