Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please prepare a form 1040 for alex use tbe appropriate tax table. please give me full answer ssume the taxpayer does NOT wish to contribute

please prepare a form 1040 for alex use tbe appropriate tax table.

please give me full answer

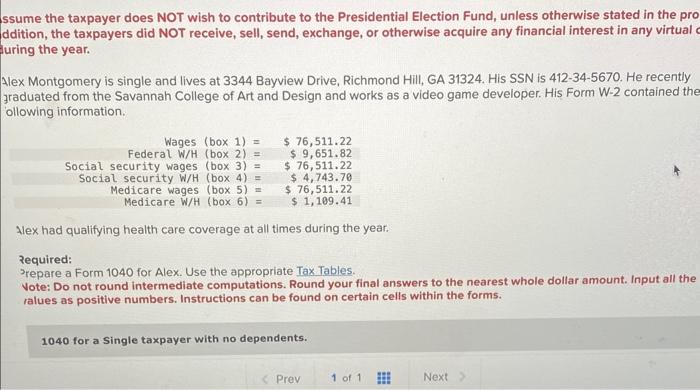

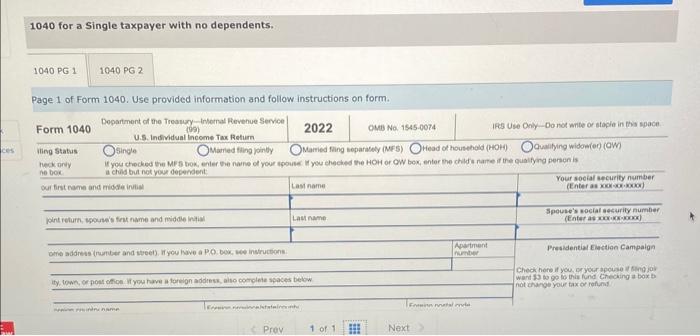

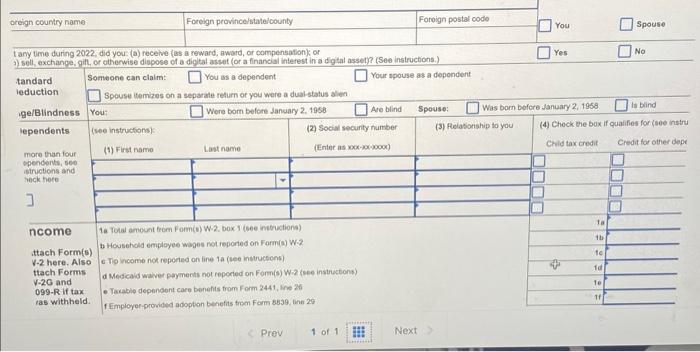

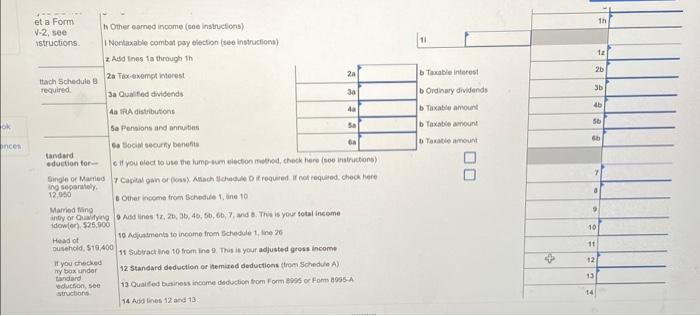

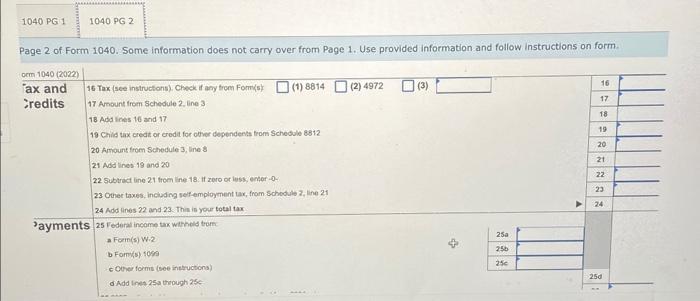

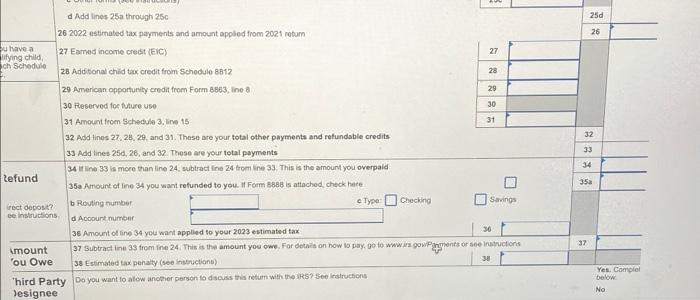

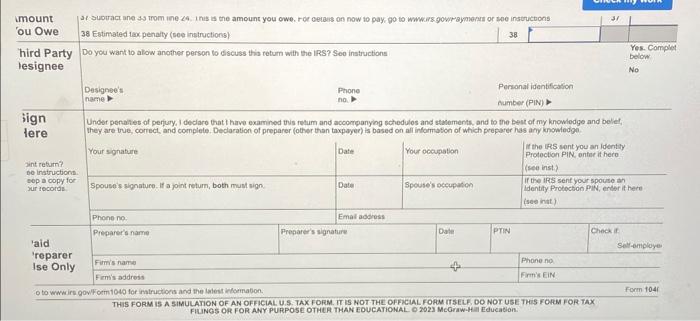

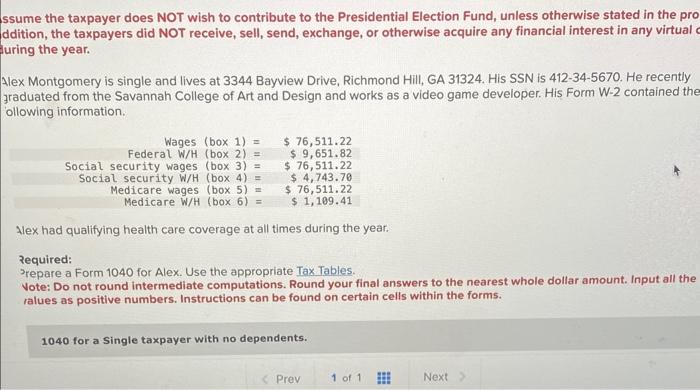

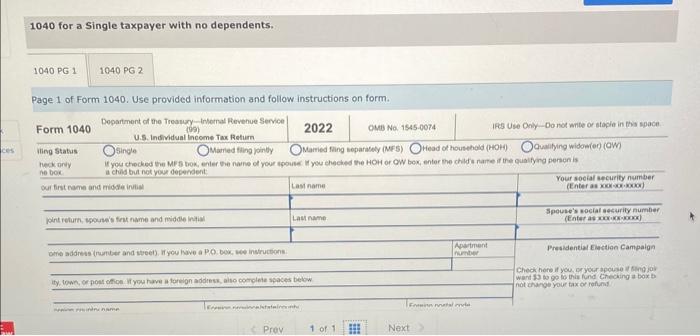

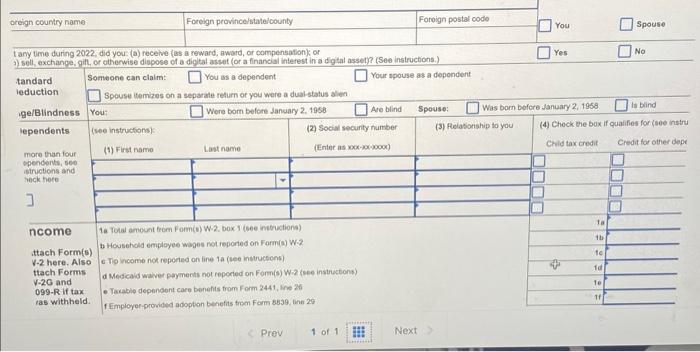

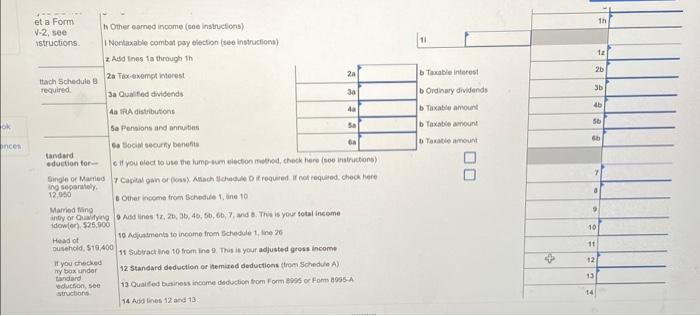

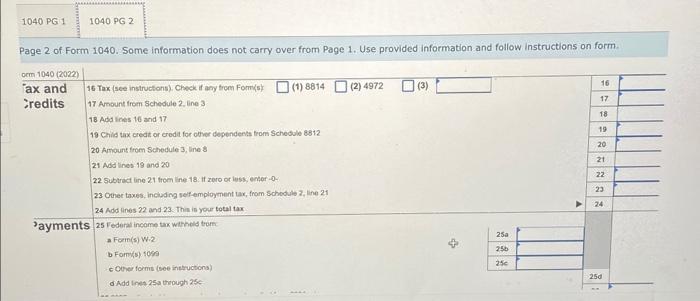

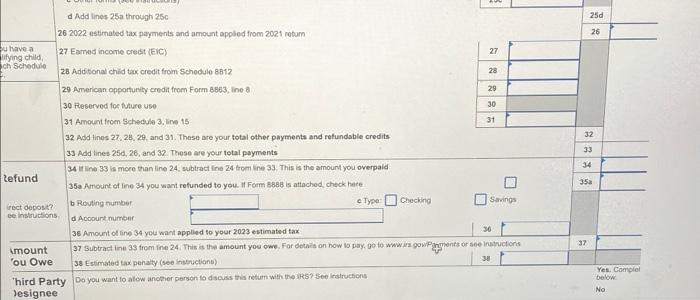

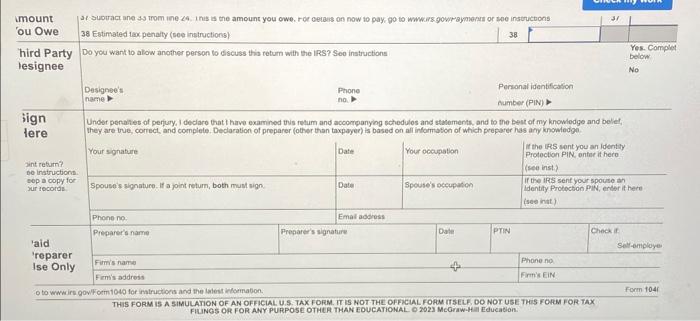

ssume the taxpayer does NOT wish to contribute to the Presidential Election Fund, unless otherwise stated in the pro ddition, the taxpayers did NOT receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual uring the year. Alex Montgomery is single and lives at 3344 Bayview Drive, Richmond Hill, GA 31324. His SSN is 412-34-5670. He recently graduated from the Savannah College of Art and Design and works as a video game developer. His Form W-2 contained the ollowing information. Alex had qualifying health care coverage at all times during the year. Required: Trepare a Form 1040 for Alex. Use the appropriate Tax Tables. vote: Do not round intermediate computations. Round your final answers to the nearest whole dollar amount. Input all the ralues as positive numbers. Instructions can be found on certain cells within the forms. 1040 for a Single taxpayer with no dependents. 