Answered step by step

Verified Expert Solution

Question

1 Approved Answer

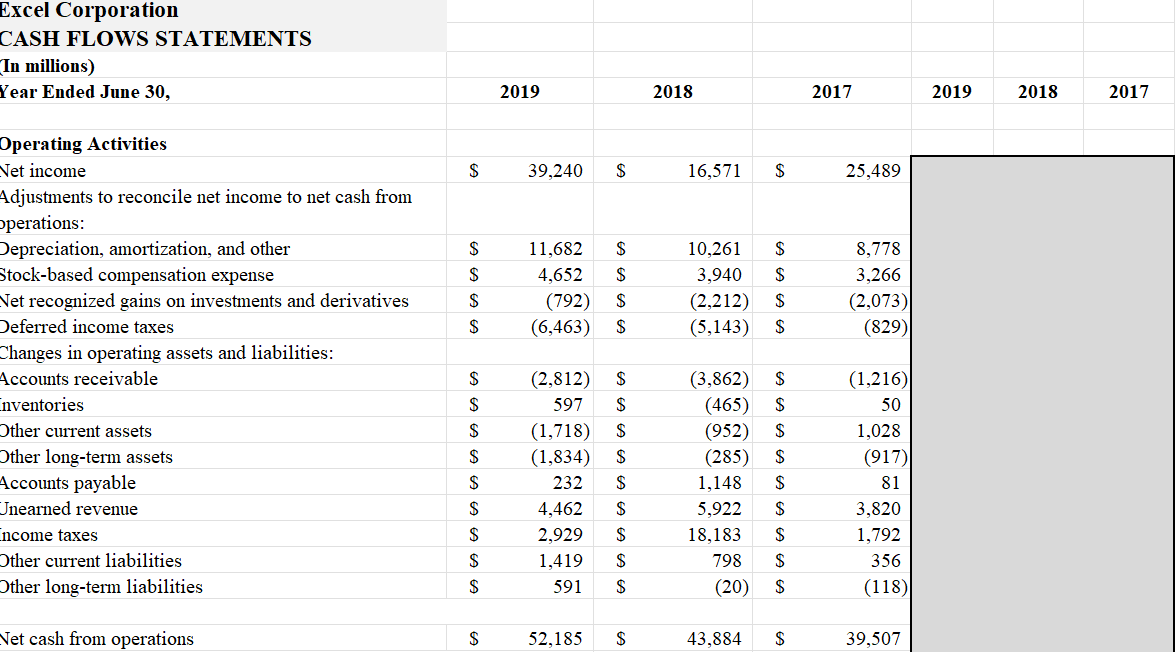

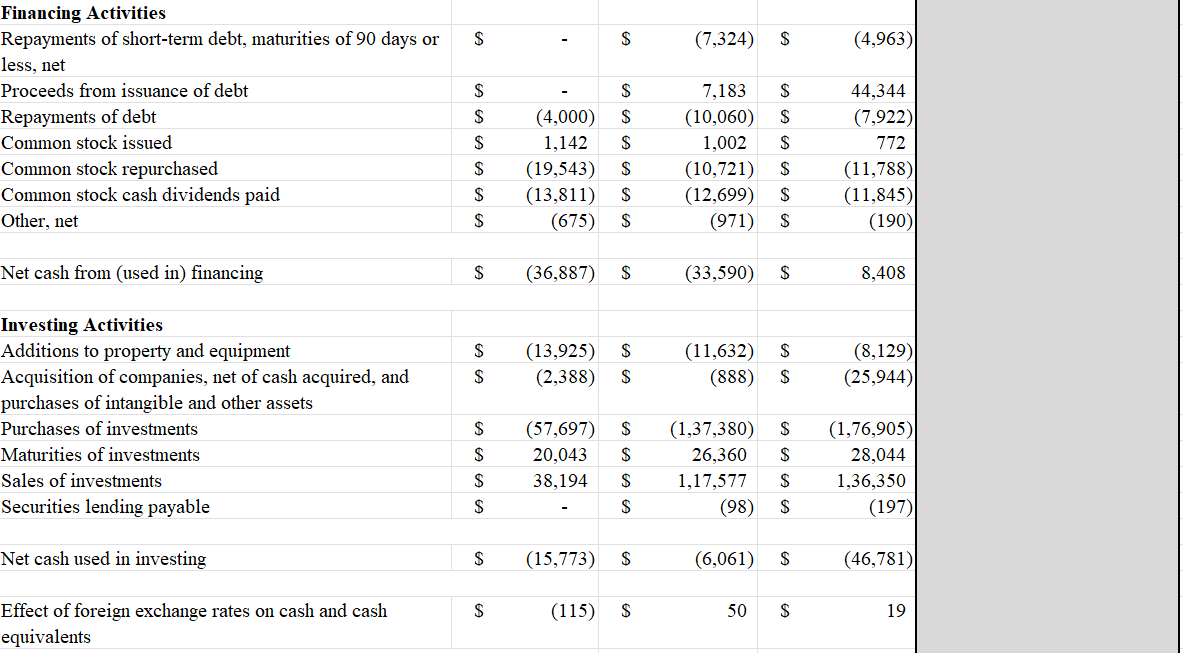

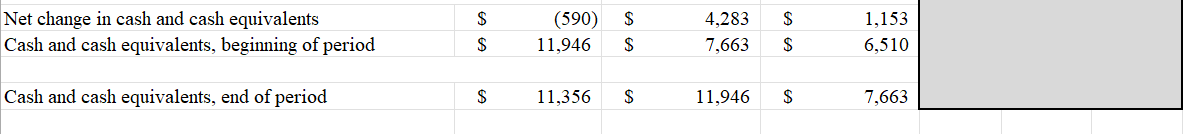

PLEASE PREPARE COMMON SIZE CASH FLOW STATEMENT FOR REST OF THE YEARS Excel Corporation CASH FLOWS STATEMENTS (In millions) Year Ended June 30, begin{tabular}{|l|l|l|l|l|l|} hline

