please prepare income statement thank you

There are no dates associated.

The entries are just numbered 1-20.

If needed , you can assume that the dates start from January 1 - January 20.

thank you for all of your help!

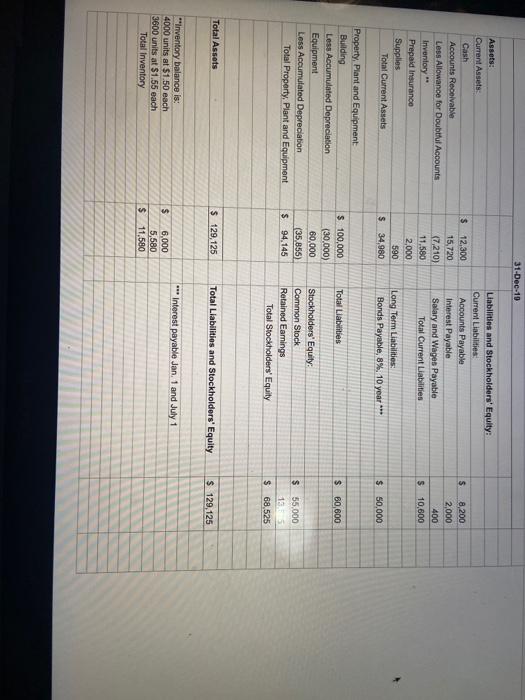

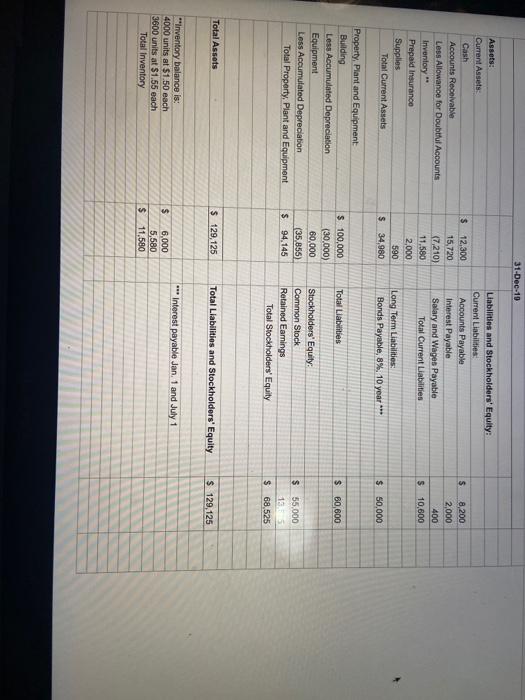

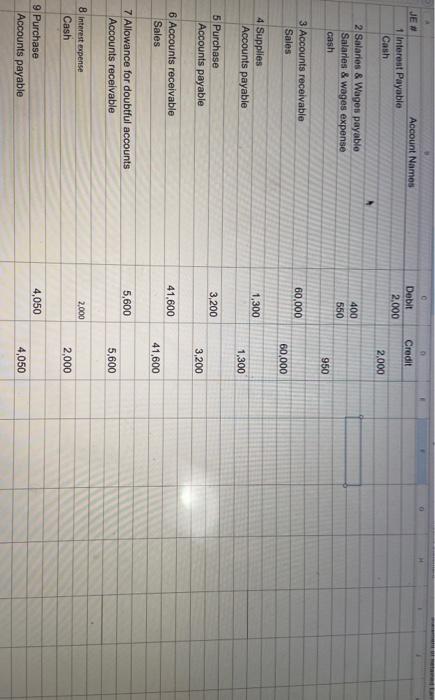

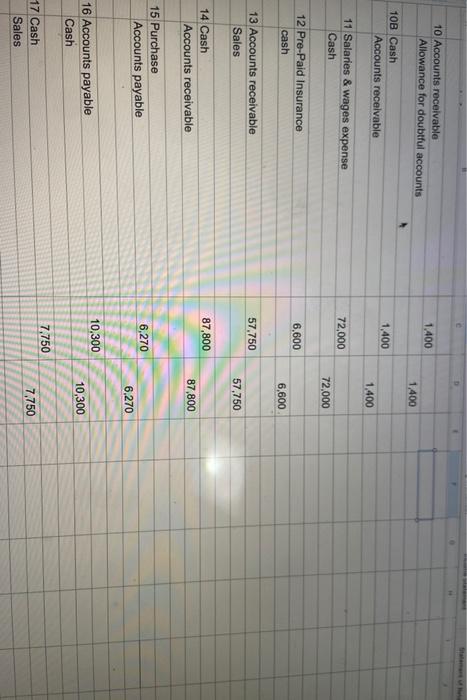

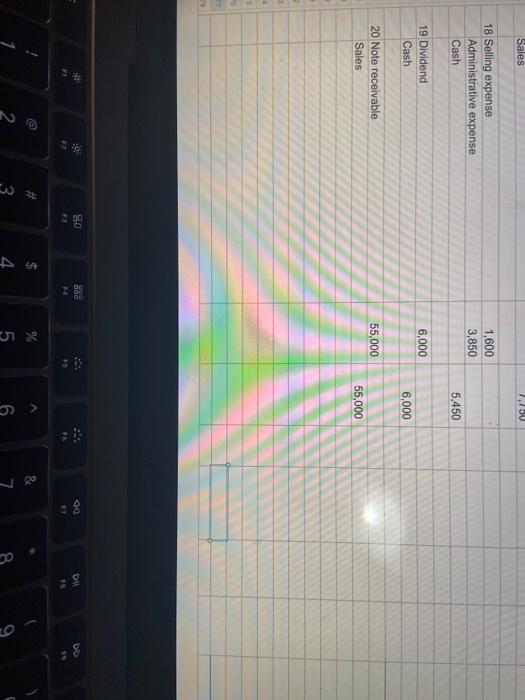

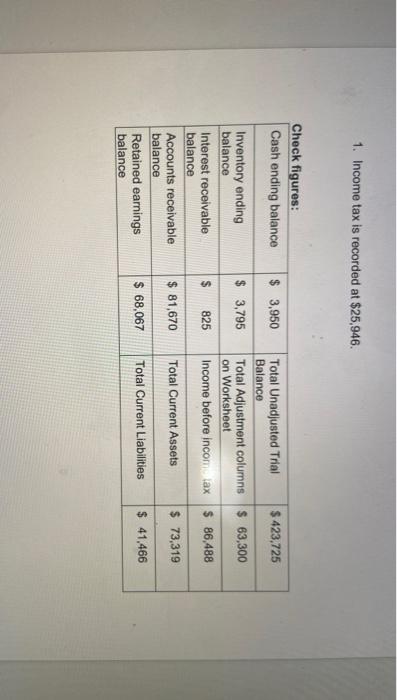

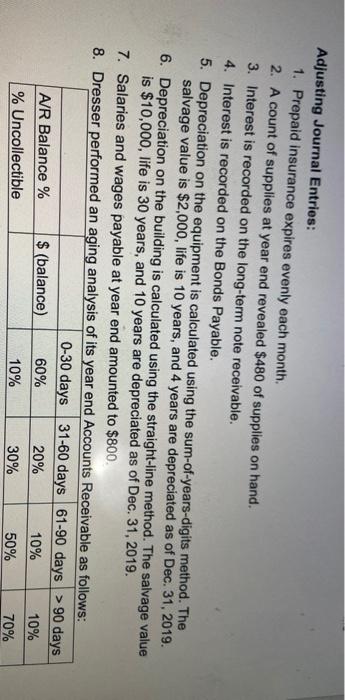

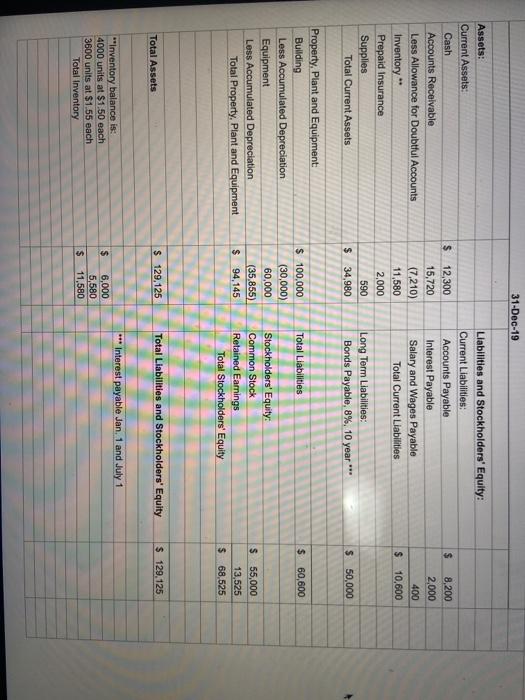

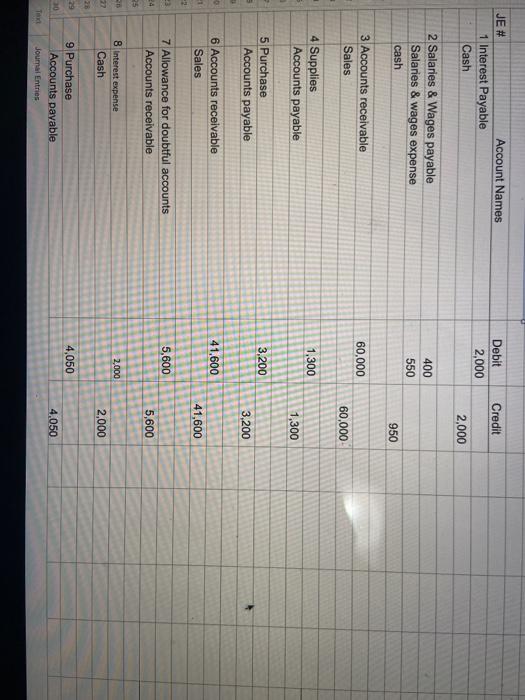

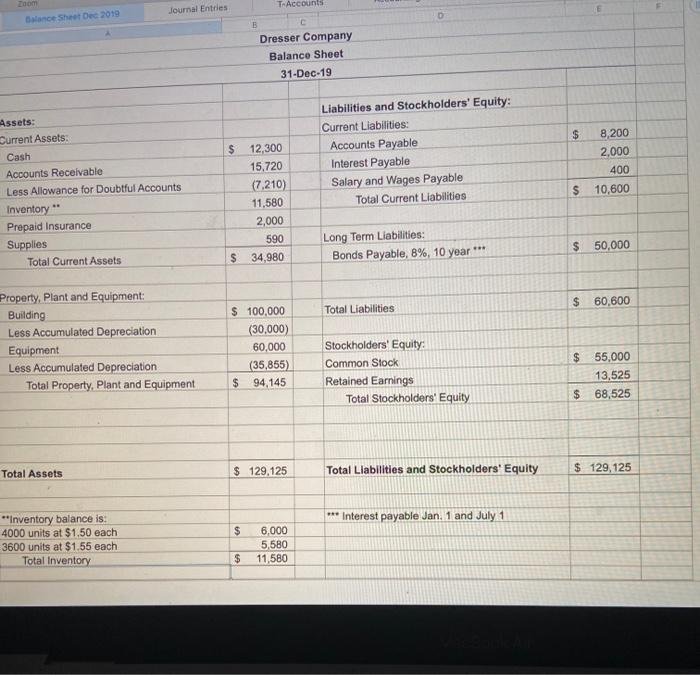

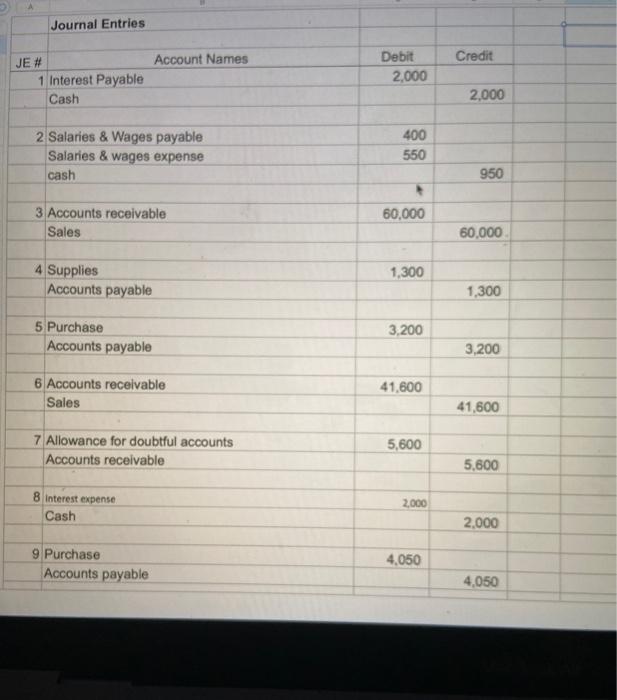

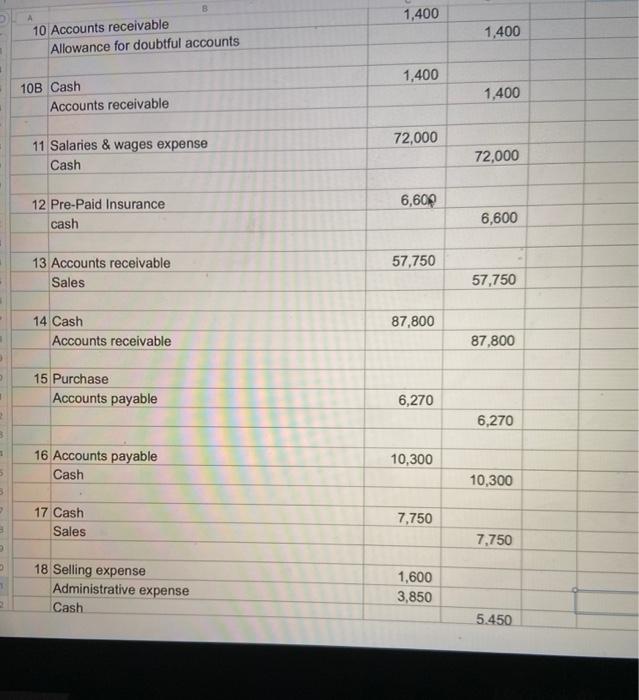

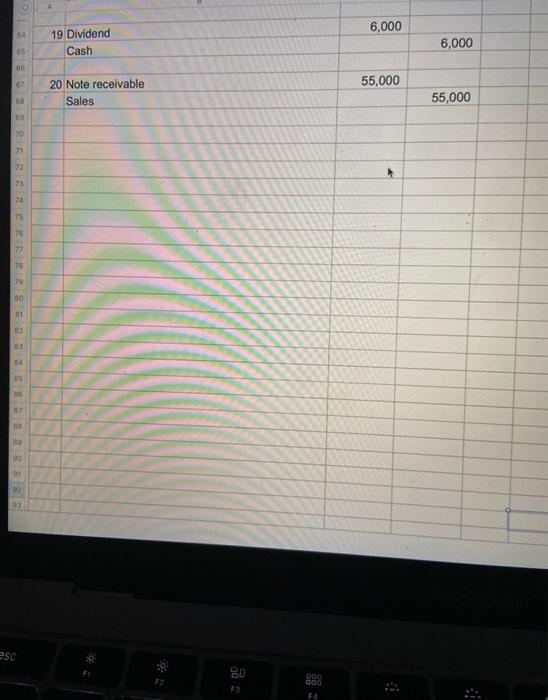

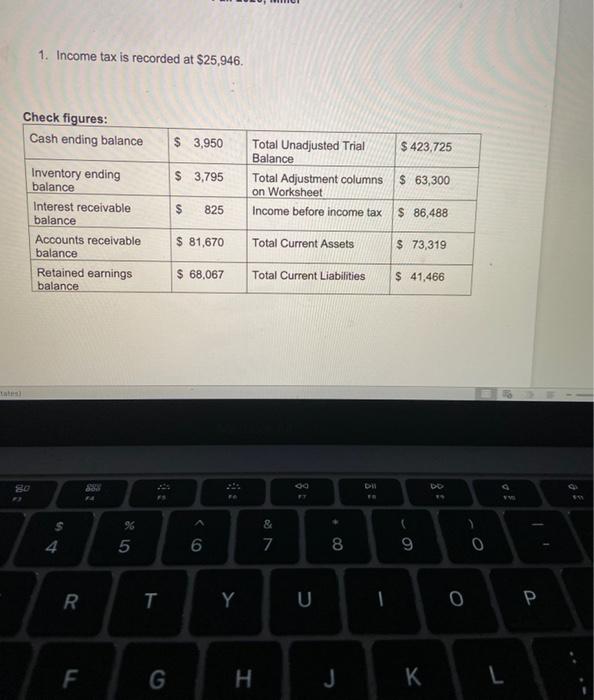

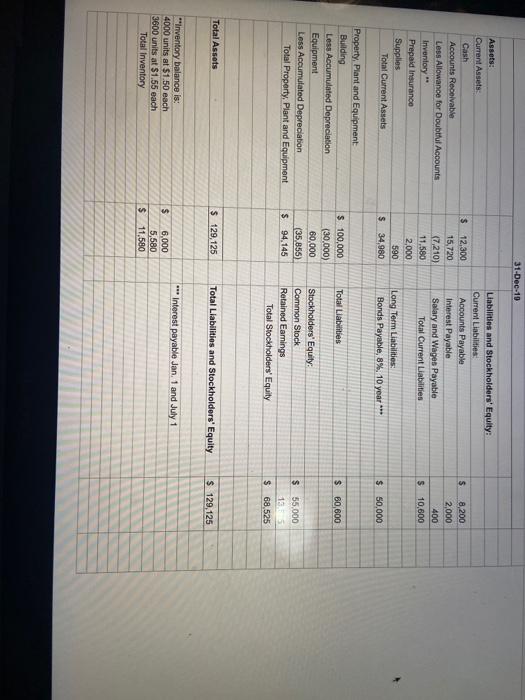

31-Dec-19 Assets Current Assets Cash Accounts Receivable Less Allowance for Doubtful Accounts Inventory Prepaid Insurance Supplies Total Current Assets $ 12,300 15,720 (7,210) 11.580 2,000 590 $ 34,980 Liabilities and Stockholders' Equity Current Liabilities Accounts Payable Interest Payable Salary and Wagon Payable Total Current Liabilities 8,200 2,000 400 $ 10,600 Long Term Liabilities: Bonds Payable, 8%. 10 year $ 50,000 Total Liabilities $ 60,600 Property Plant and Equipment Building Less Accumulated Depreciation Equipment Less Accumulated Depreciation Total Property Plant and Equipment $ 100,000 (30,000) 60,000 (35 855) $ 94,145 Stockholders' Equity Common Stock Retained Earnings Total Stockholders' Equity $ 55.000 133 $ 68.525 Total Assets $ 129,125 Total Liabilities and Stockholders' Equity $ 129,125 *** Interest payable Jan. 1 and July 1 Inventory balance is: 4000 units at $1.50 each 3600 units at $1.55 each Total Inventory $ 6,000 5,580 11.580 $ Account Names JE# 1 Interest Payable Cash Debit 2.000 Credit 2,000 2 Salaries & Wages payablo