Answered step by step

Verified Expert Solution

Question

1 Approved Answer

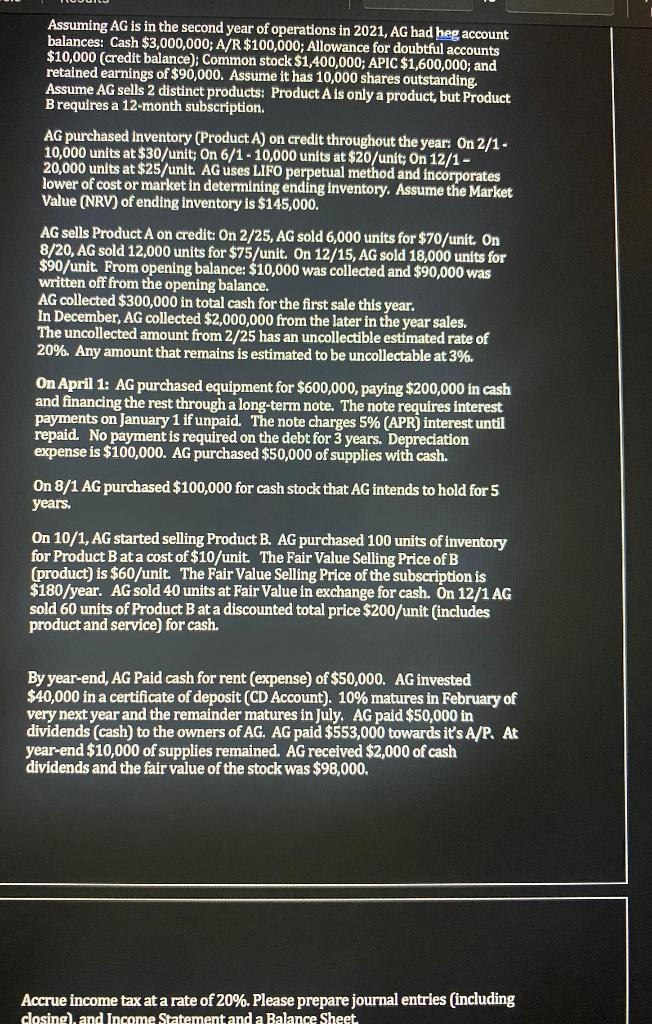

Please prepare journal entries (including closing), and Income Statement and a Balance Sheet. $10,000 (credit balance): Common stovo; Allowance for doubtfiul accounts retained earnings of

Please prepare journal entries (including closing), and Income Statement and a Balance Sheet.

$10,000 (credit balance): Common stovo; Allowance for doubtfiul accounts retained earnings of $90000. Pr has 10,000 shares outstanding. B requires a 12-month subscription. AG purchased inventory (Product A) on credit throughout the year: On 2/1. 10,000 units at $30/ unit; On 6/110,000 units at $20/ unit; On 12/1 20,000 units at \$25/unit. AG uses LIFO perpetual method and incorporates lower of cost or market in determining ending inventory. Assume the Market Value (NRV) of ending inventory is $145,000. AG sells Product A on credit: On 2/25, AG sold 6,000 units for $70/ unit. On 8/20, AG sold 12,000 units for $75 /unit. On 12/15, AG sold 18,000 units for $90/ unit. From opening balance: $10,000 was collected and $90,000 was written off from the opening balance. AG collected $300,000 in total cash for the first sale this year. In December, AG collected $2,000,000 from the later in the year sales. The uncollected amount from 2/25 has an uncollectible estimated rate of 20%. Any amount that remains is estimated to be uncollectable at 3%. On April 1: AG purchased equipment for $600,000, paying $200,000 in cash and financing the rest through a long-term note. The note requires interest payments on January 1 if unpaid. The note charges 5% (APR) interest until repaid. No payment is required on the debt for 3 years. Depreciation expense is $100,000. AG purchased $50,000 of supplies with cash. On 8/1 AG purchased $100,000 for cash stock that AG intends to hold for 5 years. On 10/1, AG started selling Product B. AG purchased 100 units of inventory for Product B at a cost of \$10/unit. The Fair Value Selling Price of B (product) is $60 /unit. The Fair Value Selling Price of the subscription is $180 year. AG sold 40 units at Fair Value in exchange for cash. On 12/1 AG sold 60 units of Product B at a discounted total price $200/ unit (includes product and service) for cash. By year-end, AG Paid cash for rent (expense) of $50,000. AG invested $40,000 in a certificate of deposit (CD Account). 10% matures in February of very next year and the remainder matures in July. AG paid $50,000 in dividends (cash) to the owners of AG. AG paid $553,000 towards it's A/P. At year-end $10,000 of supplies remained. AG received $2,000 of cash dividends and the fair value of the stock was $98,000. Accrue income tax at a rate of 20%. Please prepare journal entries (including closing) and Income Statement and a Balance SheetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started