Answered step by step

Verified Expert Solution

Question

1 Approved Answer

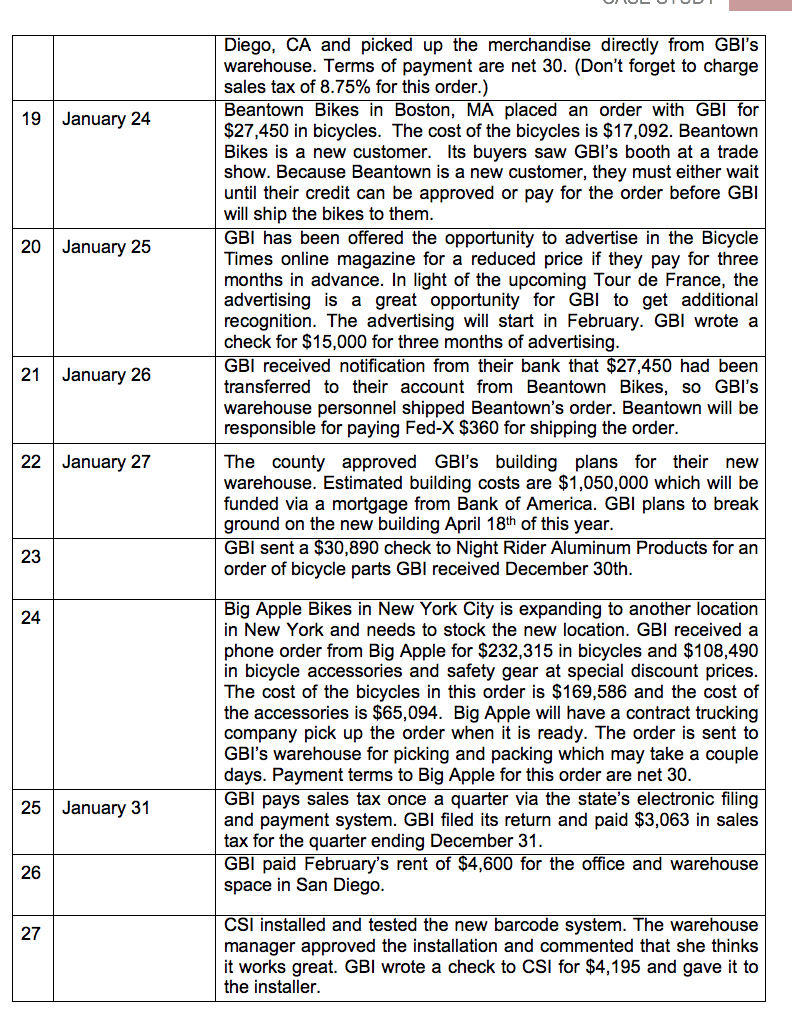

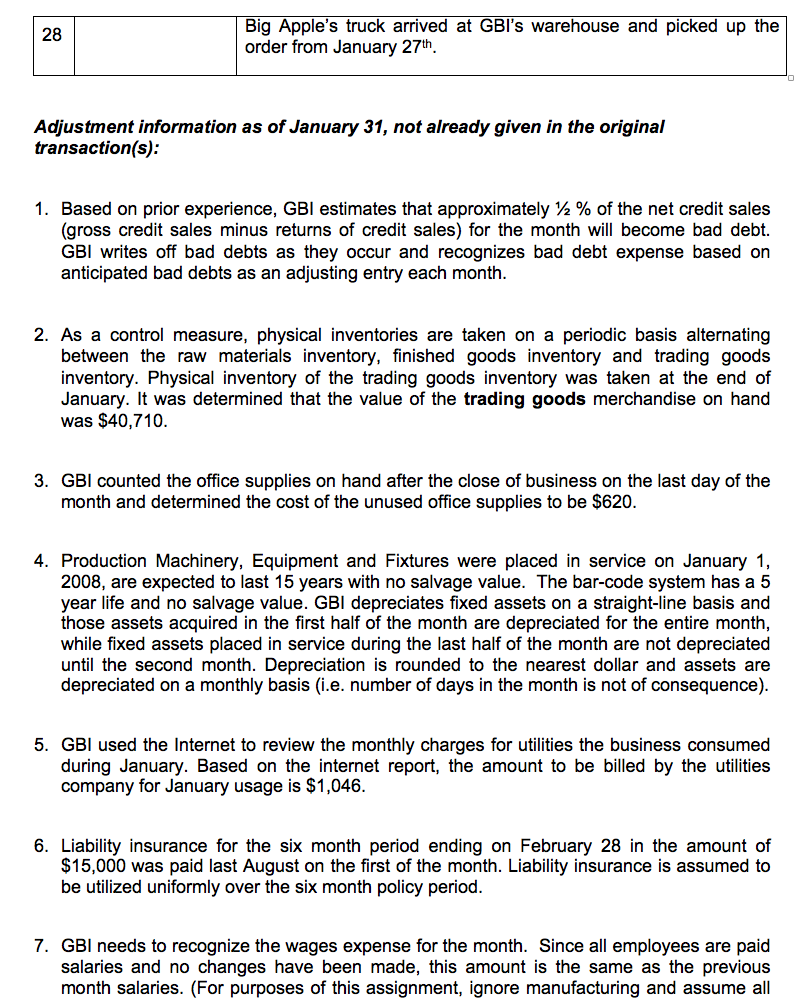

PLEASE prepare Journal Entries: using following columns (example below) for General Journal: Date, JE#, Event#, Account# (GL LIST) and whether its a DR or CR.