Salaries & wages expense cash 400 550 950 3 Accounts receivable Sales 60,000 60,000 4 Supplies Accounts payable 1,300 1,300 5 Purchase Accounts payable 3,200 3,200 6 Accounts receivable Sales 41.600 41,600 7 Allowance for doubtful accounts Accounts receivable 5,600 5,600 8 Interest expense 2,000 Cash 2,000 4,050 9 Purchase Accounts payable 4,050 10 Accounts receivable Allowance for doubtful accounts 1.400 1,400 10B Cash Accounts receivable 1,400 1,400 11 Salaries & wages expense Cash 72,000 72,000 12 Pre-Paid Insurance cash 6,600 6,600 13 Accounts receivable Sales 57,750 57.750 87,800 14 Cash Accounts receivable 87,800 15 Purchase Accounts payable 6,270 6,270 10,300 16 Accounts payable Cash 10,300 7.750 17 Cash Sales 7,750 Sales 2.100 18 Selling expense Administrative expense Cash 1,600 3,850 5,450 19 Dividend Cash 6,000 6,000 20 Note receivable Sales 55,000 55,000 80 ooo Dii DO : FE 3 4 1. Income tax is recorded at $25,946. Check figures: Cash ending balance $ 3,950 $ 3,795 Total Unadjusted Trial $ 423,725 Balance Total Adjustment columns $ 63,300 on Worksheet Income before incom tax $ 86,488 $ 825 Inventory ending balance Interest receivable balance Accounts receivable balance Retained earnings balance $ 81,670 Total Current Assets $ 73,319 $ 68,067 Total Current Liabilities $ 41,466 Adjusting Journal Entries: 1. Prepaid insurance expires evenly each month. 2. A count of supplies at year end revealed $480 of supplies on hand. 3. Interest is recorded on the long-term note receivable. 4. Interest is recorded on the Bonds Payable. 5. Depreciation on the equipment is calculated using the sum-of-years-digits method. The salvage value is $2,000, life is 10 years, and 4 years are depreciated as of Dec. 31, 2019. 6. Depreciation on the building is calculated using the straight-line method. The salvage value is $10,000, life is 30 years, and 10 years are depreciated as of Dec. 31, 2019. 