Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please post the complete answer without rounding Question 40 2.5 pts Vasudevan, Inc. forecasts the free cash flows (in millions) shown below. If the weighted

please post the complete answer without rounding

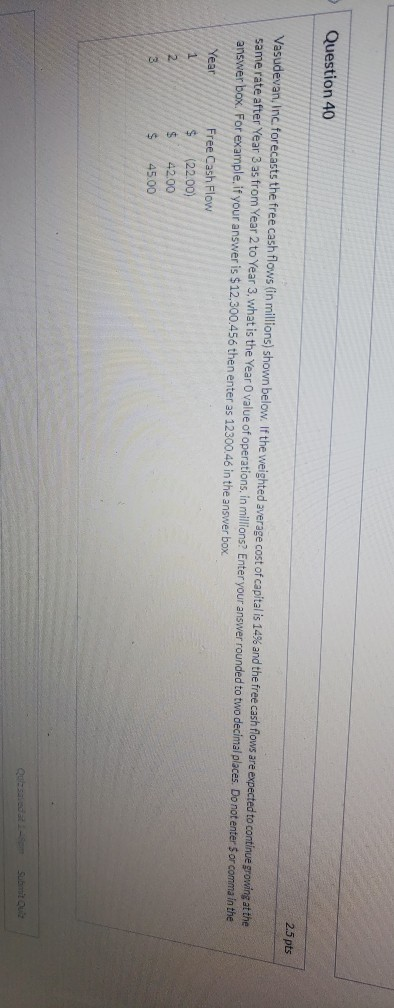

Question 40 2.5 pts Vasudevan, Inc. forecasts the free cash flows (in millions) shown below. If the weighted average cost of capital is 14% and the free cash flows are expected to continue growing at the same rate after Year 3 as from Year 2 to Year 3, what is the Year O value of operations, in millions? Enter your answer rounded to two decimal places. Do not enters or comma in the answer box. For example, if your answer is $12,300.456 then enter as 12300.46 in the answer box Year 1 (22.00) Free Cash Flow $ $ 42.00 $ 45.00 2 3 Qui said at - Submit OutStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started