Please post steps 5, 6, 7. Thank you.

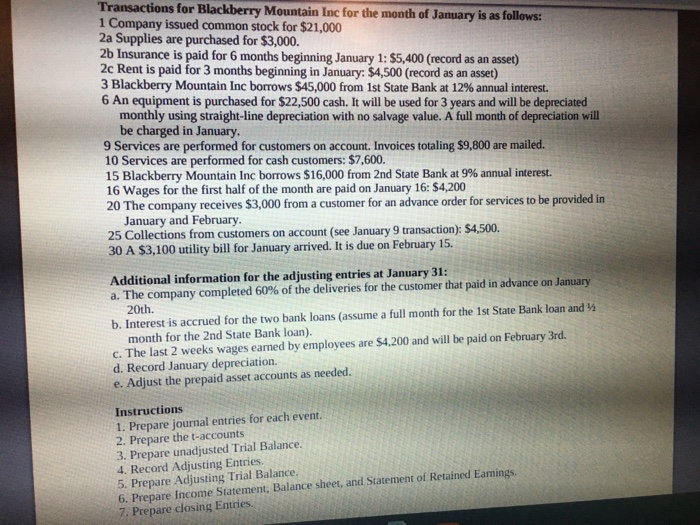

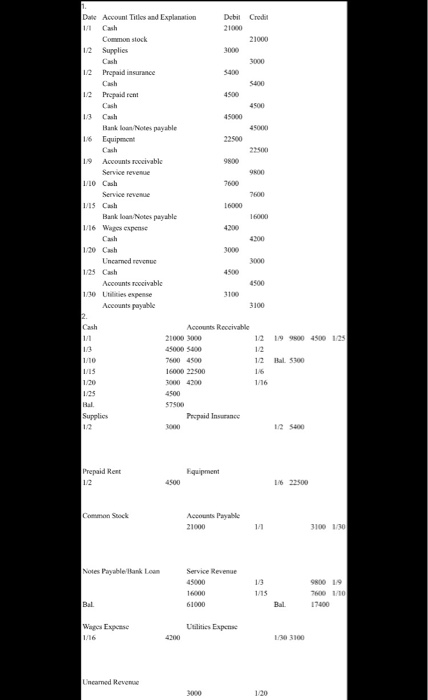

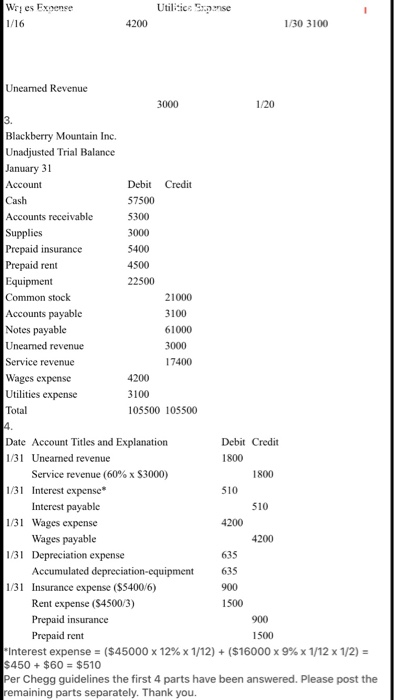

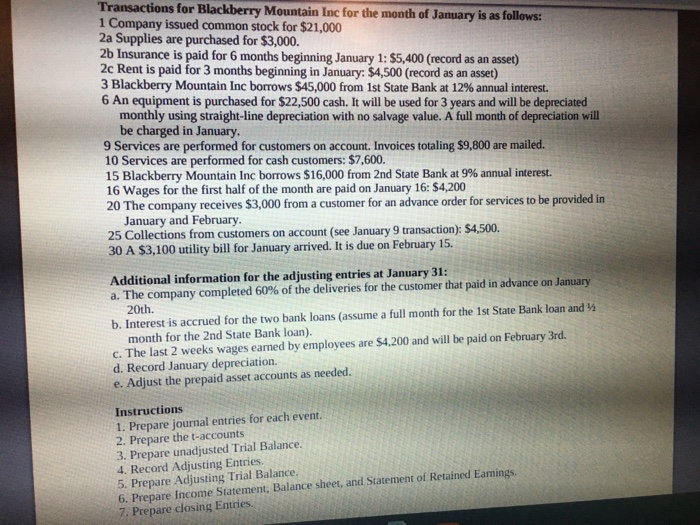

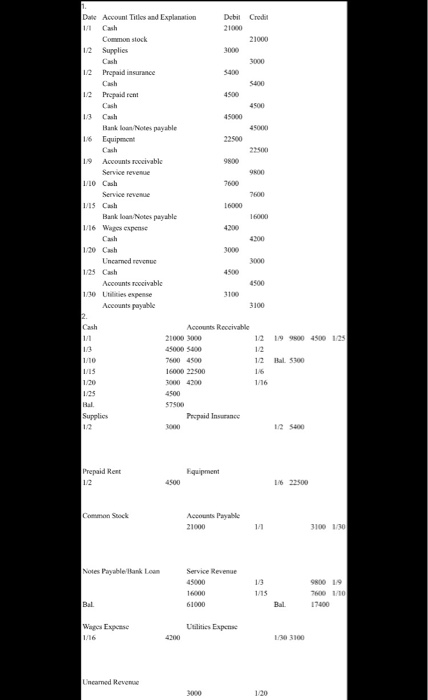

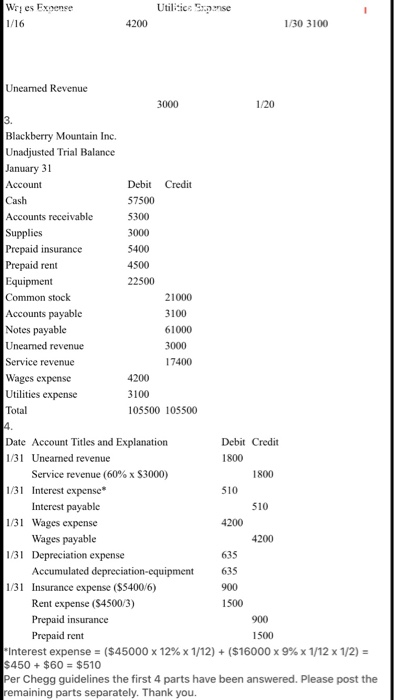

Transactions for Blackberry Mountain Inc for the month of January is as follows: 1 Company issued common stock for $21,000 2a Supplies are purchased for $3,000. 2b Insurance is paid for 6 months beginning January 1: $5,400 (record as an asset) 2c Rent is paid for 3 months beginning in January: $4,500 (record as an asset) 3 Blackberry Mountain Inc borrows $45,000 from 1st State Bank at 12% annual interest. 6 An equipment is purchased for $22,500 cash. It will be used for 3 years and will be depreciated monthly using straight-line depreciation with no salvage value. A full month of depreciation will be charged in January 9 Services are performed for customers on account. Invoices totaling $9,800 are mailed. 10 Services are performed for cash customers: $7,600. 15 Blackberry Mountain Inc borrows $16.000 from 2nd State Bank at 9% annual interest. 16 Wages for the first half of the month are paid on January 16: $4,200 20 The company receives $3,000 from a customer for an advance order for services to be provided in January and February. 25 Collections from customers on account (see January 9 transaction): $4,500. 30 A $3,100 utility bill for January arrived. It is due on February 15. Additional information for the adjusting entries at January 31: a. The company completed 60% of the deliveries for the customer that paid in advance on January 20th. b. Interest is accrued for the two bank loans (assume a full month for the 1st State Bank loan and month for the 2nd State Bank loan). c. The last 2 weeks wages earned by employees are $4,200 and will be paid on February 3rd. d. Record January depreciation. e. Adjust the prepaid asset accounts as needed. Instructions 1. Prepare journal entries for each event. 