7. Salaries and wages payable at year end amounted to $800. 8. Dresser performed an aging analysis of its year end Accounts Receivable as follows: 0-30 days 31-60 days 61-90 days > 90 days A/R Balance % $ (balance) 60% 20% 10% 10% % Uncollectible 10% 30% 50% 70% 31-Dec-19 $ Assets: Current Assets: Cash Accounts Receivable Less Allowance for Doubtful Accounts Inventory Prepaid Insurance Supplies Total Current Assets $ 12,300 15,720 (7,210) 11,580 2,000 590 $ 34,980 Liabilities and Stockholders' Equity: Current Liabilities: Accounts Payable Interest Payable Salary and Wages Payable Total Current Liabilities 8,200 2,000 400 10,600 $ Long Term Liabilities: Bonds Payable. 8%. 10 year $ 50,000 Total Liabilities $ 60,600 Property Plant and Equipment: Building Less Accumulated Depreciation Equipment Less Accumulated Depreciation Total Property, Plant and Equipment $ 100,000 (30,000) 60,000 (35,855) $ 94,145 Stockholders' Equity Common Stock Retained Earnings Total Stockholders' Equity $ 55,000 13,525 $ 68,525 Total Assets $ 129,125 Total Liabilities and Stockholders' Equity $ 129, 125 *** Interest payable Jan. 1 and July 1 $ **Inventory balance is: 4000 units at $1.50 each 3600 units at $1.55 each Total Inventory 6,000 5,580 11,580 $ Account Names Credit JE# 1 Interest Payable Cash Debit 2,000 2.000 2 Salaries & Wages payable Salaries & wages expense cash 400 550 950 3 Accounts receivable Sales 60,000 60,000 1,300 4 Supplies Accounts payable 1,300 3,200 5 Purchase Accounts payable 3,200 41,600 6 Accounts receivable Sales 1 41,600 5,600 7 Allowance for doubtful accounts Accounts receivable 5,600 25 2.000 8 Interest expense Cash 2,000 28 29 4,050 20 9 Purchase Accounts payable Journal Entries 4.050 Text TAAccounts Journal Entries Balance Sheet Dee 2019 B Dresser Company Balance Sheet 31-Dec-19 $ Assets: Current Assets Cash Accounts Receivable Less Allowance for Doubtful Accounts Inventory ** Prepaid Insurance