1040 for a Single taxpayer with no dependents. Page 1 of Form 1040. Use provided information and follow instructions on form. If you blect to whe the hump wam electon neverd, check hare (soe instrictions) Cagital gan or (Gass) A Aach Ischeds 0 if requered if not requied, check here Other income from Bchedile 1. ane to Asd ines 1x,20,3b,46,5b,6b,7, and 8 . This is your total income 10 Adiunimenta to income from Bchedule 1, ine 20 11 Subbract it o 10 from ine 9 . This is your adjusted gress incerne 12 standard deduction of Aemired deductions (trom Schedvia A) 13 Gual feg business income deducbign from Form 8985 or Foms 3955 - A. 14 Avid lines 12 ard 13. Page 2 of Form 1040. Some information does not carry over from Page 1. Use provided information and follow instructions on form. 0cm1040(2022) ax and 16 Tax (see instructons), Chock if any trom Formis) (1) 8814 (2) 4972 (3) iredits 17 Amount from Schedule 2, line 3 18 Ads ines 16 and 17 19 Chila tax credt or credit for ohver dependenta from Schedule 8312 20 Amount trom Schedule 3, ine to 21 Add lines 19 and 20 22 Subtract line 21 trom ine 18 : If zoro or luss, enter 0 - 23 Oher taxes, incuding seffemployment tax, from Schodule 2 , line 21 24 Add lines 22 and 23 . Thin is your total tax ?ayments 25 Federal income tax witheld tom: a Forn(s) W.2 b Forrifs sogsa e obver forms (see intructions) dAdd ines 25 a theough 25F d Add lines 25a through 25c 262022 estimated tax payments and amount appled from 20021 roturn 27 Earned income crecit (EiC) 28 Additonal child tax credit from Schedule 8812 29 American opporturity credit from Form B863, ine 8 30 Preserved tor tuture use 31 Amount froen Schedule 3. line 15 32 Add lines 27, 28, 29, and 31 . These are your total other payments and refundable credits 33 Add lines 25d, 26, and 32 . These are your total payments 34 if line 33 is more than line 24, subtract ine 24 trom line 33. This is the amourt you overpaid Refund 35a Amount of line 34 you want refunded to you. If Form 8888 is attached, check here irect depost? b Rovitig number d Acoount number 36 Amount of line 34 you want applied to your 2023 estimated tax. imount 37 subtract ine 33 from ine 24. This is the amount you owe. For detaits on how