Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please prepare Direct Materials Budget 2023. Time sensitive. Fine Office Company makes office furniture for offices. They are in the process of preparing a Master

Please prepare Direct Materials Budget 2023. Time sensitive.

Fine Office Company makes office furniture for offices. They are in the process of preparing a Master Budget including the Operating budget, Cash Statement, Income Statement and Balance Sheet for 2023. The yearly budget is broken into quarters. The year end is 31st December 2023. Your group has been requested to compile a master budget for the fiscal year 2023.

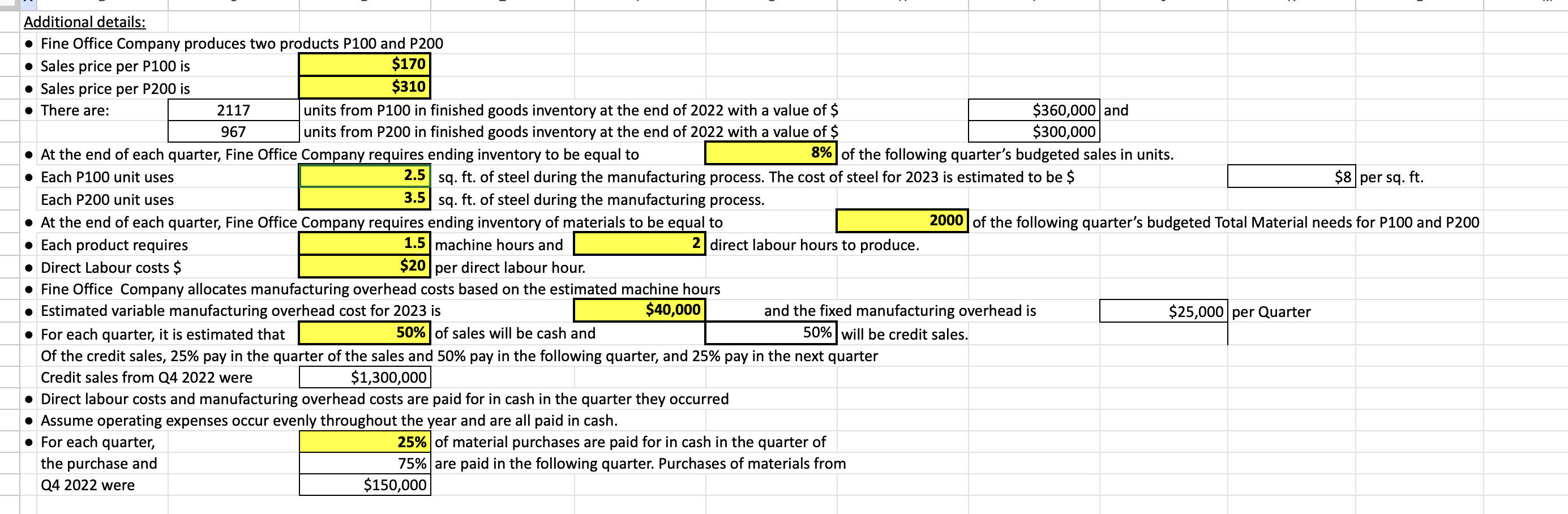

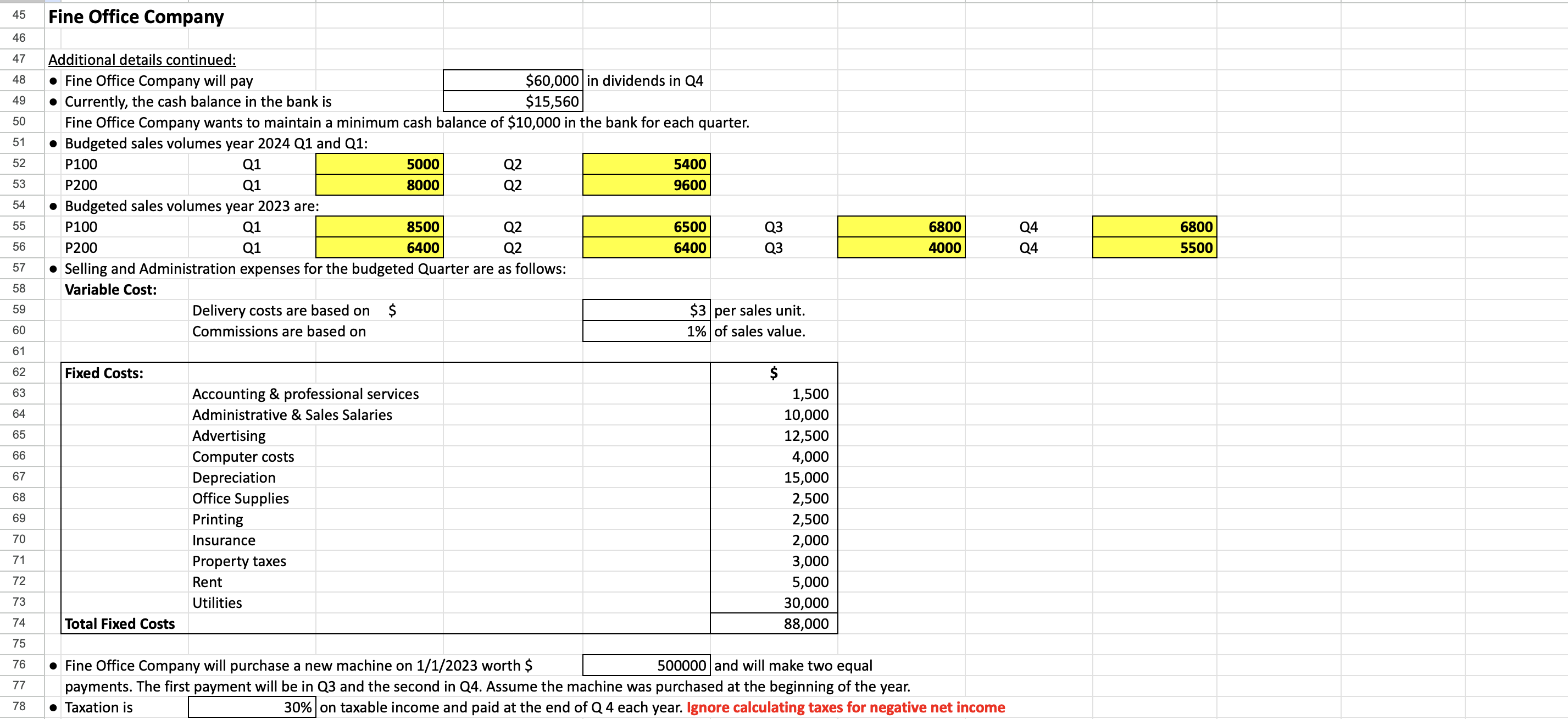

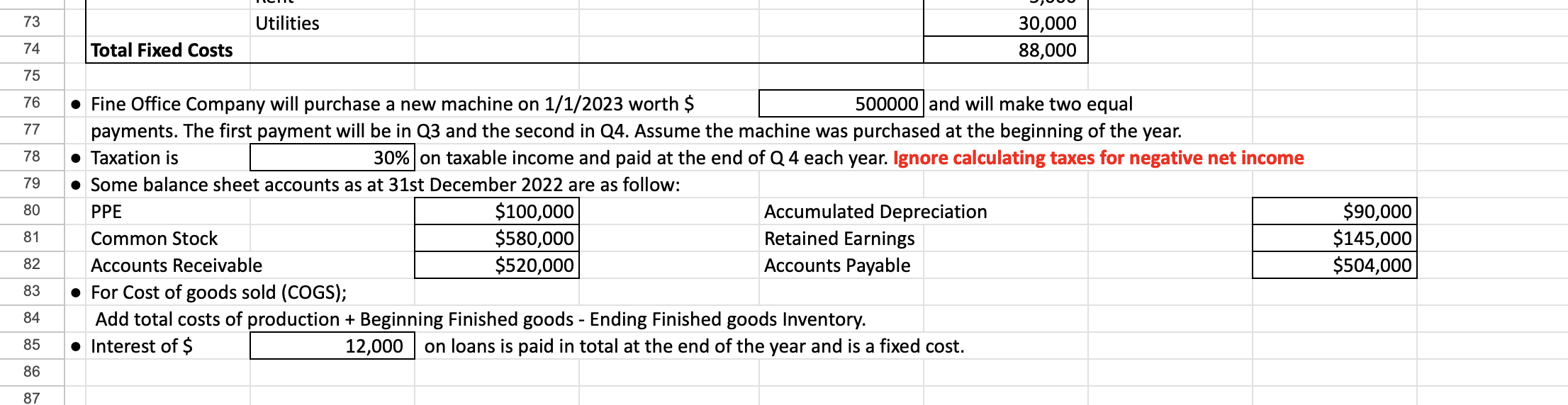

Additional details: - Fine Office Company produces two products P100 and P200 - Sales price per P100 is - Sales price per P200 is - There are: 2117 \begin{tabular}{|r|} \hline $170 \\ \hline 310 \\ \hline \end{tabular} units from P100 in finished goods inventory at the end of 2022 with a value of $ units from P200 in finished goods inventory at the end of 2022 with a value of $ - At the end of each quarter, Fine Office Company requires ending inventory to be equal to 8% of the following quarter's budgeted sales in units. - Each P100 unit uses \begin{tabular}{r|} \hline 2.5 \\ \hline 3.5 \\ \hline \end{tabular} sq. ft. of steel during the manufacturing process. The cost of steel for 2023 is estimated to be \$ sq. ft. of steel during the manufacturing process. Each P200 unit uses Company requires ending inventory of materials to be equal to 2000 of the following quarter's budgeted Total Material needs for P100 and P200 - At the end of each quarter, Fine Office - Each product requires - Direct Labour costs \$ \begin{tabular}{|r|} \hline 1.5 \\ \hline$20 \\ \hline \end{tabular} machine hours and 2 direct labour hours to produce. per direct labour hour. - Fine Office