Supplies Total Current Assets Liabilities and Stockholders' Equity: Current Liabilities: Accounts Payable Interest Payable Salary and Wages Payable Total Current Liabilities 8,200 2,000 400 10,600 $ 12,300 15,720 (7,210) 11,580 2,000 590 $ 34,980 Long Term Liabilities: Bonds Payable, 8%, 10 year $ 50,000 $ 60,600 Total Liabilities Property, Plant and Equipment: Building Less Accumulated Depreciation Equipment Less Accumulated Depreciation Total Property, Plant and Equipment $ 100,000 (30,000) 60,000 (35,855) $ 94,145 Stockholders' Equity: Common Stock Retained Earnings Total Stockholders' Equity $ 55,000 13,525 $ 68,525 Total Assets $ 129,125 Total Liabilities and Stockholders' Equity $ 129,125 *** Interest payable Jan. 1 and July 1 $ **Inventory balance is 4000 units at $1.50 each 3600 units at $1.55 each Total Inventory 6,000 5,580 11,580 $ Journal Entries Account Names Credit JE# 1 Interest Payable Cash Debit 2,000 2,000 2 Salaries & Wages payable Salaries & wages expense cash 400 550 950 60,000 3 Accounts receivable Sales 60.000 4 Supplies Accounts payable 1,300 1,300 5 Purchase Accounts payable 3,200 3,200 6 Accounts receivable Sales 41,600 41,600 7 Allowance for doubtful accounts Accounts receivable 5,600 5,600 8 Interest expense Cash 2,000 2.000 9 Purchase Accounts payable 4,050 4,050 1,400 10 Accounts receivable Allowance for doubtful accounts 1,400 1,400 10B Cash Accounts receivable 1,400 72,000 11 Salaries & wages expense Cash 72,000 6,600 12 Pre-Paid Insurance cash 6,600 57,750 13 Accounts receivable Sales 57,750 87,800 14 Cash Accounts receivable 87,800 15 Purchase Accounts payable 6,270 6,270 1 16 Accounts payable Cash 10,300 5 10,300 3 17 Cash Sales 7,750 7,750 18 Selling expense Administrative expense Cash 1,600 3,850 5.450 6,000 64 19 Dividend Cash 6,000 65 55,000 20 Note receivable Sales 55,000 30 31 22 73 70 15 78 79 80 1 02 35 30 91 esc DOO 000 F4 1. Income tax is