is pay, go to wwwign gow Peingrents or see initructors ou Owe 38 Estimated tax penaty (see instrctions) 'hird Party Do you want to atow anoter person to dscuss this retum with the irs?' See irstructions: lesignee THIS FORM IS A SIMULATION OF AN OFFICAL U.S. TAX FORM. IT IS NOT THE OFFICUL FOHM ITSELE, DO NOT USE THIS FOFM FOR TAX FIUNOS OR FOR ANY PURPOSE OTHER THAN EOUCATIONAL O 2023 McGraw.HA Education. ssume the taxpayer does NOT wish to contribute to the Presidential Election Fund, unless otherwise stated in the pro ddition, the taxpayers did NOT receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual uring the year. Alex Montgomery is single and lives at 3344 Bayview Drive, Richmond Hill, GA 31324. His SSN is 412-34-5670. He recently graduated from the Savannah College of Art and Design and works as a video game developer. His Form W-2 contained the ollowing information. Alex had qualifying health care coverage at all times during the year. Required: Trepare a Form 1040 for Alex. Use the appropriate Tax Tables. vote: Do not round intermediate computations. Round your final answers to the nearest whole dollar amount. Input all the ralues as positive numbers. Instructions can be found on certain cells within the forms. 1040 for a Single taxpayer with no dependents. 1040 for a Single taxpayer with no dependents. Page 1 of Form 1040. Use provided information and follow instructions on form. If you blect to whe the hump wam electon neverd, check hare (soe instrictions) Cagital gan or (Gass) A Aach Ischeds 0 if requered if not requied, check here Other income from Bchedile 1. ane to Asd ines 1x,20,3b,46,5b,6b,7, and 8 . This is your total income 10 Adiunimenta to income from Bchedule 1, ine 20 11 Subbract it o 10 from ine 9 . This is your adjusted gress incerne 12 standard deduction of Aemired deductions (trom Schedvia A) 13 Gual feg business income deducbign from Form 8985 or Foms 3955 - A. 14 Avid lines 12 ard 13. Page 2 of Form 1040. Some information