Company allocates manufacturing overhead costs based on the estimated machine hours - Estimated variable manufacturing overhead cost for 2023 is $40,000 and the fixed manufacturing overhead is 50% will be credit sales. $25,000 per Quarter - For each quarter, it is estimated that 50% of sales will be cash and \begin{tabular}{|r|r|} \hline$25,000 & per Quarter \\ \hline & \end{tabular} Of the credit sales, 25% pay in the quarter of the sales and 50% pay in the following quarter, and 25% pay in the next quarter Credit sales from Q4 2022 were $1,300,000 - Direct labour costs and manufacturing overhead costs are paid for in cash in the quarter they occurred - Assume operating expenses occur evenly throughout the year and are all paid in cash. - For each quarter, the purchase and Q4 2022 were \begin{tabular}{|r|} \hline 25% \\ \hline 75% \\ \hline$150,000 \\ \hline \end{tabular} of material purchases are paid for in cash in the quarter of are paid in the following quarter. Purchases of materials from - Fine Office Company will purchase a new machine on 1/1/2023 worth \$ 500000 and will make two equal payments. The first pavment will be in Q3 and the second in Q4. Assume the machine was purchased at the beginning of the year. - Taxation is on taxable income and paid at the end of Q 4 each year. Ignore calculating taxes for negative net income Additional details: - Fine Office Company produces two products P100 and P200 - Sales price per P100 is - Sales price per P200 is - There are: 2117 \begin{tabular}{|r|} \hline $170 \\ \hline 310 \\ \hline \end{tabular} units from P100 in finished goods inventory at the end of 2022 with a value of $ units from P200 in finished goods inventory at the end of 2022 with a value of $ - At the end of each quarter, Fine Office Company requires ending inventory to be equal to 8% of the following quarter's budgeted sales in units. - Each P100 unit uses \begin{tabular}{r|} \hline 2.5 \\ \hline 