Please prepare a adjusted trail balance with the information provided. If crucial information is missing please note it.

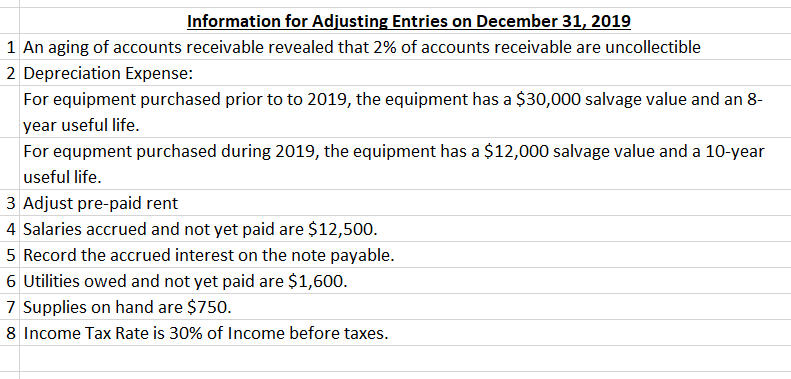

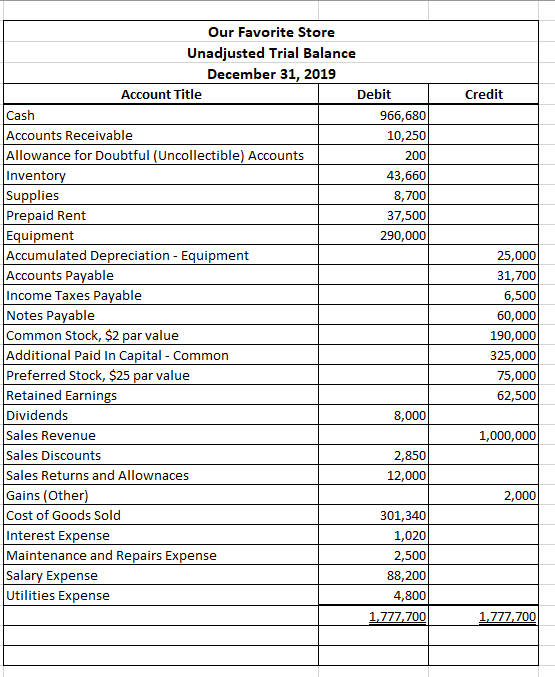

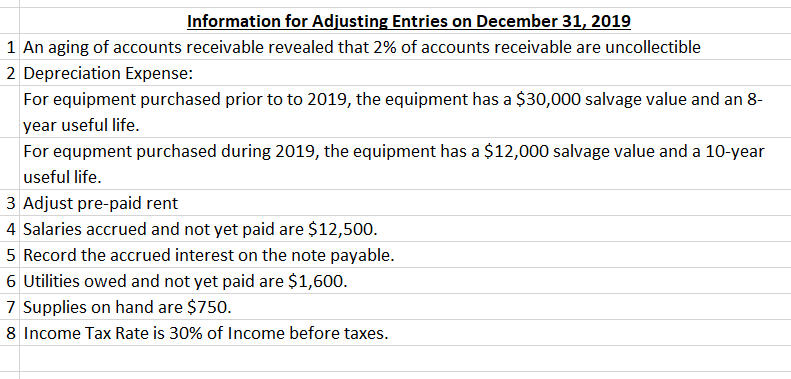

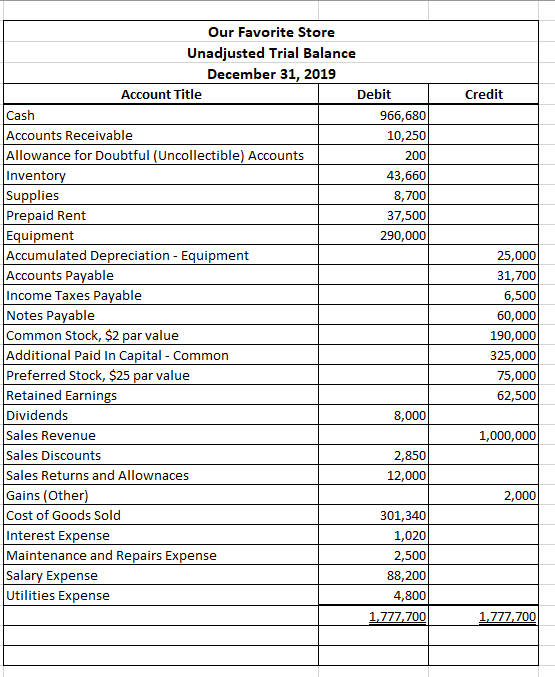

Information for Adjusting Entries on December 31, 2019 1 An aging of accounts receivable revealed that 2% of accounts receivable are uncollectible 2 Depreciation Expense: For equipment purchased prior to to 2019, the equipment has a $30,000 salvage value and an 8- year useful life. For equpment purchased during 2019, the equipment has a $12,000 salvage value and a 10-year useful life. 3 Adjust pre-paid rent 4 Salaries accrued and not yet paid are $12,500. 5 Record the accrued interest on the note payable. 6 Utilities owed and not yet paid are $1,600. 7 Supplies on hand are $750. 8 Income Tax Rate is 30% of Income before taxes. Our Favorite Store Unadjusted Trial Balance December 31, 2019 Account Title Debit Cash 966,6801 Accounts Receivable 10,250 Allowance for Doubtful (Uncollectible) Accounts 200 Inventory 43,660 Supplies 8,700 Prepaid Rent 37,500 Equipment 290,000 Accumulated Depreciation - Equipment Accounts Payable Income Taxes Payable Notes Payable Common Stock, $2 par value Additional Paid In Capital - Common Preferred Stock, $25 par value Retained Earnings Dividends 8,000 Sales Revenue Sales Discounts 2,850 Sales Returns and Allownaces Gains (Other) Cost of Goods Sold 301,340 Interest Expense 1,020 Maintenance and Repairs Expense 2,500 