Question

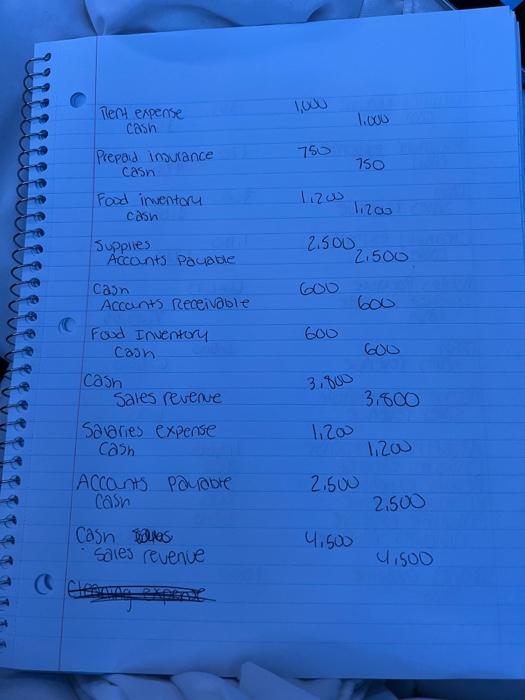

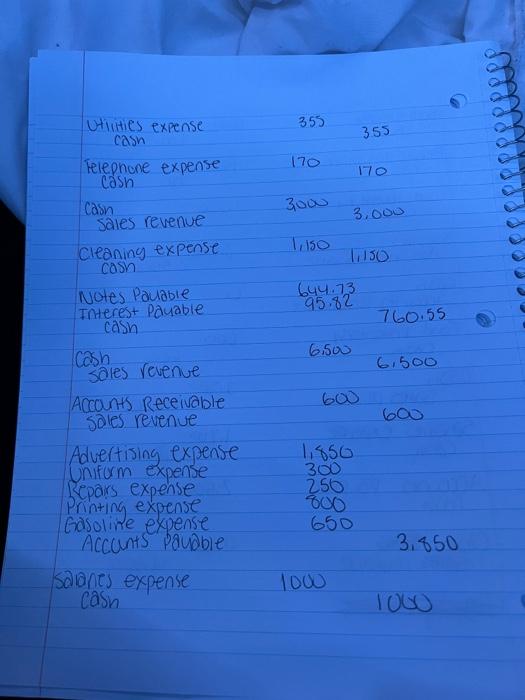

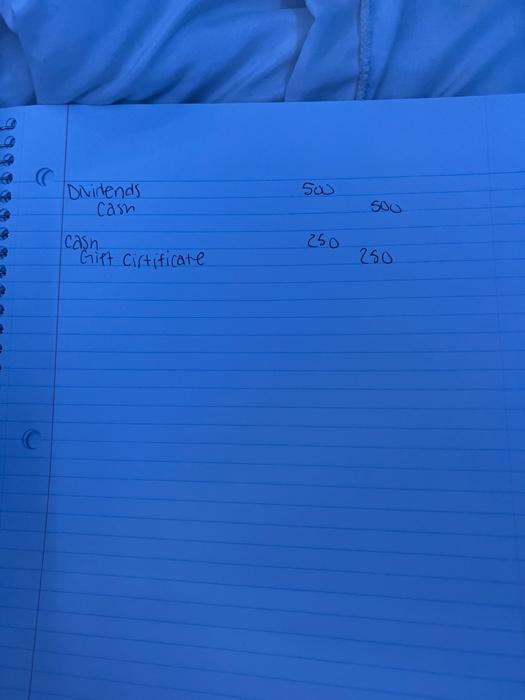

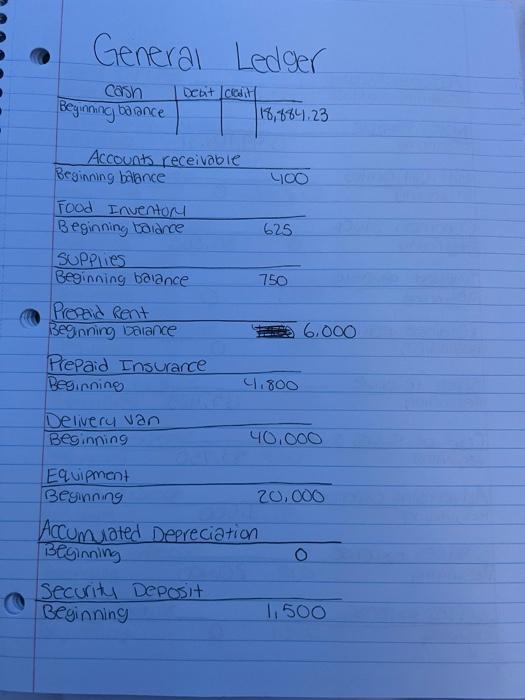

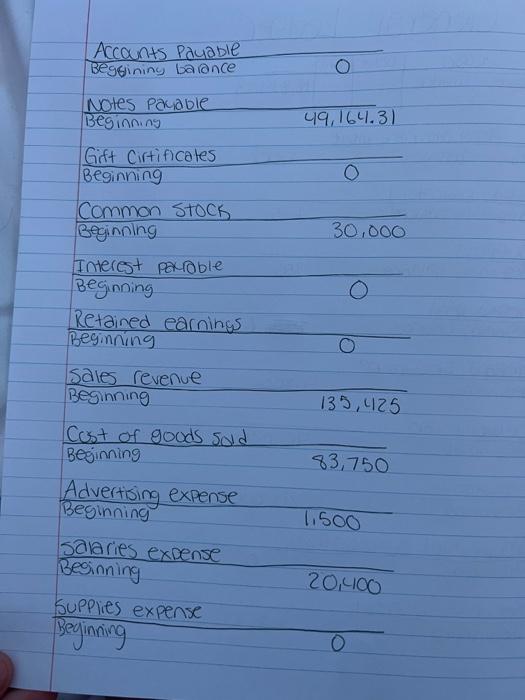

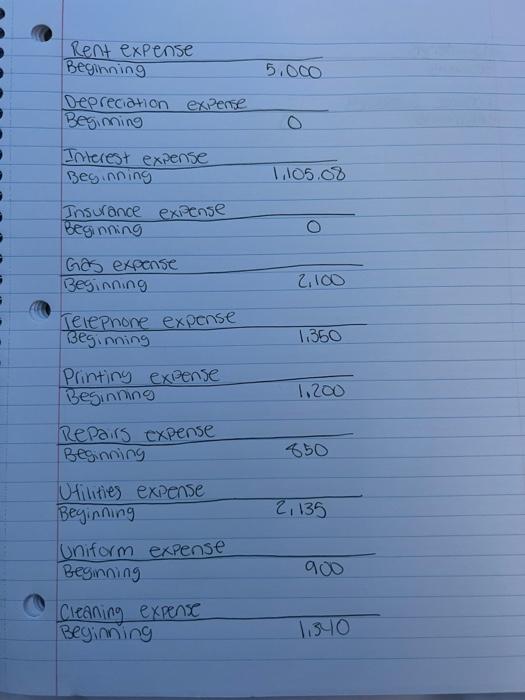

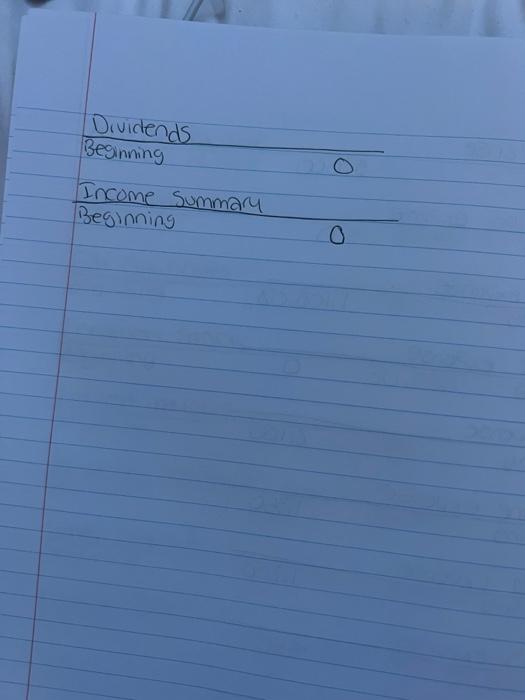

Please post these transactions into a general ledger. here are the general ledger account names and beginning balances. The following transactions are reflected in the

July 1. 2020. Liz Burnes and her brother, James each invested $15,000 in a corporation they formed

to run Diner 64, Inc. Each were issued 1,500 shares of $10 par value common stock.

July 1, 2020 The corporation took a $30,000 small business loan from a local bank. The loan is an

'interest only' loan for three years at a fixed rate of 12% per year. A balloon payment of the principal will be due in 3 years. The monthly interest payment is due by the 10th of the following month.

July 1,2020. Because this was a new business, the landlord required the business to prepay

$6,000 for the rent for the first six month, plus a $1,500 security deposit for a total cash outlay

of $7.500.

July 1, 2020 The business purchased equipment and fixtures for $20,000 in cash.

The assets have a useful life of 10 years.

July 1, 2020 The company purchased delivery van value at $40,000 with a $15,000 down payment and a 3-year, $25,000 note payable with an annual intereste rate of 6%. The truck has a 10-year useful life. The monthly payment including principal and interest is $760.55.

July 8, 2020 Preston Hill, a local Bed & Breakfast (B & B), arranges with Diner 64 to provide breakfast for their guests at $10 per person per day. Diner 64 will bill the B & B at the end of each month for the meals provided. Payment is required by the 10th of the next month

July 15,2020 Paid $4 800 for two-year fire and liability insurance with coverage beginning September 1. 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started