3.5 \\ \hline \end{tabular} sq. ft. of steel during the manufacturing process. The cost of steel for 2023 is estimated to be \$ sq. ft. of steel during the manufacturing process. Each P200 unit uses Company requires ending inventory of materials to be equal to 2000 of the following quarter's budgeted Total Material needs for P100 and P200 - At the end of each quarter, Fine Office - Each product requires - Direct Labour costs \$ \begin{tabular}{|r|} \hline 1.5 \\ \hline$20 \\ \hline \end{tabular} machine hours and 2 direct labour hours to produce. per direct labour hour. - Fine Office Company allocates manufacturing overhead costs based on the estimated machine hours - Estimated variable manufacturing overhead cost for 2023 is $40,000 and the fixed manufacturing overhead is 50% will be credit sales. $25,000 per Quarter - For each quarter, it is estimated that 50% of sales will be cash and \begin{tabular}{|r|r|} \hline$25,000 & per Quarter \\ \hline & \end{tabular} Of the credit sales, 25% pay in the quarter of the sales and 50% pay in the following quarter, and 25% pay in the next quarter Credit sales from Q4 2022 were $1,300,000 - Direct labour costs and manufacturing overhead costs are paid for in cash in the quarter they occurred - Assume operating expenses occur evenly throughout the year and are all paid in cash. - For each quarter, the purchase and Q4 2022 were \begin{tabular}{|r|} \hline 25% \\ \hline 75% \\ \hline$150,000 \\ \hline \end{tabular} of material purchases are paid for in cash in the quarter of are paid in the following quarter. Purchases of materials from - Fine Office Company will purchase a new machine on 1/1/2023 worth \$ 500000 and will make two equal payments. The first pavment will be in Q3 and the second in Q4. Assume the machine was purchased at the beginning of the year. - Taxation is on taxable income and paid at the end of Q 4 each year. Ignore calculating taxes for negative net income

