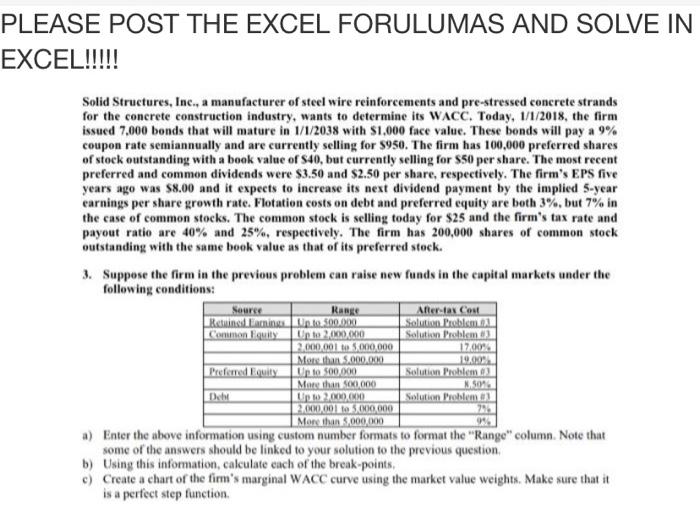

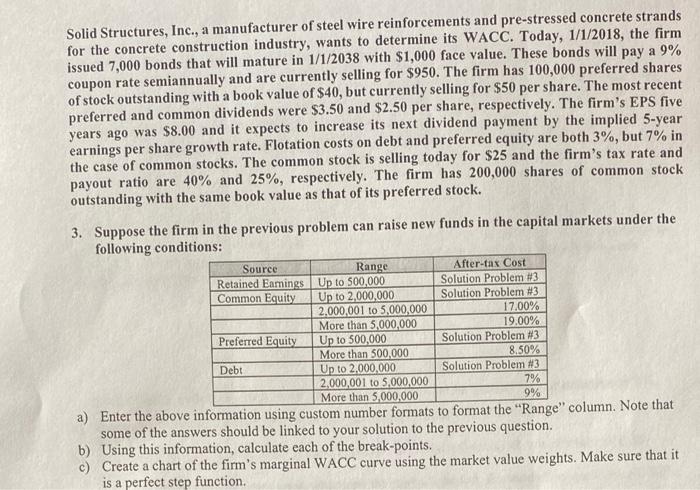

PLEASE POST THE EXCEL FORULUMAS AND SOLVE IN EXCEL!!!!! Solid Structures, Inc., a manufacturer of steel wire reinforcements and pre-stressed concrete strands for the concrete construction industry, wants to determine its WACC. Today, 1/1/2018, the firm issued 7.000 bonds that will mature in 1/1/2038 with $1,000 face value. These bonds will pay a 9% coupon rate semiannually and are currently selling for $950. The firm has 100,000 preferred shares of stock outstanding with a book value of S40, but currently selling for $50 per share. The most recent preferred and common dividends were $3.50 and $2.50 per share, respectively. The firm's EPS five years ago was $8.00 and it expects to increase its next dividend payment by the implied 5-year earnings per share growth rate. Flotation costs on debt and preferred equity are both 3%, but 7% in the case of common stocks. The common stock is selling today for $25 and the firm's tax rate and payout ratio are 40% and 25%, respectively. The firm has 200,000 shares of common stock outstanding with the same book value as that of its preferred stock. 3. Suppose the firm in the previous problem can raise new funds in the capital markets under the following conditions: Source Range After fax Cout Reminding .40.500.000 Solution Problem Comen Buy Up to 2.000.000 Solution Problem 2.000.001 to 3000.000 1700% More than 5.000.000 19.00% Preferred Equity Up to 500.000 Solution Problem More than 1,000 MASON Up. Solution Problem 3.000,001 to 5.000.000 More than 5,000,000 a) Enter the above information using custom number formats to format the "Range" column. Note that some of the answers should be linked to your solution to the previous question b) Using this information, calculate each of the break-points, c) Create a chart of the firm's marginal WACC curve using the market value weights. Make sure that it is a perfect step function Dahi Solid Structures, Inc., a manufacturer of steel wire reinforcements and pre-stressed concrete strands for the concrete construction industry, wants to determine its WACC. Today, 1/1/2018, the firm issued 7,000 bonds that will mature in 1/1/2038 with $1,000 face value. These bonds will pay a 9% coupon rate semiannually and are currently selling for $950. The firm has 100,000 preferred shares of stock outstanding with a book value of $40, but currently selling for $50 per share. The most recent preferred and common dividends were $3.50 and $2.50 per share, respectively. The firm's EPS five years ago was $8.00 and it expects to increase its next dividend payment by the implied 5-year earnings per share growth rate. Flotation costs on debt and preferred equity are both 3%, but 7% in the case of common stocks. The common stock is selling today for $25 and the firm's tax rate and payout ratio are 40% and 25%, respectively. The firm has 200,000 shares of common stock outstanding with the same book value as that of its preferred stock. 3. Suppose the firm in the previous problem can raise new funds in the capital markets under the following conditions: Source Range After-tax Cost Retained Eamings Up to 500,000 Solution Problem #3 Common Equity Up to 2,000,000 Solution Problem #3 2.000,001 to 5,000,000 17.00% More than 5,000,000 19.00% Preferred Equity Up to 500,000 Solution Problem #3 More than 500,000 8.50% Debt Up to 2,000,000 Solution Problem #3 2,000,001 to 5,000,000 7% More than 5,000,000 9% a) Enter the above information using custom number formats to format the "Range" column. Note that some of the answers should be linked to your solution to the previous question. b) Using this information, calculate each of the break-points. c) Create a chart of the firm's marginal WACC curve using the market value weights. Make sure that it is a perfect step function