recorded at $25,946. Check figures: Cash ending balance $ 3,950 $ 423.725 $ 3,795 Total Unadjusted Trial Balance Total Adjustment columns on Worksheet Income before income tax $ 63,300 $ 825 $ 86,488 Inventory ending balance Interest receivable balance Accounts receivable balance Retained earnings balance $ 81,670 Total Current Assets $ 73,319 $ 68,067 Total Current Liabilities $ 41,466 D S & 5 6 7 00 9 0 R T Y Y 0 P F G H J 31-Dec-19 Assets Current Assets Cash Accounts Receivable Less Allowance for Doubtful Accounts Inventory Prepaid Insurance Supplies Total Current Assets $ 12,300 15,720 (7,210) 11.580 2,000 590 $ 34,980 Liabilities and Stockholders' Equity Current Liabilities Accounts Payable Interest Payable Salary and Wagon Payable Total Current Liabilities 8,200 2,000 400 $ 10,600 Long Term Liabilities: Bonds Payable, 8%. 10 year $ 50,000 Total Liabilities $ 60,600 Property Plant and Equipment Building Less Accumulated Depreciation Equipment Less Accumulated Depreciation Total Property Plant and Equipment $ 100,000 (30,000) 60,000 (35 855) $ 94,145 Stockholders' Equity Common Stock Retained Earnings Total Stockholders' Equity $ 55.000 133 $ 68.525 Total Assets $ 129,125 Total Liabilities and Stockholders' Equity $ 129,125 *** Interest payable Jan. 1 and July 1 Inventory balance is: 4000 units at $1.50 each 3600 units at $1.55 each Total Inventory $ 6,000 5,580 11.580 $ Account Names JE# 1 Interest Payable Cash Debit 2.000 Credit 2,000 2 Salaries & Wages payablo Salaries & wages expense cash 400 550 950 3 Accounts receivable Sales 60,000 60,000 4 Supplies Accounts payable 1,300 1,300 5 Purchase Accounts payable 3,200 3,200 6 Accounts receivable Sales 41.600 41,600 7 Allowance for doubtful accounts Accounts receivable 5,600 5,600 8 Interest expense 2,000 Cash 2,000 4,050 9 Purchase Accounts payable 4,050 10 Accounts receivable Allowance for doubtful accounts 1.400 1,400 10B Cash Accounts