PLEASE prepare Journal Entries: using following columns (example below) for General Journal: Date, JE#, Event#, Account# (GL LIST) and whether its a DR or CR. NOTE: some Events DO NOT require a journal entry

| Date | Journal Entry# | Event# | Account# | Account Name | DR | CR |

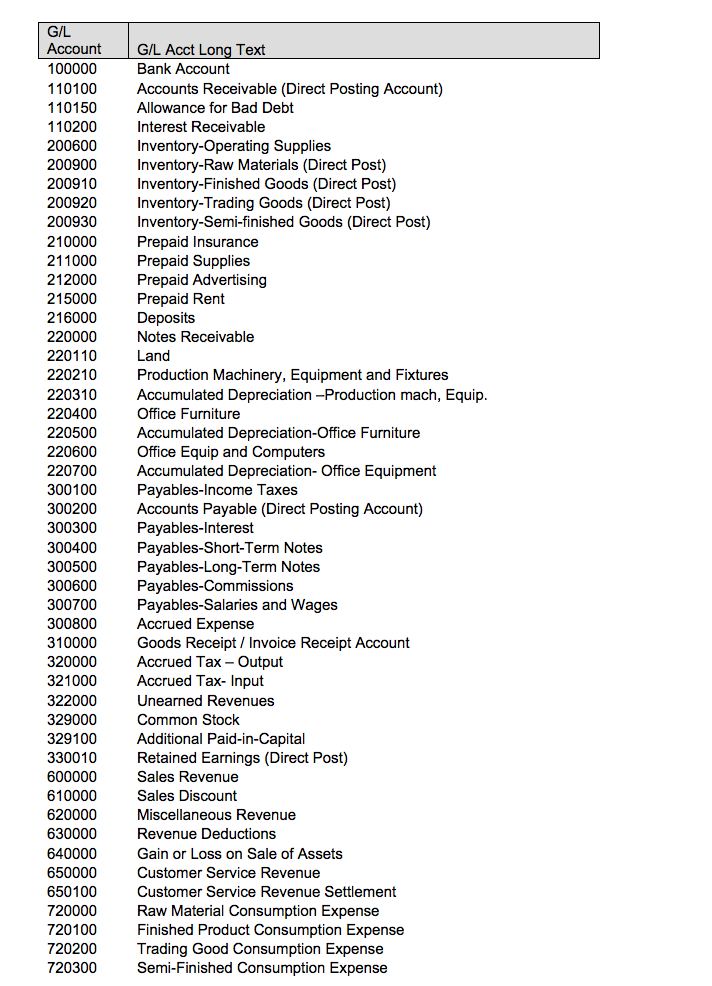

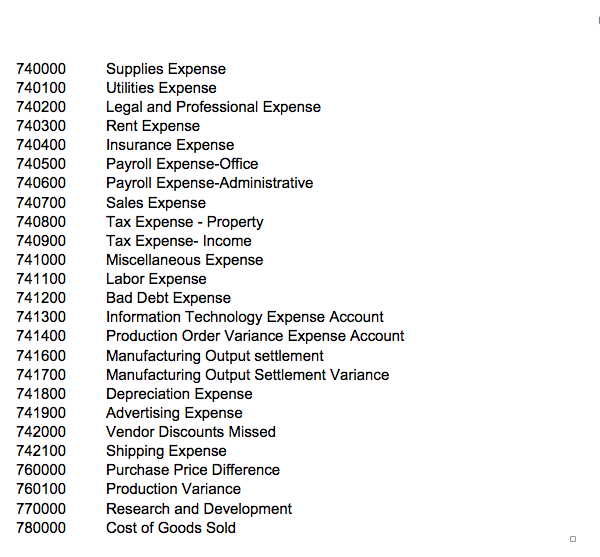

Here's is the GL list:

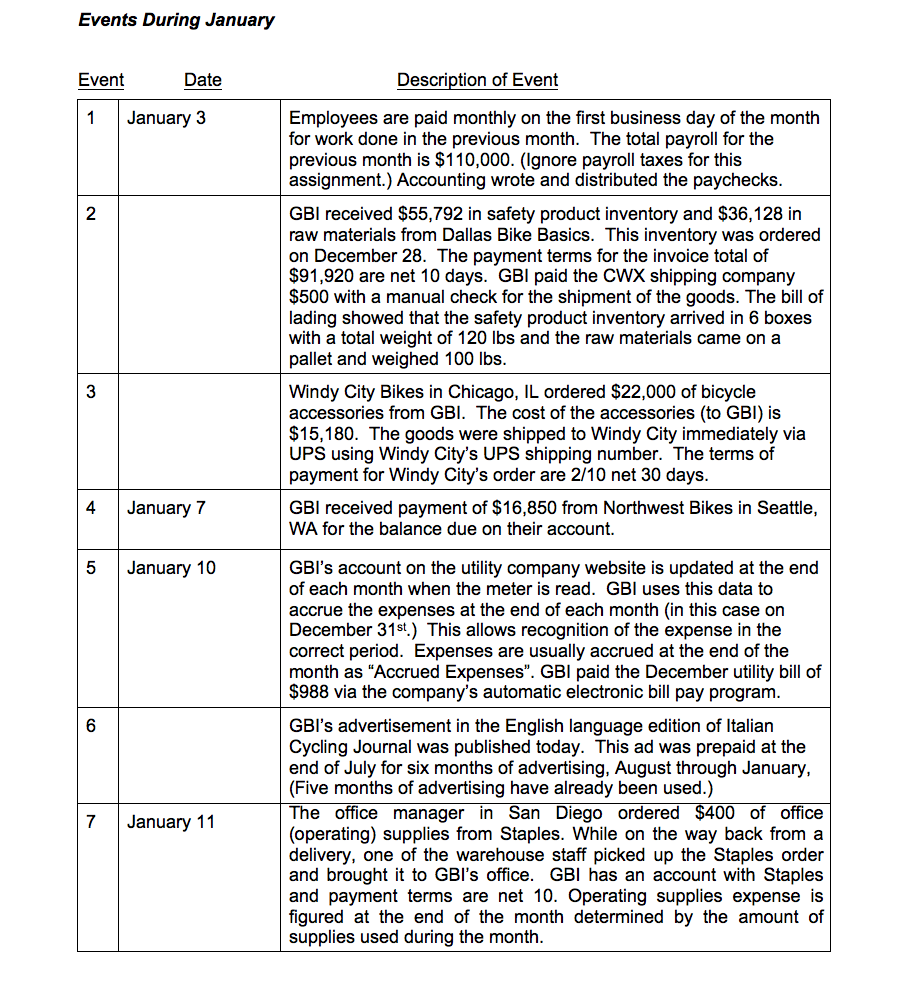

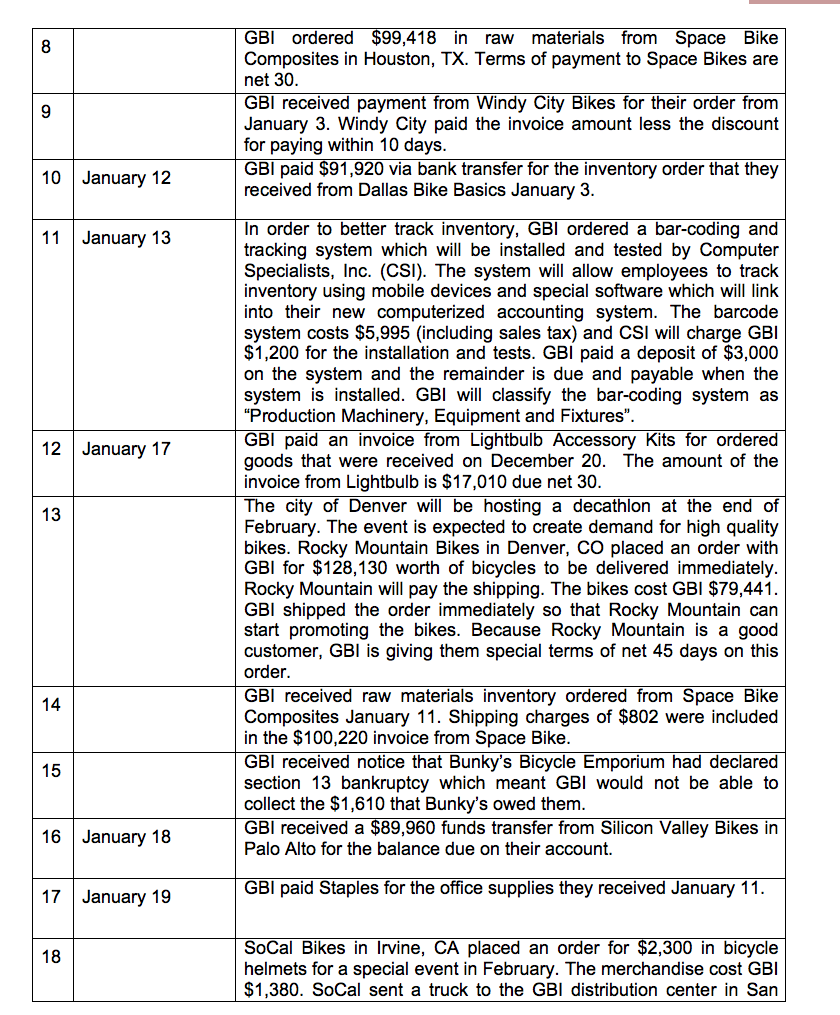

Here are the list of Events for JE's:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started