Salary Expense 88,200 Utilities Expense 4,800 1,777,700 25,000 31,700 6,500 60,000 190,000 325,000 75,000 62,500 1,000,000 12,000 2,000 1,777,700 Information for Adjusting Entries on December 31, 2019 1 An aging of accounts receivable revealed that 2% of accounts receivable are uncollectible 2 Depreciation Expense: For equipment purchased prior to to 2019, the equipment has a $30,000 salvage value and an 8- year useful life. For equpment purchased during 2019, the equipment has a $12,000 salvage value and a 10-year useful life. 3 Adjust pre-paid rent 4 Salaries accrued and not yet paid are $12,500. 5 Record the accrued interest on the note payable. 6 Utilities owed and not yet paid are $1,600. 7 Supplies on hand are $750. 8 Income Tax Rate is 30% of Income before taxes. Our Favorite Store Unadjusted Trial Balance December 31, 2019 Account Title Debit Cash 966,6801 Accounts Receivable 10,250 Allowance for Doubtful (Uncollectible) Accounts 200 Inventory 43,660 Supplies 8,700 Prepaid Rent 37,500 Equipment 290,000 Accumulated Depreciation - Equipment Accounts Payable Income Taxes Payable Notes Payable Common Stock, $2 par value Additional Paid In Capital - Common Preferred Stock, $25 par value Retained Earnings Dividends 8,000 Sales Revenue Sales Discounts 2,850 Sales Returns and Allownaces Gains (Other) Cost of Goods Sold 301,340 Interest Expense 1,020 Maintenance and Repairs Expense 2,500 Salary Expense 88,200 Utilities Expense 4,800 1,777,700 25,000 31,700 6,500 60,000 190,000 325,000 75,000 62,500 1,000,000 12,000 2,000 1,777,700