receivable 1,400 1,400 11 Salaries & wages expense Cash 72,000 72,000 12 Pre-Paid Insurance cash 6,600 6,600 13 Accounts receivable Sales 57,750 57.750 87,800 14 Cash Accounts receivable 87,800 15 Purchase Accounts payable 6,270 6,270 10,300 16 Accounts payable Cash 10,300 7.750 17 Cash Sales 7,750 Sales 2.100 18 Selling expense Administrative expense Cash 1,600 3,850 5,450 19 Dividend Cash 6,000 6,000 20 Note receivable Sales 55,000 55,000 80 ooo Dii DO : FE 3 4 1. Income tax is recorded at $25,946. Check figures: Cash ending balance $ 3,950 $ 3,795 Total Unadjusted Trial $ 423,725 Balance Total Adjustment columns $ 63,300 on Worksheet Income before incom tax $ 86,488 $ 825 Inventory ending balance Interest receivable balance Accounts receivable balance Retained earnings balance $ 81,670 Total Current Assets $ 73,319 $ 68,067 Total Current Liabilities $ 41,466 Adjusting Journal Entries: 1. Prepaid insurance expires evenly each month. 2. A count of supplies at year end revealed $480 of supplies on hand. 3. Interest is recorded on the long-term note receivable. 4. Interest is recorded on the Bonds Payable. 5. Depreciation on the equipment is calculated using the sum-of-years-digits method. The salvage value is $2,000, life is 10 years, and 4 years are depreciated as of Dec. 31, 2019. 6. Depreciation on the building is calculated using the straight-line method. The salvage value is $10,000, life is 30 years, and 10 years are depreciated as of Dec. 31, 2019. 7. Salaries and wages payable at year end amounted to $800. 8. Dresser performed an aging analysis of its year end Accounts Receivable as follows: 0-30 days 31-60 days 61-90 days > 90 days A/R Balance % $ (balance) 60% 20% 10% 10% % Uncollectible 10% 30% 50% 70% 31-Dec-19 $ Assets: Current Assets: Cash Accounts Receivable Less Allowance for Doubtful Accounts Inventory Prepaid Insurance Supplies Total Current Assets $ 12,300 15,720 (7,210) 11,580 2,000 590 $ 34,980 Liabilities and Stockholders' Equity: Current Liabilities: Accounts Payable Interest Payable Salary and Wages Payable Total Current Liabilities 8,200 2,000 400 10,600 $ Long Term Liabilities: Bonds Payable. 