Please, preform a Horizontal analysis using the data below using the following headlines.

Then highlight the the areas of the most significant change.

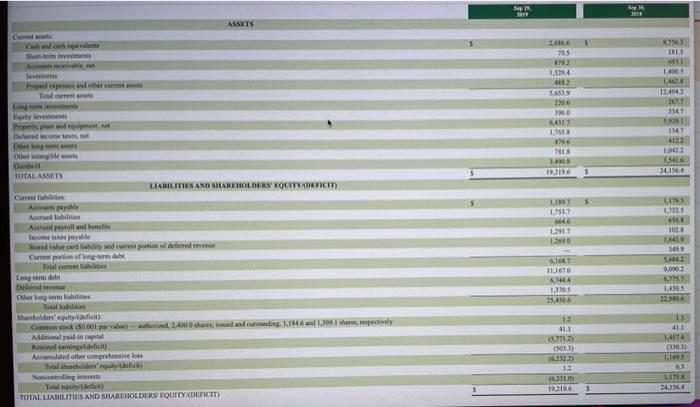

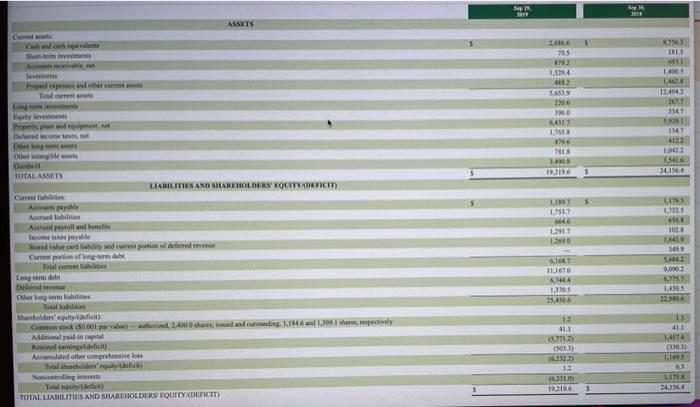

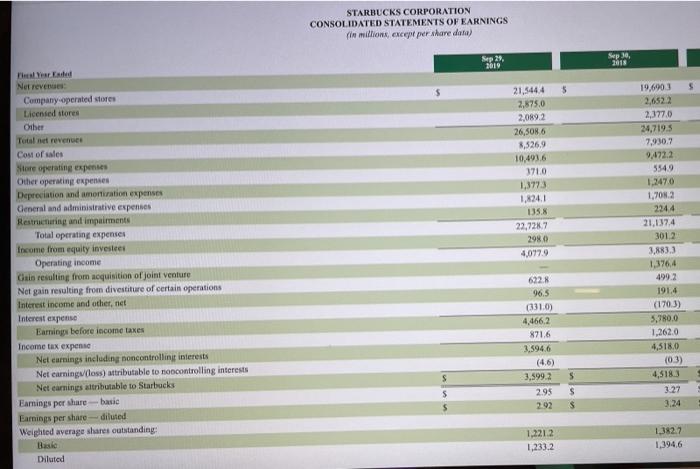

use the new data shown in the picture:

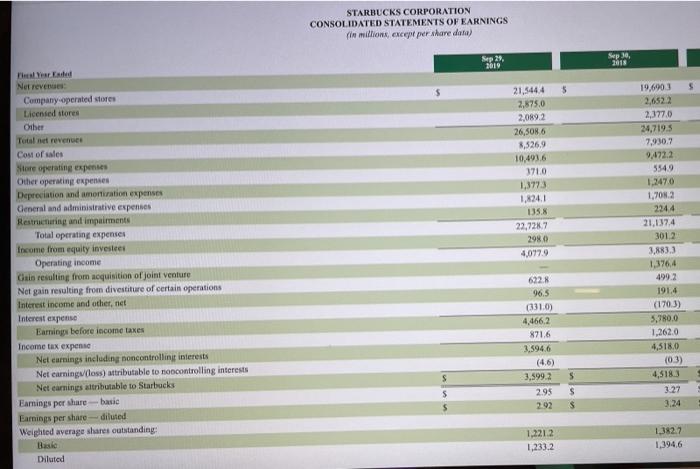

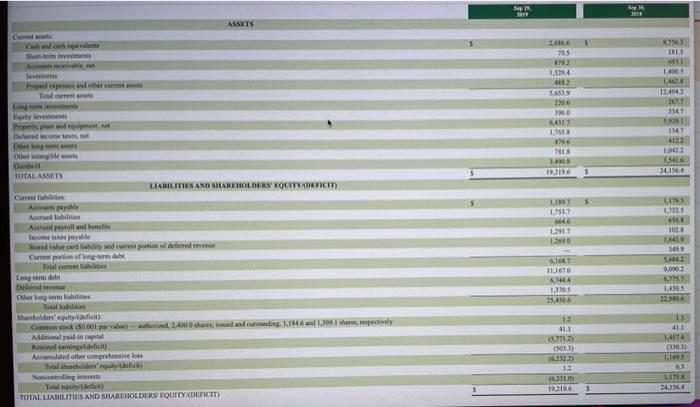

SN ASSETS 5 13 IS Storment 73 Towalcun 2.36 30 13 1,3658 7.6 783 162 13:49 3677 117 1991 11 4123 the income De Othe 1.5416 24.1964 TOTAL ASSETS LIABILITIES AND STAKEHOLDERS' EQUITVADERICIT) LIT 1.750 46 1.11 18 Achi parole Icoane pe Cup of med 1 5.6 9,03 24.1 1405 16 11.1670 67464 1.3705 5456 Leagte der De Oshley 12. Sander equity deficit Adical puid- epital Reinid Accumulated comprehensive los 13 41.1 6.771.21 (3033) 0303) 1. Nootrolig Talaigal TOTAL LIABILITIES AND SHAREHOLDERS EQUITY DEFICIT) 12 0621109 19.3196 LITE 41564 $ Difference % Difference Most Recent Year Prior Year STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF EARNINGS in millions, except per dare data) Sep 29, 2019 Sep 30, 2011 $ 19,6903 5 21,5444 2,875.0 2,0892 26,508 6 8,526,9 10,4936 3710 1,3773 135.8 22,7287 2980 4,077.9 Net revenues Company operated stores Licensed stores Other Total net revenue Cost of sales Store operating expenses Other operating expenses Depreciation and amortization expenses General and administrative expenses Restructuring and impairments Total operating expenses Income from equity investeer Operating income Csin resulting from acquisition of joint venture Net gain resulting from divestiture of certain operations Interest income and other, net Interest expense Earnings before income taxes Income tax expense Net earnings including noncontrolling interests Net earning loss) attributable to no controlling interests Net earnings attributable to Starbucks Earnings per share basic Earnings per share-diluted Weighted average shares outstanding 2,377.0 24,719.5 7,930.7 9.472.2 5549 1.247.0 1,7012 2244 21.137.4 3012 3,883.3 1,3764 4992 191.4 (1703) 3,780.0 1.262.0 4,518,0 (03) 4,5183 3.27 3.24 622.8 96.5 (3310) 4,466,2 8716 3.594.6 (4.6) 3,5992 2.95 292 5 $ $ 5 1,2212 1,233.2 1.382.7 1,394,6 Diluted CONSOLIDAIKU SIALMENISUF EARNIE (in millions, excepte per share dal Sep 23, 2019 Sep 16 2018 $ 5 Der des Net revenues Company operated stores Licensed stores Other Total net revenus Cost of sales Store operating experies Other operating expenses Depreciation and amortization expenses General and administrative expenses Restructunng and impairments Total operating expenses Incame from equity investees Operating income Gain resulting from acquisition of joint venture Net gain resulting from divestiture of certain operations Interest income and other, Diel Interest expense Farnings before income taxes ncome tax expense Net earnings including noncontrolling interests Net camingulloss) attributable to noncontrolling interests 21.5444 2,875.0 2,089.2 26,508.6 8.5269 10,493,6 371.0 1,3773 1.824.1 135.8 22,728.7 298.0 4,077.9 19,6903 2.6522 2,377.0 24,7195 7,930,7 9.4722 5549 1,247.0 1,708.2 224.4 21.137.4 301.2 3,883.3 1,376,4 499.2 191.4 (1703) 5,780.0 1,262.0 4,518.0 (0.3) 622.8 96.5 (331.0) 4,466.2 871.6 3,5946 (4.6)