PLEASE PREPARE COMMON SIZE CASH FLOW STATEMENT FOR REST OF THE YEARS

Excel Corporation CASH FLOWS STATEMENTS (In millions) Year Ended June 30, \begin{tabular}{|l|l|l|l|l|l|} \hline 2019 & 2018 & 2017 & 2019 & 2018 & 2017 \\ \hline \end{tabular} Operating Activities Net income \begin{tabular}{|l|l|l|l|} \$ 39,240 & $ & 16,571 & $ \end{tabular} 25,489 Adjustments to reconcile net income to net cash from pperations: Depreciation, amortization, and other Stock-based compensation expense Net recognized gains on investments and derivatives Deferred income taxes Changes in operating assets and liabilities: Accounts receivable nventories Other current assets Other long-term assets Accounts payable Jnearned revenue ncome taxes Other current liabilities Other long-term liabilities \begin{tabular}{|r|r|r|r|r|r|} \hline$ & 11,682 & $ & 10,261 & $ & 8,778 \\ \hline$ & 4,652 & $ & 3,940 & $ & 3,266 \\ \hline$ & (792) & $ & (2,212) & $ & (2,073) \\ $ & (6,463) & $ & (5,143) & $ & (829) \\ \hline & & & & & \\ \hline$ & (2,812) & $ & (3,862) & $ & (1,216) \\ \hline$ & 597 & $ & (465) & $ & 50 \\ \hline$ & (1,718) & $ & (952) & $ & 1,028 \\ $ & (1,834) & $ & (285) & $ & (917) \\ $ & 232 & $ & 1,148 & $ & 81 \\ $ & 4,462 & $ & 5,922 & $ & 3,820 \\ $ & 2,929 & $ & 18,183 & $ & 1,792 \\ $ & 1,419 & $ & 798 & $ & 356 \\ $ & 591 & $ & (20) & $ & (118) \\ \hline \end{tabular} Net cash from operations $52,185$43,884$39,507 Financing Activities Repayments of short-term debt, maturities of 90 days or less, net Proceeds from issuance of debt Repayments of debt Common stock issued Common stock repurchased Common stock cash dividends paid Other, net \begin{tabular}{|rr|rr|lr|} $ & - & $ & (7,324) & $ & (4,963) \\ $ & - & $ & 7,183 & $ & 44,344 \\ $ & (4,000) & $ & (10,060) & $ & (7,922) \\ $ & 1,142 & $ & 1,002 & $ & 772 \\ $ & (19,543) & $ & (10,721) & $ & (11,788) \\ $ & (13,811) & $ & (12,699) & $ & (11,845) \\ $ & (675) & $ & (971) & $ & (190) \\ \hline \end{tabular} Net cash from (used in) financing $(36,887)$(33,590)$8,408 Investing Activities Additions to property and equipment Acquisition of companies, net of cash acquired, and $$(13,925)(2,388)$$(11,632)(888)$$(8,129)(25,944) purchases of intangible and other assets Purchases of investments Maturities of investments Sales of investments Securities lending payable \begin{tabular}{rrrrrrr|} $ & (57,697) & $ & (1,37,380) & $ & (1,76,905) \\ $ & 20,043 & $ & 26,360 & $ & 28,044 \\ $ & 38,194 & $ & 1,17,577 & $ & 1,36,350 \\ $ & - & $ & (98) & $ & (197) \end{tabular} Net cash used in investing $(15,773)$(6,061)$(46,781) Effect of foreign exchange rates on cash and cash $ (115)$ 50$ 19 equivalents Cash and cash equivalents, end of period 