Answered step by step

Verified Expert Solution

Question

1 Approved Answer

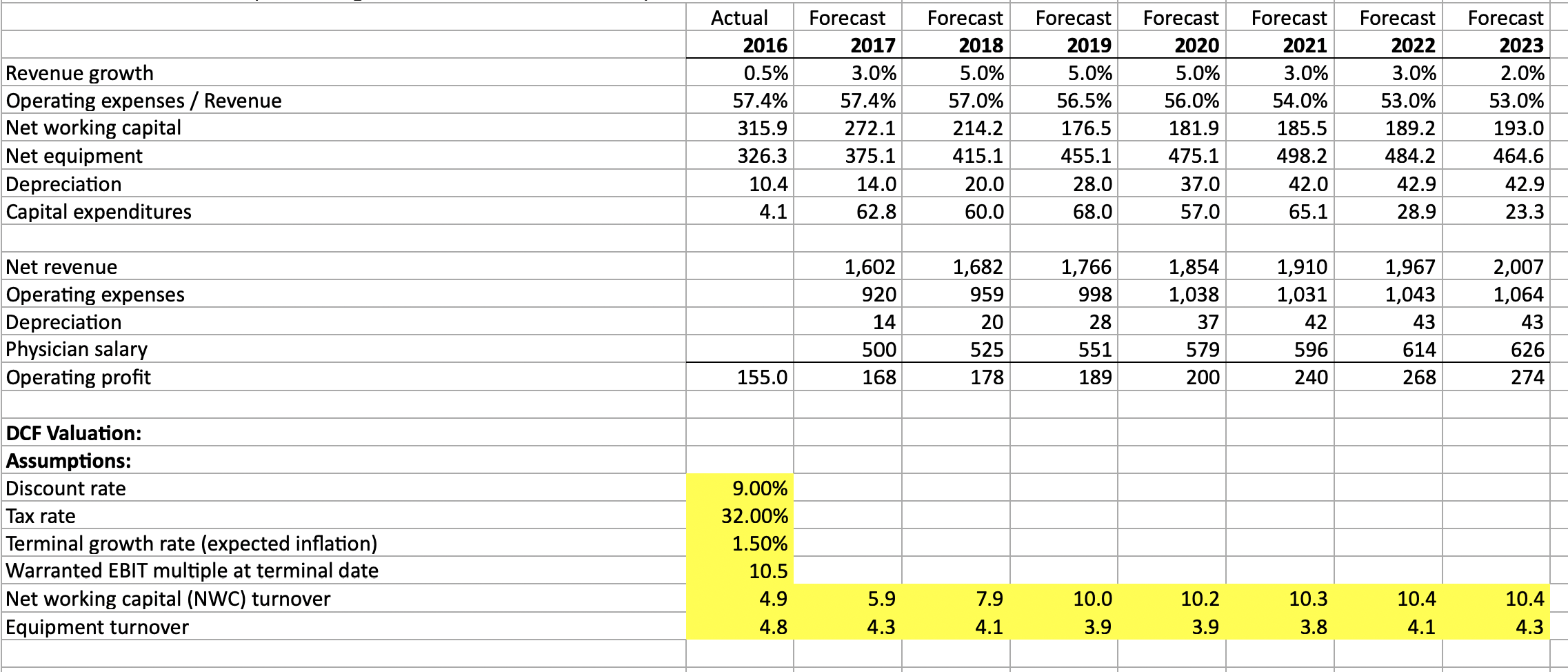

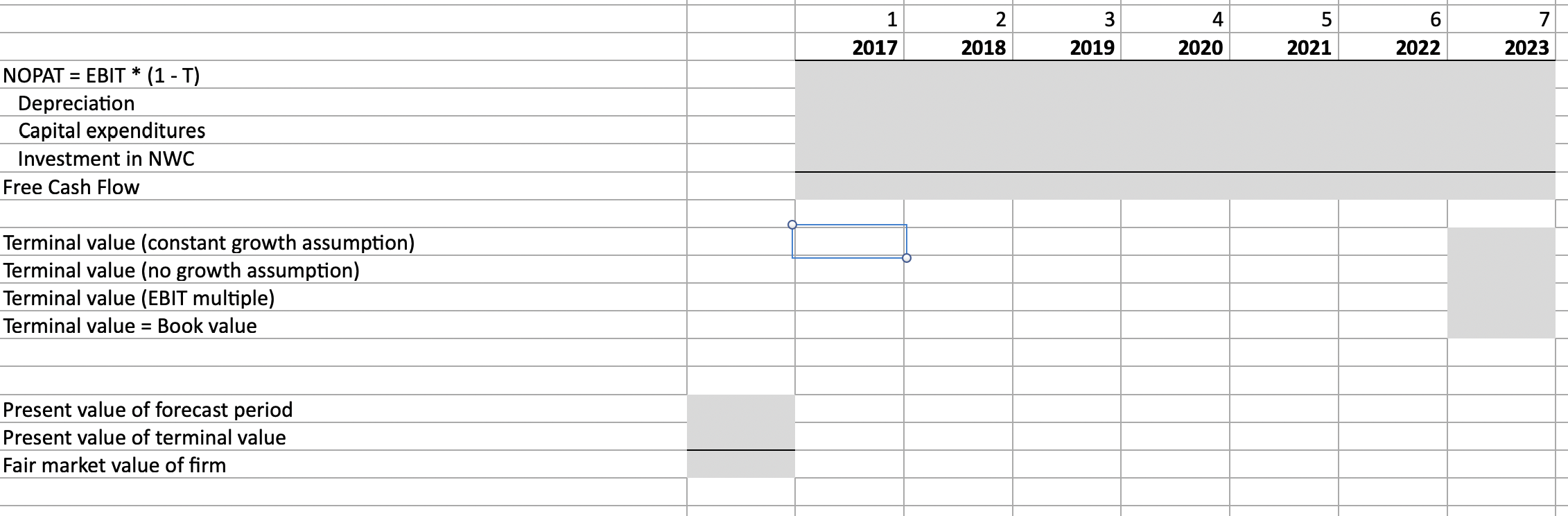

Please preform a DCF Valuation Use several different terminal value estimates. Discuss and explain which terminal value estimate you have the most and least confidence

Please preform a DCF Valuation

- Use several different terminal value estimates. Discuss and explain which terminal value estimate you have the most and least confidence in. Discuss concerns you have with the assumptions underlying the financial forecast. How do reasonable variations in key assumptions affect the valuation?Are there any other valuation methodologies you would consider? If so, describe them. Please Show excel formulas if possible

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started