does not carry over from Page 1. Use provided information and follow instructions on form. 0cm1040(2022) ax and 16 Tax (see instructons), Chock if any trom Formis) (1) 8814 (2) 4972 (3) iredits 17 Amount from Schedule 2, line 3 18 Ads ines 16 and 17 19 Chila tax credt or credit for ohver dependenta from Schedule 8312 20 Amount trom Schedule 3, ine to 21 Add lines 19 and 20 22 Subtract line 21 trom ine 18 : If zoro or luss, enter 0 - 23 Oher taxes, incuding seffemployment tax, from Schodule 2 , line 21 24 Add lines 22 and 23 . Thin is your total tax ?ayments 25 Federal income tax witheld tom: a Forn(s) W.2 b Forrifs sogsa e obver forms (see intructions) dAdd ines 25 a theough 25F d Add lines 25a through 25c 262022 estimated tax payments and amount appled from 20021 roturn 27 Earned income crecit (EiC) 28 Additonal child tax credit from Schedule 8812 29 American opporturity credit from Form B863, ine 8 30 Preserved tor tuture use 31 Amount froen Schedule 3. line 15 32 Add lines 27, 28, 29, and 31 . These are your total other payments and refundable credits 33 Add lines 25d, 26, and 32 . These are your total payments 34 if line 33 is more than line 24, subtract ine 24 trom line 33. This is the amourt you overpaid Refund 35a Amount of line 34 you want refunded to you. If Form 8888 is attached, check here irect depost? b Rovitig number d Acoount number 36 Amount of line 34 you want applied to your 2023 estimated tax. imount 37 subtract ine 33 from ine 24. This is the amount you owe. For detaits on how is pay, go to wwwign gow Peingrents or see initructors ou Owe 38 Estimated tax penaty (see instrctions) 'hird Party Do you want to atow anoter person to dscuss this retum with the irs?' See irstructions: lesignee THIS FORM IS A SIMULATION OF AN OFFICAL U.S. TAX FORM. IT IS NOT THE OFFICUL FOHM ITSELE, DO NOT USE THIS FOFM FOR TAX FIUNOS OR FOR ANY PURPOSE OTHER THAN EOUCATIONAL O 2023 McGraw.HA Education Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started