Additional details: - Fine Office Company produces two products P100 and P200 - Sales price per P100 is - Sales price per P200 is - There are: 2117 \begin{tabular}{|r|} \hline $170 \\ \hline 310 \\ \hline \end{tabular} units from P100 in finished goods inventory at the end of 2022 with a value of $ units from P200 in finished goods inventory at the end of 2022 with a value of $ - At the end of each quarter, Fine Office Company requires ending inventory to be equal to 8% of the following quarter's budgeted sales in units. - Each P100 unit uses \begin{tabular}{r|} \hline 2.5 \\ \hline 3.5 \\ \hline \end{tabular} sq. ft. of steel during the manufacturing process. The cost of steel for 2023 is estimated to be \$ sq. ft. of steel during the manufacturing process. Each P200 unit uses Company requires ending inventory of materials to be equal to 2000 of the following quarter's budgeted Total Material needs for P100 and P200 - At the end of each quarter, Fine Office - Each product requires - Direct Labour costs \$ \begin{tabular}{|r|} \hline 1.5 \\ \hline$20 \\ \hline \end{tabular} machine hours and 2 direct labour hours to produce. per direct labour hour. - Fine Office Company allocates manufacturing overhead costs based on the estimated machine hours - Estimated variable manufacturing overhead cost for 2023 is $40,000 and the fixed manufacturing overhead is 50% will be credit sales. $25,000 per Quarter - For each quarter, it is estimated that 50% of sales will be cash and \begin{tabular}{|r|r|} \hline$25,000 & per Quarter \\ \hline & \end{tabular} Of the credit sales, 25% pay in the quarter of the sales and 50% pay in the following quarter, and 25% pay in the next quarter Credit sales from Q4 2022 were $1,300,000 - Direct labour costs and manufacturing overhead costs are paid for in cash in the quarter they occurred - Assume operating expenses occur evenly throughout the year and are all paid in cash. - For each quarter, the purchase and Q4 2022 were \begin{tabular}{|r|} \hline 25% \\ \hline 75% \\ \hline$150,000 \\ \hline \end{tabular} of material purchases are paid for in cash in the quarter of are paid in the following quarter. Purchases of materials from - Fine Office Company will purchase a new machine on 1/1/2023 worth \$ 500000 and will make two equal payments. The first pavment will be in Q3 and the second in Q4. Assume the machine was purchased at the beginning of the year. - Taxation is on taxable income and paid at the end of Q 4 each year. Ignore calculating taxes for negative net income Additional details: - Fine Office Company produces two products P100 and P200 - Sales price per P100 is - Sales price per P200 is - There are: 2117 \begin{tabular}{|r|} \hline $170 \\ \hline 310 \\ \hline \end{tabular} units from P100 in finished goods inventory at the end of 2022 with a value of $ units from P200 in finished goods inventory at the end of 2022 with a value of $ - At the end of each quarter, Fine Office Company requires ending inventory to be equal to 8% of the following quarter's budgeted sales in units. - Each P100 unit uses \begin{tabular}{r|} \hline 2.5 \\ \hline 3.5 \\ \hline \end{tabular} sq. ft. of steel during the manufacturing process. The cost of steel for 2023 is estimated to be \$ sq. ft. of steel during the manufacturing process. Each P200 unit uses Company requires ending inventory of materials to be equal to 2000 of the following quarter's budgeted Total Material needs for P100 and P200 - At the end of each quarter, Fine Office - Each product requires - Direct Labour costs \$ \begin{tabular}{|r|} \hline 1.5 \\ \hline$20 \\ \hline \end{tabular} machine hours and 2 direct labour hours to produce. per direct labour hour. - Fine Office Company allocates manufacturing overhead costs based on the estimated machine hours - Estimated variable manufacturing overhead cost for 2023 is $40,000 and the fixed manufacturing overhead is 50% will be credit sales. $25,000 per Quarter - For each quarter, it is estimated that 50% of sales will be cash and \begin{tabular}{|r|r|} \hline$25,000 & per Quarter \\ \hline & \end{tabular} Of the credit sales, 25% pay in the quarter of the sales and 50% pay in the following quarter, and 25% pay in the next quarter Credit sales from Q4 2022 were $1,300,000 - Direct labour costs and manufacturing overhead costs are paid for in cash in the quarter they occurred - Assume operating expenses occur evenly throughout the year and are all paid in cash. - For each quarter, the purchase and Q4 2022 were \begin{tabular}{|r|} \hline 25% \\ \hline 75% \\ \hline$150,000 \\ \hline \end{tabular} of material purchases are paid for in cash in the quarter of are paid in the following quarter. Purchases of materials from - Fine Office Company will purchase a new machine on 1/1/2023 worth \$ 500000 and will make two equal payments. The first pavment will be in Q3 and the second in Q4. Assume the machine was purchased at the beginning of the year. - Taxation is on taxable income and paid at the end of Q 4 each year. Ignore calculating taxes for negative net income Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started