8%. 10 year $ 50,000 Total Liabilities $ 60,600 Property Plant and Equipment: Building Less Accumulated Depreciation Equipment Less Accumulated Depreciation Total Property, Plant and Equipment $ 100,000 (30,000) 60,000 (35,855) $ 94,145 Stockholders' Equity Common Stock Retained Earnings Total Stockholders' Equity $ 55,000 13,525 $ 68,525 Total Assets $ 129,125 Total Liabilities and Stockholders' Equity $ 129, 125 *** Interest payable Jan. 1 and July 1 $ **Inventory balance is: 4000 units at $1.50 each 3600 units at $1.55 each Total Inventory 6,000 5,580 11,580 $ Account Names Credit JE# 1 Interest Payable Cash Debit 2,000 2.000 2 Salaries & Wages payable Salaries & wages expense cash 400 550 950 3 Accounts receivable Sales 60,000 60,000 1,300 4 Supplies Accounts payable 1,300 3,200 5 Purchase Accounts payable 3,200 41,600 6 Accounts receivable Sales 1 41,600 5,600 7 Allowance for doubtful accounts Accounts receivable 5,600 25 2.000 8 Interest expense Cash 2,000 28 29 4,050 20 9 Purchase Accounts payable Journal Entries 4.050 Text TAAccounts Journal Entries Balance Sheet Dee 2019 B Dresser Company Balance Sheet 31-Dec-19 $ Assets: Current Assets Cash Accounts Receivable Less Allowance for Doubtful Accounts Inventory ** Prepaid Insurance Supplies Total Current Assets Liabilities and Stockholders' Equity: Current Liabilities: Accounts Payable Interest Payable Salary and Wages Payable Total Current Liabilities 8,200 2,000 400 10,600 $ 12,300 15,720 (7,210) 11,580 2,000 590 $ 34,980 Long Term Liabilities: Bonds Payable, 8%, 10 year $ 50,000 $ 60,600 Total Liabilities Property, Plant and Equipment: Building Less Accumulated Depreciation Equipment Less