7,663 Excel Corporation CASH FLOWS STATEMENTS (In millions) Year Ended June 30, \begin{tabular}{|l|l|l|l|l|l|} \hline 2019 & 2018 & 2017 & 2019 & 2018 & 2017 \\ \hline \end{tabular} Operating Activities Net income \begin{tabular}{|l|l|l|l|} \$ 39,240 & $ & 16,571 & $ \end{tabular} 25,489 Adjustments to reconcile net income to net cash from pperations: Depreciation, amortization, and other Stock-based compensation expense Net recognized gains on investments and derivatives Deferred income taxes Changes in operating assets and liabilities: Accounts receivable nventories Other current assets Other long-term assets Accounts payable Jnearned revenue ncome taxes Other current liabilities Other long-term liabilities \begin{tabular}{|r|r|r|r|r|r|} \hline$ & 11,682 & $ & 10,261 & $ & 8,778 \\ \hline$ & 4,652 & $ & 3,940 & $ & 3,266 \\ \hline$ & (792) & $ & (2,212) & $ & (2,073) \\ $ & (6,463) & $ & (5,143) & $ & (829) \\ \hline & & & & & \\ \hline$ & (2,812) & $ & (3,862) & $ & (1,216) \\ \hline$ & 597 & $ & (465) & $ & 50 \\ \hline$ & (1,718) & $ & (952) & $ & 1,028 \\ $ & (1,834) & $ & (285) & $ & (917) \\ $ & 232 & $ & 1,148 & $ & 81 \\ $ & 4,462 & $ & 5,922 & $ & 3,820 \\ $ & 2,929 & $ & 18,183 & $ & 1,792 \\ $ & 1,419 & $ & 798 & $ & 356 \\ $ & 591 & $ & (20) & $ & (118) \\ \hline \end{tabular} Net cash from operations $52,185$43,884$39,507 Financing Activities Repayments of short-term debt, maturities of 90 days or less, net Proceeds from issuance of debt Repayments of debt Common stock issued Common stock repurchased Common stock cash dividends paid Other, net \begin{tabular}{|rr|rr|lr|} $ & - & $ & (7,324) & $ & (4,963) \\ $ & - & $ & 7,183 & $ & 44,344 \\ $ & (4,000) & $ & (10,060) & $ & (7,922) \\ $ & 1,142 & $ & 1,002 & $ & 772 \\ $ & (19,543) & $ & (10,721) & $ & (11,788) \\ $ & (13,811) & $ & (12,699) & $ & (11,845) \\ $ & (675) & $ & (971) & $ & (190) \\ \hline \end{tabular} Net cash from (used in) financing $(36,887)$(33,590)$8,408 Investing Activities Additions to property and equipment Acquisition of companies, net of cash acquired, and $$(13,925)(2,388)$$(11,632)(888)$$(8,129)(25,944) purchases of intangible and other assets Purchases of investments Maturities of investments Sales of investments Securities lending payable \begin{tabular}{rrrrrrr|} $ & (57,697) & $ & (1,37,380) & $ & (1,76,905) \\ $ & 20,043 & $ & 26,360 & $ & 28,044 \\ $ & 38,194 & $ & 1,17,577 & $ & 1,36,350 \\ $ & - & $ & (98) & $ & (197) \end{tabular} Net cash used in investing $(15,773)$(6,061)$(46,781) Effect of foreign exchange rates on cash and cash $ (115)$ 50$ 19 equivalents Cash and cash equivalents, end of period 7,663Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started