2. Prepare the t-accounts 3. Prepare unadjusted Trial Balance. 4. Record Adjusting Entries. 5. Prepare Adjusting Trial Balance. 6. Prepare Income Statement, Balance sheet, and Statement of Retained Eamings. 7. Prepare closing Entries. Credit Date Account Thiles and Explanation 1/ Cash Common stock 12 Supplies Cash 12 Prepaid insurance Cash 12 Prepaid rent 13 Cash Hank lowNotes payable 1/6 Equipment Cash 19 Accounts roosivable Service revenue 1/10 Cash Service revenue 1/15 Cash Bank lowNotes payable 116 Wapes expense Cush 1/20 Cash Uncamned revenue 1/29 Cash Accounts roosivable 110 L es expense Accounts payable Cash 12 19 9 4500 125 110 VIS 12 Bal. 5300 Accounts Receivable 21000 3000 45000 500 7600 4500 16000000 3000 4200 4500 $7500 Prepaid Insurance 3000 1/16 1.25 Supplies 12 5400 Prepaid Rent Equipment 4500 1/6 22500 Common Sock Acts Payable 21000 3100 130 Notes Payable Bank Loan Service Revenue 45000 13 SO19 0 110 1000 61000 Bal Utilities Expense 1/30 3100 Uncamed Revenue Way es Exoense 1/16 Utilities Sanse 4200 1/30 3100 Uneamed Revenue 3000 3000 1/20 3. Credit Blackberry Mountain Inc. Unadjusted Trial Balance January 31 Account Cash Accounts receivable Supplies Prepaid insurance Prepaid rent Equipment Common stock Accounts payable Notes payable Uneamed revenue Service revenue Wages expense Utilities expense Total Debit 57500 5300 3000 5400 4500 22500 21000 3100 61000 3000 17400 4200 3100 105500 105500 4. 4200 Date Account Titles and Explanation Debit Credit 1/31 Uneamed revenue 1800 Service revenue (60% x S3000) 1800 1/31 Interest expense* 510 Interest payable 1/31 Wages expense 4200 Wages payable 1/31 Depreciation expense Accumulated depreciation-equipment 635 1/31 Insurance expense (S5400/6) 900 Rent expense (S4500/3) 1500 Prepaid insurance 900 Prepaid rent 1500 Interest expense = ($45000 x 12% x 1/12) + ($16000 x 9% x 1/12 x 1/2) = $450 + $60 = $510 Per Chegg guidelines the first 4 parts have been answered. Please post the remaining parts separately. Thank you