Accumulated Depreciation Total Property, Plant and Equipment $ 100,000 (30,000) 60,000 (35,855) $ 94,145 Stockholders' Equity: Common Stock Retained Earnings Total Stockholders' Equity $ 55,000 13,525 $ 68,525 Total Assets $ 129,125 Total Liabilities and Stockholders' Equity $ 129,125 *** Interest payable Jan. 1 and July 1 $ **Inventory balance is 4000 units at $1.50 each 3600 units at $1.55 each Total Inventory 6,000 5,580 11,580 $ Journal Entries Account Names Credit JE# 1 Interest Payable Cash Debit 2,000 2,000 2 Salaries & Wages payable Salaries & wages expense cash 400 550 950 60,000 3 Accounts receivable Sales 60.000 4 Supplies Accounts payable 1,300 1,300 5 Purchase Accounts payable 3,200 3,200 6 Accounts receivable Sales 41,600 41,600 7 Allowance for doubtful accounts Accounts receivable 5,600 5,600 8 Interest expense Cash 2,000 2.000 9 Purchase Accounts payable 4,050 4,050 1,400 10 Accounts receivable Allowance for doubtful accounts 1,400 1,400 10B Cash Accounts receivable 1,400 72,000 11 Salaries & wages expense Cash 72,000 6,600 12 Pre-Paid Insurance cash 6,600 57,750 13 Accounts receivable Sales 57,750 87,800 14 Cash Accounts receivable 87,800 15 Purchase Accounts payable 6,270 6,270 1 16 Accounts payable Cash 10,300 5 10,300 3 17 Cash Sales 7,750 7,750 18 Selling expense Administrative expense Cash 1,600 3,850 5.450 6,000 64 19 Dividend Cash 6,000 65 55,000 20 Note receivable Sales 55,000 30 31 22 73 70 15 78 79 80 1 02 35 30 91 esc DOO 000 F4 1. Income tax is recorded at $25,946. Check figures: Cash ending balance $ 3,950 $ 423.725 $ 3,795 Total Unadjusted Trial Balance Total Adjustment columns on Worksheet Income before income tax $ 63,300 $ 825 $ 86,488 Inventory ending balance Interest receivable balance Accounts receivable balance Retained earnings balance $ 81,670 Total Current Assets $ 73,319 $ 68,067 Total Current Liabilities $ 41,466 D S & 5 6 7 00 9 0 R T Y Y 0 P F G H J